9.5 – Income Inequality: Measurement and Causes

Learning Objectives

- Explain the distribution of income, and analyze the sources of income inequality in a market economy

- Measure income distribution in quintiles

- Calculate and graph a Lorenz curve

- Show income inequality through demand and supply diagrams

Poverty levels can be subjective based on the overall income levels of a country. Typically a government measures poverty based on a percentage of the median income. Income inequality, however, has to do with the distribution of that income, in terms of which group receives the most or the least income. Income inequality involves comparing those with high incomes, middle incomes, and low incomes—not just looking at those below or near the poverty line. In turn, measuring income inequality means dividing the population into various groups and then comparing the groups, a task that we can be carry out in several ways, as the next Clear It Up feature shows.

Clear It Up

How do you separate poverty and income inequality?

Poverty can change even when inequality does not move at all. Imagine a situation in which income for everyone in the population declines by 10%. Poverty would rise, since a greater share of the population would now fall below the poverty line. However, inequality would be the same, because everyone suffered the same proportional loss. Conversely, a general rise in income levels over time would keep inequality the same, but reduce poverty.

It is also possible for income inequality to change without affecting the poverty rate. Imagine a situation in which a large number of people who already have high incomes increase their incomes by even more. Inequality would rise as a result—but the number of people below the poverty line would remain unchanged.

Why did inequality of household income increase in the United States in recent decades? A trend toward greater income inequality has occurred in many countries around the world, although the effect has been more powerful in the U.S. economy. Economists have focused their explanations for the increasing inequality on two factors that changed more or less continually from the 1970s into the 2000s. One set of explanations focuses on the changing shape of American households. The other focuses on greater inequality of wages, what some economists call “winner take all” labour markets. We will begin with how we measure inequality, and then consider the explanations for growing inequality in the United States.

Measuring Income Distribution by Quintiles

One common way of measuring income inequality is to rank all households by income, from lowest to highest, and then to divide all households into five groups with equal numbers of people, known as quintiles. This calculation allows for measuring the distribution of income among the five groups compared to the total. The first quintile is the lowest fifth or 20%, the second quintile is the next lowest, and so on. We can measure income inequality by comparing what share of the total income each quintile earns.

U.S. income distribution by quintile appears in Table 9.5a. In 2011, for example, the bottom quintile of the income distribution received 3.2% of income; the second quintile received 8.4%; the third quintile, 14.3%; the fourth quintile, 23.0%; and the top quintile, 51.14%. The final column of Table 9.5a shows what share of income went to households in the top 5% of the income distribution: 22.3% in 2011. Over time, from the late 1960s to the early 1980s, the top fifth of the income distribution typically received between about 43% to 44% of all income. The share of income that the top fifth received then begins to rise. Census Bureau researchers trace, much of this increase in the share of income going to the top fifth to an increase in the share of income going to the top 5%. The quintile measure shows how income inequality has increased in recent decades.

| Year | Lowest Quintile | Second Quintile | Third Quintile | Fourth Quintile | Highest Quintile | Top 5% |

