17.3 Accounting Treatment For Leases, Two Accounting Standards

17.3.1. The ASPE Accounting Standard for Leases[1]

Lessee Classification:

Under ASPE, the lessee evaluates a lease on a classification basis (i.e. where the risks and rewards are deemed to substantively pass to the lessee as evidenced by the criteria below). Later in this chapter, IFRS 16 will be discussed which identifies another approach for lease evaluation, called the contract basis. More on that later.

Under ASPE, the lessee is to classify the lease as a capital lease if any one or more of the following criteria is met:

- There is either a transfer of ownership through a bargain purchase option (BPO) included in the lease agreement. If a BPO exists, it is assumed that the lessee will exercise the right to purchase the asset at the BPO price because this price is significantly lower than the asset’s fair value at that time.

- Lease term must be at least 75% of the asset’s estimated economic or useful life. The lease term also includes any bargain renewal option, which is assumed the lessee will exercise, since this price will be significantly lower than market at that time.

- The lessor will recover 90% or more of the leased asset’s fair value as well as realizing a return on the investment. The lessee is in substance purchasing the asset. The threshold calculation is the present value of the sum of the present value of:

- the lease payments (excluding any executory, maintenance, or contingent costs paid by the lessee that are included in the lease payment);

- a guaranteed residual value

- a bargain purchase option.

This sum is referred to as the minimum lease payment.

The interest rate used in the present value calculation is the lower of the lessor’s implicit rate if known, and the lessee’s incremental borrowing rate.

For points 2 and 3 above, consider that even though the leased asset’s title has not legally transferred to the lessee, the risks and rewards of ownership have been substantively transferred to the lessee, hence the accounting treatment to capitalize the lease asset, recognize the lease obligation, and record the leased asset depreciation and accrued interest on the lease obligation. This is an example of a case in which the economic substance, rather than the legal form, dictates the accounting treatment.

Special Note: For ASPE, the leased asset valuation amount cannot exceed its fair value at that date.

Lessor Classification

For the lessor classification as a capital lease, ASPE requires any one of the above three criteria for the lessee to be met, plus two additional criteria:

- Collectability of the lease payments is reasonably predictable.

- There are no important uncertainties about costs that have not yet been incurred by the lessor.

If these two additional criteria are not met, it would not be appropriate for the lessor to remove the leased asset from its accounting records.

Further analysis is required to determine if the lease is a sales-type lease, indicated by the existence of a profit, or if it is a direct-financing lease, which is usually the case when lessors are finance companies or banks and not manufacturers or dealers.

If the lease is deemed to be a capital lease, the lessor removes the asset from its leased assets inventory and records a receivable amount equal to the sum of the undiscounted lease payments, plus any guaranteed or unguaranteed residual value, or a bargain purchase option. The lessor must also record the lease as either a sale, if the fair value of the lease is greater than the cost of goods sold (a profit), or as a financing arrangement (no profit).

Special Items

Indirect costs. Any initial direct costs of negotiating and arranging the acquisition of the lease are included in the lessor’s investment amount to be recovered when calculating the lease payment amount because the lease payment is intended to recover these costs.

Executory costs. Lease payments often include leased asset use costs that the lessor has paid and wants to recoup from the lessee, such as insurance, maintenance, licenses, or tax costs. These executory costs are to be excluded when calculating the present value of the lease asset and obligation, and separately recorded as an expense for the lessee. This is because these costs don’t arise from the acquisition of the leased asset, but rather from its use. For example, if the lease payment of $14,000 included $2,000 for insurance of the leased asset, the lessee’s journal entry would be:

Economic life versus lease term. The economic life of an asset is usually longer than the lease term. Depreciation of a leased asset by the lessee for a capitalized lease is based on whether the title of the leased asset transfers to the lessee. If the legal title remains with the lessor, and the leased equipment is returned to the lessor at the end of the lease term, and the depreciation period of the leased asset will be the lease term. If the legal title to the leased asset transfers to the lessee at the end of the lease term, or there is a bargain purchase option (BPO) or bargain renewal option, it is assumed that the lessee will exercise this option since the price of either a BPO or a bargain renewal option is significantly lower than the market price at that time. For this reason, a leased asset under these circumstances will be depreciated over its economic or useful life instead of over the lease term. This makes intuitive sense, given that the lessee intends to continue to use the asset beyond the lease term.

Interest rates. ASPE advocates the lower of either the lessor’s implicit rate (if known) or the lessee’s incremental borrowing rate. This is to ensure that an artificially high interest rate is not used to lower the present value enough to result in a classification as an operating lease. Recall from previous chapters regarding long-term debt that the higher the interest rate, the lower the present value of the debt obligation. Using an unrealistically high interest rate for a lease could reduce the present value of the lease to below the capitalization threshold criterion of 90% under the ASPE standard. This would enable management to avoid the requirement to classify the lease as a capital lease and to report the leased asset and lease obligation on the balance sheet. Management might be motivated to do this because a capital lease asset and liability will change the liquidity and solvency ratios that are often monitored by creditors.

Once an interest rate is selected, the accrued interest for the lessee and interest income for the lessor are calculated using the effective interest method discussed in the long-term debt chapter.

Example 1: ASPE Sales-type Lease

The accounting treatment is best explained using a numeric example. On January 1, 2021, Tweenix Corp. (lessee) entered into an agreement to lease a piece of landscaping equipment from Morganette Ltd. (lessor). The lease details are below:

| Non-cancellable lease term | 8 years |

| Lease bargain renewal option or a bargain purchase option | None – equipment |

| reverts back to lessor | |

| Residual value (not guaranteed by lessee) | $36,000 |

| Annual lease payment due each January 1 (annuity due) | Lessor to determine |

| Equipment cost to lessor | $666,000 |

| Equipment estimated economic life | 9 years |

| Equipment fair value on January 1, 2021 | $864,000 |

| Lessor has set the following implicit rate of return, which is known to lessee | 7% |

| Lessee incremental borrowing rate | 8% |

Other information:

- Both companies’ year-ends are December 31, and both follow ASPE.

