19.2 Basic and Diluted Earnings per Share: A Review

Basic earnings per share (EPS) is simply:

![]()

Basic EPS quantifies the amount of earnings attributable to each common share issued.

If a company’s capital is composed of common shares and preferred shares or debt that has no conversion rights, this is referred to as a company with a simple capital structure. Capital structures that include securities that have conversion rights such as convertible preferred shares, convertible bonds payable, and stock options are known as companies with complex capital structures. Complex capital structures for publicly traded companies require another indicator to be calculated and reported, which is called diluted EPS. Dilution occurs when additional common shares are issued without a proportionate increase in the level of earnings or resources that generate those earnings. For example, shares issued for cash will increase both the number of shares and the resources (cash as an asset) so they are not dilutive. Shares issued to holders of convertible securities increases the number of shares and not necessarily with a corresponding increase in company resources. They are, therefore, potentially dilutive. Diluted EPS is often referred to as a worst-case scenario measurement, where the effect on earnings per share is measured assuming that all potential additional common shares for convertible securities, options, and warrants have already been issued since the beginning of the year.

In terms of reporting requirements, ASPE companies are not required to report EPS statistics, which makes intuitive sense given that these companies are privately owned, with an often closely held stockholder base. On the other hand, an IFRS company that is publicly traded is required to disclose basic EPS and diluted EPS on the face of its income statement. Moreover, if a company reports discontinued operations, EPS disclosures must also further break down EPS into income from continuing operations, discontinued operations, and net income. An example of basic and diluted EPS with discontinued operations is shown below:

| Earnings per share | Basic | Diluted |

|---|---|---|

| Income from continuing operations | $1.25 | $1.10 |

| Loss from discontinued operations, net of tax* | (0.15) | (0.08) |

| Net income | $1.10 | $1.02 |

* EPS for discontinued operations disclosures is a required disclosure, but it may be included in the notes to financial statements.

Recall the importance of being able to differentiate between what earnings from ongoing, or continuing, operations from those that will not continue. This was discussed in the chapter regarding the statement of net income.

The components of the basic EPS numerator and denominator are discussed next.

19.2.1. Basic Earnings per Share

Numerator: Net Income Available to Common Shareholders

Two things to keep in mind regarding determining the net income numerator amount:

- Net income is relevant to this calculation but other comprehensive income (OCI) is not. OCI includes items such as unrealized gains or losses for securities that management does not intend to actively trade, hence these types of gains and losses are not deemed to be part of the company’s current period performance.

- If preferred shares exist, then net income (or loss) available to common shareholders must be adjusted by the preferred shares dividends. This is because preferred shares rank in seniority over common shares regarding dividends, therefore, if necessary, a portion of net income has to be set aside to cover these dividends. The adjustment amount to deduct from net income will differ if the preferred shares are cumulative or non-cumulative:

- If cumulative, deduct the dividend amount from net income according to the preferred share’s entitlement, which is the stated dividend rate regardless of whether they were declared or paid. If dividends are in arrears, only the current year’s dividend is to be deducted from net income since the EPS figures reported in previous years already included the dividend for that year.

- If non-cumulative, deduct the dividend amount from net income only if it has been declared, regardless of their stated dividend rate or if they were paid or not. Non-cumulative preferred shares are only entitled to a dividend if the board of directors declares one. The amount of the dividend declared can be based on their stated dividend rate or it can be less. There are no dividends in arrears for non-cumulative preferred shares in cases where the board does not declare one.

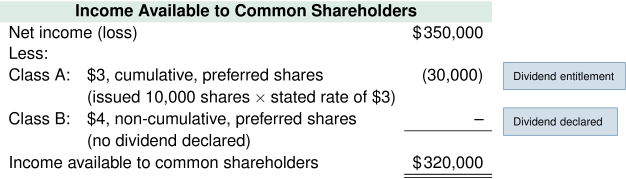

For example, Ogdell Co. has a net income of $350,000 and has two classes of preferred shares as follows:

- Class A: $3 cumulative preferred shares. Authorized 20,000; issued and outstanding, 10,000 shares.

- Class B: $4 non-cumulative preferred shares. Authorized 30,000; issued and outstanding, 15,000 shares.