|---|---|---|---|---|---|---|

| 1967 | 4.0 | 10.8 | 17.3 | 24.2 | 43.6 | 17.2 |

| 1970 | 4.1 | 10.8 | 17.4 | 24.5 | 43.3 | 16.6 |

| 1975 | 4.3 | 10.4 | 17.0 | 24.7 | 43.6 | 16.5 |

| 1980 | 4.2 | 10.2 | 16.8 | 24.7 | 44.1 | 16.5 |

| 1985 | 3.9 | 9.8 | 16.2 | 24.4 | 45.6 | 17.6 |

| 1990 | 3.8 | 9.6 | 15.9 | 24.0 | 46.6 | 18.5 |

| 1995 | 3.7 | 9.1 | 15.2 | 23.3 | 48.7 | 21.0 |

| 2000 | 3.6 | 8.9 | 14.8 | 23.0 | 49.8 | 22.1 |

| 2005 | 3.4 | 8.6 | 14.6 | 23.0 | 50.4 | 22.2 |

| 2010 | 3.3 | 8.5 | 14.6 | 23.4 | 50.3 | 21.3 |

| 2013 | 3.2 | 8.4 | 14.4 | 23.0 | 51 | 22.2 |

It can also be useful to divide the income distribution in ways other than quintiles; for example, into tenths or even into percentiles (that is, hundredths). A more detailed breakdown can provide additional insights. For example, the last column of Table 9.5a shows the income received by the top 5% percent of the income distribution. Between 1980 and 2013, the share of income going to the top 5% increased by 5.7 percentage points (from 16.5% in 1980 to 22.2% in 2013). From 1980 to 2013 the share of income going to the top quintile increased by 7.0 percentage points (from 44.1% in 1980 to 51% in 2013). Thus, the top 20% of householders (the fifth quintile) received over half (51%) of all the income in the United States in 2013.

Lorenz Curve

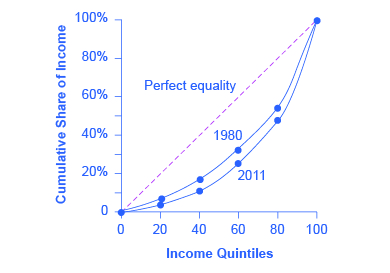

We can present the data on income inequality in various ways. For example, you could draw a bar graph that showed the share of income going to each fifth of the income distribution. Figure 9.5a presents an alternative way of showing inequality data in a Lorenz curve. This curve shows the cumulative share of population on the horizontal axis and the cumulative percentage of total income received on the vertical axis.

Every Lorenz curve diagram begins with a line sloping up at a 45-degree angle. We show it as a dashed line in Figure 9.5a. The points along this line show what perfect equality of the income distribution looks like. It would mean, for example, that the bottom 20% of the income distribution receives 20% of the total income, the bottom 40% gets 40% of total income, and so on. The other lines reflect actual U.S. data on inequality for 1980 and 2011.

The trick in graphing a Lorenz curve is that you must change the shares of income for each specific quintile, which we show in the first column of numbers in Table 9.5b, into cumulative income, which we show in the second column of numbers. For example, the bottom 40% of the cumulative income distribution will be the sum of the first and second quintiles; the bottom 60% of the cumulative income distribution will be the sum of the first, second, and third quintiles, and so on. The final entry in the cumulative income column needs to be 100%, because by definition, 100% of the population receives 100% of the income.

| Income Category | Share of Income in 1980 (%) | Cumulative Share of Income in 1980 (%) | Share of Income in 2013 (%) | Cumulative Share of Income in 2013 (%) |

|---|---|---|---|---|

| First quintile | 4.2 | 4.2 | 3.2 | 3.2 |

| Second quintile | 10.2 | 14.4 | 8.4 | 11.6 |

| Third quintile | 16.8 | 31.2 | 14.4 | 26.0 |

| Fourth quintile | 24.7 | 55.9 | 23.0 | 49.0 |

| Fifth quintile | 44.1 | 100.0 | 51.0 | 100.0 |

In a Lorenz curve diagram, a more unequal distribution of income will loop farther down and away from the 45-degree line, while a more equal distribution of income will move the line closer to the 45-degree line. Figure 9.5a illustrates the greater inequality of the U.S. income distribution between 1980 and 2013 because the Lorenz curve for 2013 is farther from the 45-degree line than for 1980. The Lorenz curve is a useful way of presenting the quintile data that provides an image of all the quintile data at once. The next Clear It Up feature shows how income inequality differs in various countries compared to the United States.

Clear It Up

How does economic inequality vary around the world?

The U.S. economy has a relatively high degree of income inequality by global standards. As Table 9.5b shows, based on a variety of national surveys for a selection of years in the last five years of the 2000s (with the exception of Germany, and adjusted to make the measures more comparable), the U.S. economy has greater inequality than Germany (along with most Western European countries). The region of the world with the highest level of income inequality is Latin America, illustrated in the numbers for Brazil and Mexico. The level of inequality in the United States is lower than in some of the low-income countries of the world, like China and Nigeria, or some middle-income countries like the Russian Federation. However, not all poor countries have highly unequal income distributions. India provides a counterexample.

Watch It!

Watch the video to see illustrated data on the distribution of wealth in the United States.

