7.2 Product Life Cycle

Stages of the Product Life Cycle

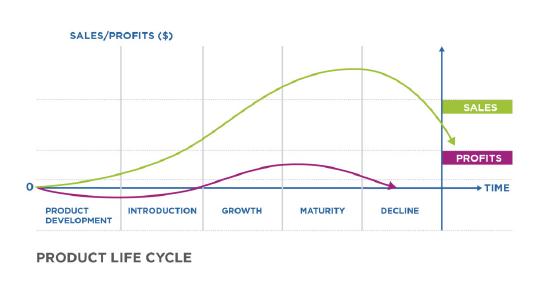

A company has to be good at both developing new products and managing them in the face of changing tastes, technologies, and competition. Products generally go through a life cycle with predictable sales and profits. Marketers use the product life cycle to follow this progression and identify strategies to influence it. The product life cycle (PLC) starts with the product’s development and introduction, then moves toward maturity, withdrawal and eventual decline. This progression is shown in the graph, below.

The five stages of the PLC are:

- Product development

- Market introduction

- Growth

- Maturity

- Decline

The table below shows common characteristics of each stage.

|

Common Characteristics |

|

|---|---|

| 0. Product development stage |

|

| 1. Market introduction stage |

|

| 2. Growth stage |

|

| 3. Maturity stage |

|

| 4. Decline stage |

|

Using the Product Life Cycle

The product life cycle can be a useful tool in planning for the life of the product, but it has a number of limitations.

Not all products follow a smooth and predictable growth path. Some products are tied to specific business cycles or have seasonal factors that impact growth. For example, enrolment in higher education tracks closely with economic trends. When there is an economic downturn, more people lose jobs and enrol in college to improve their job prospects. When the economy improves and more people are fully employed, college enrolments drop. This does not necessarily mean that education is in decline, only that it is in a down cycle.

Furthermore, evidence suggests that the PLC framework holds true for industry segments but not necessarily for individual brands or projects, which are likely to experience greater variability (Mullor-Sebastion, 1983).

Of course, changes in other elements of the marketing mix can also affect the performance of the product during its life cycle. Change in the competitive situation during each of these stages may have a much greater impact on the marketing approach than the PLC itself. An effective promotional program or a dramatic lowering of price may improve the sales picture in the decline period, at least temporarily. Usually the improvements brought about by non-product tactics are relatively short-lived, and basic alterations to product offerings provide longer benefits.

Whether one accepts the S-shaped curve as a valid sales pattern or as a pattern that holds only for some products (but not for others), the PLC concept can still be very useful. It offers a framework for dealing systematically with product marketing issues and activities. The marketer needs to be aware of the characteristics that apply to a given product as it moves through the various stages.

Marketing through the Product Cycle

There are some common marketing considerations associated with each stage of the PLC. How marketers think about the marketing mix and the blend of promotional activities–also known as the promotion mix–should reflect a product’s life-cycle stage and progress toward market adoption. These considerations cannot be used as a formula to guarantee success, but they can function as guidelines for thinking about budget, objectives, strategies, tactics, and potential opportunities and threats.

Keep in mind that we will discuss the new-product development process next, so it is not covered here.

Market Introduction Stage

Think of the market introduction stage as the product launch. This phase of the PLC requires a significant marketing budget. The market is not yet aware of the product or its benefits. Introducing a product involves convincing consumers that they have a problem or need which the new offering can uniquely address. At its core, messaging should convey, “This product is a great idea! You want this!” Usually a promotional budget is needed to create broad awareness and educate the market about the new product. To achieve these goals, often a product launch includes promotional elements such as a new Web site (or significant update to the existing site), a social media campaign, print or broadcast advertising, a press release and press campaign.

There is also a need to invest in the development of the distribution channels and related marketing support. For a B2B product, this often requires training the sales force and developing sales tools and materials for direct and personal selling. In a B2C market, it might include training and incentivizing retail partners to stock and promote the product.

Pricing strategies in the introduction phase are generally set fairly high, as there are fewer competitors in the market. This is often offset by early discounts and promotional pricing.

It is worth noting that the launch will look different depending on how new the product is. If the product is a completely new innovation that the market has not seen before, then there is a need to both educate the market about the new offering and build awareness of it. In 2013 when Google launched Google Glass—an optical head-mounted computer display—it had not only to get the word out about the product but also help prospective buyers understand what it was and how it might be used. Google initially targeted tech-savvy audiences most interested in novelty and innovation (more about them later when we discuss diffusion of innovation). By offering the new product with a lot of media fanfare and limited availability, Google’s promotional strategy ignited demand among these segments. Tech bloggers and insiders blogged and tweeted about their Google Glass adventures, and word-of-mouth sharing about the new product spread rapidly. You can imagine that this was very different from the launch of Wheat Thins Spicy Buffalo crackers, an extension of an existing product line, targeting a different audiences (retailers, consumers) with promotional activities that fit the product’s marketing and distribution channels. The Google Glass situation was also different from the launch of Tesla’s home battery. In that case Tesla offered a new line of home products from a company that had previously only offered automobiles. Breaking into new product categories and markets is challenging even for a well-regarded company like Tesla. As you might expect, the greater the difference in new products from a company’s existing offerings, the greater the complexity and expense of the introduction stage.

