20.3 Statement of Cash Flows: Direct Method

As mentioned earlier, the only difference when applying the direct method, as opposed to the indirect method, is in the operating activities section; the investing and financing sections are prepared exactly the same way. Typical reporting categories in the operating section for the direct method include:

- Cash received from sales

- Cash paid for goods and services

- Cash paid to, or on behalf of, employees

- Cash received for interest income

- Cash paid for interest

- Cash paid for income taxes

- Cash received for dividends

Recall that the categories above are based on the nature of the cash flows. Whereas with the indirect method the cash flows are based on the income statement and changes in each non-cash working capital (current) asset and liability account. Below is a comparison of the two methods:

| Indirect Method | Direct Method | |||||

|---|---|---|---|---|---|---|

| Cash flows from operating activities: | Cash flows from operating activities: | |||||

| Net income | $$ | Cash received from sales | $$ | |||

| Adjust for non-cash items: | Cash paid for goods and services | ($$) | ||||

|

Depreciation |

$$ | Cash paid to or on behalf of employees | ($$) | |||

|

Gain on sale of asset |

($$) | Cash received for interest income | $$ | |||

| Increase in accounts receivable | ($$) | Cash paid for interest | ($$) | |||

| Decrease in inventory | $$ | Cash paid for income taxes | ($$) | |||

| Increase in accounts payable | $$ | Cash received for dividends | $$ | |||

| Net cash flows from operating activities (supplementary disclosures for interest, dividends and income tax are required) | $$ | Net cash flows from operating activities (interest and income tax categories exist so no supplementary disclosures required) | $$ | |||

The direct method is straightforward due to the grouping of information by nature. This also makes interpretation of the statement more intuitive for stakeholders. However, companies record thousands of transactions every year and many of them do not involve cash. Since the accounting records are kept on an accrual basis, it can be a time-consuming and expensive task to separate and collect the cash-only data required for the direct method categories by nature. Also, providing disclosures about sensitive information, such as cash receipts from customers and cash payments to suppliers, is not in the best interest of the company. For these reasons, many companies prefer not to use the direct method. Instead, the indirect method may be easier to prepare because it collects much of its data directly from the existing income statement and balance sheet. However, it is less intuitive as evidenced by the accounts-based categories above.

20.3.1. Preparing a Statement of Cash Flows: Direct Method

As with the indirect method, preparing a statement of cash flows using the direct method is made much easier if specific steps are followed in sequence. Below is a summary of those steps to complete the operating section of the statement of cash flows using the direct method:

Direct Method Steps:

- Complete the headings and categories section of the operating activities. The example below includes seven categories based on the nature of the revenue and expenses.

- One way to determine cash flows in or out is to use a spreadsheet and create three additional columns: Income Statement (I/S) Accounts, Changes to Working Capital (WC), and Accounts and Net Cash Flows In (Out). The manner in which the amounts are determined should result in the same cash flow impact.

- Starting with the top of the income statement, record each income statement line item amount to the most appropriate direct method category in the I/S Accounts column. These would include sales, cost of goods sold, operating expenses, non-operating revenue, and various expenses items. Any non-cash items are also recorded, but only as memo items in the column. Examples of these would be depreciation, amortization, and most gains or losses. Such as gains or losses from the sale of assets, gains or losses from the redemption of debt, impairment losses, and from fair value changes reported in net income. The I/S Accounts column total must be equal to net income.

- Under the Changes to Working Capital Accounts, record the net change amount for each non-cash working capital account (current assets and current liabilities) except for the “current portion of long term debt” line item. As it is not a working capital account, it is added back to its corresponding long-term liability. Also, record as an adjustment any additional non-cash items found in net income arising from the analysis of the non-current asset, liability, and equity accounts. The obvious non-cash items were recorded as memo items only in Step 3, but other non-cash items can be uncovered when analyzing the non-current assets, liabilities, and equity accounts. When these are discovered, they must be recorded as an adjustment to net income in this column.

- Under the Net Cash Flows In (Out), calculate the net cash flows amount for each direct method category.

- Calculate the subtotal of the operating activities section and transfer the information to the statement of cash flows operating activities section.

