9.1 Monopoly and Barriers to Entry

Because of the lack of competition, monopolies tend to earn significant economic profits. These profits should attract vigorous competition as we described in Perfect Competition, and yet, because of one particular characteristic of monopoly, they do not.

Definition: Barriers to Entry

Barriers to entry are the legal, technological, or market forces that discourage or prevent potential competitors from entering a market.

Barriers to entry can range from the simple and easily surmountable, such as the cost of renting retail space, to the extremely restrictive. For example, there are a finite number of radio frequencies available for broadcasting. Once an entrepreneur or firm has purchased the rights to all of them, no new competitors can enter the market. In some cases, barriers to entry may lead to monopoly. In other cases, they may limit competition to a few firms. Barriers may block entry even if the firm or firms currently in the market are earning profits. Thus, in markets with significant barriers to entry, it is not necessarily true that abnormally high profits will attract new firms, and that this entry of new firms will eventually cause the price to decline so that surviving firms earn only a normal level of profit in the long run.

There are two types of monopoly, based on the types of barriers to entry they exploit. One is a natural monopoly, where the barriers to entry are something other than legal prohibition. The other is a legal monopoly, where laws prohibit (or severely limit) competition.

Natural Monopoly

Economies of scale can combine with the size of the market to limit competition. (We introduced this theme in Chapter 7: Production and Cost).

Example

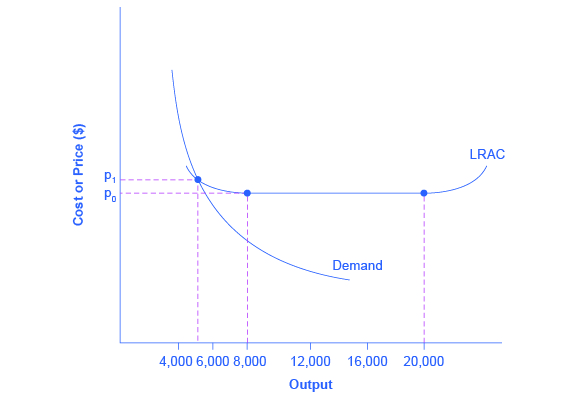

Fig 9.1 presents a long-run average cost curve for the airplane manufacturing industry. It shows economies of scale up to an output of 8,000 planes per year and a price of P0, then constant returns to scale from 8,000 to 20,000 planes per year, and diseconomies of scale at a quantity of production greater than 20,000 planes per year.

Now consider the market demand curve in the diagram, which intersects the long-run average cost (LRAC) curve at an output level of 5,000 planes per year and at a price P1, which is higher than P0. In this situation, the market has room for only one producer. If a second firm attempts to enter the market at a smaller size, say by producing a quantity of 4,000 planes, then its average costs will be higher than those of the existing firm, and it will be unable to compete. If the second firm attempts to enter the market at a larger size, like 8,000 planes per year, then it could produce at a lower average cost—but it could not sell all 8,000 planes that it produced because of insufficient demand in the market.

Economists call this situation, when economies of scale are large relative to the quantity demanded in the market, a natural monopoly. Natural monopolies often arise in industries where the marginal cost of adding an additional customer is very low, once the fixed costs of the overall system are in place. This results in situations where there are substantial economies of scale. For example, once a water company lays the main water pipes through a neighbourhood, the marginal cost of providing water service to another home is fairly low. Such industries offer an example where, because of economies of scale, one producer can serve the entire market more efficiently than a number of smaller producers that would need to make similar physical capital investments.

Ownership barrier arising out of control of a physical resource

Another type of monopoly occurs when a company has control of a scarce physical resource.

Key Takeaways

In the Canadian economy, one historical example of this pattern occurred when the International Nickel Company of Canada (INCO)—controlled most of the supply of nickel, a key mineral used leading manufacturer of specialized forged components made from alloy materials.

As another example, the majority of global diamond production is controlled by DeBeers, a multi-national company that has mining and production operations in South Africa, Botswana, Namibia, and Canada. It also has exploration activities on four continents, while directing a worldwide distribution network of rough cut diamonds. Although in recent years they have experienced growing competition, their impact on the rough diamond market is still considerable.

Legal Monopoly

For some products, the government erects barriers to entry by prohibiting or limiting competition. Under Canadian law, no organization but Canada Post is legally allowed to deliver residential mail. Many states or cities have laws or regulations that allow households a choice of only one electric company, one water company, and one company to pick up the garbage. Most legal monopolies are utilities—products necessary for everyday life—that are socially beneficial. As a consequence, the government allows producers to become regulated monopolies, to insure that customers have access to an appropriate amount of these products or services. Additionally, legal monopolies are often subject to economies of scale, so it makes sense to allow only one provider.

Definition: Patent, Trademark, Copyright & Intellectual Property

Suppose a company invests in research and development and finds the cure for the common cold.

A patent gives the inventor the exclusive legal right to make, use, or sell the invention for a limited time. In Canada, exclusive patent rights last for 20 years. The idea is to provide limited monopoly power so that innovative firms can recoup their investment in R&D, but then to allow other firms to produce the product more cheaply once the patent expires.

A trademark is an identifying symbol or name for a particular good, like Chiquita bananas, Chevrolet cars, Rogers Cable.

A copyright, according to the Canadian Law, “is a form of protection for ‘original works of authorship’ including literary, dramatic, musical, architectural, cartographic, choreographic, pantomimic, pictorial, graphic, sculptural, and audiovisual creations.”

Taken together, we call this combination of patents, trademarks, copyrights as intellectual property, because it implies ownership over an idea, concept, or image, not a physical piece of property like a house or a car. Countries around the world have enacted laws to protect intellectual property, although the time periods and exact provisions of such laws vary across countries.

Attribution

“9.1 How Monopolies Form: Barriers to Entry” in Principles of Economics 2e by OpenStax is licensed under Creative Commons Attribution 4.0 International License.