- No dividends have been declared or paid in the current year. The income available to common shareholders would be calculated as follows:

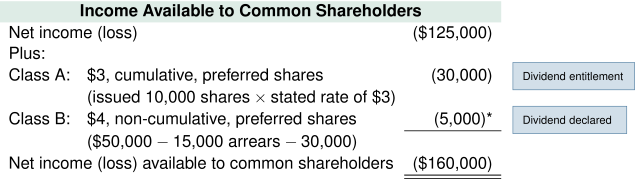

Assume now that Ogdell Co. has a net loss of $125,000 and that the Class A preferred shares have dividends in arrears from the previous year of $15,000. In the current year, the board of directors declared a total dividend to both classes of preferred shareholders of $50,000. The income available to common shareholders would be calculated as follows:

* The total dividend of $50,000 declared will first be applied to the Class A preferred shares dividends in arrears of $15,000 and next to the Class A current year dividends of $30,000, leaving a declared dividend for the Class B, non-cumulative shares of $5,000.

Denominator: Weighted Average Number of Common Shares Outstanding (WACS)

Two types of events can affect the WACS calculation:

- If common shares have been issued or purchased for consideration, that is, cash in exchange for assets or other consideration, the average must be weighted by the number of months these have been outstanding during the current fiscal year.

- If stock dividends or stock splits (or reverse stock splits) occur, the number of shares outstanding must be restated on a retroactive basis as though the stock dividend or split had occurred at the beginning of the year. (These may also be referred to as share dividends and share splits.) The shares issued before the stock dividend or split will now be restated on the same basis as shares issued after the stock dividend or split. If the stock dividend or split occurs after the year-end, but before the financial statements are issued, the WACS are to be restated for the year just ended. Additionally, any previous year’s EPS included in the comparative financial statements are also to be restated. The restatement ensures that the EPS is prepared on a consistent basis over the reporting period to enhance comparability and minimize potential manipulation of the EPS amounts because of performance benchmarks or restrictive debt covenants.

To ensure that the WACS are calculated correctly, there are three steps in the preparation of the WACS schedule:

- Step 1: Record the opening balance of shares outstanding and each subsequent event, date, description, and number of shares for the current reporting period. An event is when the outstanding number of shares changes, such as when shares are issued or repurchased for either cash, as stock dividends, or for stock splits. Complete the total shares outstanding for each row. If shares are issued on December 31, 2020, they are ignored for the purposes of calculating the WACS because they have not been outstanding during the year.

- Step 2: For stock dividends or stock splits, apply the required retroactive restatement factor(s) from the event date when it initially occurs, and backwards to the beginning of the fiscal year.

- Step 3: For each event, complete the duration between events under the date column and complete the corresponding fraction of the year column accordingly. Multiply the shares outstanding times the retroactive restatement factor(s) times the fraction of the year for each event. Sum the amounts to determine the WACS total amount.

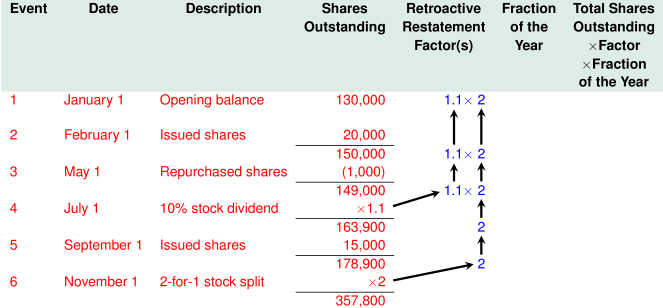

Continuing with our example for Ogdell Co., assume that the company had 130,000 common shares outstanding on January 1, 2020. The following events occurred during the year:

- On February 1, 2020, an additional 20,000 shares were issued.

- On May 1, 2020, the company repurchased 1,000 shares.

- On July 1, 2020, the company declared and issued a 10% stock dividend.

- On September 1, 2020, the company issued another 15,000 shares.

- On November 1, 2020, the company declared and issued a two-for-one stock split.