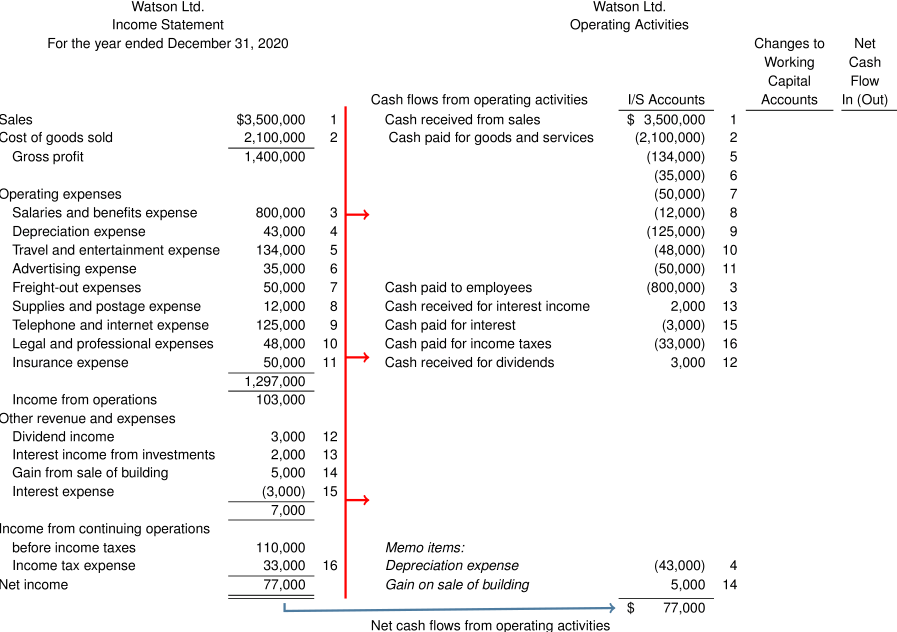

Using the financial statements from Watson Ltd. presented previously, we will apply the steps below:

Applying the Steps:

Step 1 and Step 2. Headings, categories, and three additional columns.

| Watson Ltd. Operating Activities |

|||

|---|---|---|---|

| Cash flows from operating activities | I/S Accounts | Changes to Working Capital Accounts | Net Cash Flow In (Out) |

| Cash received from sales | |||

| Cash paid for goods and services | |||

| Cash paid to employees | |||

| Cash received for interest income | |||

| Cash paid for interest | |||

| Cash paid for income taxes | |||

| Cash received for dividends | |||

| Net cash flows from operating activities | |||

Step 3. Record each income statement line item amount to its respective direct method category under the I/S Accounts column (non-cash items are memo items only):

Step 4. Record the net change amount for each non-cash working capital account, except cash (also, record any adjustment amounts to net income resulting from analysis of non-current accounts):

