Chapter 19

Solutions

Exercise 19.1

- Basic earnings per share calculation: Step 1: Record the opening balance of shares outstanding and each subsequent event, date, description, and number of shares for the current reporting. An event is where the outstanding number of shares changes. Step 2: For stock dividends or stock splits, apply the required retroactive restatement factor(s) from the event point when it initially occurs and backwards to the beginning of the fiscal year. Step 3: For each event, complete the duration between events under the date column and complete the corresponding fraction of the year column accordingly. Multiply the shares outstanding times the retroactive restatement factor(s) times the fraction of the year for each event. Sum the amounts to determine the WACS amount.

Event Date Outstanding Shares Outstanding Restatement Fraction of the Year Weighted Shares Beginning Balance 1/1-3/1 100,000 1.15 2/12 19,167 Issued Shares 3/1-7/1 106,000 1.15 4/12 40,633 Retired Shares 7/1-10/1 104,000 1.15 3/12 29,900 Stock Dividend 10/1-12/1 119,600 2/12 19,933 Issued Shares 12/1-12/31 129,600 1/12 10,800 Weighted average common shares outstanding at 12/31 120,433 Earnings per share calculation Earnings from continuing operations 336,250 Loss from discontinuing operations (net of tax) 26,250 Net Income $ 310,000 Earnings per share Earnings from continuing operations $ 2.79 Earnings from discontinuing operations (net of tax) - 0.22 Net Income $ 2.57 - Common shareholders need to know how much of a company’s available income can be attributed to the shares they own. This helps them assess future dividend payouts and the value of each share. Earnings per share (EPS) becomes a per share way of describing net income, making EPS a good metric for shareholders and investors. When the income statement reports discontinued operations, EPS should be disclosed for income from continuing operations, discontinued operations, and net income. These disclosures make it possible for shareholders and potential investors to know the specific impact of income from continuing operations on earnings per share, as opposed to a single EPS number, that includes income or loss from non-continuing operations not expected to continue.

- EPS is used in the calculation of the price earnings ratio (Market price of shares

EPS), which compares the market price of the company’s shares with income generated on a per-share basis. Market price of the company’s shares will generally adjust after issuance of a stock dividend or a stock split. For the calculation of price earnings ratio to remain valid after a stock dividend or stock split, EPS should also be adjusted in the company’s financial statements to assume that the additional shares have been outstanding since the beginning of the year in which the stock dividend or stock split occurred.

EPS), which compares the market price of the company’s shares with income generated on a per-share basis. Market price of the company’s shares will generally adjust after issuance of a stock dividend or a stock split. For the calculation of price earnings ratio to remain valid after a stock dividend or stock split, EPS should also be adjusted in the company’s financial statements to assume that the additional shares have been outstanding since the beginning of the year in which the stock dividend or stock split occurred.

Exercise 19.2

Step 1: Record the opening balance of shares outstanding and each subsequent event, date, description, and number of shares for the current reporting. An event is where the outstanding number of shares changes.

Step 2: For stock dividends or stock splits, apply the required retroactive restatement factor(s) from the event point it when initially occurs and backwards to the beginning of the fiscal year.

Step 3: For each event, complete the duration between events under the date column and complete the corresponding fraction of the year column accordingly. Multiply the shares outstanding times the retroactive restatement factor(s) times the fraction of the year for each event. Sum the amounts to determine the WACS amount.

a.

| Event | Date | Description | Shares Outstanding |

Retroactive Restatement Factor(s) |

Fraction of the Year |

Total Shares Outstanding × Factor ×Fraction of the Year |

|

|---|---|---|---|---|---|---|---|

| 2021 | |||||||

| 1 | Jan 1 | Opening balance | 475,000 | 1.1 | 4/12 | 174,167 | |

| Jan 1 – May 1 | |||||||

| 2 | May 1 | 25,000 shares issued | 25,000 | ||||

| May 1 – Jul 1 | 500,000 | 1.1 | 2/12 | 91,667 | |||

| 3 | Jul 1 | 10% stock dividend | ×1.1 | ||||

| Jul 1 – Oct 1 | 550,000 | 3/12 | 137,500 | ||||

| 4 | Oct 1 | Repurchased | (15,000) | ||||

| Oct 1 – Dec 31 | 15,000 shares | 535,500 | 3/12 | 133,750 | |||

| Total WACS | 535,500 | 12/12 | 537,084 | ||||

b.

