8.7 Perfect Competition and Efficiency

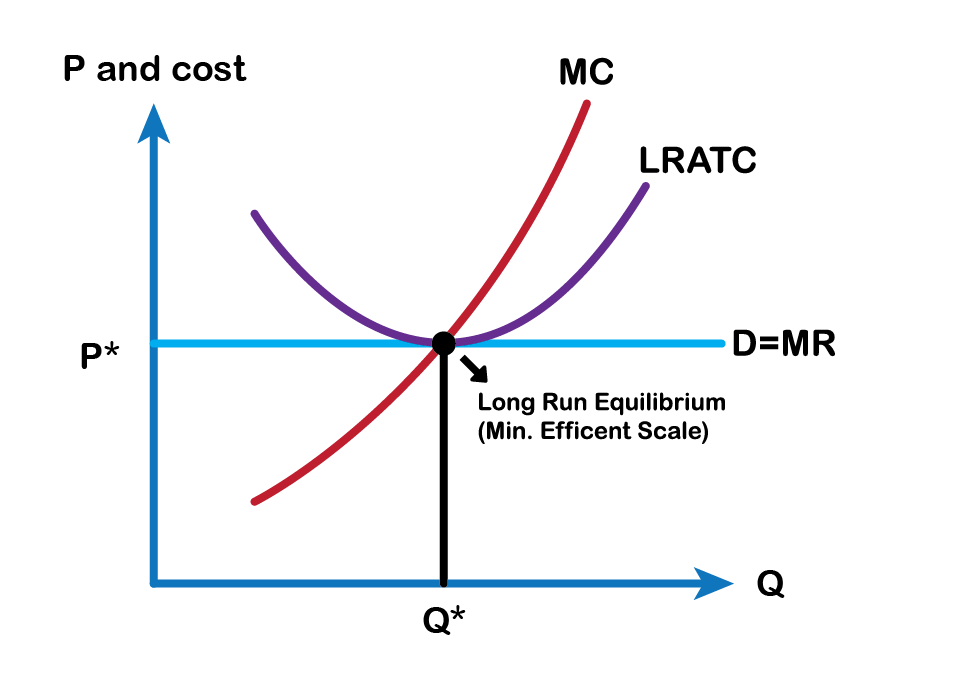

Profit-maximizing firms in perfectly competitive demonstrate both productive and allocative efficiency. In the long run in a perfectly competitive market, because of the process of entry and exit, the price in the market is equal to the minimum of the long-run average cost curve. In other words, firms produce and sell goods at the lowest possible average cost, as shown in Fig 8.14 below.

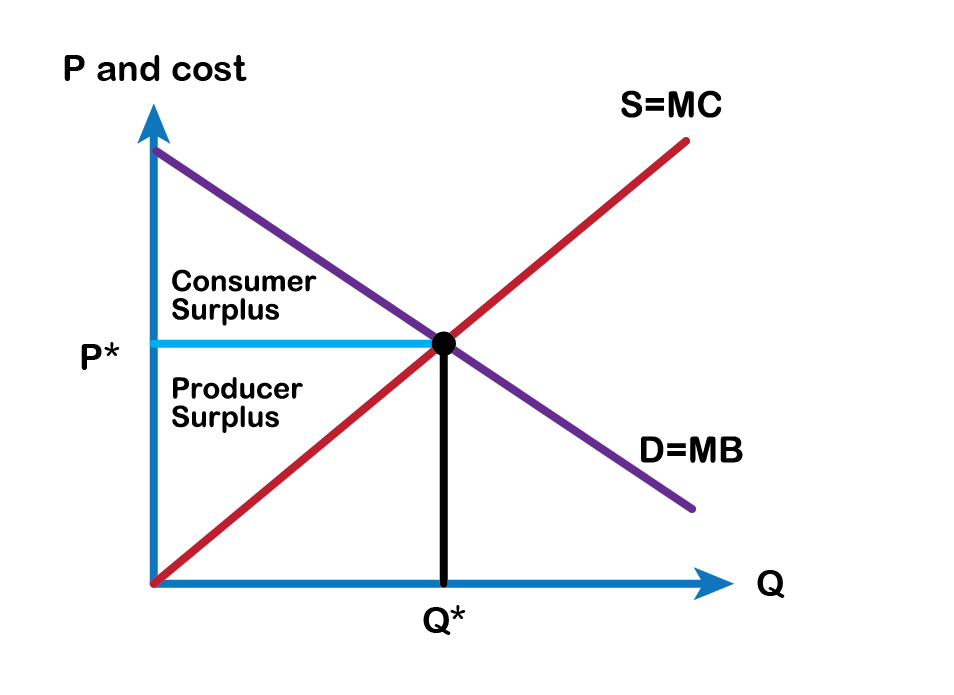

In a perfectly competitive market, the price will be equal to the marginal cost of production. Think about the price that one pays for a good as a measure of the social benefits one receives for that good; after all, willingness to pay conveys what the good is worth to a buyer. Then think about the marginal cost of producing the good as representing not just the cost for the firm, but more broadly the social cost of producing that good. When perfectly competitive firms follow the rule that profits are maximized by producing at the quantity where price (willingness of consumers to pay) is equal to marginal cost, they are thus ensuring that the social benefits they receive from producing a good are in line with the social costs of production. So perfectly competitive markets maximize consumer and producer surpluses resulting in no deadweight or efficiency loss, shown in Fig 8.15 below.

Suppose, P > MC. In that situation, the benefit to society as a whole of producing additional goods, as measured by the willingness to pay for marginal units of a good, would be higher than the cost of the inputs of labor and physical capital needed to produce the marginal good. In other words, the gains to society as a whole from producing additional marginal units will be greater than the costs.

Perfect competition, in the long run, is a hypothetical benchmark. For market structures such as monopoly, monopolistic competition, and oligopoly, which are more frequently observed in the real world than perfect competition, firms will not always produce at the minimum of average cost, nor will they always set price equal to marginal cost. Thus, these other competitive situations will not produce productive and allocative efficiency.

Attribution

“8.4 Efficiency in Perfectly Competitive Markets” in Principles of Economics 2e by OpenStax is licensed under Creative Commons Attribution 4.0 International License.