8.3 Global Pricing Approaches

Global pricing decisions can be based on a number of factors, including cost, demand, competition, value, or some combination of factors. However, while many marketers are aware that they should consider these factors, pricing remains somewhat of an art. For purposes of discussion, we categorize the alternative approaches to determining price as follows:

- cost-oriented pricing;

- demand-oriented pricing; and

- value-based approaches.

Cost-oriented pricing: cost-plus and mark-ups

The cost-plus method, sometimes called gross margin pricing, is perhaps most widely used by marketers to set price. The manager selects as a goal a particular gross margin that will produce a desirable profit level. Gross margin is the difference between how much the goods cost and the actual price for which it sells. This gross margin is designated by a per cent of net sales. The per cent selected varies among types of merchandise. That means that one product may have a goal of 48 per cent gross margin while another has a target of 33.5 per cent or 2 per cent.

A primary reason that the cost-plus method is attractive to marketers is that they do not have to forecast general business conditions or customer demand. If sales volume projections are reasonably accurate, profits will be on target. Consumers may also view this method as fair, since the price they pay is related to the cost of producing the item. Likewise, the marketer is sure that costs are covered.

A major disadvantage of cost-plus pricing is its inherent inflexibility. For example, department stores have often found difficulty in meeting competition from discount stores, catalogue retailers, or furniture warehouses because of their commitment to cost-plus pricing. Another disadvantage is that it does not take into account consumers’ perceptions of a product’s value. Finally, a company’s costs may fluctuate so constant price changing is not a viable strategy.

When middlemen use the term mark-up, they are referring to the difference between the average cost and price of all merchandise in stock, for a particular department, or for an individual item. The difference may be expressed in dollars or as a percentage.

For example, a man’s tie costs USD 4.60 and is sold for USD 8. The dollar mark-up is USD 3.40. The mark-up may be designated as a per cent of selling price 0r as a per cent of cost of the merchandise. In this example, the mark-up is 74 per cent of cost (USD 3.40/USD 4.60) or 42.5 per cent of the retail price (USD 3.40/USD 8).

There are several reasons why expressing mark-up as a percentage of selling price is preferred to expressing it as a percentage of cost. One is that many other ratios are expressed as a percentage of sales. For instance, selling expenses are expressed as a percentage of sales. If selling costs are 8 per cent, this means that for each USD 100,000 in net sales, the cost of selling the merchandise is USD 8,000. Advertising expenses, operating expenses, and other types of expenses are quoted in the same way. Thus, there is a consistency when making comparisons in expressing all expenses and costs, including mark-up, as a percentage of sales (selling price).

Middlemen receive merchandise daily and make sales daily. As new shipments are received, the goods are marked and put into stock. Cumulative mark-up is the term applied to the difference between total dollar delivered cost of all merchandise and the total dollar price of the goods put into stock for a specified period of time. The original mark-up at which individual items are put into stock is referred to as the initial mark-up.

Maintained mark-up is another important concept. The maintained mark-up percentage is an essential figure in estimating operating profits. It also provides an indication of efficiency. Maintained mark-up, sometimes called gross cost of goods, is the difference between the actual price for which all of the merchandise is sold and the total dollar delivered cost of the goods exclusive of deductions. The maintained mark-up is typically less than the initial mark-up due to mark-downs and stock shrinkages from theft, breakage, and the like. Maintained mark-up is particularly important for seasonal merchandise that will likely be marked-down substantially at the end of the season.

Although this pricing approach may seem overly simplified, it has definite merit. The problem facing managers of certain types of businesses such as retail food stores is that they must price a very large number of items and change many of those prices frequently. The standard mark-up usually reflects historically profitable margins and provides a good guideline for pricing.

Certainly costs are an important component of pricing. No firm can make a profit until it covers its costs. However, the process of determining costs and then setting a price based on costs does not take into consideration what the customer is willing to pay at the marketplace. As a result, many companies that have set out to develop a product have fallen victim to the desire to continuously add features to the product, thus adding cost. When the product is finished, these companies add some percentage to the cost and expect customers to pay the resulting price. These companies are often disappointed, as customers are not willing to pay this cost-based price.

