15.2 Differences Between Accounting and Taxable Profit

Accounting profit (or income) is something that accountants are very familiar with. Accounting profit is a financial reporting term that can also be referred to as “income before taxes” on the income statement. Taxable profit is a tax accounting term that indicates the amount on which income tax payable is calculated. The calculation of accounting profit follows GAAP and IFRS rules while the calculation of taxable profit follows the Income Tax Act and Regulations. Accounting profit and taxable profit are rarely the same dollar amount.

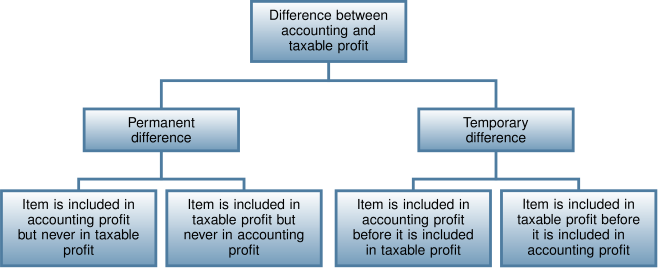

There are a variety of causes of the differences between accounting profit and taxable profit. These can be summarized as follows:

Let’s look at each of these situations.

Permanent Differences

These differences arise when an item is included in one type of reporting (accounting or tax) but is permanently excluded from the other type of reporting. Items that are included in the determination of accounting profit but not taxable profit can be both revenue and expense items. An example of a revenue item would be a dividend received from another company that is not taxed in the reporting jurisdiction. Many jurisdictions allow this tax-free flow of inter-corporate dividends. In this case, the dividend would be reported on the company’s statement of profit, but would never be taxed. An example of an expense item would be a sports club membership for the company’s executive officers. Many businesses consider this type of item to be an appropriate form of promotion and business development, but many tax authorities do not allow this to be deducted when calculating taxable profit. Items that are included in taxable profit but never in accounting profit are less common. These include such items as certain depletion allowances allowed for natural resources and certain types of capital taxes that are not based on income.

The accounting treatment for permanent differences is quite straightforward. Because these items do not affect future periods, there is no effect on future taxes. Thus, the amount is simply included (or excluded) in the determination of current taxable profit and the resulting tax payable is reported as a liability.

Examples of permanent differences:

- Non-tax-deductible expenses: fines and penalties, golf and social club dues, life insurance expenses on CEO, and expenses related to the earning of non-taxable revenue.

- Non-taxable revenue: dividends received from taxable Canadian corporations, proceeds on insurance policies on CEO (and other executives).

Since permanent differences only affect the period in which they occur, there is no deferred tax implication associated with any statement of financial position accounts.

Temporary Differences

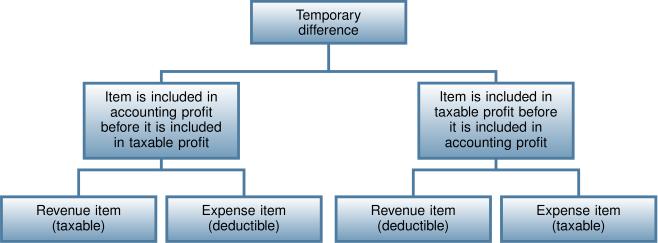

We can further classify temporary differences as follows:

Note that the items are classified as being either taxable or deductible. This feature refers to the item’s effect on future tax calculations: taxable temporary differences increase future tax payable while deductible temporary differences decrease future tax payable. For example, a warranty expense to reflect the cost of future repairs may be accrued for accounting purposes, but the appropriate tax law does not allow any deduction in determining taxable profit until the repairs are actually made. In this case, the expense is a deductible temporary difference because it will allow for a deduction against taxable profit in a future period when the repairs actually occur.

The following are some common examples of deductible and taxable temporary differences:

| Revenue Item | Expense Item | |

|---|---|---|

| Taxable | Construction revenue | Capital allowance in excess of depreciation |

| Instalment sales | Pension funding in excess of expense | |

| Unrealized holding gains | Certain prepaid expenses | |

| Deductible | Subscriptions paid in advance | Capital allowance less than depreciation |

| Royalties and rent paid in advance | Pension expense in excess of funding | |

| Sale and leaseback gains | Warranty accruals | |

| Litigation accruals | ||

| Unrealized holding losses |

These examples only represent a sample of the types of items that can result in temporary differences. In determining the tax expense for the year, the accountant must consider the effect on all items for which the accounting treatment and the tax treatment are different. For example, with construction revenue, the company will normally choose the percentage of completion method to recognize revenue for accounting purposes. However, many tax jurisdictions will allow the company to defer the recognition of revenue on a long-term construction contract until the project is completed. This will result in a future taxable amount, as future revenue for tax purposes will be greater since the revenue has already been recognized for accounting purposes.