Chapter 5 – Project Life Cycle, Scope, Charters, Proposals

5.13. Request for Proposal and Contracts

After an idea makes it through the project selection process and becomes a funded project, an organization typically issues a request for proposal (RFP), which is a “document that describes a project’s needs in a particular area and asks for proposed solutions (along with pricing, timing, and other details) from qualified vendors. When they’re well crafted, RFPs can introduce an organization to high-quality vendor-partners and consultants from outside their established networks and ensure that a project is completed as planned” (Peters, 2011). The exact form of an RFP varies from one industry to the next and from one organization to another. You can find many templates for RFPs on the web.

In response to an RFP, other organizations submit proposals describing, in detail, their plan for executing the proposed project, including budget and schedule estimates and a list of final deliverables. Officially, the term proposal is defined by Merriam-Webster (n.d. b) as “something (such as a plan or suggestion) that is presented to a person or group of people to consider.” Depending on the nature of your company, this “something” might consist of little more than a few notes in an email, or it might incorporate months of research and documentation, costing hundreds of thousands of dollars to produce. When creating a proposal, you should seek to clearly understand and address your client’s needs and interests, convincingly demonstrate your ability to meet their needs (quality, schedule, price), and prepare the proposal in a form that meets requirements.

After reviewing all submitted proposals, the organization that issued the RFP accepts one of the proposals, and then proceeds with negotiating a contract with the vendor. The term contract is more narrowly defined as “an agreement with specific terms between two or more persons or entities in which there is a promise to do something in return for a valuable benefit known as consideration” (contract, n.d., para 1). As with proposals, however, a contract can take many forms, ranging from a submitted invoice which can serve as a binding agreement to several hundred pages of legal language.

HR in Focus: Human Resources and Requests for Proposals (RFP)

Human Resources may design the Request for Proposal for the project. It would be a template designed to include:

- Summary of the project need

- Summary of the Scope and deliverables

- Specifications related to requirements

- Organization and Consultant responsibilities

- Schedule of the project

- Costs of project

- Type of contract being offered

- Experience required and number of staff required

- Criteria for how the project will be measured and evaluated

The RFP would be posted on social media sites or other media external to the organization to attract consultants. It would be in the form of an advertisement. This is similar to attracting employees to the organization. Those interested would respond to the advertisement by completing the template provided. It would be submitted to Human Resources.

The next step is the selection of the contractor. Human Resources and other stakeholders would interview candidates. HR would design structured questions to ask the candidates. They may also design criteria for measuring or evaluating the candidates. A winning contractor is selected by the interview panel, and notified. The terms and conditions of the contract would be negotiated between the contractor and the stakeholders. Human Resources would set up the contract for signatures.

Training and orientation may be necessary for the contractor related to the business, the strategy, prior projects and details of the project. Human Resources would ensure there is constant and frequent reviews and feedback given to the contractor.