|

Watson Ltd. |

|||||

|

2020 |

2019 |

Change |

|||

| Current assets | |||||

| Cash | #307,500 | $250,000 | |||

| Investments - trading | 12,000 | 10,000 | $(2,000) | 17 | |

| Accounts receivable (net) | 249,510 | 165,000 | (84,510) | 18 | |

| Notes receivable | 18,450 | 22,000 | 3,550 | 19 | |

| Inventory | 708,970 | 650,000 | (58,970) | 20 | |

| Prepaid insurance expenses | 18,450 | 15,000 | (3,450) | 21 | |

| Total current assets | 1,314,880 | 1,112,000 | |||

| Current liabilities | |||||

| Accounts payable | $221,000 | $78,000 | $143,000 | 22 | |

| Accrued interest payable | 24,600 | 33,000 | (8,400) | 23 | |

| Income taxes payable | 54,120 | 60,000 | (5,800) | 24 | |

| Unearned revenue | 25,000 | 225,000 | (200,000) | 25 | |

| Current portion of long-term notes payable | 60,000 | 45,000 | N/A | ||

| Total current liabilities | 384,720 | 441,000 | (216,660) | ||

|

Watson Ltd. |

|||||

|

Cash flows from operating activities |

I/S Accounts |

Changes to Working Capital Accounts |

Net Cash Flow In (Out) |

||

| Cash received from sales | $3,500,000 | 1 | $(84,510) | 18 | |

| 3,550 | 19 | ||||

| (200,000) | 25 | ||||

| Cash paid for goods and services | (2,100,000) | 2 | (58,970) | 20 | |

| (134,000) | 5 | (3,450) | 21 | ||

| (35,000) | 6 | 143,000 | 22 | ||

| (50,000) | 7 | ||||

| (12,000) | 8 | ||||

| (125,000) | 9 | ||||

| (48,000) | 10 | ||||

| (50,000) | 11 | ||||

| Cash paid to employees | (800,000) | 3 | |||

| Cash received for interest income | 2,000 | 13 | (2,000) | 17 | |

| Cash paid for interest | (3,000) | 15 | (8,400) | 23 | |

| Cash paid for income taxes | (33,000) | 16 | (5,880) | 24 | |

| Cash received for dividends | 3,000 | 12 | |||

| Memo items: | |||||

| Depreciation expense | (43,000) | 4 | |||

| Gain on sale of building | 5,000 | 14 | |||

| Net cash flows from operating activities | $77,000 | $(216,660) | |||

Note how items 13 and 17 on the operating activities statement, regarding the trading investments, cancel each other out. This is because the interest income from the trading investment was accrued and not actually received in cash.

In this simple example, no adjustments to net income resulting from analysis of non-current assets, liabilities, and equity are identified. However, this situation will be illustrated in the comprehensive example later in this chapter.

The change in each working capital account can be a positive or a negative cash flow (using brackets). To ensure that the cash flow is correctly identified as positive or negative, apply the principles using the accounting equation explained earlier:

![]()

Refer to the earlier section in this chapter for more details regarding this technique.

Step 5 and Step 6. Calculate the net cash flows amount for each category and calculate the subtotal for the operating activities section (transfer the information to the statement of cash flows):

| Watson Ltd. Operating Activities |

|||||

|---|---|---|---|---|---|

| Cash flows from operating activities | I/S Accounts | Changes to Working Capital Accounts | Net Cash Flow In (Out) | ||

| Cash received from sales | $3,500,000 | 1 | $(84,510) | 18 | |

| 3,550 | 19 | ||||

| (200,000) | 25 | $3,219,040 | |||

| Cash paid for goods and services | (2,100,000) | 2 | (58,970) | 20 | |

| (134,000) | 5 | (3,450) | 21 | ||

| (35,000) | 6 | 143,000 | 22 | ||

| (50,000) | 7 | ||||

| (12,000) | 8 | ||||

| (125,000) | 9 | ||||

| (48,000) | 10 | ||||

| (50,000) | 11 | (2,473,420) | |||

| Cash paid to employees | (800,000) | 3 | (800,000) | ||

| Cash received for interest income | 2,000 | 13 | (2,000) | 17 | 0 |

| Cash paid for interest | (3,000) | 15 | (8,400) | 23 | (11,400) |

| Cash paid for income taxes | (33,000) | 16 | (5,880) | 24 | (38,880) |

| Cash received for dividends | 3,000 | 12 | 3,000 | ||

| Memo items: | |||||

| Depreciation expense | (43,000) | 4 | |||

| Gain on sale of building | 5,000 | 14 | |||

| Net cash flows from operating activities | $77,000 | $(216,660) | $(101,660) | ||

A comparison of the two methods, for the operating activities section for Watson Ltd., is presented below:

| Watson Ltd. Operating Activities – Indirect Method |

Watson Ltd. Operating Activities – Direct Method |

|||

|---|---|---|---|---|

| Cash flows from operating activities | Cash flows from operating activities | |||

| Net income (loss) | $77,000 | Cash received from sales | $3,219,040 | |

| Non-cash items (adjusted from net income): | Cash paid for goods and services | (2,473,420) | ||

| Depreciation expense | 43,000 | Cash paid to employees | (800,000) | |

| Gain from sale of building | (5,000) | Cash received for interest income | 0 | |

| Cash paid for interest | (11,400) | |||

| Cash in (out) from operating working capital: | Cash paid for income taxes | (38,880) | ||

| Increase in trading investments | (2,000) | Cash received for dividends | 3,000 | |

| Increase in accounts receivable | (84,510) | |||

| Decrease in notes receivable | 3,550 | Net cash flows from operating activities | $(101,660) | |

| Increase in inventory | (58,970) | |||

| Increase in prepaid expenses | (3,450) | |||

| Increase in accounts payable | 143,000 | |||

| Decrease in interest payable | (8,400) | |||

| Decrease in income taxes payable | (5,880) | |||

| Decrease in unearned revenue | (200,000) | |||

| Net cash flows from operating activities | $(101,660) | |||

The cash received for interest income of zero dollars was included in the direct method example for illustrative purposes only. This line item would normally be removed when preparing the actual statement of cash flows. Also, additional disclosures for interest, dividends, and income taxes discussed previously are required when using the indirect method. With the direct method, these additional disclosures are not required as they are already reported as cash-paid line items within the statement (as shown in the example above).