Watch A look at income inequality in the United States | TIME (3:30 minutes) on YouTube

Video Source: TIME. (2020, February 20). A look at income inequality in the United States | TIME [Video]. YouTube. https://youtu.be/qc7g6Uhi1i4

Causes of Growing Inequality: The Changing Composition of American Households

In 1970, 41% of married women were in the labour force, but by 2015, according to the Bureau of Labor Statistics, 56.7% of married women were in the labour force. One result of this trend is that more households have two earners. Moreover, it has become more common for one high earner to marry another high earner. A few decades ago, the common pattern featured a man with relatively high earnings, such as an executive or a doctor, marrying a woman who did not earn as much, like a secretary or a nurse. Often, the woman would leave paid employment, at least for a few years, to raise a family. However, now doctors are marrying doctors and executives are marrying executives, and mothers with high-powered careers are often returning to work while their children are quite young. This pattern of households with two high earners tends to increase the proportion of high-earning households.

According to data in the National Journal, even as two-earner couples have increased, so have single-parent households. Of all U.S. families, 13.1% were headed by single mothers. The poverty rate among single-parent households tends to be relatively high.

These changes in family structure, including the growth of single-parent families who tend to be at the lower end of the income distribution, and the growth of two-career high-earner couples near the top end of the income distribution, account for roughly half of the rise in income inequality across households in recent decades.

Watch It!

Watch the following video to hear about wealth inequality in the United States.

Watch Wealth inequality in America (6:30 minutes) on YouTube

Video Source: politizane. (2012, November 12). Wealth inequality in America [Video]. YouTube. https://youtu.be/QPKKQnijnsM

Causes of Growing Inequality: A Shift in the Distribution of Wages

Another factor behind the rise in U.S. income inequality is that earnings have become less equal since the late 1970s. In particular, the earnings of high-skilled labour relative to low-skilled labour have increased. Winner-take-all labour markets result from changes in technology, which have increased global demand for “stars,”—whether the best CEO, doctor, basketball player, or actor. This global demand pushes salaries far above productivity differences versus educational differences. One way to measure this change is to take workers’ earnings with at least a four-year college bachelor’s degree (including those who went on and completed an advanced degree) and divide them by workers’ earnings with only a high school degree. The result is that those in the 25–34 age bracket with college degrees earned about 1.67 times as much as high school graduates in 2010, up from 1.59 times in 1995, according to U.S. Census data. Winner-take-all labour market theory argues that the salary gap between the median and the top 1 percent is not due to educational differences.

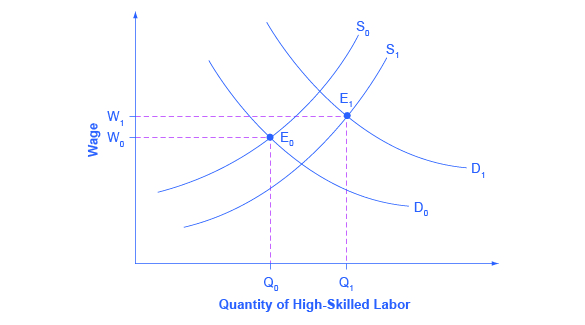

Economists use the demand and supply model to reason through the most likely causes of this shift. According to the National Center for Education Statistics, in recent decades, the supply of U.S. workers with college degrees has increased substantially. For example, 840,000 four-year bachelor’s degrees were conferred on Americans in 1970. In 2013-2014, 1,894,934 such degrees were conferred—an increase of over 90%. In Figure 9.5b, this shift in supply to the right, from S0 to S1, should result in a lower equilibrium wage for high-skilled labour. Thus, we can explain the increase in the price of high-skilled labour by a greater demand, like the movement from D0 to D1. Evidently, combining both the increase in supply and in demand has resulted in a shift from E0 to E1, and a resulting higher wage.

