2.9 – Economic Models

Learning Objectives

- Review basic algebra and calculus’ concepts relevant in introductory economics

- Assess the benefits and drawbacks of using simplifying assumptions in economics

- Apply the steps of the scientific method to economic questions

- Recognize the uses and limitations of economic models

- Contrast normative and positive statements about economic policy

Math Review

Mathematical economics uses mathematical methods, such as algebra and calculus, to represent theories and analyze problems in economics.

As a social science, economics analyzes the production, distribution, and consumption of goods and services. The study of economics requires the use of mathematics in order to analyze and synthesize complex information.

Mathematical Economics

Mathematical economics is the application of mathematical methods to represent theories and analyze problems in economics. Using mathematics allows economists to form meaningful, testable propositions about complex subjects that would be hard to express informally. Math enables economists to make specific and positive claims that are supported through formulas, models, and graphs. Mathematical disciplines, such as algebra and calculus, allow economists to study complex information and clarify assumptions.

Algebra

Algebra is the study of operations and their application to solving equations. It provides structure and a definite direction for economists when they are analyzing complex data. Math deals with specified numbers, while algebra introduces quantities without fixed numbers (known as variables). Using variables to denote quantities allows general relationships between quantities to be expressed concisely. Quantitative results in science, economics included, are expressed using algebraic equations.

Concepts in algebra that are used in economics include variables and algebraic expressions. Variables are letters that represent general, non-specified numbers. Variables are useful because they can represent numbers whose values are not yet known, they allow for the description of general problems without giving quantities, they allow for the description of relationships between quantities that may vary, and they allow for the description of mathematical properties. Algebraic expressions can be simplified using basic math operations including addition, subtraction, multiplication, division, and exponentiation.

In economics, theories need the flexibility to formulate and use general structures. By using algebra, economists are able to develop theories and structures that can be used with different scenarios regardless of specific quantities.

Calculus

Calculus is the mathematical study of change. Economists use calculus in order to study economic change whether it involves the world or human behavior.

Calculus has two main branches:

- Differential calculus is the study of the definition, properties, and applications of the derivative of a function (rates of change and slopes of curves). By finding the derivative of a function, you can find the rate of change of the original function.

- Integral calculus is the study of the definitions, properties, and applications of two related concepts, the indefinite and definite integral (accumulation of quantities and the areas under curves).

Calculus is widely used in economics and has the ability to solve many problems that algebra cannot. In economics, calculus is used to study and record complex information – commonly on graphs and curves. Calculus allows for the determination of a maximal profit by providing an easy way to calculate marginal cost and marginal revenue. It can also be used to study supply and demand curves.

Common Mathematical Terms

Economics utilizes a number of mathematical concepts on a regular basis such as:

- Dependent Variable: The output or the effect variable. Typically represented as yy, the dependent variable is graphed on the yy-axis. It is the variable whose change you are interested in seeing when you change other variables.

- Independent or Explanatory Variable: The inputs or causes. Typically represented as x1x1, x2x2, x3x3, etc., the independent variables are graphed on the xx-axis. These are the variables that are changed in order to see how they affect the dependent variable.

- Slope: The direction and steepness of the line on a graph. It is calculated by dividing the amount the line increases on the yy-axis (vertically) by the amount it changes on the xx-axis (horizontally). A positive slope means the line is going up toward the right on a graph, and a negative slope means the line is going down toward the right. A horizontal line has a slope of zero, while a vertical line has an undefined slope. The slope is important because it represents a rate of change.

- Tangent: The single point at which two curves touch. The derivative of a curve, for example, gives the equation of a line tangent to the curve at a given point.

Assumptions

Economists use assumptions in order to simplify economics processes so that they are easier to understand.

As a field, economics deals with complex processes and studies substantial amounts of information. Economists use assumptions in order to simplify economic processes so that it is easier to understand. Simplifying assumptions are used to gain a better understanding about economic issues with regards to the world and human behavior.

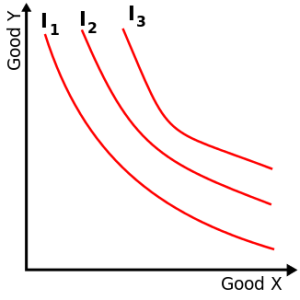

Illustrates three indifference curves, with I3 having highest utility, and I1 lowest.

Simple indifference curve: An indifference curve is used to show potential demand patterns. It is an example of a graph that works with simplifying assumptions to gain a better understanding of the world and human behavior in relation to economics.

Economic Assumptions

Neo-classical economics works with three basic assumptions:

- People have rational preferences among outcomes that can be identified and associated with a value.

- Individuals maximize utility (as consumers) and firms maximize profit (as producers).

- People act independently on the basis of full and relevant information.

