14.3 Complex Financial Instruments

Complex financial instruments possess more than one financial component, such as a combination of debt or equity attributes as explained in the introduction. Examples of complex financial instruments are: convertible bonds payable, convertible preferred shares, and options/warrants that attach to shares or bonds. Convertible bonds are usually issued in exchange for cash, which must either be repaid later at maturity (debt attribute) or, alternatively, must be converted into a specific number of common shares at specific points in time (equity attribute). Convertible preferred shares possess both the attributes of preferred shares and common shares if they are converted into a specific number of common shares at specific times. Clearly, these convertible instruments possess more than one debt or equity attribute compared to non-convertible financial instruments.

Convertible debt and convertible preferred shares will be discussed next, and derivative instruments, such as options and warrants, will be discussed briefly towards the end of the chapter.

14.3.1. Convertible Debt and Preferred Shares Classification: Two Methods

The accounting standards require that bonds that are convertible into common shares are to be separated into the value of the bond, without the conversion feature (debt component), and an embedded/attached option to convert the debt into common shares (equity component). Convertible preferred shares are separated into the value of the preferred share, without the conversion feature (shares equity component), and an option to convert preferred shares into common shares (contributed surplus equity component). There are a number of methods that can accomplish the separation of debt from equity components, but IFRS recommends only the residual method, while ASPE allows either the residual method or the zero-equity method.

- The residual method estimates and allocates the fair value of the bond first, without the conversion feature, because debt is usually the more reliably measurable component as compared to equity. As previously discussed in the chapter on long-term debt, the bond valuation basis is the present value of the future cash flows using the market rate of interest for debt instruments with similar attributes and risk. Any residual amount remaining is assigned to the equity component.

- The zero-equity method assigns the full valuation of the transaction to the debt component and a zero-value to the equity component.

Again, IFRS requires the use of the residual value method, with the debt component being value first and the residual (remaining) amount being allocated to the equity (or conversion) component). ASPE allows the equity component to be valued at zero OR the residual value method to be used.

Bonds Issued at Par – Residual Method

As an example, on January 1, Willowby Ltd. issues three-year, 8%, convertible bonds with a par value of $250,000 for $256,328 cash. Interest is payable annually on December 31. Each $1,000 bond may be converted into 80 common shares, which are currently trading at $12. Bonds without the conversion feature trade in the market at par.

Using the residual method, the present value of the bonds with the conversion feature is equal to the cash amount received of $256,328. This is compared to the present value of the bonds without the conversion feature or the par value of $250,000 (debt component). The difference between the two values is allocated to the embedded option (equity component).

| Face value of the bond | $250,000 | |

| Present value of the bond with option feature attached | $256,328 | |

| Difference equals option valuation | $6,328 |

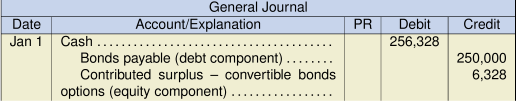

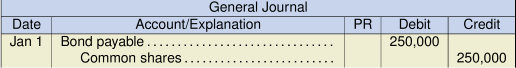

The entry to record the issuance of the convertible bond is:

At each reporting date, each component would be reported according to their respective standard. For example, bonds would be reported at their amortized cost as a liability and the options at historical cost as contributed surplus in equity. In this case, the bonds were issued at par so there is no premium or discount to amortize, and the bonds payable balance would remain at $250,000 until conversion or maturity.

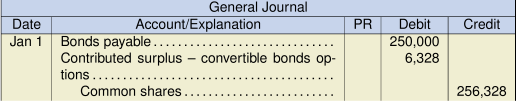

If the market price of the shares increased to $16, bondholders would be motivated to convert the bonds to shares, even before maturity in three years. This is because each $1,000 would now be worth $1,280 (![]() ). The entry to convert would be:

). The entry to convert would be:

Note that the carrying values (book values) at the time of conversion were the values used in the conversion entry, hence its name: the book value method. This method is required for both IFRS and ASPE when recording bond conversions, and it results in no gain or loss recognized or recorded upon conversion. Any accrued interest that was forfeited at the time of conversion would also be credited to common shares.

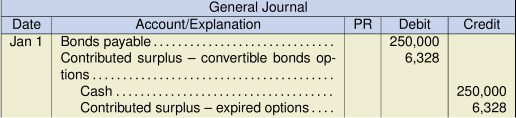

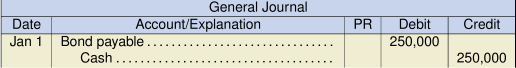

Conversely, if the share price did not increase, and the bonds reach maturity without conversion, the amount owing for the bond is payable to the bondholder and the contributed surplus (in some counties referred to as reserves) amount in equity will lapse. The entry for fully amortized bonds at maturity would be:

Bonds Issued at Par – Zero-Equity Method

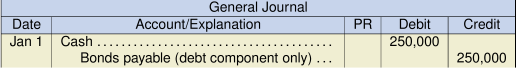

For the zero-equity method, the policy choice for ASPE companies, the entry for the convertible bond issuance is straightforward since zero is assigned to the equity component:

The entry upon conversion would be:

The entry upon maturity without conversion would be:

Bonds Issued at a Premium or Discount – Residual Method

On January 1, Jason Inc. issues $300,000, five-year, 7% convertible bonds at 98. Interest is payable annually on December 31. Each $1,000 bond may be converted into 100 common shares, which are currently trading at $9. Bonds without the conversion feature trade in the market at 8%.

