Chapter 21

Solutions

Exercise 21.1

| Item | Type of Change |

|---|---|

| The useful life of a piece of equipment was revised from five years to six years. | AE |

| An accrued litigation liability was adjusted upwards once the lawsuit was concluded. | AE |

| An item was missed in the year-end inventory count. | E |

| The method used to depreciate a factory machine was changed from straight-line to declining balance as it was felt this better reflected the pattern of use. | AE |

| A company adopted the new IFRS for revenue recognition. | P |

| The accrued pension liability was adjusted downwards as the company’s actuary had not included one employee group when estimating the remaining service life. | E |

| The allowance for doubtful accounts was adjusted upwards due to current economic conditions. | AE |

| The allowance for doubtful accounts was adjusted downwards because the previous estimate was based on an aged trial balance that classified some outstanding invoices into the wrong aging categories. | E |

| A company changed its inventory cost flow assumption from LIFO to FIFO, as the newly appointed auditors indicated that LIFO was not allowable under IFRS. | E |

| A company began to apply the revaluation model to certain property, plant, and equipment assets, as it was felt this presentation would be more useful to investors. | P |

Exercise 21.2

a. Because the change in the useful life of the copyright is based on the existence of new information and new conditions, this would be a change in estimate and should be treated prospectively by adjusting amortization only for current and future years. The recording of the insurance premium is an accounting error as it should have originally been recorded as a prepaid expense. As such, this error should be accounted for retrospectively, correcting the error in the appropriate period and restating comparative information.

b. Original amortization = ![]()

Amortization to 1 January 2021 = ![]()

NBV at 1 January 2021 = ![]()

New rate = ![]()

Note: Because the books are still open for 2021, we can correct the error for the current year as well as for the future year. However, the company would have to consider when the conditions changed that led to the estimate revision.

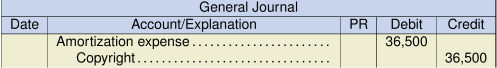

Journal entry:

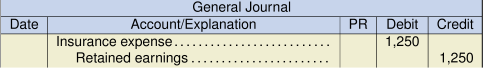

The insurance premium should have been reported as a prepaid asset when purchased, and recognized as an expense at

The insurance premium should have been reported as a prepaid asset when purchased, and recognized as an expense at ![]() . Thus, for the year ended December 31, 2020, only

. Thus, for the year ended December 31, 2020, only ![]() should have been expensed. The following adjustment is required to correct this error:

should have been expensed. The following adjustment is required to correct this error:

Note that this entry simply moves ten months of the insurance expense from 2020 to 2021. There is no need to adjust the prepaid as the insurance was fully utilized by the end of 2021. However, a comparative balance sheet, if presented, would need to include the prepaid expense of $1,250.

Note that this entry simply moves ten months of the insurance expense from 2020 to 2021. There is no need to adjust the prepaid as the insurance was fully utilized by the end of 2021. However, a comparative balance sheet, if presented, would need to include the prepaid expense of $1,250.

Exercise 21.3

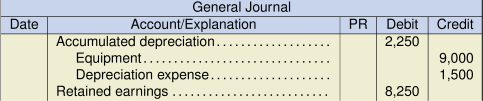

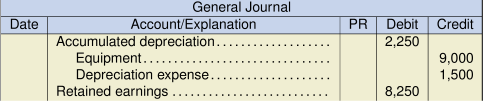

In this case, there is both an accounting error and a change in accounting estimate. The error should be corrected first, retrospectively, and then the change in estimate can be applied.

Depreciation as originally calculated: ![]()

Depreciation should have been: ![]()

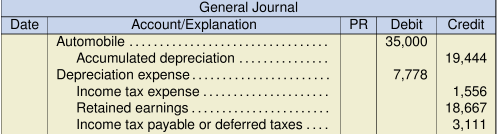

The following journal entry corrects the 2021 accounts:

The carrying amount is now ![]()

As one year has passed, the remaining useful life is now ![]() .

.

Double declining balance rate = ![]() .

.

Therefore, 2022 depreciation will be ![]()

Note: Remember that residual values are not used in DDB calculations.

