8.6 How Entry and Exit Lead to Zero Profits in the Long Run

No perfectly competitive firm acting alone can affect the market price. However, the combination of many firms entering or exiting the market will affect the overall supply in the market. In turn, a shift in supply for the market as a whole will affect the market price. Entry and exit to and from the market are the driving forces behind a process that, in the long run, pushes the price down to minimum average total costs so that all firms are earning zero profit.

Entry of New Firms

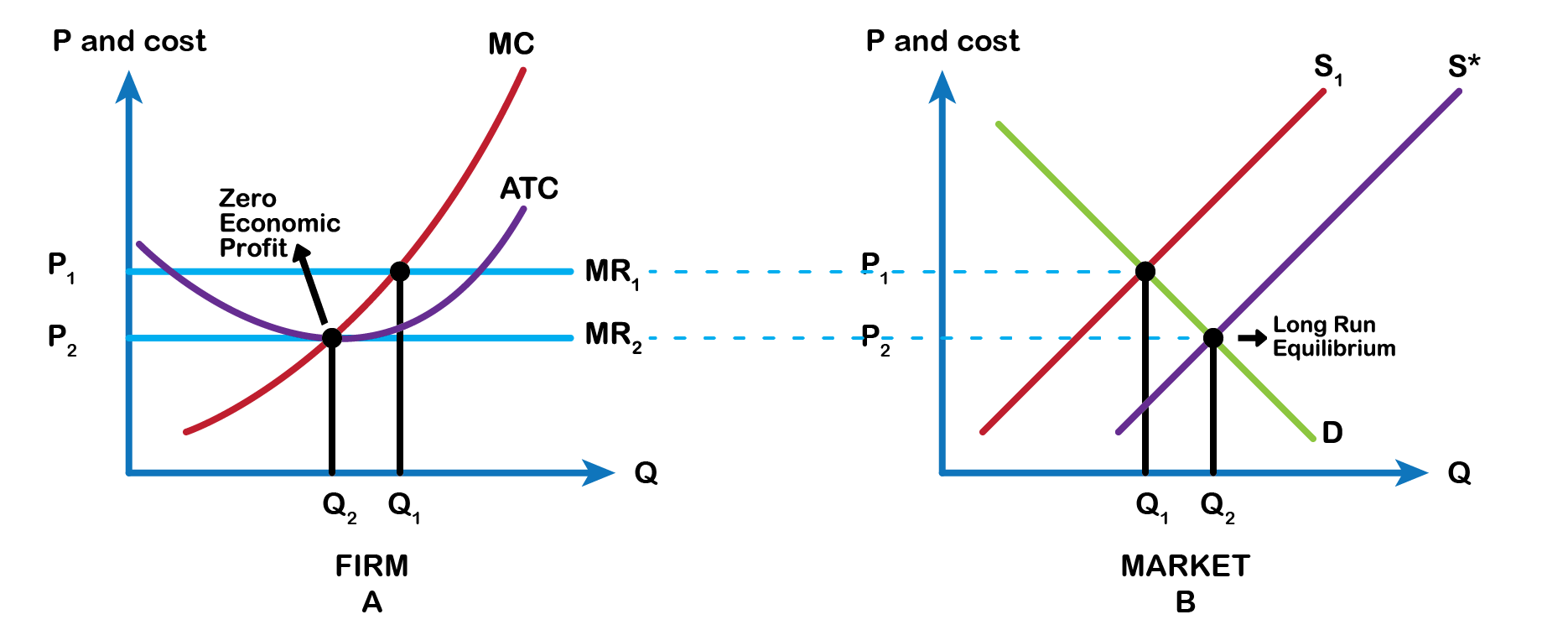

Let’s say that the product’s demand increases, and with that, the market price goes up. The existing firms in the industry are now facing a higher price than before, so they will increase production to the new output level where P = MR = MC. Now the existing firms make a positive economic profit at output Q1 (Fig 8.12 A). This induces new firms to enter the market. As new firms enter, market supply increases and shifts the supply curve to the right to S* (Fig 8.12 B). As the supply curve shifts to the right, the market price starts falling, and with that, economic profits fall for new and existing firms. As long as there are still profits in the market, entry will continue to shift supply to the right. This will stop whenever the market price is driven down to the zero-profit level at output Q2, where no firm is earning positive economic profits. This is the long-run equilibrium where the firms continue to produce as long as price equals average total cost and end up earning zero economic profits. Each firm’s share falls but the market output increases.