- Collectability of the lease payments is reasonably predictable and there are no important uncertainties about costs that have not yet been incurred by the lessor.

- The lessee depreciates all equipment on a straight-line basis.

Accounting Treatment of a Capital Lease – Steps and Entries

Step 1. Lease variables include determining the lease payment amount, the length of the lease, the interest (discount) rate, the bargain purchase option or bargain renewal option (if any), and the residual value whether guaranteed or unguaranteed by the lessee:

In this case, the lessor wants to get a return of 7% on the investment. Other negotiated details between the lessor and lessee result in a lease term of eight years, no bargain purchase or bargain renewal options, with the leased asset reverting back to lessor at the end of the lease term. The lessee does not guarantee the residual value of $36,000 at the end of the lease term in this case. The equipment originally cost $666,000 and has a current fair value of $864,000. The lessor must now calculate the lease payment amount that the lessee will pay at the beginning of each year which will enable the lessor to recoup the investment cost plus a return on investment. Because the lease payments will be made at the beginning of each year, the payment calculation using present values and a financial calculator will be for an annuity due (AD). This means that, in this example, the lease payment is to be made at the beginning of each year instead of at the end. The annuity due concept was discussed in further detail in the chapter on long-term debt under present values and timelines.

The variables used to calculate present value of the the lease payment amount include a 7% expected rate of return (I/Y), the $864,000 fair value as the present value (PV) of the equipment, the eight years duration of the arrangement (N), and the $36,000 unguaranteed residual value (FV) that the lessor hopes to receive by reselling the used equipment in the marketplace at the end of the lease term.

Recall that when calculating the lease payment, it does not matter if the residual value is guaranteed or not guaranteed by the lessee because the residual value represents a cash flow in, no matter the source because the lease payment calculation is from the lessor’s point of view. The present value calculation of the lease payment (annuity) using a financial calculator is:

| = |

The lease payment will be $131,947 per year for eight years for the lessor to recoup the asset’s fair value of $864,000, earn a 7% return, and recoup a residual value of $36,000 from the marketplace at the end of eight years. The unguaranteed residual value that the lessor expects to receive once the leased asset is sold in the marketplace at the end of the lease term causes the lease payment amount for the lessee to be reduced. Had there been no residual value, the lessee’s lease payment amount would be for a higher amount of $135,226 (+/- 864,000 PV, 7 I/Y, 8 N, 0 FV).

Step 2. Analysis and classification of the lease as an operating or capital lease:

The terms of the lease agreement are now set, and it is time to determine whether the lease is to be classified as an operating or capital lease by both parties. Since these companies follow ASPE, this will be the criteria used.

Lessee Analysis

As previously stated, at least one of the four criteria below must be met for the lease to be classified as capital, otherwise it will be classified as an operating lease. Below, highlighted in red, are the results of the analysis for this example:

- Does ownership title pass? No, title remains with the lessor.

- Is there a BPO or a bargain renewal option? No

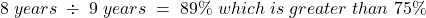

- Is the lease term at least 75% of the asset’s estimated economic or useful life? Yes, capitalize leased asset.

Note: At this point, as one of the criteria has been met, the capitalization classification of the lease is now applicable, but the lessee analysis will continue to include the fourth criteria for illustrative purposes.

- Is the present value of the minimum lease payment (i.e. the net cash flows) at least 90% of the fair value of the leased asset? Yes, as calculated below.

| The lease cash flows = | |

The interest rate is the lower of the lessor’s implicit rate (7%) which is known to the lessee or the lessee’s incremental borrowing rate (8%).

Present value calculation of the minimum lease payments:

| PV | = |

| = |

* The residual value is not guaranteed by the lessee so it is not included in the lessee’s present value calculation.

The fair value of the leased asset is $864,000, so the present value of the net cash flows is 97.575% and is greater than the threshold criterion of 90%. The present value of $843,048 is lower than the fair value amount of $864,000. The leased asset and the associated lease obligation will be the amount of the present value of the lessee’s minimum lease payments of $843,048. For the lessee, the analysis reveals that this lease meets two of the criteria for capitalization. Since only one needs to be met, the lessee will classify this lease as a capital lease.

Lessor Analysis

The criteria above are also used to determine if the lease is to be a capital lease for the lessor, plus two additional criteria, and both of these must be met to be a capital lease:

- Collectability of the lease payments is reasonably predictable. Yes

- There are no important uncertainties about the un-reimbursable costs yet to be incurred by the lessor. Yes

The lessor must now determine if the lease is to be treated as a sales-type lease or a direct-financing lease. In this case, the fair value of the lease of $864,000 exceeds the lessor’s cost of $666,000, meaning that a profit exists which classifies this as a sales-type lease. To summarize the analyses above, if the lease meets the criteria for capitalization for the lessee, it will also be classified as a capital lease for the lessor, provided that there are no collectability issues or uncertainties about un-reimbursable costs. For the accounting treatment, in summary:

- The lessee records the capitable leased asset and the corresponding lease obligation based on the lower of the present value of the minimum lease payments and the leased asset’s fair value at that time. The payments made to the lessor are recorded as a reduction in the lease obligation. At the end of each reporting period, the leased asset is depreciated and the interest on the lease obligation is accrued.