Step 1: Record the opening balance of shares outstanding and each subsequent event, date, description, and number of shares for the current reporting period. An event is where the outstanding number of shares changes such as when shares are issued or re-purchased for either cash, as stock dividends or for stock splits. Complete the total shares outstanding for each row. If shares are issued on December 31, 2020, they are ignored for the purposes of calculating the WACS because they have not been outstanding during the year.

| Event | Date | Description | Shares Outstanding |

Retroactive Restatement Factor(s) |

Fraction of the Year |

Total Shares Outstanding x Factor x Fraction of the year |

|---|---|---|---|---|---|---|

| 1 | January 1 | Opening balance | 130,000 | |||

| 2 | February 1 | Issued shares | 20,000 | |||

| 150,000 | ||||||

| 3 | May 1 | Repurchased shares | (1,000) | |||

| 149,000 | ||||||

| 4 | July 1 | 10% stock dividend | x 1.1 | |||

| 163,900 | ||||||

| 5 | September 1 | Issued shares | 15,000 | |||

| 178,900 | ||||||

| 6 | November 1 | 2-for-1 stock split | x 2 | |||

| 357,800 |

Step 2: For stock dividends or stock splits, apply the required retroactive restatement factor(s) from the event date it initially occurs and backwards to the beginning of the fiscal year.

Step 3: For each event, complete the duration between events under the date column and complete the corresponding fraction of the year column accordingly. Multiply the shares outstanding times the retroactive restatement factor(s) times the fraction of the year for each event. Sum the amounts to determine the WACS amount.

* ![]()

Note: Under the fraction of year column the total should always sum to 12/12. Going back to the earlier calculation regarding income available to common shareholders, Ogdell Co.’s net income was $350,000, and the company had two classes of preferred shares as follows:

- Class A: $3 cumulative preferred shares, authorized 20,000, issued and outstanding, 10,000 shares.

- Class B: $4 non-cumulative preferred shares, authorized 30,000, issued and outstanding, 15,000 shares.

- No dividends have been declared or paid in the current year. The income available to common shareholders was calculated earlier to be $320,000 (

).

).

The numerator and denominator are now both calculated, so the basic earnings per share calculation can now be completed as follows:

| Basic EPS | |

| Basic EPS |

If Ogdell Co. also had a discontinued operations loss of $20,000 net of tax, the basic EPS would be calculated as follows:

| Income | WACS | Basic EPS | |

|---|---|---|---|

| Net Income (from continuing operations available to common shareholders) | $320,000 | 334,865 | $0.9556 |

| Loss from discontinued operations net of tax* | (20,000) | 334,865 | (0.0597) |

| Net income available to common shareholders | $300,000 | 334,865 | $0.8959 |

* Discontinued operations: ![]()

The reporting disclosures for basic earnings per share are shown below:

| Earnings per share: | ||

| Income from continuing operations | $0.96 | |

| Loss from discontinued operations, net of tax* | (0.06) | |

| Net income | $0.90 |

* EPS for discontinued operations disclosures may be included in the notes to financial statements.

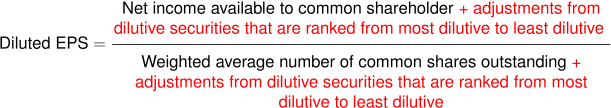

19.2.2. Diluted Earnings per Share

As previously stated, any publicly traded company with a complex capital structure is to also disclose diluted EPS, separated into continuing operations and non-continuing operations, like basic EPS illustrated above. This indicator assumes that all dilutive securities are converted to common shares, which give shareholders a worst-case scenario of the lowest possible EPS about company performance. The dilutive calculation also assumes that, since the conversion to common shares has fully taken place, the convertible securities themselves will be extinguished and the company will no longer be obligated to pay interest or dividends on the original security. In other words, the dilutive calculation will affect both the income available to shareholders (numerator) and the weighted average number of common shares outstanding (denominator) in the original equation:

Below are three steps that, if followed carefully, will make the diluted EPS calculation easier:

Step 1: Identify all potentially dilutive securities. These can be convertible bonds or convertible preferred shares, both exchangeable into common shares or stock options and warrants that entitle the holder to buy common shares at a specified price. The conversion feature details will be itemized in the documentation for each convertible security and will include information regarding the conversion time frame, the rate of conversion to common shares, and the specified price to purchase common shares, if applicable.

Step 2: Calculate the individual effect of each potentially dilutive security and rank them from most to least dilutive. Some of these securities will only affect the number of shares (denominator) such as stock options, warrants, and contingent commitments for shares, while others such as convertible bonds and convertible preferred shares will affect both the income available to common shareholders (numerator) and number of shares (denominator).

Step 3: Complete a diluted EPS schedule and report the results, starting with the basic EPS numerator and denominator amounts. Transfer the numerator and denominator amounts from the individual effects calculated in Step 2 above for each convertible security identified as dilutive, in ranked order, and calculate a diluted EPS subtotal after each. Remove any securities whose subtotal indicates that an increase in diluted EPS has occurred. Complete the EPS disclosures resulting from the analyses.