| Event | Date | Description | Shares Outstanding | Retroactive Restatement Factor(s) | Fraction of the Year | Total Shares Outstanding × Factor ×Fraction of the Year | |

|---|---|---|---|---|---|---|---|

| 2021 | |||||||

| 1 | Jan 1 | Opening balance | 475,000 | 0.2 | 4/12 | 31,667 | |

| Jan 1 – May 1 | |||||||

| 2 | May 1 | 25,000 shares issued | 25,000 | ||||

| May 1 – Jul 1 | 500,000 | 0.2 | 2/12 | 16,667 | |||

| 3 | Jul 1 | 1:5 reverse stock | × 0.2 | ||||

| Jul 1 – Oct 1 | split (1÷5=0.2) | (400,000) | |||||

| 100,000 | 3/12 | 25,000 | |||||

| 4 | Oct 1 | Repurchased | (15,000) | ||||

| Oct 1 – Dec 31 | 15,000 shares | 85,000 | 3/12 | 21,250 | |||

| Total WACS | 85,000 | 12/12 | 94,584 | ||||

Exercise 19.3

-

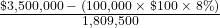

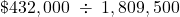

Event Date Description Shares Outstanding Retroactive Restatement Factor(s) Fraction of the Year Total Shares Outstanding × Factor ×Fraction of the Year 2021 1 Jan 1 Opening balance 500,000 3 × 1.1 1/12 137,500 Jan 1 – Feb 1 2 Feb 1 180,000 shares issued 180,000 Feb 1 – Mar 1 680,000 3 × 1.1 1/12 187,000 3 Mar 1 10% stock dividend × 1.1 Mar 1 – May 1 748,000 3× 2/12 374,000 4 May 1 Repurchased (200,000) May 1 – Jun 1 200,000 shares 548,000 3× 1/12 137,000 5 Jun 1 3-for-1 stock split ×3 Jun 1 – Oct 1 1,644,000 4/12 548,000 6 Oct 1 60,000 shares issued 60,000 Oct 1 – Dec 31 1,704,000 3/12 426,000 Total WACS 1,704,000 12/12 1,809,500 - Earnings per share:

(declared dividend for non-cumulative preferred shares)EPS = $1.93

(declared dividend for non-cumulative preferred shares)EPS = $1.93 - Earnings per share:

(dividend entitlement for non-cumulative preferred shares)EPS = $1.49

(dividend entitlement for non-cumulative preferred shares)EPS = $1.49 - Earnings per share:

EPS Income from continuing operations $2.17 Discontinued operations, net of tax* (0.24) Net income $1.93 from part (b) * (

)

)

- The earnings process occurs continuously throughout the fiscal year and the capital basis can fluctuate during that time. It is, therefore, necessary to adjust the denominator of the EPS ratio to reflect the various lengths of time during the year that the different amounts of capital from the different number of shares outstanding were available to generate earnings during the year.

Exercise 19.4

a. Basic earnings per share = ![]() = $0.55

= $0.55

Diluted EPS: Bonds interest saved ![]()

Additional shares ![]() Individual effect

Individual effect ![]() therefore, dilutive

therefore, dilutive

Diluted EPS = ![]() = $0.54

= $0.54

Required disclosures: Basic EPS $0.55 Diluted EPS $0.54

b. Earnings per share = ![]() = $0.40

= $0.40

Diluted EPS: Bonds interest saved ![]()

Additional shares ![]()

Individual effect ![]() therefore, anti-dilutive

therefore, anti-dilutive

Required disclosures: Basic and diluted EPS $0.40

Note that the company has convertible bonds, which means that it has a complex capital structure. This requires both basic and diluted EPS to be reported, even if they are the same amount.