Using the residual method, the present value of the bonds at the market-based discounted amount, with the conversion feature, is $294,000. This is compared to the present value of the bonds, without the conversion feature, at the market rate of 8% (debt component). The difference between the two present values is allocated to the option (equity component).

| (Face value of the bond $300,000) | ||

| Fair market price with conversion feature ($300,000 × 0.98) | $294,000 | |

| Present value of the bond without the conversion feature at the market | ||

| rate of 8%:

Interest payment = $300,000 × 7% =$21,000 PMT annually |

||

| PV = ($21,000 PMT, 8 I/Y, 5 N, $300,000 FV) | $288,022 | |

| Difference equals option valuation | $5,978 |

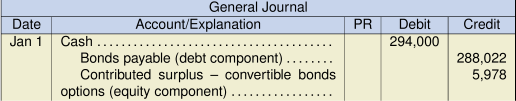

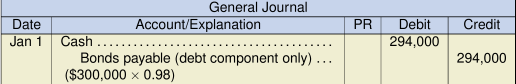

The entry to record the issuance of the convertible bond is:

As in the previous example, bonds would be reported as a long-term liability at their amortized cost and the contributed surplus for the options at historical cost in equity. In this case, the bonds were issued at 98, so the discount amount of $11,978 ($300,000 − $288,022) would be amortized over the five years using the effective method at 8%* for IFRS and ASPE (or the optional straight-line method for ASPE) until conversion or maturity.

*Interest calculation:

PV = (PMT, I/Y, N, FV)

+/- $288,022 PV = $21,000 PMT, I/Y, 5 N, $300,000 FV

I/Y = 8% rounded

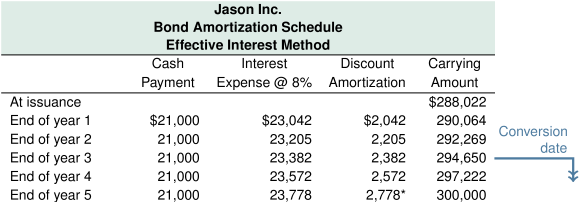

The schedule for the effective interest method is shown below:

*Some rounding effects are present.

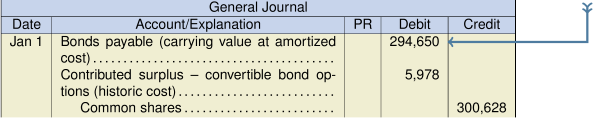

If the market price of shares increased, and all the bonds were converted into shares at the end of three years (prior to maturity), the entry to convert to shares would be:

Again, because of the book-value method accounting treatment, the carrying values at the time of conversion were the values used in the conversion entry above with no gain or loss recognized.

Bonds Issued at a Premium or Discount – Zero-Equity Method

With the zero-equity method option for ASPE companies, the entry for the bond issuance is straightforward since zero is assigned to the equity component. The straight-line method is used below to amortize the bond discount (ASPE option).

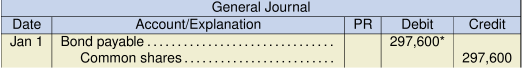

The entry upon conversion at the end of three years would be:

* ![]() discount amortization per year

discount amortization per year

![]()

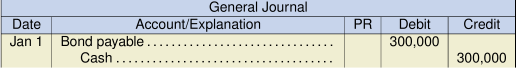

The entry when the bonds matured without conversion would also be straightforward, as the bonds would be fully amortized by this time:

Bonds Retired Prior to Maturity with Incentives

Sometimes a company will want to retire a bonds issue before maturity to reduce interest expenses. To facilitate this, any convertible bonds that are repaid prior to maturity will usually include a sweetener, which is added to the repayment proceeds to motivate the bondholders to sell. In this case, both the amounts paid to the bondholders and the sweetener must be allocated between the debt and equity components. Unlike the previous examples with no sweeteners, the additional funds added to the payout as a sweetener will result in a loss reported in net income.