Contract Types

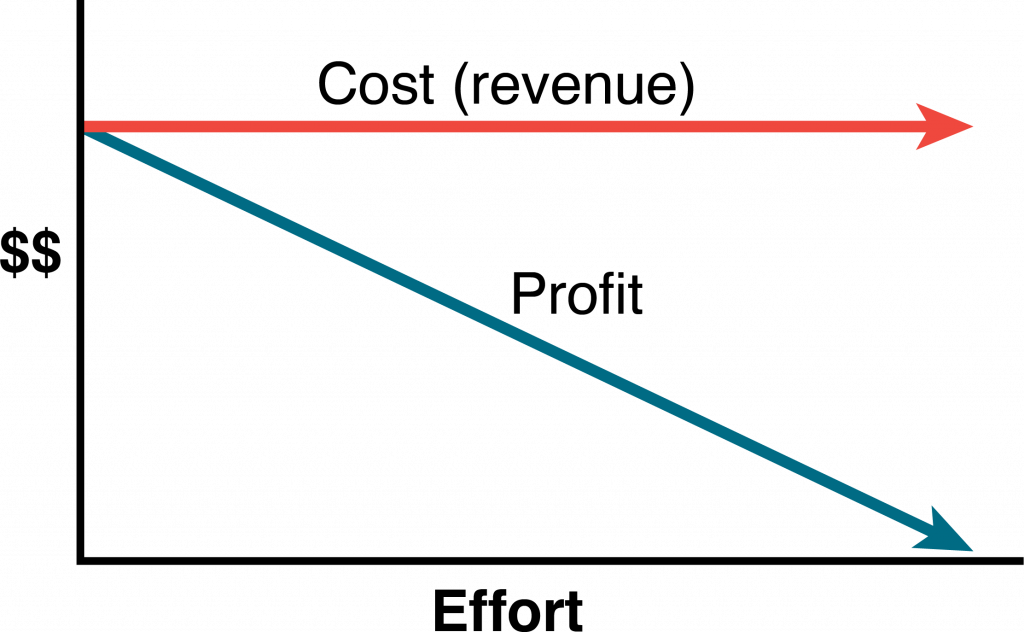

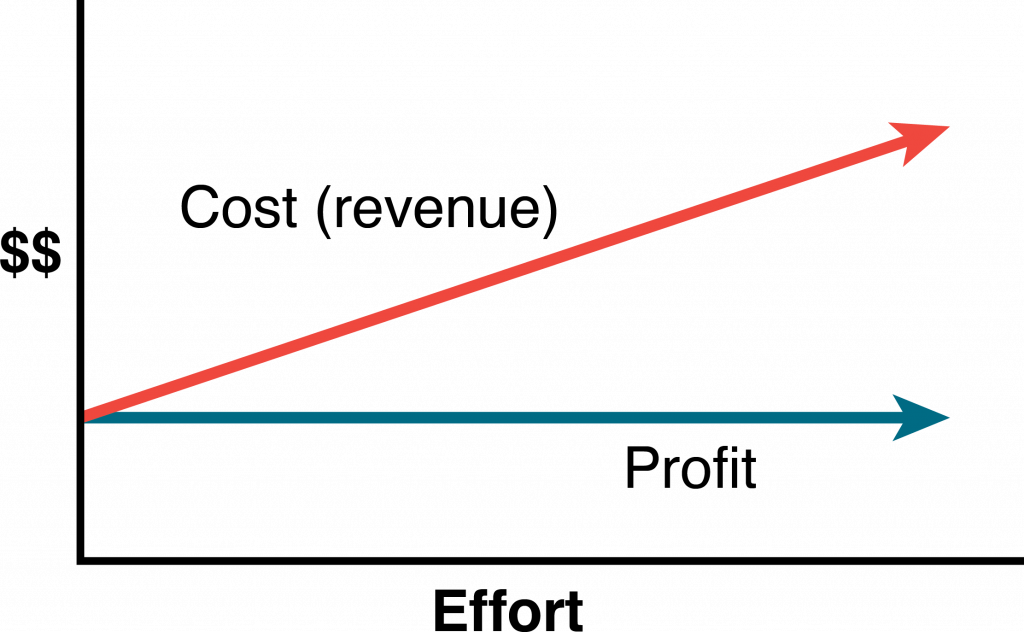

You should know a little bit about the major kinds of contracts available to you (the client) so that you choose the one that creates the most fair and workable deal for you and the contractor. Some contracts are fixed price: no matter how much time or effort goes into them, the client always pay the same. In Figure 5-6 the cost to the client stays the same, but as more effort is exerted the profit to the contractor goes down. Some are cost reimbursable, also called cost plus. This is where the seller charges you for the cost of doing the work plus some fee or rate. Figure 5-7 illustrates this by showing that as efforts increase, costs to the client go up but the contractor’s profits stay the same. The third major kind of contract is time and materials. That’s where the client pays a rate for the time spent working on the project and also pays for all the materials used to do the work. As costs to the client go up, so does the profit for the contractor.

Fixed-Price Contracts

The fixed-price contract is a legal agreement between the project organization and an entity (person or company) to provide goods or services to the project at an agreed-on price. The contract usually details the quality of the goods or services, the timing needed to support the project, and the price for delivering goods or services. There are several variations of the fixed-price contract. For commodities and goods and services where the scope of work is very clear and not likely to change, the fixed-price contract offers a predictable cost. The responsibility for managing the work to meet the needs of the project is focused on the contractor. The project team tracks the quality and schedule progress to ensure the contractors will meet the project needs. The risks associated with fixed-price contracts are the costs associated with project change. If a change occurs on a project that requires a change order from the contractor, the price of the change is typically very high. Even when the price for changes is included in the original contract, changes on a fixed-price contract will create higher total project costs than other forms of contracts because the majority of the cost risk is transferred to the contractor, and most contractors will add a contingency to the contract to cover their additional risk.

| Type | Known Scope | Share of Risk | Incentive for Meeting Milestones | Predictability of Cost |

|---|---|---|---|---|

| Fixed Total Cost | Very High | All Contractor | Low | Very High |

| Fixed Unit Price | High | Mostly Project | Low | High |

| Fixed Price with Incentive Fee | High | Mostly Project | High | Medium-High |

| Fixed Fee with Price Adjustment | High | Mostly Project | Low | Medium |

Table of Fixed Price Contracts and Characteristics - PM for Instructional Designers by Wiley et al CC-BY-NC-SA

Fixed-price contracts require the availability of at least two or more suppliers that have the qualifications and performance histories that ensure the needs of the project can be met. The other requirement is a scope of work that is most likely not going to change. Developing a clear scope of work based on good information, creating a list of highly qualified bidders, and developing a clear contract that reflects that scope of work are critical aspects of a good fixed-priced contract.