Exercise 19.5

a. Follow the three steps identified earlier in the chapter to calculate the WACS in the schedule below:

| Event | Date | Description | Shares Outstanding |

Retroactive Restatement Factor(s) |

Fraction of the Year |

Total Shares Outstanding × Factor ×Fraction of the Year | |

|---|---|---|---|---|---|---|---|

| 2021 | |||||||

| 1 | Jan 1 | Opening balance | 550,000 | ×2 | 2/12 | 183,333 | |

| Jan 1 – Mar 1 | |||||||

| 2 | Mar 1 | Issued shares | 50,000 | ||||

| Mar 1 – Jun 1 | 600,000 | ×2 | 3/12 | 300,000 | |||

| 3 | Jun 1 | Repurchased shares | (100,000) | ||||

| Jun 1 – Aug 1 | 500,000 | ×2 | 2/12 | 166,667 | |||

| 4 | Aug 1 | 2-for-1 stock split | ×2 | ||||

| Aug 1 – Dec 31 | 1,000,000 | 5/12 | 416,667 | ||||

| Total WACS | 12/12 | 1,066,667 | |||||

Basic EPS = ![]() = $3.99

= $3.99

* ![]()

Note that the preferred shares are not convertible, so this company has a simple capital structure and needs only report its basic EPS.

b. The basic EPS will remain the same as the amount calculated in part (a). This is because the preferred shares are cumulative, so the dividend entitlement amount would be used to reduce the income available to common shareholders. For this reason, any dividends in arrears will not be included, since they would have already been included in the previous years’ respective EPS calculations. To include dividends in arrears for cumulative preferred shares in 2021 would be, in effect, double counting.

c. The basic EPS will be the same amount as calculated in part (a). If the preferred shares are non-cumulative, only dividends that are declared are deducted from net income. Since they are paid up to date, they will be the same amount as the dividend amount used in part (a), making the EPS calculation the same.

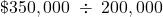

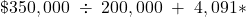

d. If the preferred shares are non-cumulative, only dividends declared would be used in the numerator to reduce net income available to common shareholders. In this case, no dividends were declared in 2021, so the calculation would be:

e. A stock split, which only increases the number of shares outstanding, will result in a decreased market price per share, making the shares more affordable to potential investors. If the company’s shares are made more affordable to potential investors, the shares may become more marketable, causing an increase in the market value because of the stock split.

f. The weighted average number of shares outstanding provides the correct basis for EPS to be reported because the number of common shares outstanding throughout the year can fluctuate due to various in-year capital transactions. When stock dividends or stock splits occur, a restatement of the weighted average number of shares to the beginning of the year must be made. This is done to allow valid comparisons can be made between periods before and after the stock dividend or stock split.

Exercise 19.6

- This company has a complex capital structure because it has options that can potentially be converted into common shares. Both basic and diluted EPS are required to be disclosed, even if the amounts are the same.

- Basic EPS=

= $1.75 Diluted EPS =

= $1.75 Diluted EPS =  = $1.71 * Additional common shares using the treasury method:

= $1.71 * Additional common shares using the treasury method:

Shares purchased 45,000 Less shares retired

(40,909) Net additional shares 4,091 shares

Note: A quick way to calculate the net additional common shares due to options (treasury method) is:

Required disclosures:

Basic EPS $1.75 Diluted EPS $1.71 - Basic EPS

= $1.75 Diluted EPS = $1.75 Options are not in the money because the market price is $9, and the exercise price is $10. Options holders would not be motivated to purchase any common shares using their options because they can buy them directly from the market at a lower price.Required disclosures:

= $1.75 Diluted EPS = $1.75 Options are not in the money because the market price is $9, and the exercise price is $10. Options holders would not be motivated to purchase any common shares using their options because they can buy them directly from the market at a lower price.Required disclosures:

Basic and diluted EPS $1.75

Exercise 19.7

- There will be no incremental shares in this case as these options are anti-dilutive. Recall that only an increase in additional shares will be dilutive since the net income (numerator) will remain unchanged. If call options have an exercise price ($10) that is lower than the market price ($13), these options will be anti-dilutive, as fewer shares will need to be issued (at $13) in order to obtain sufficient cash to exercise the options to purchase the 20,000 shares at $10. The net result would be a reduction of 4,615 outstanding shares, making these options anti-dilutive as calculated below:

Shares issued at $13 to obtain $200,000 15,385 increase Using proceeds to exercise options at $10 per share 20,000 reduction As this results in a net reduction of 4,615 common shares, these options are considered anti-dilutive and would be excluded from the diluted EPS calculation.