One other consideration is the maturity of the product itself. Sometimes marketers will choose to be conservative during the marketing introduction stage when the product is not yet fully developed or proven, or when the distribution channels are not well established. This might mean initially introducing the product to only one segment of the market, doing less promotion, or limiting distribution (as with Google Glass). This approach allows for early customer feedback but reduces the risk of product issues during the launch.

While we often think of an introduction or launch as a single event, this phase can last several years. Generally a product moves out of the introduction stage when it begins to see rapid growth, though what counts as “rapid growth” varies significantly based on the product and the market.

Growth Stage

Once rapid growth begins, the product or industry has entered the growth stage. When a product category begins to demonstrate significant growth, the market usually responds: new competitors enter the market, and larger companies acquire high-growth companies and products.

These emerging competitive threats drive new marketing tactics. Marketers who have been seeking to build broad market awareness through the introduction phase must now differentiate their products from competitors, emphasizing unique features that appeal to target customers. The central thrust of market messaging and promotion during this stage is “This brand is the best!” Pricing also becomes more competitive and must be adjusted to align with the differentiation strategy.

Often in the growth phase the marketer must pay significant attention to distribution. With a growing number of customers seeking the product, more distribution channels are needed. Mass marketing and other promotional strategies to reach more customers and segments start to make sense for consumer-focused markets during the growth stage. In business-to-business markets, personal selling and sales promotions often help open doors to broader growth. Marketers often must develop and support new distribution channels to meet demand. Through the growth phase, distribution partners will become more experienced selling the product and may require less support over time.

The primary challenges during the growth phase are to identify a differentiated position in the market that allows the product to capture a significant portion of the demand and to manage distribution to meet the demand.

Maturity Stage

When growth begins to plateau, the product has reached the maturity phase. In order to achieve strong business results through the maturity stage, the company must take advantage of economies of scale. This is usually a period in which marketers manage budget carefully, often redirecting resources toward products that are earlier in their life cycle and have higher revenue potential.

At this stage, organizations are trying to extract as much value from an established product as they can, typically in a very competitive field. Marketing messages and promotions seek to remind customers about a great product, differentiate from competitors, and reinforce brand loyalty: “Remember why this brand is the best.” As mentioned in the previous section, this late in the life cycle, promotional tactics and pricing discounts are likely to provide only short-term benefits. Changes to product have a better chance of yielding more sustained results.

In the maturity stage, marketers often focus on niche markets, using promotional strategies, messaging, and tactics designed to capture new share in these markets. Since there is no new growth, the emphasis shifts from drawing new customers to the market to winning more of the existing market. The company may extend a product line, adding new models that have greater appeal to a smaller segment of the market.

Often, distribution partners will reduce their emphasis on mature products. A sales force will shift its focus to new products with more growth potential. A retailer will reallocate shelf space. When this happens the manufacturer may need to take on a stronger role in driving demand.

We have repeatedly seen this tactic in the soft drink industry. As the market has matured, the number of different flavors of large brands like Coke and Pepsi has grown significantly. We will look at other product tactics to extend the growth phase and manage the maturity phase in the next section.

Decline Stage

Once a product or industry has entered decline, the focus shifts almost entirely to minimizing costs. Marketing spend is reduced for products in this life stage, because the marketing investment is better spent on other priorities. For goods, distributors will seek to eliminate inventory by cutting prices. For services, companies will reallocate staff to ensure that delivery costs are in check. Where possible, companies may initiate a planned obsolescence process. Commonly technology companies will announce to customers that they will not continue to support a product after a set obsolescence date.

Often a primary focus for marketers during this stage is to transition customers to newer products that are earlier in the product life cycle and have more favorable economics. Promotional activities and marketing communications typically focus on making this transition successful among brand-loyal segments who still want the old product. A typical theme of marketing activity is “This familiar brand is still here, but now there’s something even better.”

The New-Product Development Process

There are probably as many varieties of new-product development systems as there are types of companies, but most of them share the same basic steps or stages—they are just executed in different ways. Below, we have divided the process into eight stages, grouped into three phases. Many of the activities are performed repeatedly throughout the process, but they become more concrete as the product idea is refined and additional data are gathered. For example, at each stage of the process, the product team is asking, “Is this a viable product concept?” but the answers change as the product is refined and more market perspectives can be added to the evaluation.