Benefits of Economic Assumptions

Assumptions provide a way for economists to simplify economic processes and make them easier to study and understand. An assumption allows an economist to break down a complex process in order to develop a theory and realm of understanding. Good simplification will allow the economists to focus only on the most relevant variables. Later, the theory can be applied to more complex scenarios for additional study.

For example, economists assume that individuals are rational and maximize their utilities. This simplifying assumption allows economists to build a structure to understand how people make choices and use resources. In reality, all people act differently. However, using the assumption that all people are rational enables economists study how people make choices.

Criticisms of Economic Assumptions

Although, simplifying assumptions help economists study complex scenarios and events, there are criticisms to using them. Critics have stated that assumptions cause economists to rely on unrealistic, unverifiable, and highly simplified information that in some cases simplifies the proofs of desired conclusions. Examples of such assumptions include perfect information, profit maximization, and rational choices. Economists use the simplified assumptions to understand complex events, but criticism increases when they base theories off the assumptions because assumptions do not always hold true. Although simplifying can lead to a better understanding of complex phenomena, critics explain that the simplified, unrealistic assumptions cannot be applied to complex, real world situations.

Hypotheses and Tests

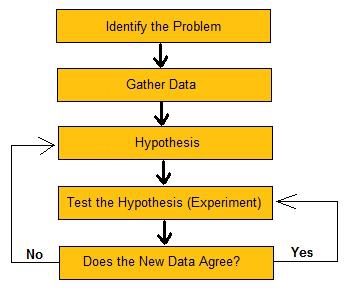

Economics, as a science, follows the scientific method in order to study data, observe patterns, and predict results of stimuli. There are specific steps that must be followed when using the scientific method. Economics follows these steps in order to study data and build principles:

Scientific Method: The scientific method is used in economics to study data, observe patterns, and predict results.

- Identify the problem – in the case of economics, this first step of the scientific method involves determining the focus or intent of the work. What is the economist studying? What is he trying to prove or show through his work?

- Gather data – economics involves extensive amounts of data. For this reason, it is important that economists can break down and study complex information. The second step of the scientific method involves selecting the data that will be used in the study.

- Hypothesis – the third step of the scientific method involves creating a model that will be used to make sense of all of the data. A hypothesis is simply a prediction. What does the economist think the overall outcome of the study will be?

- Test hypothesis – the fourth step of the scientific method involves testing the hypothesis to determine if it is true. This is a critical stage within the scientific method. The observations must be tested to make sure they are unbiased and reproducible. In economics, extensive testing and observation is required because the outcome must be obtained more than once in order for it to be valid. It is not unusual for testing to take some time and for economists to make adjustments throughout the testing process.

- Analyze the results – the final step of the scientific method is to analyze the results. First, an economist will ask himself if the data agrees with the hypothesis. If the answer is “yes,” then the hypothesis was accurate. If the answer is “no,” then the economist must go back to the original hypothesis and adjust the study accordingly. A negative result does not mean that the study is over. It simply means that more work and analysis is required.

Observation of data is critical for economists because they take the results and interpret them in a meaningful way. Cause and effect relationships are used to establish economic theories and principles. Over time, if a theory or principle becomes accepted as universally true, it becomes a law. In general, a law is always considered to be true. The scientific method provides the framework necessary for the progression of economic study. All economic theories, principles, and laws are generalizations or abstractions. Through the use of the scientific method, economists are able to break down complex economic scenarios in order to gain a deeper understanding of critical data.

Economic Models

A model is simply a framework that is designed to show complex economic processes.

Economic Models

In economics, a model is defined as a theoretical construct that represents economic processes through a set of variables and a set of logical or quantitative relationships between the two. A model is simply a framework that is designed to show complex economic processes. Most models use mathematical techniques in order to investigate, theorize, and fit theories into economic situations.

Uses of an Economic Model

Economists use models in order to study and portray situations. The focus of a model is to gain a better understanding of how things work, to observe patterns, and to predict the results of stimuli. Models are based on theory and follow the rules of deductive logic.

In economics, economic model diagrams are used in order to study and portray situations and gain a better understand of how things work. Economic models have two functions:

- to simplify and abstract from observed data,

- to serve as a means of selection of data based on a paradigm of econometric study.

Economic processes are known to be enormously complex, so simplification to gain a clearer understanding is critical. Selecting the correct data is also very important because the nature of the model will determine what economic facts are studied and how they will be compiled. Examples of the uses of economic models include: professional academic interest, forecasting economic activity, proposing economic policy, presenting reasoned arguments to politically justify economic policy, as well as economic planning and allocation.

Constructing a Model

The construction and use of a model will vary according to the specific situation. However, creating a model does have two basic steps: 1) generate the model, and 2) checking the model for accuracy – also known as diagnostics. The diagnostic step is important because a model is only useful if the data and analysis is accurate.