Break-even analysis

A somewhat more sophisticated approach to cost-based pricing is the break-even analysis. The information required for the formula for break-even analysis is available from the accounting records in most firms. The break even price is the price that will produce enough revenue to cover all costs at a given level of production. Total cost can be divided into fixed and variable (total cost = fixed cost + variable cost). Recall that fixed cost does not change as the level of production goes up or down. The rent paid for the building to house the operation might be an example. No cost is fixed in the long run, but in the short run, many expenses cannot realistically be changed. Variable cost does change as production is increased or decreased. For example, the cost of raw material to make the product will vary with production.

A second shortcoming of break-even analysis is it assumes that variable costs are constant. However, wages will increase with overtime and shipping discounts will be obtained. Third, break-even assumes that all costs can be neatly categorized as fixed or variable. Where advertising expenses are entered, break-even analysis will have a significant impact on the resulting break-even price and volume.

Target rates of return

Break-even pricing is a reasonable approach when there is a limit on the quantity which a firm can provide and particularly when a target return objective is sought. Assume, for example, that the firm with the costs illustrated in the previous example determines that it can provide no more than 10,000 units of the product in the next period of operation. Furthermore, the firm has set a target for profit of 20 per cent above total costs. Referring again to internal accounting records and the changing cost of production at near capacity levels, a new total cost curve is calculated. From the cost curve profile, management sets the desirable level of production at 80 per cent of capacity or 8,000 units. From the total cost curve, it is determined that the cost for producing 8,000 units is USD 18,000. 20 per cent of USD 18,000 is USD 3,600. Adding this to the total cost at 8,000 units yields the point at that quantity through which the total revenue curve must pass. Finally, USD 21,600 divided by 8,000 units yields the price of USD 2.70 per unit; here the USD 3,600 in profit would be realized. The obvious shortcoming of the target return approach to pricing is the absence of any information concerning the demand for the product at the desired price. It is assumed that all of the units will be sold at the price which provides the desired return.

It would be necessary, therefore, to determine whether the desired price is in fact attractive to potential customers in the marketplace. If break-even pricing is to be used, it should be supplemented by additional information concerning customer perceptions of the relevant range of prices for the product. The source of this information would most commonly be survey research, as well as a thorough review of pricing practices by competitors in the industry. In spite of their shortcomings, break-even pricing and target return pricing are very common business practices.

Demand-oriented pricing

Demand-oriented pricing focuses on the nature of the demand curve for the product or service being priced. The nature of the demand curve is influenced largely by the structure of the industry in which a firm competes. That is, if a firm operates in an industry that is extremely competitive, price may be used to some strategic advantage in acquiring and maintaining market share. On the other hand, if the firm operates in an environment with a few dominant players, the range in which price can vary may be minimal.

Value-based pricing

If we consider the three approaches to setting price, cost-based is focused entirely on the perspective of the company with very little concern for the customer; demand-based is focused on the customer, but only as a predictor of sales; and value-based pricing focuses entirely on the customer as a determinant of the total price/value package. Marketers who employ value-based pricing might use the following definition: “It is what you think your product is worth to that customer at that time.” Moreover, it acknowledges several marketing/price truths:

- To the customer, price is the only unpleasant part of buying.

- Price is the easiest marketing tool to copy.

- Price represents everything about the product

Still, value-based pricing is not altruistic. It asks and answers two questions : (a) what is the highest price I can charge and still make the sale? and (b) am I willing to sell at that price? The first question must take two primary factors into account: customers and competitors. The second question is influenced by two more: costs and constraints. Let us discuss each briefly.

Many customer-related factors are important in value-based pricing. For example, it is critical to understand the customer buying process. How important is price? When is it considered? How is it used? Another factor is the cost of switching. Have you ever watched the television program “The Price is Right”? If you have, you know that most consumers have poor price knowledge. Moreover, their knowledge of comparable prices within a product category —e.g. ketchup—is typically worse. So price knowledge is a relevant factor. Finally, the marketer must assess the customers’ price expectations. How much do you expect to pay for a large pizza? Colour TV? DVD? Newspaper? Swimming pool? These expectations create a phenomenon called “sticker shock” as exhibited by gasoline, automobiles, and ATM fees.