The following journal entry will record current year depreciation:

Exercise 21.4

This is an accounting policy change that should be applied retrospectively. It means that the effect of the revaluations on prior years will need to be recorded, as well as the effects on depreciation expense. The changes are summarized below:

| Year | Depr. Taken | Carrying Value | Revaluation | Revised Depr. | New CV |

|---|---|---|---|---|---|

| 2018 | 25,000 | 725,000 | 800,000 | 800,000 | |

| 2019 | 25,000 | 700,000 | 800,000 | 27,586 | 772,414 |

| 2020 | 25,000 | 675,000 | 800,000 | 27,586 | 744,828 |

| 2021 | 25,000 | 650,000 | 825,000 | 30,556 | 794,444 |

Note: On December 31, 2018, the building is revalued, creating a revaluation surplus of 75,000 (![]() ). The revised depreciation is calculated as

). The revised depreciation is calculated as ![]() . This depreciation rate is used for 2019 and 2020. On December 31, 2020, the building is revalued creating a valuation surplus of 80,172 (

. This depreciation rate is used for 2019 and 2020. On December 31, 2020, the building is revalued creating a valuation surplus of 80,172 (![]() ). The new depreciation rate to be used for 2021 and 2022 is

). The new depreciation rate to be used for 2021 and 2022 is ![]() .

.

On January 1, 2022, the total depreciation actually recorded is $100,000 (![]() ). Total depreciation that would have been recorded under the revaluation model is $110,728 (

). Total depreciation that would have been recorded under the revaluation model is $110,728 (![]() ). The additional depreciation of 10,728 (

). The additional depreciation of 10,728 (![]() ) needs to be adjusted to retained earnings. As well, the two revaluation surplus amounts 155,172 (

) needs to be adjusted to retained earnings. As well, the two revaluation surplus amounts 155,172 (![]() ) need to be reflected in the revaluation surplus account.

) need to be reflected in the revaluation surplus account.

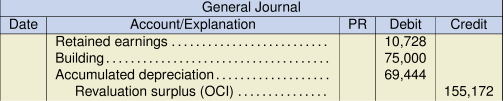

The following journal entry adjusts the opening balances on January 1, 2022:

Note: Remember that when using the revaluation model, previous accumulated depreciation amounts are eliminated when a revaluation occurs. Thus, the accumulated depreciation on December 31, 2021, would be $30,556, so the adjustment needs to be 69,444 (![]() ). The building cost adjustment is based on the revised value (825,000) less the original cost recorded (750,000). This solution also assumes that there is no reclassification of OCI to retained earnings, as this is an optional treatment.

). The building cost adjustment is based on the revised value (825,000) less the original cost recorded (750,000). This solution also assumes that there is no reclassification of OCI to retained earnings, as this is an optional treatment.

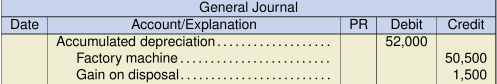

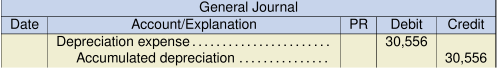

In 2022, the depreciation would be recorded as follows:

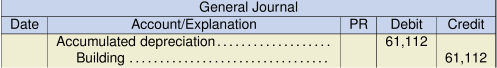

When the revaluation occurs on December 31, 2022, previous accumulated depreciation (the prior two years) is reversed and the revaluation is recorded:

The carrying value of the building, prior to revaluation, is 763,888 (![]() ).

).

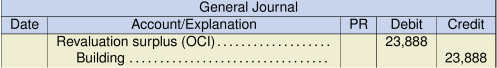

The entry to record the revaluation on December 31, 2022, is:

This will reduce the carrying value of the building to $740,000.

Exercise 21.5

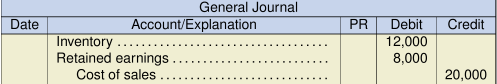

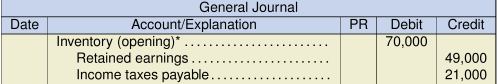

a. This is an accounting policy change that should be applied retrospectively. The following journal entry is required on January 1, 2021, to reflect the adjustment:

* The account used here will depend on whether the company uses a perpetual or periodic inventory system. With a periodic system, opening inventory is adjusted. With a perpetual system, cost of sales would be adjusted.