Limitations of a Model

Due to the complexity of economic models, there are obviously limitations that come into account. First, all of the data provided must be complete and accurate in order for the analysis to be successful. Also, once the data is entered, it must be analyzed correctly. In most cases, economic models use mathematical or quantitative analysis. Within this realm of observation, accuracy is very important. During the construction of a model, the information will be checked and updated as needed to ensure accuracy. Some economic models also use qualitative analysis. However, this kind of analysis is known for lacking precision. Furthermore, models are fundamentally only as good as their founding assumptions.

The use of economic models is important in order to further study and understand economic processes. Steps must be taken throughout the construction of the model to ensure that the data provided and analyzed is correct.

Normative and Positive Economics

Positive economics is defined as the “what is” of economics, while normative economics focuses on the “what ought to be”.

Positive and normative economic thought are two specific branches of economic reasoning. Although they are associated with one another, positive and normative economic thought have different focuses when analyzing economic scenarios.

Positive Economics

Positive economics is a branch of economics that focuses on the description and explanation of phenomena, as well as their casual relationships. It focuses primarily on facts and cause-and-effect behavioral relationships, including developing and testing economic theories. As a science, positive economics focuses on analyzing economic behavior. It avoids economic value judgments. For example, positive economic theory would describe how money supply growth impacts inflation, but it does not provide any guidance on what policy should be followed. “The unemployment rate in France is higher than that in the United States” is a positive economic statement. It gives an overview of an economic situation without providing any guidance for necessary actions to address the issue.

Normative Economics

Normative economics is a branch of economics that expresses value or normative judgments about economic fairness. It focuses on what the outcome of the economy or goals of public policy should be. Many normative judgments are conditional. They are given up if facts or knowledge of facts change. In this instance, a change in values is seen as being purely scientific. Welfare economist Amartya Sen explained that basic (normative) judgments rely on knowledge of facts.

An example of a normative economic statement is “The price of milk should be $6 a gallon to give dairy farmers a higher living standard and to save the family farm. ” It is a normative statement because it reflects value judgments. It states facts, but also explains what should be done. Normative economics has subfields that provide further scientific study including social choice theory, cooperative game theory, and mechanism design.

Relationship Between Positive and Normative Economics

Positive economics does impact normative economics because it ranks economic policies or outcomes based on acceptability (normative economics). Positive economics is defined as the “what is” of economics, while normative economics focuses on the “what ought to be. ” Positive economics is utilized as a practical tool for achieving normative objectives. In other words, positive economics clearly states an economic issue and normative economics provides the value-based solution for the issue.

Key Takeaways

- Using mathematics allows economists to form meaningful, testable propositions about complex subjects that would be hard to express informally.

- Algebra is the study of operations and their application to solving equations. It provides structure and a definite direction for economists when they are analyzing complex data.

- Concepts in algebra that are used in economics include variables and algebraic expressions.

- Calculus is the mathematical study of change. Economists use calculus in order to study economic change whether it involves the world or human behavior.

- In economics, calculus is used to study and record complex information – commonly on graphs and curves.

- Neo-classical economics employs three basic assumptions: people have rational preferences among outcomes that can be identified and associated with a value, individuals maximize utility and firms maximize profit, and people act independently on the basis of full and relevant information.

- An assumption allows an economist to break down a complex process in order to develop a theory and realm of understanding. Later, the theory can be applied to more complex scenarios for additional study.

- Critics have stated that assumptions cause economists to rely on unrealistic, unverifiable, and highly simplified information that in some cases simplifies the proofs of desired conclusions.

- Although simplifying can lead to a better understanding of complex phenomena, critics explain that the simplified, unrealistic assumptions cannot be applied to complex, real world situations.

- The scientific method involves identifying a problem, gathering data, forming a hypothesis, testing the hypothesis, and analyzing the results.

- A hypothesis is simply a prediction.

- In economics, extensive testing and observation is required because the outcome must be obtained more than once in order to be valid.

- Cause and effect relationships are used to establish economic theories and principles. Over time, if a theory or principle becomes accepted as universally true, it becomes a law. In general, a law is always considered to be true.

- The scientific method provides the framework necessary for the progression of economic study.

- Many models use mathematical techniques in order to investigate, theorize, and fit theories into economic situations.

- Economic models have two functions: 1) to simplify and abstract from observed data, and 2) to serve as a means of selection of data based on a paradigm of econometric study.

- Creating a model has two basic steps: 1) generate the model, and 2) checking the model for accuracy – also known as diagnostics.

- Examples of the uses of economic models include: professional academic interest, forecasting economic activity, proposing economic policy, presenting reasoned arguments to politically justify economic policy, as well as economic planning and allocation.

- Positive economics is a branch of economics that focuses on the description and explanation of phenomena, as well as their casual relationships.

- Positive economics clearly states an economic issue and normative economics provides the value-based solution for the issue.