Diluted EPS Example

Using the steps outlined above, and continuing with the example for Ogdell Co., the basic EPS before discontinued operations is:

| Income | WACS | Basic EPS | |

|---|---|---|---|

| Income from continuing operations | |||

|

available to common shareholders |

$320,000 | 334,865 | $0.9556 |

Step 1: Identify and calculate the individual effects for all potentially dilutive options, warrants, and other contingent commitments.

Stock options allow the option holder either to buy shares (call options) or sell shares (put options) for a specified price (exercise price) within a time limit as defined by the option document. If the options are in the money (i.e., the specified price compared to the current market price will result in a benefit to the holder), and the holder proceeds to exercise the options, the company is obligated to sell (write) or to buy (purchase) the shares as set out in the options agreement. Conversely, if the options are not in the money, the option holder will not exercise them, and the options will eventually expire. Therefore, it follows that only options that are in the money will be dilutive as they are the only ones that will be exercised.

For example, if the option holder purchased call options that entitles her or him to purchase common shares for $30 each, at a time when the current market price for the shares has risen to $36 each, it is likely that the option holder will exercise the right to purchase as the shares are in the money. Issuing more shares to the option holder increases the total number of shares issued (denominator); as such, the options must be included in the diluted EPS calculations. However, as the effect on net income from the exercise of options is not easy to estimate, the treasury stock method is chosen to calculate the dilutive effect of options and warrants, which limits the calculation to the number of shares denominator value. It also assumes that the company would use the monies received from the option holders to repurchase common shares from the market and subsequently retire them. This would lessen the dilutive impact on EPS. Put another way, shares would be issued to the holders and the resulting proceeds would be used to repurchase its own shares from the market. Since the exercise price is less than the current market price, more shares would be issued than could be repurchased from the market. This difference is the additional number of shares to be included in the diluted EPS calculation using the treasury stock method.

For example, Ogdell Co. has (call) options outstanding that entitle the option holder to purchase 1,000 common shares for an exercise, or strike, price of $30 per share. The company has performed well lately, and the average market price per share has risen to $50.[1] Option holders will benefit from purchasing the shares for $30, so these options are in the money and are dilutive under the treasury stock method. The difference between the 1,000 shares issued to the option holders and the number of shares that the company could repurchase with the proceeds, given a market price of $50, is as follows:

| Treasury Stock Method | |||

|---|---|---|---|

| Proceeds received from exercise of options | |||

| ( |

1,000 | shares | |

| Proceeds used to purchase common shares from the market | |||

| (600) | shares | ||

| Incremental shares issued | 400 | shares | |

If Ogdell has (put) options outstanding that entitle the option holder to sell 1,000 common shares back to the company at an exercise price of $40 per share, when the current average market price is $35, these would also be considered in the money and dilutive. In this case, the reverse treasury stock method would be used, which assumes that the company would issue enough shares for cash in the market at the beginning of the year to cover their obligation to buy back the put options. As option holders will benefit from selling the shares at $40 each, the options are considered in the money and dilutive under the reverse treasury stock method. The proceeds required by the company to meet their obligations to the option holders would be $40,000 (![]() ). If the current market price is currently $35 per share, the company would have to ensure that it issued an additional 1,143 shares (

). If the current market price is currently $35 per share, the company would have to ensure that it issued an additional 1,143 shares (![]() ) at the beginning of the year in order to have enough proceeds available to meet their obligation to buy back the 1,000 shares from the option holders. The difference between the 1,143 shares issued for cash at the beginning of the year and the subsequent buy-back of 1,000 shares from the options holders, or 143 shares, would be included in the diluted EPS calculation in the same way as is shown for the (call) options illustrated above.

) at the beginning of the year in order to have enough proceeds available to meet their obligation to buy back the 1,000 shares from the option holders. The difference between the 1,143 shares issued for cash at the beginning of the year and the subsequent buy-back of 1,000 shares from the options holders, or 143 shares, would be included in the diluted EPS calculation in the same way as is shown for the (call) options illustrated above.

Contingently issuable shares can also be considered dilutive if they meet the criteria at any point during the reporting period. For example, if shares are issuable to key executive when earnings reach a certain level, and this level had already been achieved by the beginning of the reporting period, the diluted earnings per share calculation would include these contingent shares in the denominator since the beginning of the reporting period. If Ogdell Co. had agreed to issue 50 shares to any division manager who was able to increase their respective divisional earnings by 10% in the current year, and three such managers did in fact achieve the 10% increase, the diluted EPS calculation would include 150 (![]() ) additional shares.