- As a sales-type lease, the lessor records the total lease receivable, the sales revenue, and the unearned interest income that will be realized over the lease term. The leased asset is also transferred from the leased assets inventory to cost of goods sold. Any lease payments received are recorded as a reduction of the lease receivable. At the end of each reporting period, the interest earned is transferred from unearned interest income to interest income.

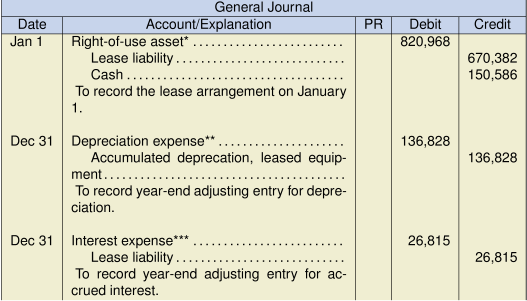

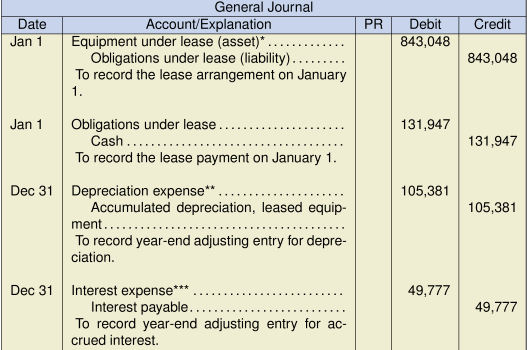

Step 3. Record the entries for the lessee:

* PV = (131,947 PMT/AD, 7 I/Y, 8 N, 0 FV)

** 843,048 lease asset amount divided by 8 years lease term if SL depreciation policy is used.

*** ![]()

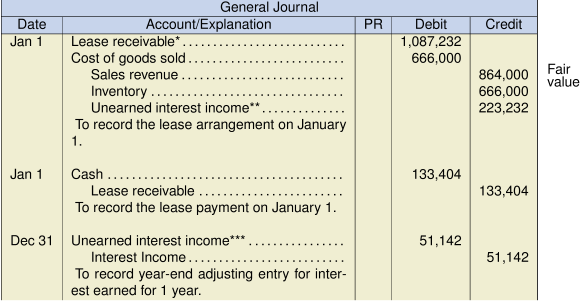

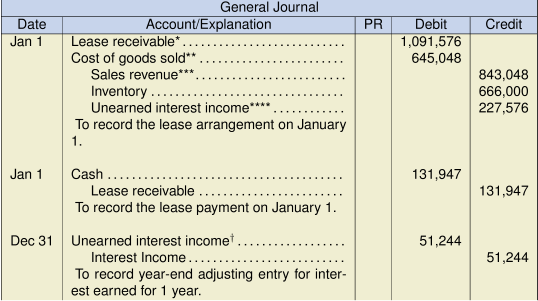

Step 4. Record the entries for the lessor:

* ![]()

Since the residual value is not guaranteed by the lessee, its present value is excluded from both COGS and sales as shown below:

** ![]()

PV = (7 I/Y, 8 N, 36,000 FV) = 20,952

*** ![]()

**** ![]()

![]()

Step 5. Report the results, a partial balance sheet:

| Lessee – Balance Sheet as at December 31, 2021 | Lessor – Income Statement for the year ended December 31, 2021 | ||||||

|---|---|---|---|---|---|---|---|

| Property, plant, and equipment | |||||||

| Equipment under lease | $843,048 | Sales revenue | 843,048 | ||||

|

Accumulated depreciation |

(105,381) |

Cost of goods sold |

645,048 | ||||

| 737,667 | Gross profit | 198,000 | |||||

| Current liabilities | Other revenue | ||||||

|

Interest payable |

$49,777 |

Interest income |

51,244 | ||||

| Current portion of lease obligation* | 82,170 | ||||||

| Long-term liabilities** | |||||||

| Lease obligation (note X) | 628,931 | ||||||

* ![]() principal portion due in one year

principal portion due in one year

** ![]() long-term portion

long-term portion

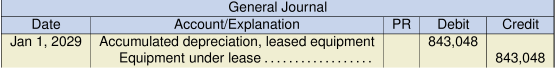

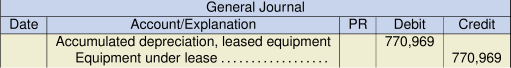

Step 6. Record the final entry at the end of the lease term:

At the end of the lease term, the leased asset is returned to the lessor. The lessee’s accounting records will show that the leased asset will now be fully depreciated, and the lease obligation will have a zero-balance owing. If the residual value of $36,000 is equal to the fair value at that time, the final entries for the lessee and lessor at the end of the lease term would be:

For lessee:

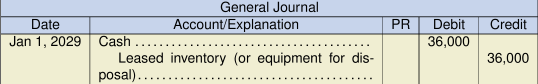

For lessor:

If the lessor receives the full amount of the unguaranteed residual value from the marketplace, the entry would be:

For lessor:

Guaranteed Residual Value

If the lessee guaranteed the residual value, the entries would be changed as shown below (changes for the previous entries are shown in red for comparative purposes):

For lessee:

* PV = (131,947 PMT/AD, 7 I/Y, 8 N, 36,000 FV)

** 864,000 lease asset amount minus the guaranteed residual value of 36,000 divided by an 8-year lease term

*** ![]()

For lessor:

* ![]()

Since the residual value is guaranteed by the lessee, its present value is included in both COGS and sales as shown below:

** ![]()

*** ![]()

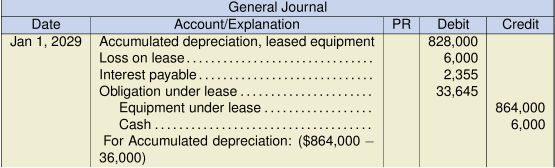

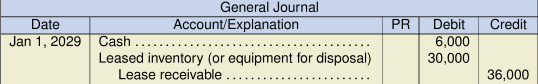

At the end of the lease, the leased asset is returned to the lessor. If the lessor can sell the asset for $30,000, then the tessee will owe the lessor $6,000 for the unrecovered portion of the guaranteed residual value of $36,000. The lessee’s lease amortization schedule using the effective interest method would be:

| Lessee Lease Amortization Schedule Annuity Due, Guaranteed Residual Value Interest |

||||

| Year | Payment | @ 7% | Principal | Balance |

|---|---|---|---|---|

| 2021 | 864,000 | |||

| 2021 | 131,947 | 732,053 | ||

| 2022 | 131,947 | 51,244 | 80,703 | 651,350 |

| 2023 | 131,947 | 45,594 | 86,353 | 564,997 |

| 2024 | 131,947 | 39,550 | 92,397 | 472,600 |

| 2025 | 131,947 | 33,082 | 98,865 | 373,735 |

| 2026 | 131,947 | 26,161 | 105,786 | 267,949 |

| 2027 | 131,947 | 18,756 | 113,191 | 154,759 |

| 2028 | 131,947 | 10,833 | 121,114 | 33,645 |

| 2029 | 36,000 | 2,355 | 33,645 | 0 |

Note how ASPE includes the full value of the guaranteed residual in the lease amortization schedule. This is different from IFRS which will be discussed later in the chapter. The entries for the lessee and lessor at the end of the lease term would be:

For lessee:

For lessor:

Bargain Purchase Option

What if the lessor included a bargain purchase option (BPO) instead of a guaranteed / unguaranteed residual value, which is less than its fair value at the end of the lease? It is assumed that the lessee will exercise the right to purchase the leased asset at the end of the lease term for the BPO price. The leased asset will no longer be returned to the lessor and the residual value will now apply to the lessee’s depreciation calculation. Also, since the title to the asset will transfer to the lessee, the asset will be depreciated over its economic life instead of the lease term.

For simplicity, the fair value of $864,000 will remain the same. The lease payment amount calculated by the lessor will be adjusted to include a BPO of $20,000 in place of the residual value:

| PMT/AD | = |

| = |

The lease payment will be $133,404 per year for eight years so that the lessor can recoup the asset’s fair value of $864,000, earn a 7% return, and receive a BPO from the lessee of $20,000 at the end of eight years.

The entries assuming a BPO of $20,000 are shown below. Assume for purposes of depreciation that the asset will have a residual value of $31,500 at the end of its useful life.

For lessee:

* PV = (133,404 PMT/AD, 7 I/Y, 8 N, 20,000 FV)

** (864,000 lease asset amount minus a residual value of 31,500) divided by 9 years economic life

*** ![]()

For lessor:

* ![]()

** ![]()

*** ![]()

Note that the lessee’s depreciation decreases significantly with the existence of a BPO and with changing the depreciation period to the asset’s economic life instead of the lease term.

The lessee’s lease amortization schedule would be:

| Lessee Lease Amortization Schedule Annuity Due, Bargain Purchase Option |

||||

| Year | Payment | Interest @ 7% | Principal | Balance |

|---|---|---|---|---|

| 2021 | 864,000 | |||

| 2021 | 133,404 | 730,596 | ||

| 2022 | 133,404 | 51,142 | 82,262 | 648,334 |

| 2023 | 133,404 | 45,383 | 88,021 | 560,313 |

| 2024 | 133,404 | 39,222 | 94,182 | 466,131 |

| 2025 | 133,404 | 32,629 | 100,775 | 365,356 |

| 2026 | 133,404 | 25,575 | 107,829 | 257,527 |

| 2027 | 131,947 | 18,027 | 115,377 | 142,150 |

| 2028 | 133,404 | 9,950 | 123,454 | 18,696 |

| 2029 | 20,000 | 1,304 | 18,696 | 0 |

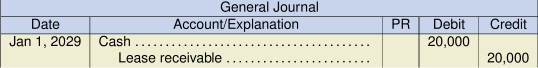

The entries for the lessee and lessor at the end of the lease term would be:

For lessee:

For lessor:

Example 2: ASPE Direct-Financing Lease

On May 31, 2021, Visuel Ltd. (lessee) leases its equipment from First Finance Corporation (lessor). The lease has the following terms:

| Non-cancellable lease term | 5 years |

| Lease bargain renewal option or a bargain purchase option | None – equipment |

| reverts back to lessor | |

| Residual value (guaranteed by lessee) | $19,652 |

| Annual lease payment due each May 31 (annuity due) | $41,400 |

| Equipment estimated economic life | 6 years |

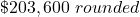

| Equipment fair value on May 31, 2021 | $203,600 |

| Lessor has set the following implicit rate of return, which is known to lessee | 5% |

| Lessee incremental borrowing rate | 6% |

Other information:

- Both companies’ year-ends are December 31, and both follow ASPE.

- Collectability of the lease payments is reasonably predictable and there are no important uncertainties about costs that have not yet been incurred by the lessor.

- The lessee depreciates all equipment on a straight-line basis.

Step 1. Lease terms:

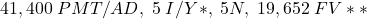

In this case, the lease payment of $41,400* is already calculated. All other terms are known.

