18.4 Dividends

Cash Dividends

For investors, receiving dividends represents one of the essential motivations for holding shares. Although many established companies may have a policy of paying regular and predictable dividends, shareholders understand that there is no automatic right to dividends. The payment of dividends is decided by the board of directors and is based on several relevant criteria. First, the dividend must be legal. The rules for dividends vary by jurisdiction, but essentially the company must have sufficient distributable profits to pay the dividend. Some jurisdictions have complex methods of calculating this amount, but it can often be approximated using the balance in the retained earnings account. The purpose of limiting the dividends is to ensure that the company is not left in a position where it cannot pay its liabilities. Directors need to be aware of the legal requirements for dividend payments, as the payment of an illegal dividend could result in personal liability to the director if the company cannot, subsequently, pay its creditors. Second, the company must have sufficient cash to pay the dividend. Cash flow planning is important to the management of a business, and although the company may have sufficient retained earnings to declare a dividend, it may not have the cash readily available. Remember that the retained earnings balance does not equal cash, as companies will invest in many different types of assets. Third, the dividend must fit with the company’s strategic priorities. A company that is able to pay dividends may choose not to in order to preserve cash for various future uses, such as reinvestment in capital assets, funding strategic acquisitions, entrance into new markets, funding share buybacks, and committing to research and development. As well, a company may not want to pay the maximum dividend it is legally entitled to because it does not want to create unrealistic expectations among shareholders for future dividends.

Once the directors have decided to declare a dividend, three significant dates need to be considered. First, the date of declaration is the date the board of directors meets to approve the dividend payment. This will be formally documented as a directors’ resolution, and it is on this date that a liability is created, for both legal and accounting purposes. Second, in the directors’ resolution, the date of record will be specified, which is the date on which a list of the shareholders who will receive dividends is compiled. Obviously, between the date of declaration and the date of record, shares will trade at a price based on the understanding that whoever holds the shares on the date of record is eligible for the dividend. Note, for many public stock exchanges, an ex-dividend date may also be relevant. This is a date several days before the date of record, which allows a period of time for share transactions to be processed. Third, sometime after the date of record is the date of payment. It is on this day that dividend payments are distributed to the shareholders of record.

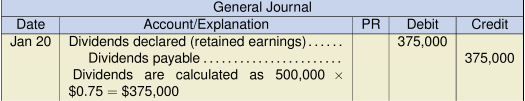

Consider the following example. A company with 500,000 outstanding common shares declares a dividend of $0.75 per share on January 20. The resolution indicates a record date of January 31 and a payment date of February 15. The following journal entries would be made on each date:

Declaration date:

Note: The debit can either be made to a temporary account called Dividends declared, which will be closed to retained earnings at year-end, or it can be made directly to retained earnings.

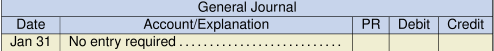

Date of record:

No entry is made here, as the date of record does not represent an accounting event.

Date of payment:

Note: The dividends can be expressed as a per share amount, or they may be described as a percentage of the share’s par value. Also, no dividends are paid on treasury shares as the company cannot pay itself.

If preferred dividends are declared, the accounting is similar to the accounting of common share dividends.

Property Dividends

In certain instances, a company may choose to pay a dividend with assets other than cash. This could include shares of other companies held as investments, property, plant and equipment, inventory, or any other asset held. These types of transactions are rare for three obvious reasons: 1) the asset must be equally divisible among all holders of a particular class of shares, 2) the fair value of the asset needs to be determined, and 3) the asset must be able to be physically distributed to the shareholders. When the company can overcome these restrictions, the property dividend will be recorded in a manner similar to the journal entries previously identified. There will be an additional step, however, in that the asset must first be revalued to its fair value before the dividend is distributed. This will usually result in a gain or loss being recorded, which is appropriate as the asset is being disposed of to settle a liability.

Share Dividends

One way that a company can distribute a dividend to shareholders without depleting its cash resources is to pay a share (stock) dividend. This dividend distributes additional shares of the company to the shareholders proportional to their current holdings. For example, if a company declares a 5% share dividend, a shareholder who currently holds 100 shares would receive an additional five shares. Although there may be some complicated jurisdictional legal requirements regarding share dividends, the general principle is that they should be recorded at the fair value of the shares issued.

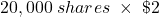

Consider the following example. A company currently has 100,000 shares outstanding that are trading at $5.25 per share. The company decides to declare a 5% share dividend, which means an additional 5,000 shares will be issued to existing shareholders (![]() ). Immediately prior to the dividend declaration, the implied value of the company is $525,000 (

). Immediately prior to the dividend declaration, the implied value of the company is $525,000 (![]() ). Because a share dividend does not have any effect on the assets or liabilities of the company, we would expect the total value of the company to remain the same after the dividend. However, we would expect the market price per share to drop to $5.00 per share (

). Because a share dividend does not have any effect on the assets or liabilities of the company, we would expect the total value of the company to remain the same after the dividend. However, we would expect the market price per share to drop to $5.00 per share (![]() ), as the value is now spread among more shares.