A second factor influencing value-based pricing is competitors. As noted in earlier chapters, defining competition is not always easy. Of course there are like-category competitors such as Toyota and Nissan. We have already discussed the notion of pricing above, below, and at the same level of these direct competitors. However, there are also indirect competitors that consumers may use to base price comparisons. For instance, we may use the price of a vacation as a basis for buying vacation clothes. The cost of eating out is compared to the cost of groceries. There are also instances when a competitor, especially a market leader, dictates the price for everyone else. Weyerhauser determines the price for lumber. Kellogg establishes the price for cereal.

If you are building a picnic table, it is fairly easy to add up your receipts and calculate costs. For a global corporation, determining costs is a great deal more complex. For example, calculating incremental costs and identifying avoidable costs are valuable tasks. Incremental cost is the cost of producing each additional unit. If the incremental cost begins to exceed the incremental revenue, it is a clear sign to quit producing. Avoidable costs are those that are unnecessary or can be passed onto some other institution in the marketing channel. Adding costly features to a product that the customer cannot use is an example of the former. As to the latter, the banking industry has been passing certain costs onto customers.

Another consideration is opportunity costs. Because the company spent money on store remodelling, they are not able to take advantage of a discounted product purchase. Finally, costs vary from market-to-market as well as quantities sold. Research should be conducted to assess these differences.

Although it would be nice to assume that a business has the freedom to set any price it chooses, this is not always the case. There are a variety of constraints that prohibit such freedom. Some constraints are formal, such as government restrictions in respect to strategies like collusion and price-fixing. This occurs when two or more companies agree to charge the same or very similar prices. Other constraints tend to be informal. Examples include matching the price of competitors, a traditional price charged for a particular product, and charging a price that covers expected costs.

Ultimately, value-based pricing offers the following three tactical recommendations:

- Employ a segmented approach toward price, based on such criteria as customer type, location, and order size.

- Establish highest possible price level and justify it with comparable value.