* PMT = (![]() )

)

Step 2. Analysis and classification of the lease as an operating or capital lease:

Lessee Analysis

At least one of the four criteria below must be met for the lease to be classified as a capital lease, otherwise it will be classified as an operating lease:

- Does ownership title pass? No, title remains with the lessor.

- Is there a BPO or a bargain renewal option? No.

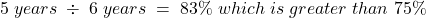

- Is the lease term at least 75% of the asset’s estimated economic or useful life? Yes, capitalize leased asset.

- Is the present value of the minimum lease payment (net cash flows) at least 90% of the fair value of the leased asset? Yes, as calculated below. Present value calculation:

PV =

* Recall that the ASPE standards state that the lower of the two interest rates is to be used since both are known to the lessee. In this case, 5% is the lower of the two interest rates.

** Residual value is guaranteed by the lessee, so it is included in the lessee’s present value calculation.Using a financial calculator, the present value of the leased asset is calculated as:

PV =

If the fair value of the leased asset is $203,600, the present value of the net cash flows is 100% and is, therefore, greater than the threshold of 90%.

For the lessee, this analysis reveals that the lease meets two of the criteria for capitalization. Since only one criterion needs to be met, this lease can be classified as a capital lease by the lessee.

Lessor Analysis

Based on the criteria above, the lease will also be a capital lease to the lessor provided that both criteria below are met:

- Collectability of the lease payments is reasonably predictable. Yes

- There are no important uncertainties about the un-reimbursable costs yet to be incurred by the lessor. Yes

To determine the type of lease, since the cost to the lessor is the same as the fair value (i.e., there is no profit) and the First Finance Corporation is not a manufacturer or dealer, the lease is classified as a direct-financing lease for the lessor.

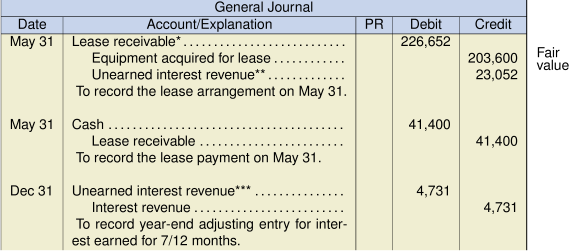

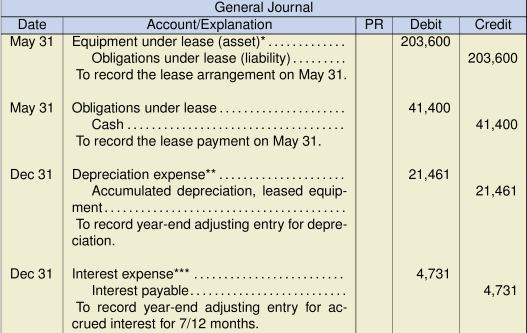

Steps 3. Record the entries for the lessee:

* PV = (41,400 PMT/AD, 5 I/Y, 5 N, 19,652 FV)

** ($203,600 lease asset amount minus the guaranteed residual value of $19,652) divided by 5 years lease term for 7/12 months

*** ![]()

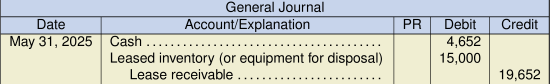

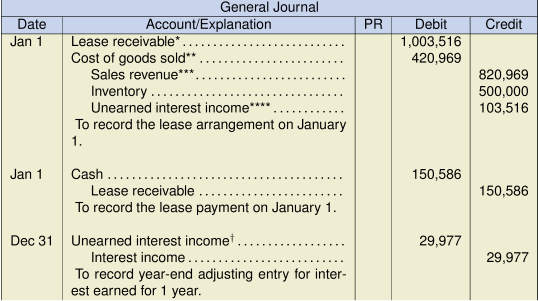

Steps 4. Record the entries for the lessor:

Step 5. Report the results, a partial balance sheet:

| Lessee – Balance Sheet as at December 31, 2021 | Lessor – Income Statement for the year ended December 31, 2021 | |||||||

|---|---|---|---|---|---|---|---|---|

| Property, plant, and equipment | ||||||||

| Equipment under lease | $203,600 | Interest revenue | $4,731 | |||||

| Accumulated depreciation | (21,461) | |||||||

| 182,139 | ||||||||

| Current liabilities | ||||||||

| Interest payable | $4,731 | |||||||

| Current portion of lease obligation* | 33,290 | |||||||

| Long-term liabilities** | ||||||||

| Lease obligation (note X) | 128,910 | |||||||

* ![]()

** ![]()

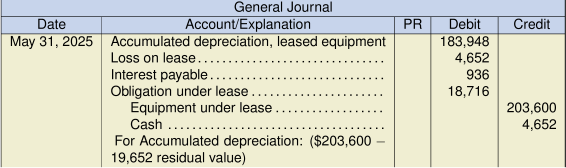

Step 6. Record the final entry at the end of the lease term:

At the end of the lease, the leased asset is returned to the lessor. If the lessor can sell the asset for $15,000, the lessee will owe the lessor $4,652 for the unrecovered portion of the guaranteed residual value. The entries for the lessee and lessor at the end of the lease term would be:

For lessee:

For lessor:

17.3.2. The IFRS Accounting Standard for Leases (IFRS 16, effective January 1, 2019)

Lessee – Contract Basis:

As previously stated, under ASPE the lessee evaluates a lease using a classification basis to determine if the risks and rewards substantively pass to the lessee using specific criteria such as the 75%/90% hurdle rates. Under IFRS 16, each lease must be evaluated on a contract basis. The contract basis approach is to determine whether a lease contract gives the lessee right-of-use of the leased asset for a specified time period or by a specified extent of use (such as for a specific number of units, kilometers, or other unit-based measure), in exchange for some sort of consideration. The lessee can elect not to capitalize a lease if it is a short-term lease (12 months or less at the commencement date, with no purchase option) or a low-value item when new. Examples of low-value leases could be IT equipment used by employees at their desks, office furniture items, water dispensers, coffee makers, and so on. Both the lessee and the lessor need to make this assessment at the inception of the contract and this determination will remain throughout the lease unless the terms of the contract change. The key factors to consider if a right-of-use asset is to be capitalized along with the obligation for lease payments include:

- There is a specified asset that is:

- physically distinct or that the lessee has rights to substantially all of the capacity of that asset and

- the lessor has no substantive substitution rights,

- The lessee obtains substantially all the economic benefits throughout the period of use (easier to assess if the lessee has exclusive use of the asset throughout the period of use.)