Exit of Firms

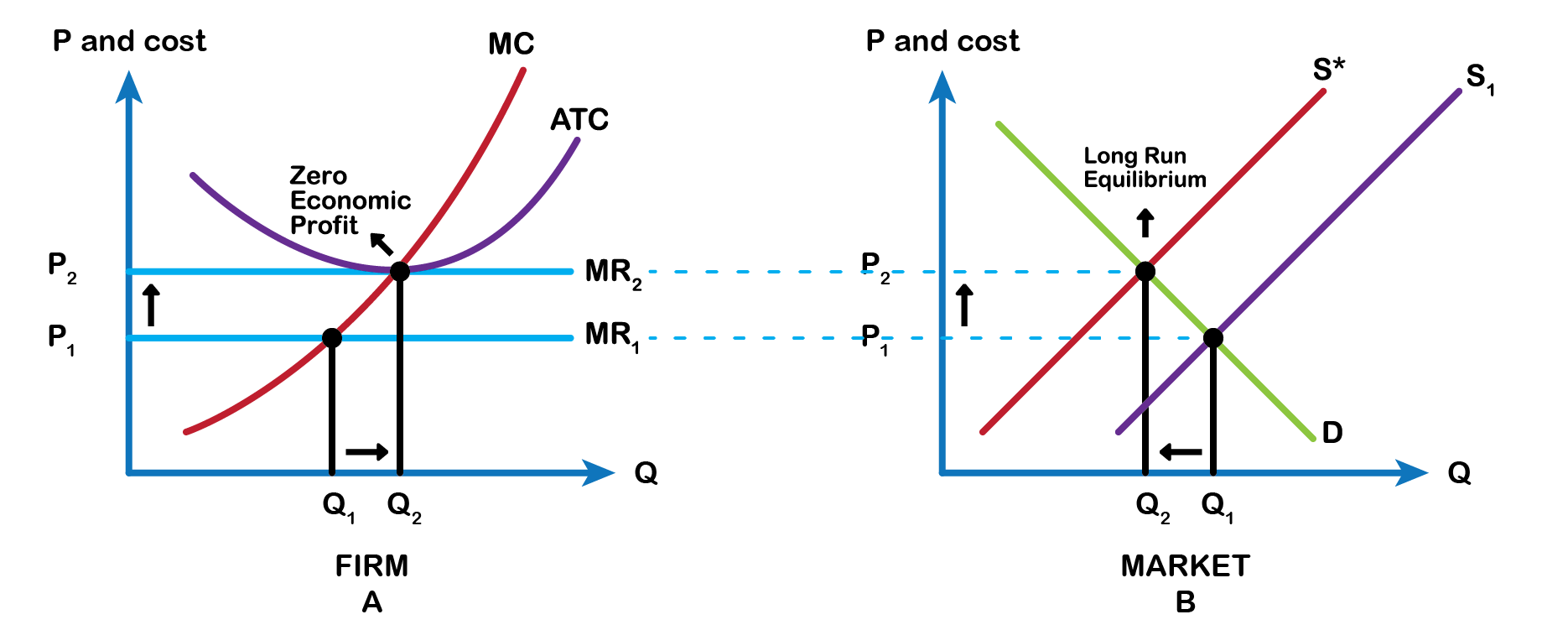

Short-run losses will fade away by reversing this process. Say that this time, instead, demand decreases, and with that, the market price starts falling. The existing firms in the industry are now facing a lower price than before, and as it will be below the average cost curve, they will now be making economic losses at output Q1 (Fig 8.13 A). Some firms will continue producing where the new P = MR = MC, as long as they are able to cover their average variable costs. Some firms will have to shut down immediately as they will not be able to cover their average variable costs, and will then only incur their fixed costs, minimizing their losses. The exit of many firms causes the market supply curve to shift to the left to S* (Fig 8.13 B). As the supply curve shifts to the left, the market price starts rising, and economic losses start to be lower. This process ends whenever the market price rises to the zero-profit level at output Q2, where the existing firms are no longer losing money and are at zero profits again. Each firm’s share rises but the market output decreases.

Thus, while a perfectly competitive firm can earn profits in the short run, in the long run, the process of entry will push down prices until they reach the zero-profit level. Conversely, while a perfectly competitive firm may earn losses in the short run, firms will not continually lose money. In the long run, firms making losses are able to escape from their fixed costs, and their exit from the market will push the price back up to the zero-profit level. In the long run, this process of entry and exit will drive the price in perfectly competitive markets to the zero-profit point at the bottom of the ATC curve, where the marginal cost curve crosses the average total cost at its minimum point.

Attribution

“8.3 Entry and Exit Decisions in the Long Run” in Principles of Economics 2e by OpenStax is licensed under Creative Commons Attribution 4.0 International License.