Figure 9.5b Why Would Wages Rise for High-Skilled Labour? (Text Version)

The vertical axis is Wage (W) and the horizontal axis is quantity of high-skilled labour (Q). Both supply curves (S0 and S1) slope upwards from left to right and both demand curves (D0 and D1) slope downwards from left to right. The proportion of workers attending college has increased in recent decades, so the supply curve for high-skilled labour has shifted to the right, from S0 to S1. If the demand for high-skilled labour had remained at D0, then this shift in supply would have led to lower wages for high-skilled labour. However, the wages for high-skilled labour, especially if there is a large global demand, have increased even with the shift in supply to the right. The explanation must lie in a shift to the right in demand for high-skilled labour, from D0 to D1. The figure shows how a combination of the shift in supply, from S0 to S1, and the shift in demand, from D0 to D1, led to both an increase in the quantity of high-skilled labour hired and also to a rise in the wage for such labour, from W0 to W1. The original supply curve (S0) and original demand curve (D0) intersect at E, at point W0 and Q0. The new supply curve (S1) and new demand curve (D1) intersect at E1, at point W1 and Q1.

We can view the market for high-skilled labour as a race between forces of supply and demand. Additional education and on-the-job training will tend to increase the high-skilled labour supply and to hold down its relative wage. Conversely, new technology and other economic trends like globalization tend to increase the demand for high-skilled labour and push up its relative wage. We can view the greater inequality of wages as a sign that demand for skilled labour is increasing faster than supply. Alternatively, if the supply of lower skilled workers exceeds the demand, then average wages in the lower quintiles of the income distribution will decrease. The combination of forces in the high-skilled and low-skilled labour markets leads to increased income disparity.

Key Concepts and Summary

Measuring inequality involves making comparisons across the entire distribution of income, not just the poor. One way of doing this is to divide the population into groups, like quintiles, and then calculate what share of income each group receives. An alternative approach is to draw Lorenz curves, which compare the cumulative income actually received to a perfectly equal distribution of income. Income inequality in the United States increased substantially from the late 1970s and early 1980s into the 2000s. The two most common explanations that economists cite are changes in household structures that have led to more two-earner couples and single-parent families, and the effect of new information and communications technology on wages.

Attribution

Except where otherwise noted, this chapter is adapted from “Income Inequality: Measurement and Causes” In Principles of Economics 2e by Steven A. Greenlaw & David Shapiro, licensed under CC BY 4.0.

Access for free at Principles of Microeconomics 2e

Original Source Chapter References

Ebeling, Ashlea. 2014. “IRS Announces 2015 Estate And Gift Tax Limits.” Forbes. Accessed March 16, 2015. http://www.forbes.com/sites/ashleaebeling/2014/10/30/irs-announces-2015-estate-and-gift-tax-limits/.

Federal Register: The Daily Journal of the United States Government. “State Median Income Estimates for a Four-Person Household: Notice of the Federal Fiscal Year (FFY) 2013 State Median Income Estimates for Use Under the Low Income Home Energy Assistance Program (LIHEAP).” Last modified March 15, 2012. https://www.federalregister.gov/articles/2012/03/15/2012-6220/state-median-income-estimates-for-a-four-person-household-notice-of-the-federal-fiscal-year-ffy-2013#t-1.

Luhby, Tami. 2014. “Income is on the rise . . . finally!” Accessed April 10, 2015. http://money.cnn.com/2014/08/20/news/economy/median-income/.

Meyer, Ali. 2015. “56,023,000: Record Number of Women Not in Labor Force.” CNSNews.com. Accessed March 16, 2015. http://cnsnews.com/news/article/ali-meyer/56023000-record-number-women-not-labor-force.

Orshansky, Mollie. “Children of the Poor.” Social Security Bulletin. 26 no. 7 (1963): 3–13. http://www.ssa.gov/policy/docs/ssb/v26n7/v26n7p3.pdf.

The World Bank. “Data: Poverty Headcount Ratio at $1.25 a Day (PPP) (% of Population).” http://data.worldbank.org/indicator/SI.POV.DDAY.

U.S. Department of Commerce: United States Census Bureau. “American FactFinder.” http://factfinder2.census.gov/faces/nav/jsf/pages/index.xhtml.

U.S. Department of Commerce: United States Census Bureau. “Current Population Survey (CPS): CPS Table Creator.” http://www.census.gov/cps/data/cpstablecreator.html.

U.S. Department of Commerce: United States Census Bureau. “Income: Table F-6. Regions—Families (All Races) by Median and Mean Income.” http://www.census.gov/hhes/www/income/data/historical/families/.

U.S. Department of Commerce: United States Census Bureau. “Poverty: Poverty Thresholds.” Last modified 2012. http://www.census.gov/hhes/www/poverty/data/threshld/.