- Normative economics is a branch of economics that expresses value or normative judgments about economic fairness. It focuses on what the outcome of the economy or goals of public policy should be.

- Positive economics does impact normative economics because it ranks economic polices or outcomes based on acceptability (normative economics).

Attribution

Except where otherwise noted, this chapter is adapted from “Economic Models” In Economics (LibreTexts) by Boundless, licensed under CC BY-SA 4.0./ Adaptations include removal of U.S. Total Budget Deficits vs. Debt Increases graph and accompanying content./

References and attribution from original source

- Economics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economics. License: CC BY-SA: Attribution-ShareAlike

- Elementary algebra. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Elementary_algebra. License: CC BY-SA: Attribution-ShareAlike

- Mathematical economics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Mathematical_economics. License: CC BY-SA: Attribution-ShareAlike

- Calculus. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Calculu. ..ntial_calculus. License: CC BY-SA: Attribution-ShareAlike

- Dependent variable. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Depende. ..ndent_variable. License: CC BY-SA: Attribution-ShareAlike

- Tangent. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Tangent. License: CC BY-SA: Attribution-ShareAlike

- Slope. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Slope. License: CC BY-SA: Attribution-ShareAlike

- variable. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/variable. License: CC BY-SA: Attribution-ShareAlike

- quantitative. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/quantitative. License: CC BY-SA: Attribution-ShareAlike

- Neo-classical economics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Neo-classical_economics. License: CC BY-SA: Attribution-ShareAlike

- Economics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economi. ..of_assumptions. License: CC BY-SA: Attribution-ShareAlike

- simplify. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/simplify. License: CC BY-SA: Attribution-ShareAlike

- assumption. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/assumption. License: CC BY-SA: Attribution-ShareAlike

- Simple-indifference-curves. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Si. ..nce-curves.svg. License: CC BY-SA: Attribution-ShareAlike

- Scientific Method. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/Scientific_Method. License: CC BY-SA: Attribution-ShareAlike

- Principles of Economics/Economic Modeling. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/Princip. ..nomic_Modeling. License: CC BY-SA: Attribution-ShareAlike

- The Scientific Method/Independent and Dependent Variables. Provided by: Wikibooks. Located at: en.wikibooks.org/wiki/The_Sci. ..dent_Variables. License: CC BY-SA: Attribution-ShareAlike

- hypothesis. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/hypothesis. License: CC BY-SA: Attribution-ShareAlike

- The Scientific Method. Provided by: Wikimedia. Located at: commons.wikimedia.org/wiki/Fi. ..fic_Method.jpg. License: CC BY-SA: Attribution-ShareAlike

- Economic model. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Economic_model. License: CC BY-SA: Attribution-ShareAlike

- diagnostics. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/diagnostics. License: CC BY-SA: Attribution-ShareAlike

- deductive. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/deductive. License: CC BY-SA: Attribution-ShareAlike

- qualitative. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/qualitative. License: CC BY-SA: Attribution-ShareAlike

- Islm. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Islm.svg. License: CC BY-SA: Attribution-ShareAlike

- positive economics. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/positive_economics. License: CC BY-SA: Attribution-ShareAlike

- normative economics. Provided by: Wiktionary. Located at: en.wiktionary.org/wiki/normative_economics. License: CC BY-SA: Attribution-ShareAlike

- Value (economics). Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Value_(economics). License: CC BY-SA: Attribution-ShareAlike

- Positive economics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Positive_economics. License: CC BY-SA: Attribution-ShareAlike

- Normative economics. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/Normative_economics. License: CC BY-SA: Attribution-ShareAlike

- Deficits vs.nDebt Increases – 2009. Provided by: Wikipedia. Located at: en.Wikipedia.org/wiki/File:Deficits_vs._Debt_Increases_-_2009.png. License: CC BY-SA: Attribution-ShareAlike

Media Attributions

- Simple indiference curve © SilverStar is licensed under a CC BY (Attribution) license

- Flowchart of the steps in the Scientific Method © CK-12 Foundation is licensed under a CC BY-SA (Attribution ShareAlike) license

- islm © [[:en:User:{{{1}}}|{{{1}}}]] is licensed under a CC BY-SA (Attribution ShareAlike) license

something whose value may be dictated or discovered.

Of a measurement based on some number rather than on some quality.

The act of taking for granted, or supposing a thing without proof; a supposition; an unwarrantable claim.

To make simpler, either by reducing in complexity, reducing to component parts, or making easier to understand.

An assumption taken to be true for the purpose of argument or investigation.

Based on inferences from general principles.

The process of determining the state of or capability of a component to perform its function(s).

Based on descriptions or distinctions rather than on some quantity.

The description and explanation of economic phenomena and their causal relationships.

Economic thought in which one applies moral beliefs, or judgment, claiming that an outcome is “good” or “bad”.