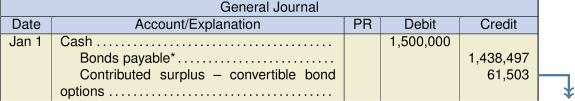

For example, on January 1, 2020, Essessive Corp. offers 5-year, 6% convertible bonds with a par value of $1,000. Interest is paid annually on December 31. Each $1,000 bond may be converted into 150 common shares, which are currently trading at $3 per share. Similar bonds without the conversion feature carry an interest rate of 7%. Essessive issues 1,500 bonds at par and allocates the proceeds under the residual method. The entry to record the bond issuance using the residual method would be recorded the same way as par value bonds discussed earlier:

*PV = ($90,000 PMT, 7 I/Y, 5 N, $1,500,000 FV)

![]() interest payable each December 31

interest payable each December 31

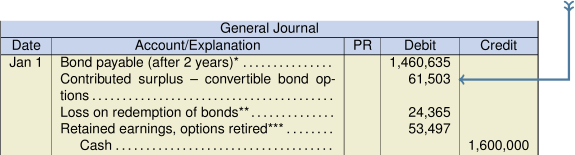

On January 1, 2022, immediately following the interest payment, Essessive Corp. decides to retire the convertible bonds early to reduce interest costs. They offer the bondholders $1,600,000 cash, the fair value of the convertible bonds at the time of early retirement, plus a sweetener. The fair value of the debt portion of the payout for the convertible bond is $1,485,000. Because a sweetener is included, the $1,600,000 payout to the bondholders will result in a loss for the company, as shown in the entry below:

* Carrying value of bonds at the end of two years using the effective interest method = ($90,000 PMT, 7 I/Y, (5-2) N, $1,500,000 FV)

![]()

![]()

![]()

![]()

***Retained earnings, options retired = carrying value of contributed surplus, convertible bond options ($61,503) – FV of equity portion allocated from payout amount ($1,600,000 – $1,480,000 fair value for debt portion)

![]()

The $24,365 loss is the difference between the carrying value of the bond at the time of early retirement ($1,460,635) and the fair value of the debt component of $1,485,000. The reduction in equity of $53,497 is due to the difference between the carrying value of the contributed surplus, convertible bond options of $61,503, and the fair value of the equity component of $115,000 ($1,600,000 – $1,485,000 debt component).

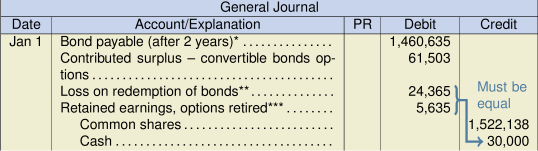

If the early retirement were in the form of a conversion to common shares, plus an additional cash sweetener of $30,000, instead of a repayment of the debt in cash, the entry using the residual method under ASPE would be:

* ![]()

![]()

![]()

![]()

*** Reduction in retained earnings (equity) = additional cash of $30,000

loss on redemption of bonds of $24,365

Under IFRS, the entire cash incentive of $15,000 is recorded as a debit to the loss account, eliminating the retained earnings account.

In summary, an early payout, or conversion of convertible bonds, usually requires a sweetener to motivate bondholders to accept the deal. This additional cash amount must be allocated between a loss, due to debt component of $24,365, and a reduction in equity, due to a capital transaction cost of $5,635, associated with the convertible capital options retired. The sum of the loss and the reduction to retained earnings should balance with the cash sweetener amount of $30,000. Other than the addition of the loss ($24,365) and the reduction in retained earnings ($5,635), the accounting treatment for early retirement is basically the same as before (using book values). In other words, the carrying values of the debt ($1,460,635) and equity ($61,503) components are still used to determine the common shares amount ($1,522,138), as was the case in the earlier examples.

14.3.2. Presentation of Convertible Debt and Preferred Shares

At each reporting date, the debt and equity components for convertible instruments would be reported according to their respective standard. Bonds would, therefore, classify the debt component as a long-term liability at amortized cost and the options as contributed surplus in equity at historical cost:

| Essessive Corp. Partial Statement of Financial Position January 1, 2020 |

|

|---|---|

| 2020 | |

| Long-term liabilities | |

| Bonds payable, 6% annually, due January 1, 2025 | $1,438,497 |

| Shareholders’ Equity | |

| Paid-in capital: | |

| Contributed surplus, conversion rights | $61,503 |

For convertible preferred shares, reporting as either a liability or equity would depend on the characteristics of the convertible preferred shares. The general rule is that if the company has little control over an obligation to issue common shares in exchange for the preferred shares, or if they must pay inordinately high dividends upon some threshold being met, the company must report these preferred shares as a liability because they represent an unavoidable obligation. Moreover, the dividends paid for preferred shares, classified as liabilities, would be reported in net income as an interest expense instead of a reduction to retained earnings, as is the case for preferred shares dividends without liability attributes. An example of convertible preferred shares classified as a liability would be mandatorily redeemable preferred shares, such as preferred shares that must be repurchased if common shares exceed some sort of threshold market price. In this case, the company clearly has an obligation over which it has little control. This classification as a liability is a requirement for IFRS companies in all instances. For ASPE companies, the liability classification is used when the likelihood of the obligation arising is high.