- The lessee has the right to direct the asset’s use decisions (such as “how and for what purpose”). This can be evidenced by the lessee’s rights to change the asset’s output, rights to change when to produce the output, where to produce the output, whether or not to produce output, or how much output is produced. [These rights are not to be confused with the lessor’s rights to protect the leased asset in terms of compliance with laws and regulations and for its safe use.]

In summary, IFRS 16 uses a contract basis to evaluate lease contracts and this results in virtually all lease contracts to be capitalized as finance leases, with a right-of-use asset and a lease liability recorded by the lessee (other than if deemed to be short-term or low $-value leases).

Lessor – Classification Basis:

The evaluation of a lease for the lessor uses a classification basis same as is done under ASPE. (For IFRS, only the Lessee evaluation is done on a contract basis). For the lessor, this means that IFRS requires that a lease be classified as a finance lease if it substantively transfers the risks and rewards of ownership from the lessor to the lessee. This is evidenced by the inclusion of a title transfer, a purchase option that is of lower than its fair value, or if the lease term is a substantial portion of the asset’s economic life or present value in the lease agreement. Since these are not specific hurdle rates such as the ASPE 75%/90% rates criteria, professional judgement is required to determine if the IFRS substantive-based criteria is met.

If the lease is deemed to be a capital lease, the lessor removes the asset from its assets inventory and records a receivable amount equal to the sum of the lease payments, plus any guaranteed or unguaranteed residual value, or a bargain purchase option. The lessor must also record the lease as either a sale, if the fair value of the lease is greater than the cost of goods sold (a profit), or as a financing arrangement (no profit).

Lease Liability Details:

The lease liability is based on present values of estimated cash flows which are identified in IFRS as:

- fixed lease payments,

- variable lease payments that are determined by applying an index or rate,

- purchase option or renewals, if reasonably expected to be exercised by the lessee (usually considered likely if the option is set lower than the fair value at that time),

- the estimated deficiency payable by lessee regarding any guaranteed residual values,*

- any lease termination penalties that are deemed likely to occur.

* Note that ASPE includes the full amount of the guaranteed residual value in the lessee’s present value calculation whereas IFRS includes only the estimated deficiency portion of the guaranteed residual that the lessor could not get from a third-party sale, that the lessee would be obligated to pay. Fundamentally, IFRS is providing a finer level of detail regarding the guaranteed residual value to the lessee’s present value calculation. A lower amount for a residual value will result in a lower present value compared to ASPE. That said, the overall outcomes and treatments will not be significantly different between the two standards since both provide a final adjustment for the actual deficiency that the lessee must pay to the lessor as the guarantee.

The lease term generally covers the non-cancellable period of the lease and any extensions reasonably expected to be exercised by the lessee. The interest rate used for the present value calculation is the rate implicit in the lease if determinable, otherwise it is to be the lessee’s incremental borrowing rate.

Example 3: IFRS Direct-Financing Lease

On January 1, 2022, Lyle Ltd. (lessee) entered into an agreement to lease equipment from Durage Ltd. (lessor). The lease details are below:

| Non-cancellable lease term | 5 years |

| Lease renewal option or a purchase option? | None – equipment |

| reverts back to lessor | |

| Residual value (not guaranteed by lessee) | $0 |

| Annual lease payment due each January 1 (annuity due), which includes a maintenance fee of $3,000 paid by the lessee to the lessor | $26,190 |

| Equipment estimated economic life | 6 years |

| Equipment fair value on January 1, 2022 | $100,000 |

| Lessor has set the following implicit rate of return, which is known to lessee | 8.0% |

| Lessee incremental borrowing rate | 7.5% |

Other information:

- Both companies’ year-ends are December 31, and both follow IFRS.

- The contract is not deemed to be a low $-value.

- The equipment is a specified asset that is physically distinct. The lessee has rights to all of the capacity of the asset and the lessor has no substitution rights.

- The lessee obtains substantially all the economic benefits throughout the period of use.

- The lessee has the right to direct all of the asset’s use and output decisions

- The lessor has the protective right to ensure that the asset is properly maintained and is safe to operate.

- The lessee depreciates all equipment on a straight-line basis.

Lessee Analysis

Using the contract basis, the non-cancellable lease term is greater than one year, the contract value is not a low $-value, and all of the right-of-use factors for the lessee have been met (i.e. specificity, economic benefits, and output decisions), meaning that this contract is to be capitalized as a right-of-use asset along with the corresponding lease liability.

The present value of the lease payments would be:

![]()

- PMT =

Present value calculation:

| PV | = |

| = |

Note: IFRS states to use the lessor’s implicit rate of 8%. Had the lessee followed ASPE, the lower of the two rates or 7.5% would have been used. This would have resulted in a slightly higher present value of $100,860 which exceeds the fair value of $100,000. The maximum valuation for the asset in this case would be limited to the fair value amount of $100,000 under ASPE.