-

Proceeds required to exercise options (20,000 × $14) $280,000 Shares issued at $13 to obtain $280,000 21,538 increase Using proceeds to exercise options at $14 per share 20,000 reduction There is a net increase of 1,538 common shares, making this dilutive. The diluted EPS calculation would include the additional 1,538 common shares.

If the exercise price is $12 instead of $14:

Proceeds required to exercise options ([20,000 × $12) $240,000 Shares issued at $13 to obtain $240,000 18,462 increase Using proceeds to exercise options at $12 per share 20,000 reduction There is a net decrease of 1,538 common shares, making this anti-dilutive and, therefore, excluded from the diluted EPS calculation.

- The company would not exercise the option to sell its common shares for $11 because the option price per share of $11 is lower than the market price of $13. These are, therefore, not dilutive.

Exercise 19.8

a. Basic EPS = $400,000 – 10,000* ÷ 60,000 = $6.50

* ![]()

This company has a complex capital structure due to the convertible securities. As a result, diluted EPS is also required to be calculated and reported.Individual effects:4% convertible bonds:

| Interest saved |

$3,697 |

| Additional shares |

2,500 shares |

Individual EPS effects = ![]() (therefore dilutive)

(therefore dilutive)

$20, convertible preferred shares:

| Dividends saved | $10,000 |

| Additional shares ( |

5,000 |

Individual EPS effects = ![]() (therefore dilutive)

(therefore dilutive)

| Ranking: | Convertible bonds |

$1.48 |

#1 |

| Preferred shares | $2.00 | #2 |

| Income (Numerator) |

Number of Shares (Denominator) |

Individual EPS Effect |

|

|---|---|---|---|

| Basic EPS | $390,000 | 60,000 | $6.50 |

| 4% bonds – Interest saved | 3,697 | ||

| Additional shares | 2,500 | ||

| Subtotal | 393,697 | 62,500 | 6.30 |

| $20 convertible preferred shares | 10,000 | ||

| Additional shares ($250,000 ÷ $20) × 7 ÷ 12 | 5,000 | ||

| Diluted EPS | 403,697 | 67,500 | $5.98 |

Required disclosures:

| Basic EPS | $6.50 | |

| Diluted EPS | $5.98 |

b. Discontinued operations gain before tax $20,000. Discontinued operations gain, net of tax (![]() ) = $15,200

) = $15,200

Net income from continuing operations = ![]() = $384,800

= $384,800

Basic EPS, continuing operations = ![]() = $6.25

= $6.25

Both the bonds and preferred shares remain dilutive with the same ranking as in part (a) as they continue to be less than the basic EPS from continuing operations for $6.25, and their individual EPS effects have not changed.

| Income (Numerator) |

Number of Shares (Denominator) |

Individual EPS Effect |

|

|---|---|---|---|

| Basic EPS (from continuing operations) | $374,800 | 60,000 | $6.25 |

| 4% bonds – Interest saved | 3,697 | ||

| Additional shares | 2,500 | ||

| Subtotal | 378,497 | 62,500 | 6.06 |

| $20 convertible preferred shares | |||

| Dividends saved | 10,000 | ||

| Additional shares | 5,000 | ||

| Diluted EPS | 388,497 | 67,500 | $5.76 |

Required disclosures:

| Basic | Diluted | ||

|---|---|---|---|

| Income from continuing operations | $6.25 | $5.76 | |

| Discontinued operations gain, net of tax* | 0.25 | 0.23 | |

| Net income | $6.50 | $5.99 |

* Basic (![]() ); Diluted (

); Diluted (![]() )

)

Exercise 19.9

| Event | Date | Description | Shares Outstanding |

Retroactive Restatement Factor(s) |

Fraction of the Year |

Total Shares Outstanding × Factor ×Fraction of the Year | |

|---|---|---|---|---|---|---|---|

| 2021 | |||||||

| 1 | Jan 1 | Opening balance | 70,000 | × 1.1 | 2/12 | 12,833 | |

| Jan 1 – Mar 1 | |||||||

| 2 | Mar 1 | Issued shares | 30,000 | ||||

| Mar 1 – Jun 1 | 100,000 | × 1.1 | 3/12 | 27,500 | |||

| 3 | Jun 1 | 10% stock dividend | 10,000 | ||||

| Jun 1 – Nov 1 | 110,000 | 5/12 | 45,833 | ||||

| 4 | Nov 1 | Repurchase | |||||

| Nov 1 – Dec 31 | common shares | (20,000) | 2/12 | 15,000 | |||

| Total WACS | 90,000 | 12/12 | 101,166 | ||||

Basic EPS = ![]() = $3.44

= $3.44

* (![]() )

)

This company has convertible bonds and preferred shares, so its capital structure is complex and, therefore, requires calculation and disclosure of diluted EPS.

