13.4 Fair Value Option, Defeasance, and Off-Balance Sheet Financing

Notes and Bonds – the Fair Value Option

Long-term debt is usually measured at amortized cost; however, there is an alternative called the fair-value option that ASPE allows for all types of financial instruments. If a company chooses to use the fair-value option, the debt instruments are continually remeasured to their fair value. In the case of IFRS, the fair-value option can be used if it results in more relevant information.

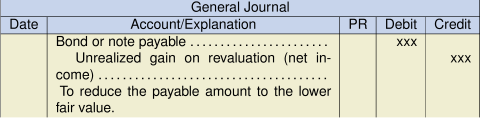

As discussed earlier in this chapter, the higher the credit or solvency risk, the lower the grade assigned by the independent rating agencies. Furthermore, the grade assigned can change for better or for worse, depending on the performance of the company over the life of the debt instrument. In cases where the grade deteriorates because of increasing credit or solvency risk, the effective interest rate must also increase to compensate for the higher risk–causing the fair value of the bond instrument to decrease. A decrease in fair value creates a gain on the credit side of the entry, as shown below:

Notes and Bonds – Defeasance and Off-Balance Sheet Financing

Defeasance

If a company wishes to pay off a debt before its maturity date, problems can arise if the debt agreement stipulates early repayment penalties. One way around this issue is for the debtor to deposit sufficient funds into a separate trust account that will generate returns enough to cover the payments owed to the creditor, as outlined in the original agreement. This is called defeasance, and it can be executed in one of two ways. First, as legal defeasance, where the creditor agrees to change the debt obligation from the debtor to the trust. Second, informally as in-substance defeasance, in which case both ASPE and IFRS do not allow the original debt to be derecognized as the company still legally owes the debt.

Off-Balance Sheet and Other Sources of Financing

Company performance is in part measured by its liquidity and solvency position. For this reason, companies are motivated to keep debt off the books. Below are various sources of financing that do not require recording a debt obligation.

- Operating leases: Companies can avoid reporting a lease obligation if a lease agreement is written in such a way as to not meet the lease capitalization criteria required by ASPE and IFRS. The lease payments are subsequently recorded as rental expenses in exchange for the use of the asset being leased (leases will be discussed further in a later chapter).

- Selling receivables and investments: Companies can obtain funding by selling receivables and other investments to special purpose entities (SPE) in exchange for cash rather than incurring debt. This is known as securitization and is discussed in more detail in the cash and receivables chapter from the previous intermediate accounting text.

- Parental control of another company: Companies can obtain access to another company’s funds through mergers and acquisitions. Additionally, ASPE gives investee companies the choice to report their investments in other companies using either the equity method or cost, even if control exists. If control in another company is reported only as a single line item asset called “investment” on the SFP/BS, this will obscure any potential significant debt that the investee company may have on their books, which the investor parent company may ultimately be responsible for. Investments are discussed further in the Intercorporate Investments chapter from the previous intermediate accounting text.

It is important to note that adequate disclosures of these arrangements are important for financial statement users.