Lessor Analysis

Using a classification basis, the lease substantively transfers the risks and rewards of ownership from the lessor to the lessee making this a capital lease for the lessor. This is evidenced by the asset’s present value being a substantive (100%) portion of the assets’ fair value.

There is no profit for the lessor which would be evidenced by the presence of an asset cost less than the fair value, so the lease will be treated as a financing lease with no cost of goods sold or sales to record.

To summarize the analyses above, the lease meets the criteria for capitalization as a right-of-use asset for the lessee, and as a financing lease for the lessor.

To summarize the accounting treatment:

- The lessee records the right-of-use asset and the corresponding lease liability based on the lower of the present value of the minimum lease payments of $100,000 and the leased asset’s fair value at that time of $100,000. Any lease payment made at the beginning of the lease is netted with the present value of the lease liability when recorded. The payments made to the lessor after the inception date are recorded as a reduction in the lease liability. At the end of each reporting period, the asset is depreciated, and the lease liability’s interest is accrued and recorded to the lease liability account (ASPE uses an interest payable account).

- As a financing lease, the lessor records the total lease receivable, the removal of the asset from the lessor’s accounting records and the unearned interest income which will be realized over the lease term. The lease payments received are recorded as a reduction of the lease receivable. At the end of each reporting period, the interest earned for the reporting period is transferred from unearned interest income to interest income.

This example below uses the effective interest rate calculations instead of completing an amortization schedule as was shown under ASPE. Either method is acceptable, but the mathematical calculation will likely take less time.

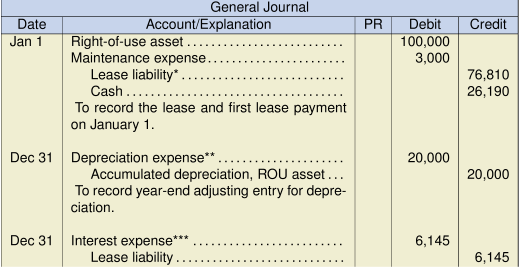

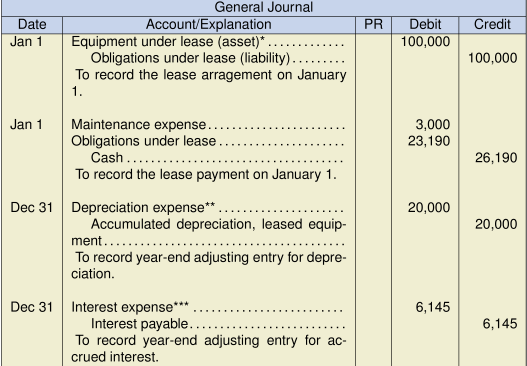

Record the entries for the lessee: (with corresponding ASPE entries for comparative purposes)

IFRS:

* ![]()

** ![]()

*** ![]()

Note how the IFRS standard combines the first two entries recorded separately under ASPE. The net result is identical, since both entries occurred on Jan 1 and therefore can be netted together into one entry as is shown under IFRS. The lease obligation/liability is $76,810 for both ASPE and IFRS immediately after the January 1 entry which also includes the first cash payment of $23,190 net of executory costs and paid in advance. However, one other notable difference is the debit account used to record the accrued interest. For IFRS the lease liability account is used compared to ASPE which records the accrued interest to interest payable. So, what difference does this make on the statement of financial position (balance sheet)? There is no difference because total current liabilities amount is the same amount in total for both. ASPE simply splits it into two current liability accounts while IFRS does not.

Record the entries for the lessor:

Report the results, a partial statement of financial position:

| Lessee – Statement of Financial Position as at December 31, 2022 | Lessor – Income Statement for the year ended December 31, 2022 | ||||||

|---|---|---|---|---|---|---|---|

| Property, plant, and equipment | |||||||

| Equipment under lease | $100,000 | ||||||

| Accumulated depreciation | (20,000) | ||||||

| 80,000 | |||||||

| Current liabilities | Other revenue | ||||||

| Lease liability | $23,190 | Interest income | 6,145 | ||||

| Executory costs reimbursed | 3,000 | ||||||

| Long-term liabilities** | |||||||

| Lease obligation (note X) | 52,620 | ||||||

* ![]()

![]()

** ![]()

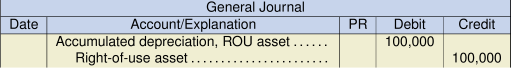

Record the final entry at the end of the lease term:

At the end of the lease term, the right-of-use asset is returned to the lessor. The lessee’s accounting records will show that the leased asset will now be fully depreciated and the lease liability will have a zero-balance owing.

For lessee:

For lessor:

No entry since the asset has no residual value and is likely to be disposed of as a zero value, unusable asset. A notation may be made in an asset subledger that the asset was returned and disposed of by the lessor.

Guaranteed Residual Value

If the lessee guaranteed some sort of residual value, the present value calculations would follow the same methodology as was shown under the ASPE for the example of a guaranteed residual. However, the entries recorded would follow the format and accounts shown above since the accrued interest is recorded to a different account than is used for ASPE companies (lease liability instead of interest payable). Assuming a guaranteed residual value deficiency of $10,000 and a fair value of $100,000, below are some of the lessee calculations:

Lessor’s lease payment calculation: (+/-100000, 8 I/Y, 5 N, 10000FV) = $21,612

Lessee’s present value calculation: (21612 PMT/AD, 8 I/Y, 5N, 10000 FV) = $100,000

Depreciation: ![]()

Interest: ![]()

Lessor’s lease receivable:

![]()

A Low Purchase Option

What if the lessor included a significantly low purchase option (PO) of $10,000, instead of a residual value? If the residual value is now estimated to be $15,000, the lessee will likely exercise the right to purchase the right-of-use asset at the end of the lease term for the lower than market PO price of $10,000. The leased asset title will now pass to the lessee due to the existence of the PO likely to be exercised. This will require that the asset be depreciated over its economic life of 6 years instead of the 5-year lease term. Note that the lessee’s depreciation expense has decreased significantly due to changing to the asset’s longer economic life.

