17.4 Sales and Leaseback Transactions

A sales and leaseback transaction occurs when an asset is sold to the buyer, and is immediately leased back from the buyer. The seller becomes the lessee, and the buyer becomes the lessor. This is common in situations where the seller/lessee needs to generate cash. They can obtain the cash they need through the sale of the asset, but, as they need to continue using it, they lease it back right away. This represents a bundled transaction (sale/lease) between two parties.

The ASPE Accounting Standard

Under ASPE, typically, gains on sale and leaseback transactions that are classified as a finance lease are to be deferred and amortized. For a finance lease, the amortization of the deferred gain/loss uses the same basis as the depreciation policy of the lessee. For example, on January 1, Langmeyer Ltd. owns an office building, which it sells to Bagel Ltd. for $20 million, which is the fair value on that date. It is immediately leased back to Langmeyer Ltd. for a 25-year term, which is equal to the office’s remaining useful life. At the time of the sale, the asset had a cost of $5 million and accumulated depreciation of $4 million. The purchaser/lessor wants to obtain an 8% return on the lease, so the lease payments would be:

| PMT/AD | =±20,000,000 PV, 8 I/Y, 25 N, 0 FV) |

| =$1,734,792 due at the beginning of each year (annuity due) |

Since the lease term is 25 years, which is equal to the remaining useful life of the asset, it meets the criteria necessary to be classified as a finance lease for the lessee. The year-end for both companies is December 31, and both follow IFRS (IAS 17).

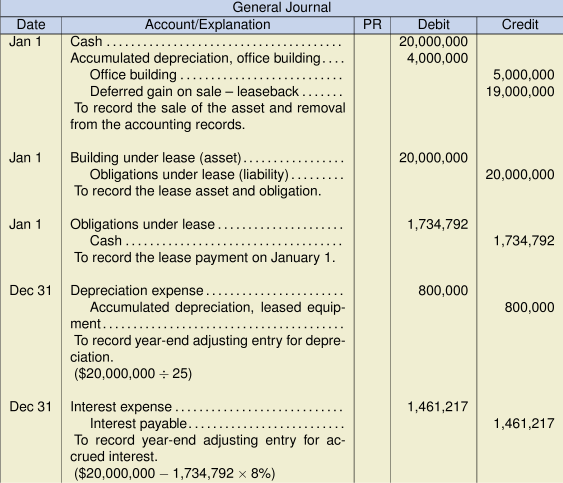

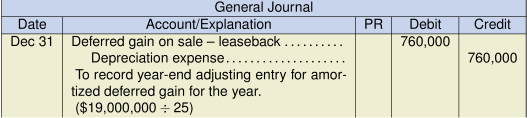

The first entry for this transaction will be for the sale, where the removal of the asset and its related accumulated depreciation is recorded along with a deferred gain/loss. For the buyer, it is simply a purchase of an asset for cash. The remaining entries will be for the lease agreement, as previously illustrated earlier in this chapter. The only change is that, for the lessee, there will be an additional entry for the amortization of a portion of the deferred gain.

For seller/lessee:

For buyer/lessor:

Recall that the amortization for the deferred gain used the same basis (25 years) as the depreciation policy of the company. Also, note that the realized gain of $760,000 is credited to depreciation expense as a reduction to this operating expense.

The IFRS Accounting Standard

Under IFRS, to determine the accounting treatment of a SALT and whether it is a sale, the transaction must be evaluated in terms of IFRS 15 (Revenue) requirements to see if it qualifies to be a sale. If the transaction qualifies as a sale, the seller/lessee will derecognize the carrying amount of the asset and record a right-of-use (ROU) asset on a proportionate basis as shown in the examples below. Note that if the sales price is less than the fair value of the asset, this difference is accounted for as a prepayment of lease payments and so it is recorded to the right-of-use asset (IFRS 16). If there is a gain, the gain is treated as additional financing as a financial liability to the seller/lessee with a corresponding financial asset to the buyer/lessor. If the transaction is not a sale, the treatment will follow IFRS 9, Financial Instruments, where the seller/lessee will not derecognize the asset and will record a financial liability equal to the proceeds. The buyer-lessee will not recognize the asset and will record a financial asset equal to the proceeds.

Below are three scenarios that illustrate a SALT transaction meeting the requirements for a sale (IFRS 15), with and without a gain/loss. The present value of the total payments is $6M and the payments are made at the end of each year. The buyer/lessor classified the lease as an operating lease.

| Selling price = FV of asset | Selling price < FV of asset | Selling price > FV of asset | |

|---|---|---|---|

| Selling price | $10M | $9M | $12M |

| FV of asset | $10M | $10M | $10M |

| Difference | $0 | ($1M) | $2M |

| Lease term | 6 years | 6 years | 6 years |

| Implicit interest rate | 4.5% | 4.5% | 4.5% |

| Carrying value of asset | $8M | $8M | $8M |

| PV of lease* | $6M | $6M | $6M |

| ($4M lease & | |||

| $2M add’l financing) | |||

| See below | |||

| Right-of-use asset | $4.8M | $5.8M | $3.2M |

| valuation** | |||

| Entry – seller/lessee: | DR……………..CR | DR……………..CR | DR……………..CR |

| Cash | $10 M | $9 M | $12 M |

| ROU asset | $4.8 M | $5.8 M | $3.2 M |

| Asset (carrying value) | $8 M | $8 M | $8 M |

| SALT liability | $6 M | $6 M | $6 M |

| Gain on sale of asset | $0.8 M | $0.8 M | $1.2 M |

| Entry – buyer/lessor: | |||

| ROU Asset | $10 M | $10 M | $10 M |

| Financial asset | $0 | $1 M | $2 M |

| Cash | $10 M | $9 M | $12 M |

* PV lease = (1163270 PMT, 4.5 I/Y, 6 N, 0 FV) = $6M

** Right-of-use asset = carrying value of asset\times (PV lease ÷ Fair value of asset) + difference (Sales < asset)

| Example 1: ROU asset | |

| (there is no difference, so PV lease is for $6M) | |

| Example 2: ROU asset | |

| (PV lease is for $6M and difference of ($1M)) | |

| is considered as a prepayment of lease payments | |

| and therefore included in ROU asset) | |

| Example 3: ROU asset |

* ![]()