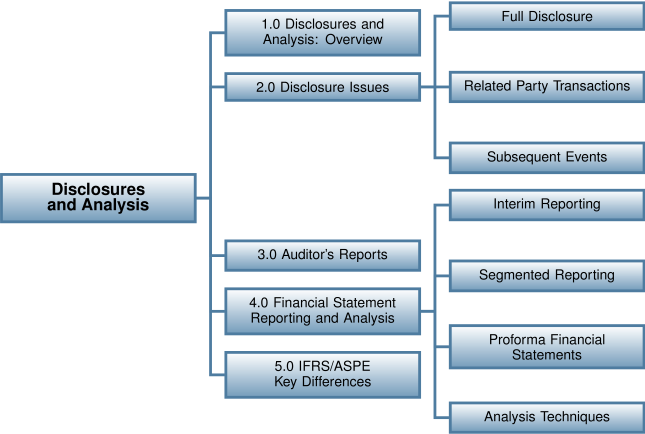

22.0 Putting It All Together: Disclosures and Analysis Overview

Learning Objectives

After completing this chapter, you should be able to:

- Discuss the rationale and methods of full disclosure in corporate reporting.

- Identify the issues and disclosure requirements for related parties.

- Describe the appropriate accounting and disclosure requirements for events occurring after the reporting period.

- Describe the purpose of the audit opinion and the contents of the auditor’s report.

- Explain the various financial statement analysis tools and techniques.

- Explain the similarities and differences between ASPE and IFRS regarding disclosures and analysis of financial statements.

Introduction

The previous chapters of this text and the previous course text were focused on the individual aspects of financial reporting. For example, the previous intermediate financial accounting text covered how to prepare the basic core financial statements as well as the more complex aspects of current and long-term assets. In contrast, this text has discussed the complex issues regarding current and long-term liabilities and equity such as complex financial instruments, income taxes, pensions, leases, earnings per share, as well as an in-depth look at accounting changes, error analysis, and the direct method for preparing the statement of cash flows. This last chapter will focus on pulling together these individual topics into a cohesive overview of financial statement disclosures and analyses.