U.S. Department of Health & Human Services. 2015. “2015 Poverty Guidelines.” Accessed April 10, 2015. http://www.medicaid.gov/medicaid-chip-program-information/by-topics/eligibility/downloads/2015-federal-poverty-level-charts.pdf.

U.S. Department of Health & Human Services. 2015. “Information on Poverty and Income Statistics: A Summary of 2014 Current Population Survey Data.” Accessed April 13, 2015. http://aspe.hhs.gov/hsp/14/povertyandincomeest/ib_poverty2014.pdf.

Congressional Budget Office. 2015. “The Effects of Potential Cuts in SNAP Spending on Households With Different Amounts of Income.” Accessed April 13, 2015. https://www.cbo.gov/publication/49978.

Falk, Gene. Congressional Research Service. “The Temporary Assistance for Needy Families (TANF) Block Grant: Responses to Frequently Asked Questions.” Last modified October 17, 2013. http://www.fas.org/sgp/crs/misc/RL32760.pdf.

Library of Congress. “Congressional Research Service.” http://www.loc.gov/crsinfo/about/.

Office of Management and Budget. “Fiscal Year 2013 Historical Tables: Budget of the U.S. Government.” http://www.whitehouse.gov/sites/default/files/omb/budget/fy2013/assets/hist.pdf.

Tax Policy Center: Urban Institute and Brookings Institution. “The Tax Policy Briefing Book: Taxation and the Family: What is the Earned Income Tax Credit?” http://www.taxpolicycenter.org/briefing-book/key-elements/family/eitc.cfm.

Frank, Robert H., and Philip J. Cook. The Winner-Take-All Society. New York: Martin Kessler Books at The Free Press, 1995.

Institute of Education Sciences: National Center for Education Statistics. “Fast Facts: Degrees Conferred by Sex and Race.” http://nces.ed.gov/fastfacts/display.asp?id=72.

Nhan, Doris. “Census: More in U.S. Report Nontraditional Households.” National Journal. Last modified May 1, 2012. http://www.nationaljournal.com/thenextamerica/demographics/census-more-in-u-s-report-nontraditional-households-20120430.

U.S. Bureau of Labor Statistics: BLS Reports. “Report 1040: Women in the Labor Force: A Databook.” Last modified March 26, 2013. http://www.bls.gov/cps/wlf-databook-2012.pdf.

U.S. Department of Commerce: United States Census Bureau. “Income: Table H-2. Share of Aggregate Income Received by Each Fifth and Top 5 Percent of Households.” http://www.census.gov/hhes/www/income/data/historical/household/.

United States Census Bureau. 2014. “2013 Highlights.” Accessed April 13, 2015. http://www.census.gov/hhes/www/poverty/about/overview/.

United States Census Bureau. 2014. “Historical Income Tables: Households: Table H-2 Share of Aggregate Income Received by Each Fifth and Top 5% of Income. All Races.” Accessed April 13, 2015. http://www.census.gov/hhes/www/income/data/historical/household/.

Board of Governors of the Federal Reserve System. “Research Resources: Survey of Consumer Finances.” Last modified December 13, 2013. http://www.federalreserve.gov/econresdata/scf/scfindex.htm.

Congressional Budget Office. “The Distribution of Household Income and Federal Taxes, 2008 and 2009.” Last modified July 10, 2012. http://www.cbo.gov/publication/43373.

Huang, Chye-Ching, and Nathaniel Frentz. “Myths and Realities About the Estate Tax.” Center on Budget and Policy Priorities. Last modified August 29, 2013. http://www.cbpp.org/files/estatetaxmyths.pdf.

Media Attributions

- Figure © Steven A. Greenlaw & David Shapiro (OpenStax) is licensed under a CC BY (Attribution) license

- Figure © Steven A. Greenlaw & David Shapiro (OpenStax) is licensed under a CC BY (Attribution) license

When one group receives a disproportionate share of total income or wealth than others

Percentage of the population living below the poverty line

A graph that compares the cumulative income actually received to a perfectly equal distribution of income; it shows the share of population on the horizontal axis and the cumulative percentage of total income received on the vertical axis