15.4 Tax Rate Changes

So far our examples have assumed a constant tax rate over the period of temporary difference reversal. However, this may not always be the case, as tax rates and regulations are subject to periodic changes as governments implement new policy directions. IAS 12 requires the deferred tax amounts to be measured at the rate expected to be in effect when the related asset is realized or the liability is settled. The standard further states that the rates should be enacted, or substantively enacted, by the end of the reporting period. Substantively enacted means that although the rate may not be formalized into law at the end of the reporting period, it has been publicly announced by the government and is very likely to be subsequently altered through a legislative process. Let’s look at an example of how this is applied.

A company reports $30,000 of instalment revenue in 2021 that will be paid in two equal instalments in 2022 and 2023. Additionally, the revenue will be taxed when the payments are actually received. The $30,000 receivable thus creates a taxable temporary difference that reverses over the next two years, and this temporary difference will result in a deferred tax liability. The government has recently announced that tax rates will be implemented as follows: 2021 – 25%, 2022 – 22%, and 2023 – 20%.

The deferred tax liability would be measured as follows:

| Total temporary difference arising in 2021 | $30,000 | |||

|---|---|---|---|---|

| Amount reversing in 2022 | (15,000) | = | $3,300 | |

| Amount reversing in 2023 | (15,000) | = | $3,000 | |

| Total | $0 | $6,300 |

Thus, on the company’s 2021 balance sheet a deferred tax liability of $6,300 would be reported and, on the 2021 income statement, a deferred tax expense of $6,300 would also be reported.

This situation is quite straightforward, as we simply apply the appropriate enacted rate to the amount of the reversing temporary difference each year. However, there can be complications if the reversal can be realized in different ways. For example, many tax jurisdictions apply different tax rates to capital gains and ordinary income. In order to properly determine the deferred tax amount related to an asset, an assumption needs to be made about how the temporary difference will be realized (i.e., will the asset be used or sold during the reversal period?). IAS 12 states that the rate applied should be consistent with the company’s intended use of the asset. In other words, two identical assets could result in different deferred tax amounts if one is to be sold and the other is to be used in operations. This difference in treatment reflects the conceptual framework’s requirement to convey the economic truth of a transaction, rather than the mere substance.

A more complicated situation arises when tax rates are changed after the deferred tax amount has already been established in previous years. This type of change is treated as a change in estimate and, as such, should be treated prospectively. This means that an adjustment is made in the current period, but no attempt is made to restate prior years. This treatment is considered reasonable as management would not have known about the tax rate change when the deferred tax balance was originally established.

Let’s revisit the previous example, with one change. Assume that change in tax rates was not announced until the middle of 2022, and that the 25% rate was already in effect for 2021. At the end of 2021, the company would have recorded a deferred tax liability of $7,500 ($30,000 × 25%).

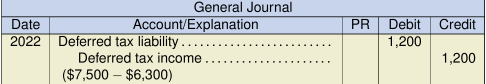

In 2022 when the rate change is announced, the company needs to recalculate the deferred tax liability and adjust it accordingly. As such, the following journal entry would be required:

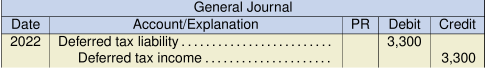

At the end of the year when the temporary difference partially reverses, the following journal entry would be required:

Thus, in 2022 the company will report a total deferred tax income of $4,500, which represents both the effect of the rate change on the opening temporary difference and the effect of temporary difference reversal during the year. Although this amount may be reported as a single line item on the income statement, IAS 12 does require separate disclosures for the effect of the temporary difference reversal and the effect of the rate change.