- Use price as a basis for establishing strong customer relationships

Penetration and Skimming Pricing

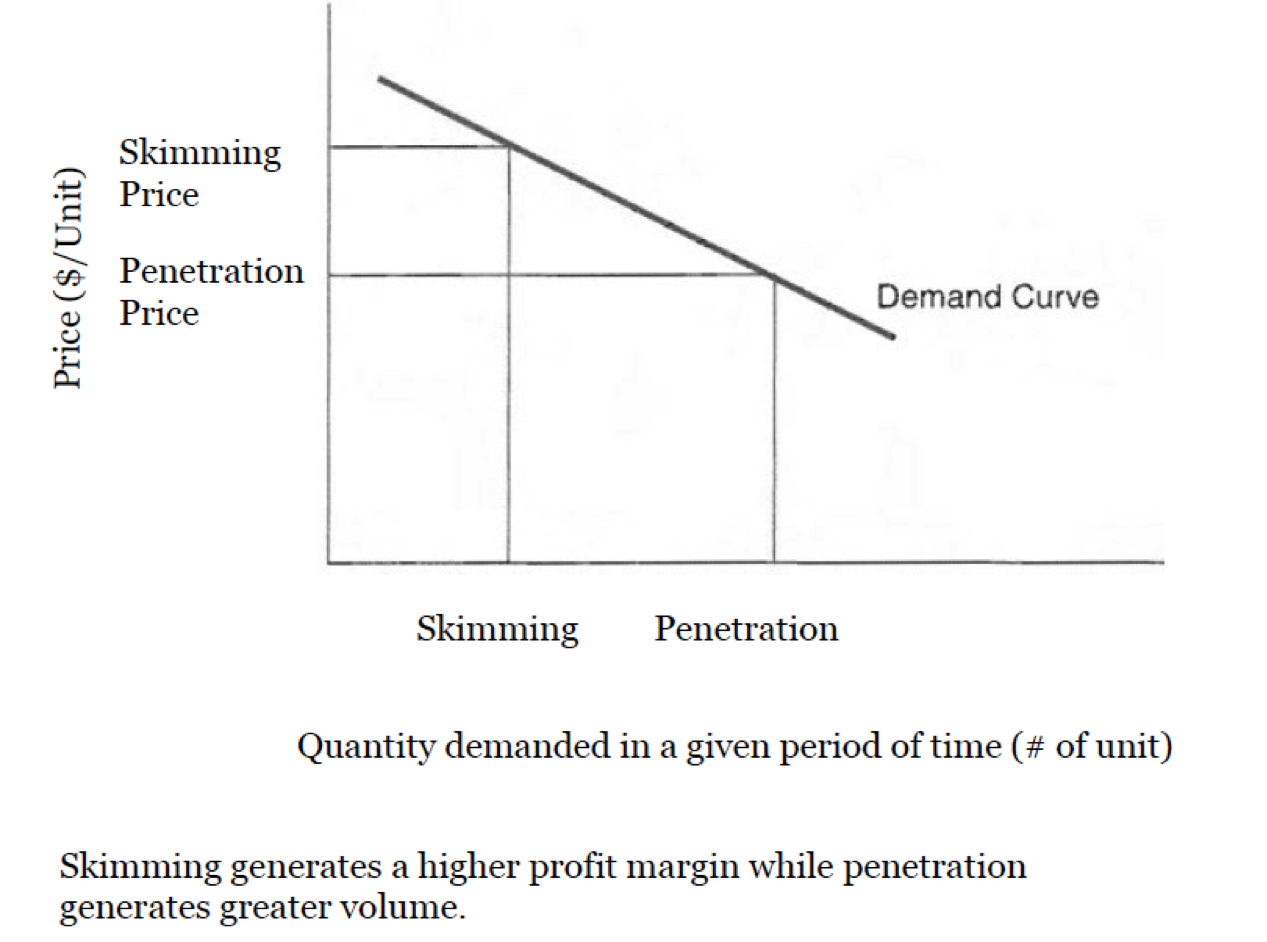

Penetration pricing is usually used in the introductory stage of a new product’s life cycle, and involves accepting a lower profit margin and to price relatively low. Such a strategy should generate greater sales and establish the new product in the market more quickly. Price skimming involves the top part of the demand curve. Price is set relatively high to generate a high profit margin and sales are limited to those buyers willing to pay a premium to get the new product (see Figure).

Penetration pricing can be used to achieve market share as a competitive strategy to achieve market leadership. Other times, it can also be used to increase market and sales growth. For example, Sony needed to sell the Walkman at a retail price of ¥50,000 ($249) to achieve breakeven, but a price of ¥35,000 ($170) was needed to attract the youth market segment. Through a long process of cost cutting, a breakeven price of ¥40,000 was achieved. Then Chairman Akio Morita insisted on a retail price of ¥33,000 ($165) to commemorate Sony’s 33rd anniversary. Sony also used this approach when its camcorder market became very competitive with price competition from Samsung, Hitachi and Panasonic. Another example is Google’s penetration pricing strategy, where they offered their Google Checkout service at a break-even price or at a loss, trying to gain market share against Paypal.

Which strategy is best depends on a number of factors. A penetration strategy would generally be supported by the following conditions: price-sensitive consumers, opportunity to keep costs low, the anticipation of quick market entry by competitors, a high likelihood for rapid acceptance by potential buyers, and an adequate resource base for the firm to meet the new demand and sales.

A skimming strategy is most appropriate when the opposite conditions exist. A premium product generally supports a skimming strategy. In this case, “premium” does not just denote high cost of production and materials; it also suggests that the product may be rare or that the demand is unusually high. An example would be a USD 500 ticket for the World Series or an USD 80,000 price tag for a limited-production sports car. Having legal protection via a patent or copyright may also allow for an excessively high price. Intel and their Pentium chip possessed this advantage for a long period of time. In most cases, the initial high price is gradually reduced to match new competition and allow new customers access to the product.

Several electronic products that were very innovative during their introduction, such as DVRs, CR payers, Flat Screen TVs, were priced very high during the initial introduction phase; then the prices dropped steeply. According to Cateora, Graham and Gilly (2016), this strategy can also be used when their markets have only two income levels: the super-rich and the very poor, as when Johnson & Johnson priced their diapers in Brazil before the arrival of P&G. As the company’s cost structure will not allow the setting of a low enough price for the low income segment, the company will cater to the wealthier segment using a premium price.

Core Principles of International Marketing – Chapter 12.3 by Babu John Mariadoss is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License, except where otherwise noted.