) additional shares.

The incremental shares for the options and the contingently issuable shares will be included in the diluted EPS schedule as denominator values as shown below:

| Diluted EPS Calculation Schedule | |||

| Income (numerator) | # of shares (denominator) | EPS | |

|---|---|---|---|

| Basic EPS | $320,000 | 334,865 | $0.9556 |

| Call options: | |||

| Shares issued @ $30 per share | 1,000 | ||

|

Shares repurchased (1,000 × $30) ÷ $50 |

(600) | ||

| – | 400 | ||

| Contingently issuable shares: | |||

| (3 managers × 50 shares) | 150 | ||

| – | 150 | ||

| Put options: | |||

| Shares issued ($40,000 ÷ $35) | 1,143 | ||

| Share repurchased (1,000 @ $40) | (1,000) | ||

| – | 143 | ||

| Diluted EPS | $320,000 | 335,558 | $0.9536 |

As seen above, the net additional 693 shares (400 + 143 + 150) have resulted in a diluted EPS of $0.95, or $0.01 less per share than the basic EPS of $0.96 (rounded). The dilutive effect of the options and contingently issuable shares makes sense as only the number of shares has increased with no effect on the income numerator. Mathematically, an increasing denominator with an unchanged numerator will be the most dilutive and will be listed first in the diluted EPS calculation, which is illustrated later in Step 3.

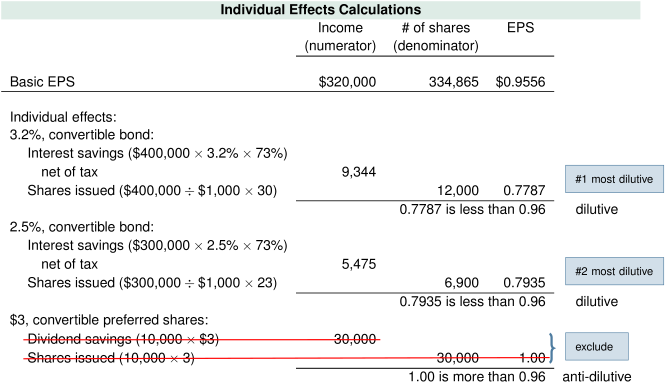

Step 2: Calculate the individual effect of each potentially dilutive convertible security and rank them from most to least dilutive.

Convertible debts, such as bonds and cumulative preferred shares that are convertible into common shares, are potentially dilutive convertible securities. Unlike options, both securities will affect not only the number of shares but also the net income. For example, if bonds are converted into common shares, the number of shares will increase (denominator), and the interest expense saved due to the conversion of the debt to common shares will increase the amount of income available to common shareholders (numerator).

If cumulative preferred shares are converted to common shares, the number of shares will increase (denominator) and the dividends for the preferred shares saved, due to the conversion to common shares, will increase the income available to the common shareholders (numerator). Again, the assumption is that these outstanding convertible securities would have converted to common shares since the beginning of the period, using the if-converted method. For both types of securities, the income (numerator) and number of shares (denominator) are affected, but are they dilutive? Two steps are needed to determine this:

- First, calculate the individual EPS effect on income (numerator) and number of shares (denominator) for each type of convertible security. If the individual EPS effect is less than the basic EPS calculated earlier, it is dilutive. If the individual EPS effect is more than the basic EPS, it is anti-dilutive and can be excluded from the subsequent calculations.

- Second, rank the dilutive securities from most to least dilutive and complete the diluted EPS calculation as shown in the example below.

For example, Ogdell Co. has the following convertible debt and equity securities:

| Bonds payable, 3.2% annually, 20-year amortization, due 2035, issued at par, each $1,000 bond is convertible into 30 common shares | 400,000 |

| Bonds payable, 2.5% annually, 15-year amortization, due 2030, issued at par, each $1,000 bond is convertible into 23 common shares | 300,000 |

| Class A: $3 cumulative, convertible, preferred shares; authorized, 20,000issued and outstanding, 10,000 shares, each share is convertible issued and outstanding, 10,000 shares, into three common shares | 800,000 |

Ogdell Co.’s income tax rate is 27%. Preferred dividends were not declared in the current year.

