11.6 Cartels

A cartel is an agreement among competing firms to collude in order to attain higher profits. Cartels usually occur in an oligopolistic industry, where the number of sellers is small and the products being traded are homogeneous. Cartel members may agree on such matters are price fixing, total industry output, market share, allocation of customers, allocation of territories, bid rigging, establishment of common sales agencies, and the division of profits.

Game theory suggests that cartels are inherently unstable, because the behaviour of cartel members represents a prisoner’s dilemma. Each member of a cartel would be able to make a higher profit, at least in the short-run, by breaking the agreement (producing a greater quantity or selling at a lower price) than it would make by abiding by it. However, if the cartel collapses because of defections, the firms would revert to competing, profits would drop, and all would be worse off.

Whether members of a cartel choose to cheat on the agreement depends on whether the short-term returns to cheating outweigh the long-term losses from the possible breakdown of the cartel. It also partly depends on how difficult it is for firms to monitor whether the agreement is being adhered to by other firms. If monitoring is difficult, a member is likely to get away with cheating for longer; members would then be more likely to cheat, and the cartel will be more unstable.

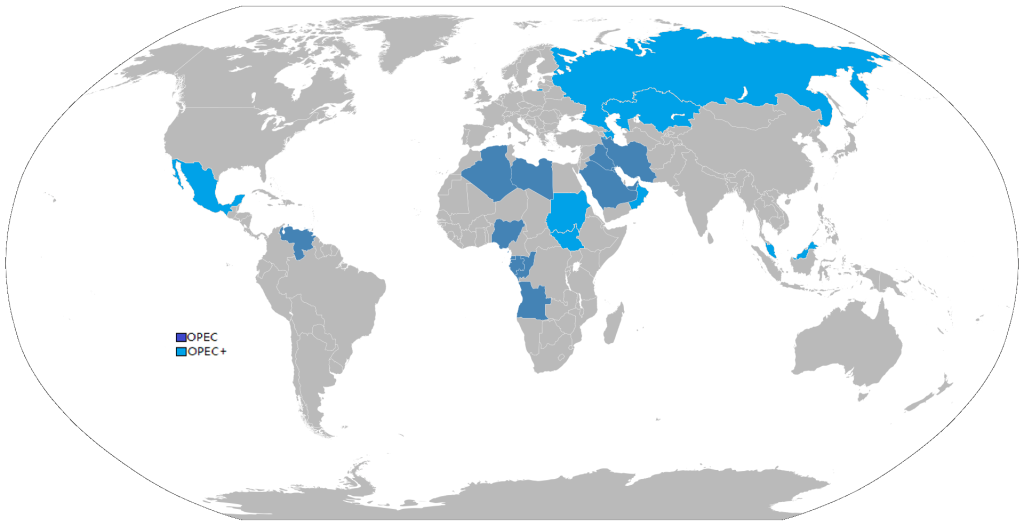

Perhaps the most globally recognizable and effective cartel is OPEC, the Organization of Petroleum Exporting Countries. In 1973 members of OPEC reduced their production of oil. Because crude oil from the Middle East was known to have few substitutes, OPEC member’s profits skyrocketed. From 1973 to 1979, the price of oil increased by $70 per barrel, an unprecedented number at the time. In the mid 1980s, however, OPEC started to weaken. Discovery of new oil fields in Alaska and Canada introduced new alternatives to Middle Eastern oil, causing OPEC’s prices and profits to fall. Around the same time OPEC members also started cheating to try to increase individual profits.

Because oligopolists cannot sign a legally enforceable contract to act like a monopoly, the firms may instead keep close tabs on what other firms are producing and charging. Alternatively, oligopolists may choose to act in a way that generates pressure on each firm to stick to its agreed quantity of output.

Example

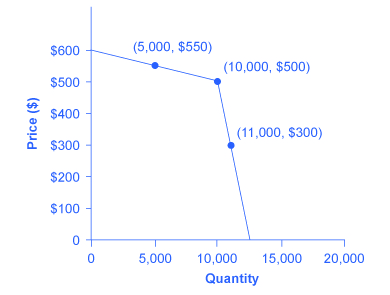

One example of the pressure these firms can exert on one another is the kinked demand curve, in which competing oligopoly firms commit to match price cuts, but not price increases. This situation is shown in Figure 11.3. Say that an oligopoly airline has agreed with the rest of a cartel to provide a quantity of 10,000 seats on the New York to Los Angeles route, at a price of $500. This choice defines the kink in the firm’s perceived demand curve. The reason that the firm faces a kink in its demand curve is because of how the other oligopolists react to changes in the firm’s price. If the oligopoly decides to produce more and cut its price, the other members of the cartel will immediately match any price cuts—and therefore, a lower price brings very little increase in quantity sold.

If one firm cuts its price to $300, it will be able to sell only 11,000 seats. However, if the airline seeks to raise prices, the other oligopolists will not raise their prices, and so the firm that raised prices will lose a considerable share of sales. For example, if the firm raises its price to $550, its sales drop to 5,000 seats sold. Thus, if oligopolists always match price cuts by other firms in the cartel, but do not match price increases, then none of the oligopolists will have a strong incentive to change prices, since the potential gains are minimal. This strategy can work like a silent form of cooperation, in which the cartel successfully manages to hold down output, increase price, and share a monopoly level of profits even without any legally enforceable agreement

Many real-world oligopolies, prodded by economic changes, legal and political pressures, and the egos of their top executives, go through episodes of cooperation and competition. If oligopolies could sustain cooperation with each other on output and pricing, they could earn profits as if they were a single monopoly. However, each firm in an oligopoly has an incentive to produce more and grab a bigger share of the overall market; when firms start behaving in this way, the market outcome in terms of prices and quantity can be similar to that of a highly competitive market.

Attribution

“10.2 Oligopoly” in Principles of Economics 2e by OpenStax is licensed under Creative Commons Attribution 4.0 International License.

“Prisoner’s Dilemma” in Microeconomics by Lumen Learning is licensed under a Creative Commons Attribution 4.0 International License unless otherwise noted.