| Phase I: Generating and Screening Ideas | Phase II: Developing New Products | Phase III: Commercializing New Products |

|---|---|---|

| Stage 1: Generating New Product Ideas | Stage 4: Business Case Analysis | Stage 6: Test Marketing |

| Stage 2: Screening Product Ideas | Stage 5: Technical and Marketing Development | Stage 7: Launch |

| Stage 3: Concept Development and Testing |

Stage 1: Generating New Product Ideas

Generating new product ideas is a creative task that requires a particular way of thinking. Coming up with ideas is easy, but generating good ideas is another story. Companies use a range of internal and external sources to identify new product ideas. A SWOT analysis might suggest strengths in existing products that could be the basis for new products or market opportunities. Research might identify market and customer trends. A competitive analysis might expose a hole in the company’s product portfolio. Customer focus groups or the sales team might identify unmet customer needs. Many amazing products are also the result of lucky mistakes—product experiments that don’t meet the intended goal but have an unintended and interesting application. For example, 3M scientist Dr. Spencer Silver invented Post-It Notes in a failed experiment to create a super-strong adhesive.

The key to the idea generation stage is to explore possibilities, knowing that most will not result in products that go to market.

Stage 2: Screening Product Ideas

The second stage of the product development process is idea screening. This is the first of many screening points. At this early stage much is not known about the product and its market opportunity. Still, product ideas that do not meet the organization’s overall objectives should be rejected at this stage. If a poor product idea is allowed to pass the screening stage, it wastes effort and money in later stages until it is abandoned. Even more serious is the possibility of screening out a worthwhile idea and missing a significant market opportunity. For this reason, this early screening stage allows many ideas to move forward that may not eventually go to market.

At this early stage, product ideas may simply be screened through some sort of internal rating process. Employees might rate the product ideas according to a set of criteria, for example; those with low scores are dropped and only the highest ranked products move forward.

Stage 3: Concept Development and Testing

Today, it is increasingly common for companies to run some small concept test in a real marketing setting. The product concept is a synthesis or a description of a product idea that reflects the core element of the proposed product. Marketing tries to have the most accurate and detailed product concept possible in order to get accurate reactions from target buyers. Those reactions can then be used to inform the final product, the marketing mix, and the business analysis.

New tools leveraging technology for product development are available that support the rapid development of prototypes which can be tested with potential buyers. When concept testing can include an actual product prototype, the early test results are much more reliable. Concept testing helps companies avoid investing in bad ideas and at the same time helps them catch and keep outstanding product ideas.

Stage 4: Business Case Analysis

Before companies make a significant investment in a product’s development, they need to be sure that it will bring a sufficient return.

The company seeks to answer such questions as the following:

- What is the market opportunity for this product?

- What are the costs to bring the product to market?

- What are the costs through the stages of the product life cycle?

- Where does the product fit in the product portfolio and how will it impact existing product sales?

- How does this product impact the brand?

- How does this product impact other corporate objectives such as social responsibility?

The marketing budget and costs are one element of the business analysis, but the full scope of the analysis includes all revenues, costs, and other business impacts of the product.

Stage 5: Technical and Marketing Development

A product that has passed the screening and business analysis stages is ready for technical and marketing development. Technical development processes vary greatly according to the type of product. For a product with a complex manufacturing process, there is a lab phase to create specifications and an equally complex phase to develop the manufacturing process. For a service offering, there may be new processes requiring new employee skills or the delivery of new equipment. These are only two of many possible examples, but in every case the company must define both what the product is and how it will be delivered to many buyers.

While the technical development is under way, the marketing department is testing the early product with target customers to find the best possible marketing mix. Ideally, marketing uses product prototypes or early production models to understand and capture customer responses and to identify how best to present the product to the market. Through this process, product marketing must prepare a complete marketing plan—one that starts with a statement of objectives and ends with a coherent picture of product distribution, promotion, and pricing integrated into a plan of marketing action.

Stage 6: Test Marketing and Validation

Test marketing is the final stage before commercialization; the objective is to test all the variables in the marketing plan including elements of the product. Test marketing represents an actual launching of the total marketing program, done on a limited basis.

Initial product testing and test marketing are not the same. Product testing is totally initiated by the producer: he or she selects the sample of people, provides the consumer with the test product, and offers the consumer some sort of incentive to participate.

Test marketing, on the other hand, is distinguished by the fact that the test group represents the full market, the consumer must make a purchase decision and pay for the product, and the test product must compete with the existing products in the actual marketing environment. For these and other reasons, a market test is an accurate simulation of the broader market and serves as a method for reducing risk. It should enhance the new product’s probability of success and allow for final adjustment in the marketing mix before the product is introduced on a large scale.

Stage 7: Launch

Finally, the product arrives at the commercial launch stage. The marketing mix comes together to introduce the product to the market. This stage marks the beginning of the product life cycle.

Stage 8: Evaluation

The launch does not in any way signal the end of the marketing role for the product. To the contrary, after launch the marketer finally has real market data about how the product performs in the wild, outside the test environment. These market data initiate a new cycle of idea generation about improvements and adjustments that can be made to all elements of the marketing mix.

Introduction to Business (Lumen) The Marketing Mix 14.2: Product by LibreTexts is licensed under a Creative Commons Attribution-ShareAlike 4.0 license unless otherwise noted.