Lessor’s lease payment calculation: same as above, $21,612

Lessee’s present value calculation: same as above, $100,000

Depreciation: ![]()

Interest: same as above, $6,271

Lessor’s lease receivable: same as above, $118,060

Example 4: IFRS Sales-Type Lease

On January 1, 2021, ABC Corp. (lessee) entered into an agreement to lease a boat from XYZ Ltd. (lessor). The lease details are below:

| Non-cancellable lease term | 6 years |

| Lease bargain renewal option or a bargain purchase option | None – equipment |

| reverts back to lessor | |

| Residual value (not guaranteed by lessee) | $100,000 |

| Annual lease payment due each January 1 (annuity due) | Lessor to determine |

| Equipment cost to lessor | $500,000 |

| Equipment estimated economic life | 10 years |

| Equipment fair value on January 1, 2021 | $900,000 |

| Lessor has set the following implicit rate of return, which is known to lessee | 4% |

| Lessee incremental borrowing rate | 5% |

Other information:

- Both companies’ year-ends are December 31, and both follow IFRS.

- The contract is not deemed to be a low $-value.

- The equipment is a specified asset that is physically distinct. The lessee has rights to all of the capacity of the asset and the lessor has no substitution rights.

- The lessee obtains substantially all the economic benefits throughout the period of use.

- The lessee has the right to direct all of the asset’s use and output decisions.

- The lessor has the protective right to ensure that the asset is properly maintained and is safe to operate.

- The lessee depreciates all equipment on a straight-line basis.

Lessor calculation of the lease payment:

The method that the lessor uses to calculate the lease payment amount was already discussed in the ASPE section of this chapter. The calculation detail is shown below for review purposes.

| PMT/AD | = |

| = |

Analysis and classification of the lease as an operating or capital lease:

Lessee Analysis

Using the contract basis, the non-cancellable lease term is greater than one year, the contract value is not a low $-value, and all of the right-of-use factors for the lessee have been met (i.e. specificity, economic benefits, and output decisions), meaning that this contract is to be capitalized as a right-of-use asset along with the corresponding lease liability.

Using the lessor’s implicit rate (4%), below is the present value calculation.

| PV | = |

| = |

The present value of $820,968 is the valuation amount because it does not exceed the fair value of the leased asset of $900,000.

Lessor Analysis

On a classification basis, the lease substantively transfers the risks and rewards of ownership from the lessor to the lessee making this a capital lease for the lessor. This is evidenced by the asset’s present value being a substantive portion (91%) of the asset’s fair value (![]() ).

).

The fair value of the lease of $900,000 exceeds the lessor’s cost of $500,000, which classifies it as a manufacturing/dealer lease because a profit exists.

Record the entries for the lessee:

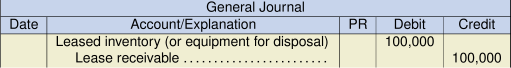

Record the entries for the lessor:

* ![]()

Since the residual value is not guaranteed by the lessee, its present value is excluded from both COGS and sales as shown below:

** ![]()

*** ![]()

**** ![]()

![]()

Record the final entry at the end of the lease term:

At the end of the lease term, the leased asset is returned to the lessor. The lessee’s accounting records will show that the right-of-use asset will now be fully depreciated, and the lease liability will have a zero-balance owing. If the residual value of $100,000 is equal to the fair value at that time, the final entries for the lessee and lessor at the end of the lease term would be:

For the lessee:

For the lessor:

If the lessor receives the full amount of the unguaranteed residual value from the marketplace, the entry would be:

For the lessor:

Comparison Between ASPE and IFRS

Comparing the IFRS 16 entries above with those from ASPE, the differences in the journal entries for a capital lease (ASPE) compared to a right-of-use lease (IFRS) are:

- The lease evaluation uses a classification basis for the lessee regarding if the risks and rewards using specific hurdle rates were transferred to the lessee (ASPE) and a contract basis for the lessee regarding if right-of-use asset exists using qualitative criteria (IFRS). For IFRS 16, this results in virtually all leases being capitalized other than low $-value or lease terms of twelve months or less. The lease evaluation for the lessor uses a classification basis for both ASPE and IFRS, so the standards are the same in this instance.

- Use of the full estimated residual value (ASPE) and the estimated deficiency portion of the residual value (IFRS) are used in determining the lessee’s minimum lease payments (a present value calculation).

- Terminology differences such as “leased asset” and “lease obligation” (ASPE) compared to “right-of-use asset” and “lease liability” (IFRS)

- the account used to record the accrued interest credit entry is “interest payable” for ASPE and “lease liability” for IFRS

- the interest rate used for the lessee’s minimum lease payments is to be the lower of the lessor’s implicit rate if known, and the lessee’s incremental borrowing rate (ASPE) compared to using the lessor’s implicit rate if determinable, otherwise the lessee’s incremental borrowing rate (IFRS).

Note that none of these differences above appear to significantly change the impact of a capitalized lease on the statement of financial position/balance sheet under either ASPE or IFRS, assuming that the two interest rates are not significantly different from each other.

- CPA Canada Handbook, Part II, Section 3065 ↵