If the service provider is responsible for incorporating all costs, including profit, into the agreed-on price, it is a fixed-total-cost contract. The contractor assumes the risks for unexpected increases in labor and materials that are needed to provide the service or materials and, in the materials, and timeliness needed.

The Fixed-Price Contract with Price Adjustment is used for unusually long projects that span years. The most common use of this type of contract is the inflation-adjusted price. In some countries, the value of its local currency can vary greatly in a few months, which affects the cost of local materials and labour. In periods of high inflation, the client assumes the risk of higher costs due to inflation, and the contract price is adjusted based on an inflation index. The volatility of certain commodities can also be accounted for in a price-adjustment contract. For example, suppose the price of oil significantly affects the costs of the project. In that case, the client can accept the oil price volatility risk and include a provision in the contract that would allow the contract price adjustment based on a change in the price of oil.

The Fixed-Price Contract with an Incentive Fee provides an incentive for performing on the project above the established baseline in the contract. The contract might include an incentive for completing the work on an important milestone for the project. Often contracts have a penalty clause if the work is not performed according to the contract. For example, suppose the new software is not completed in time to support the implementation of the training. In that case, the contract might penalize the software company a daily amount of money for every day the software is late. This type of penalty is often used when the software is critical to the project and the delay will cost the project significant money.

If the service or materials can be measured in standard units, but the amount needed is not known accurately, the price per unit can be fixed—a fixed-unit-price contract. The project team assumes the responsibility of estimating the number of units used. If the estimate is not accurate, the contract does not need to be changed, but the project will exceed the budgeted cost.

Cost-Reimbursable Contracts

In a cost-reimbursable contract, the organization agrees to pay the contractor for the cost of performing the service or providing the goods. Cost-reimbursable contracts are also known as cost-plus contracts. Cost-reimbursable contracts are most often used when the scope of work or the costs for performing the work are not well known. The project uses a cost-reimbursable contract to pay the contractor for allowable expenses related to performing the work. Since the cost of the project is reimbursable, the contractor has much less risk associated with cost increases. When the costs of the work are not well known, a cost-reimbursable contract reduces the amount of money the bidders place in the bid to account for the risk associated with potential increases in costs. The contractor is also less motivated to find ways to reduce the cost of the project unless there are incentives for supporting the accomplishment of project goals.

Cost-reimbursable contracts require good documentation of the costs that occurred on the project to ensure that the contractor gets paid for all the work performed and to ensure that the organization is not paying for something that was not completed. The contractor is also paid an additional amount above the costs. There are several ways to compensate the contractor.

- A Cost-Reimbursable Contract with a Fixed Fee provides the contractor with a fee, or profit amount, that is determined at the beginning of the contract and does not change.

- A Cost-Reimbursable Contract with a Percentage Fee pays the contractor for costs plus a percentage of the costs, such as 5% of total allowable costs. The contractor is reimbursed for allowable costs and is paid a fee.

- A Cost-Reimbursable Contract with an Incentive Fee is used to encourage performance in areas critical to the project. Often the contract attempts to motivate contractors to save or reduce project costs. The use of the cost reimbursable contract with an incentive fee is one way to motivate cost-reduction behaviours.

- A Cost-Reimbursable Contract with Award Fee reimburses the contractor for all allowable costs plus a fee that is based on performance criteria. The fee is typically based on goals or objectives that are more subjective. An amount of money is set aside for the contractor to earn through excellent performance, and the decision on how much to pay the contractor is left to the judgment of the project team. The amount is sufficient to motivate excellent performance.

On small activities that have a high uncertainty, the contractor might charge an hourly rate for labour, plus the cost of materials, plus a percentage of the total costs. This type of contract is called time and materials (T&M). Time is usually contracted on an hourly rate basis, and the contractor usually submits time sheets and receipts for items purchased on the project. The project reimburses the contractor for the time spent based on the agreed-on rate and the actual cost of the materials. The fee is typically a percentage of the total cost.