), as the value is now spread among more shares.

The journal entries to record this transaction, assuming the share price drops to $5 as expected, would be as follows:

Declaration date:

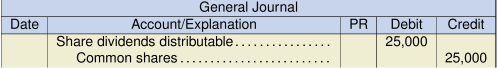

Payment date:

Note: The fair value we use to determine the amount is the post-dividend (sometimes referred to as ex-dividend) value of ![]() . Also, if the company’s year-end were to fall between the declaration date and the payment date, then the share dividends distributable balance would be reported in the equity section of the balance sheet, as it does not represent a liability like a cash dividend payable.

. Also, if the company’s year-end were to fall between the declaration date and the payment date, then the share dividends distributable balance would be reported in the equity section of the balance sheet, as it does not represent a liability like a cash dividend payable.

Declaring a share dividend causes part of the company’s retained earnings to become capitalized as contributed capital (common shares). By doing so, the company has removed this portion of retained earnings from the pool of distributable earnings that can be later used to pay cash dividends.

Share Splits

Share splits, also known as stock splits, scrip issues, or bonus issues, are similar to share dividends except they have a different accounting treatment. Generally, the motivation for a share split is to reduce the market price of the share. For example, if the share price has risen to a point where it is no longer affordable, this makes it difficult for the company to sell shares to the public. A share split will be expressed as a proportion, such as a 2-for-1 split. This means that for every share held an additional share will be issued. Thus, after the 2-for-1 split, the number of outstanding shares will be twice the previous number. This will normally have the effect of reducing the market price of the share by half, so that the total market capitalization remains unchanged.

Because there is no change in the economic resources or position of the company, no journal entry is required to record a share split. However, a memorandum entry should be made, noting the new number of shares. This will be important in the future for the purposes of calculating dividend payments and earnings per share amounts.

In some cases, it may be difficult to distinguish between a share split and a large share dividend. For example, the effects of a 100% share dividend and a 2-for-1 share split are essentially the same. As IFRS does not provide any specific guidance on this issue, professional judgment and consideration of the relevant legal framework will be required in determining how to record large share dividends.

A company may also engage in a reverse share split, sometimes referred to as a share consolidation. This will reduce the number of outstanding shares by a certain proportion. This type of transaction is usually motivated by the need to increase the market price of a share.

18.4.1. Dividend Preferences

As noted previously, a feature of preferred shares is that they often receive preferential treatment when dividends are declared. We will now look at some examples of how dividends are split when both common and preferred shares are outstanding and a lump sum dividend is declared.

Assume a company has two classes of shares: 1) common shares, of which 100,000 are outstanding with a carrying amount of $480,000, and 2) preferred shares with a fixed dividend of $2 per share, of which 20,000 are outstanding with a carrying amount of $320,000. In the current year, the company has declared total dividends of $120,000. Dividends will be allocated to each class of shares as follows:

- Preferred shares are non-cumulative and non-participating:

Calculation Preferred Common Total Current year:

$40,000 $40,000 Balance of dividends

( )

)– $80,000 80,000 $40,000 $80,000 $120,000 - Preferred shares are cumulative and non-participating, and dividends were not paid last year:

Calculation Preferred Common Total Arrears:

$40,000 $40,000 Current year:

40,000 40,000 Balance of dividends

( )

)– $40,000 40,000 $80,000 $40,000 $120,000 - Preferred shares are cumulative and non-participating, and dividends were not paid for the last two years:

Calculation Preferred Common Total Arrears:

$80,000 $80,000 Current year:

40,000 40,000 Balance of dividends

( )

)– – – $120,000 – $120,000 - Preferred shares are non-cumulative and fully participating:

Calculation Preferred Common Total Current year basic dividend $40,000 $60,000 $100,000 Current year participating dividend 8,000 12,000 20,000 $48,000 $72,000 $120,000

Note: The basic preferred dividend is calculated as before. Then, a like amount is allocated to the common shares. The preferred dividend can be expressed as a percentage: ![]() . Therefore, the common shares are also allocated a basic dividend of

. Therefore, the common shares are also allocated a basic dividend of ![]() . This leaves a remaining dividend of $20,000, which is available for participation. The participation is allocated on a pro-rata basis as follows:

. This leaves a remaining dividend of $20,000, which is available for participation. The participation is allocated on a pro-rata basis as follows:

Carrying amounts of each class:

| Preferred | $320,000 | 40% | |

| Common | 480,000 | 60% | |

| Total | $800,000 | 100% |

The participating dividend is therefore:

| Preferred | = | $8,000 | |

| Common | = | $12,000 |

If the preferred shares were cumulative and fully participating, the process followed is the same as above, except the dividends available for participation must be reduced by any preferred dividends in arrears, as these must be paid first before any dividends can be paid to common shareholders.

The pro-rata allocation of the participating dividend, shown above, is one way to determine the rate of participation. However, if a company’s articles of incorporation specify other methods of participation for different classes of shares, then these calculations must be applied instead.