* The account used here will depend on whether the company uses a perpetual or periodic inventory system. With a periodic system, opening inventory is adjusted. With a perpetual system, cost of sales would be adjusted.

Note: Only the effect in 2020 needs to be considered. Inventory adjustments are self-correcting over a two-year period, so only the difference in the 2020 ending inventory needs to be adjusted.

b. The comparative column (2020) of the retained earnings statement would look like this:

| 2020 (Restated) | ||

| Opening retained earnings as previously stated | $1,100,000 | |

| Accounting policy change, net of tax of $18,000 | 42,000 | |

| Opening balance, restated | 1,142,000 | |

| Net income (restated) | 282,000 | |

| Closing retained earnings | $1,424,000 |

The effect on opening retained earnings (i.e., January 1, 2020) reflects the inventory difference on December 31, 2019 (![]() ) less tax. The net income for 2020 is calculated as follows:

) less tax. The net income for 2020 is calculated as follows:

| Income as previously reported | $275,000 | |

| Reversal of 2019 difference, less tax | (42,000) | |

| 2020 difference, less tax | 49,000 | |

| Revised net income | $282,000 |

Exercise 21.7

2021 depreciation recorded = ![]()

2022 depreciation recorded = ![]()

Accrued Interest Omission

Accrued interest receivable on December 31, 2022 = ![]()

Note: This represents the interest accrued between November 30 and December 31.

As the balance of the interest receivable account is $1,000, no adjustment is required as the balance is already correct.

Land Depreciation Error

Building depreciation as recorded:

| 2020: |

$9,500 |

| 2021: | $19,000 |

| 2022: | $19,000 |

| Total | $47,500 |

Building depreciation should be:

| 2020: |

$7,000 |

| 2021: | $14,000 |

| 2022: | $14,000 |

| Total | $35,000 |

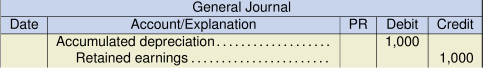

Note: Adjustment to accumulated depreciation is 12,500 (![]() ), which is allocated to depreciation expense (

), which is allocated to depreciation expense (![]() ) for the current year, with the remainder allocated to retained earnings.

) for the current year, with the remainder allocated to retained earnings.

Exercise 21.8

Depreciation charges should be:

2020: ![]()

Retained earnings adjustment: ![]()

Tax payable (deferred) adjustment: ![]()

Exercise 21.9

| 2021 | 2020 | |

|---|---|---|

| Reported net income | $1,200,000 | $1,050,000 |

| Adjustment for rent | 60,000 | (90,000) |

| Adjustment for office supplies | 5,700 | (4,500) |

| Adjustment for warranty | (6,000) | (38,000) |

| Corrected net income | $1,259,700 | $917,500 |

Exercise 21.10

Y4 Journal Entry

| Accumulated depreciation (1) | 77,850 | ||

| Income tax payable (or deferred tax liability) (2) | 15,570 | ||

| Retained Earnings (3) | 62,280 | ||

| (1) $234,650 - 156,800 (too much depreciation expense was recorded). | |||

| (2) too much expense was deducted so income tax is owed ($77,580 × 20%). | |||

| (3) since prior period records are closed, adjust through retained earnings. | |||

Exercise 21.11

Y7 Journal Entry

| Equipment | 97,920 | ||

| Depreciation Expense (Y7 only) | 16,320 | ||

| Accumulated Depreciation (1) | 48,960 | ||

| Income tax payable (2) | 19,584 | ||

| Retained Earnings | 45,696 | ||

| (1) depreciation expense = $97,920 / 6 years = $16,320 per year × 3 years | |||

| (2) income tax is owed because $97,920 of extra expense was taken in error. | |||

| (2) however, depreciation was not taken, the liability is reduced: ($97,920 - $16,320 - $16,320) × 30% | |||