Solution:

Calculate the individual EPS effect on income (numerator) and number of shares (denominator) for each type of convertible security and compare each to the basic EPS amount. If the individual EPS effect for each security is less than the basic EPS, it is dilutive. If the individual EPS is more than the basic EPS, it is anti-dilutive and can be excluded from the subsequent calculations.

For the 3.2% convertible bonds, the calculation above assumes that interest will no longer be paid if the bond is converted to common shares. The effect of the interest expense savings on net income would be:

![]()

The increase in common shares if converted would be:

![]()

The individual EPS effect compared to basic EPS would be:

![]() compared to basic EPS of $0.9556 and is, therefore, dilutive. This security will be included in the overall diluted EPS calculation illustrated in Step 3 below.

compared to basic EPS of $0.9556 and is, therefore, dilutive. This security will be included in the overall diluted EPS calculation illustrated in Step 3 below.

The same calculation is done for the 2.5% convertible bonds. The individual EPS effect is $0.7935, which is less than the basic EPS of $0.9556, and is, therefore, dilutive.

For the convertible preferred shares, the calculation above assumes that the dividends will no longer be paid if the preferred shares are converted into common shares. The effect of the dividends saved will increase the net income available to common shareholders because that portion of net income no longer has to be set aside, as done in the basic EPS calculation illustrated earlier. Below is the calculation of the individual effects of the preferred shares using the if-converted method:

![]() , resulting in additional income available to common shareholders. Note that there is no tax effect on dividends.

, resulting in additional income available to common shareholders. Note that there is no tax effect on dividends.

The increase in common shares if converted would be:

![]()

The individual EPS effect compared to basic EPS would be:

![]() which is more than the basic EPS of $0.9556 and is, therefore, anti-dilutive. This security will be excluded from the diluted EPS calculation illustrated in Step 3 below.

which is more than the basic EPS of $0.9556 and is, therefore, anti-dilutive. This security will be excluded from the diluted EPS calculation illustrated in Step 3 below.

Both convertible bonds are dilutive and are ranked from most to lease dilutive as follows:

| 3.2% bonds | $0.7787 | #2, ranked most dilutive after options and contingent shares |

| 2.5% bonds | $0.7935 | #3, ranked next most dilutive after options and contingent shares |

Step 3: Consolidating the results – complete a diluted EPS schedule and report the results.

Starting with basic EPS, input each of the dilutive securities in ranked order starting with options, warrants, and contingently issuable securities (which are the most dilutive). Subtotal the diluted EPS calculation for each type of security to ensure that each continues to be dilutive when included in the overall diluted EPS calculation. Any securities that are no longer contributing to the dilutive EPS are removed, and the remaining securities are dilutive. This process is shown in the dilutive EPS schedule below:

Note that the dilutive EPS starts at $0.9536 because of the options and contingently issuable shares. It subsequently decreases to $0.9476 for the next most dilutive 3.2% convertible bonds, and finally it decreases once more to $0.9446 for the third-ranked 2.5% convertible bond. This means that each of the securities continues to contribute to the dilutive EPS and should be kept in the schedule. As previously stated, and important to remember, if any of the securities cause the diluted EPS subtotal to increase, it must be removed from the calculation as it is no longer dilutive.

Carrying out these steps in the correct sequence is critical to ensure that the securities reported as dilutive continue to have a dilutive effect throughout the entire diluted EPS calculation.

The final diluted EPS amounts are disclosed on the face of the income statement and rounded to the nearest two decimals:

| Earnings per share: | Basic | Diluted |

|---|---|---|

| Income from continuing operations | $0.96 | $0.94 |

| Loss from discontinued operations, net of tax* | (0.06) | (0.06) |

| Net income | $0.90 | $0.88 |

* Basic – Discontinued operations:

![]()

Diluted – Discontinued operations:

![]()

Companies can choose to disclose EPS – discontinued operations in the notes to the financial statements.

- IAS 33.45 (CPA Canada, 2016) states that the average market price is to be used in the following manner: “For the purpose of calculating diluted earnings per share, an entity shall assume the exercise of dilutive options and warrants of the entity. The assumed proceeds from these instruments shall be regarded as having been received from the issue of ordinary shares at the average market price of ordinary shares during the period. The difference between the number of ordinary shares issued and the number of ordinary shares that would have been issued at the average market price of ordinary shares during the period shall be treated as an issue of ordinary shares for no consideration” (CPA Canada, 2016, Accounting, IAS 33.45). ↵