Individual effects:

| Options: | ||

| At an exercise price of $16, they are in the money. | ||

| Additional shares issued | 10,000 | |

| Shares retired ( |

8,889 | |

| Net additional shares | 1,111 | dilutive |

| 6%, convertible bonds: | |

| Interest saved ( |

$2,400 |

| Additional common shares ( |

5,333 |

| Individual EPS effect = |

|

| $2, convertible preferred shares: | |

| Dividends saved ( |

$2,000 |

| Additional shares | 10,000 |

| Individual EPS effect |

|

Ranking: Most to least dilutive

| #1 Options | – no income effect |

| – 1,111 shares |

| #2 Preferred shares | – income effect – $2,000 |

| – 10,000 shares |

| #3 Bonds – income effect | – $2,400 |

| – 5,333 shares |

| Income (Numerator) |

Number of Shares (Denominator) |

Individual EPS Effect |

|

|---|---|---|---|

| Basic EPS (from continuing operations) | $348,000 | 101,166 | $3.44 |

| Options | 1,111 | ||

|

Subtotal |

348,000 | 102,277 | 3.40 |

| Preferred shares | 2,000 | 10,000 | |

|

Subtotal |

350,000 | 112,277 | 3.12 |

| Bonds | 2,400 | 5,333 | |

| Diluted EPS | $352,400 | 117,610 | $3.00 |

None of the securities failed to remain dilutive so all of them will remain in the diluted EPS calculation.

Disclosures:

| Basic EPS | $3.44 | |

| Diluted EPS | $3.00 |

Exercise 19.10

|

Net Income |

Common |

Earnings per |

||

|---|---|---|---|---|

| Basic | $500,000 | 125,000 | $4.00 | basic EPS |

| Bonds (1) | $56,000 | 60,000 | ||

| Diluted | $556,000 | 185,000 | $3.01 | Diluted EPS |

| (1) impact of converting bonds to common shares. | ||||

| Impact to net income: | ||

| Annual interest | $80,000 | ($1,000,000 × 8%) |

| Tax savings | 24,000 | ($80,000 × 30%) |

| After tax - net savings | $56,000 | |

| Impact to shares: | ||

| Number of bonds | 1,000 | ($1,000,000 total value / $1,000 face) |

| Conversion rate | 60 | |

| Shares to be issued | 60,000 | |

Exercise 19.11

|

Net |

Common |

Earnings per |

||

|---|---|---|---|---|

| Basic | $1,000,000 | 50,000 | $20.00 | basic EPS |

| Options (1) | $- | 400 | ||

| Diluted | $1,000,000 | 50,400 | $19.84 | Diluted EPS |

| (1) impact outstanding options. | ||||

| there is NO impact to net income. | ||||

| Impact to number of shares outstanding: | |

| Proceeds (based on agreed price (2,000 shares × $40) | $80,000 |

| Shares issued upon exercise of options | 2,000 |

| Shares purchasable with proceeds ($80,000 / $50 market price) | 1,600 |

| Incremental number of shares outstanding | 400 |

Exercise 19.12

|

Event |

Outstanding Dates |

Shares |

Restatement |

Fraction of Year |

Weighted Shares |

|---|---|---|---|---|---|

| Beginning balance | 1/1 - 3/1 | 125,000 | 1.20 | 2/12 | 25,000 |

| Issued shares | 3/1 - 8/31 | 165,000 | 1.20 | 6/12 | 99,000 |

| Repurchased shares | 8/31 - 10/1 | 150,000 | 1.20 | 1/12 | 15,000 |

| Issued stock dividend | 10/1 - 12/31 | 180,000 | 3/12 | 45,000 | |

| Weighted average number of shares outstanding | 184,000 | ||||