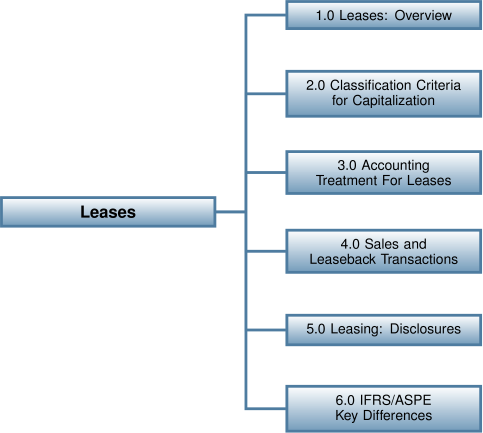

17.0 Leases

Learning Objectives

After completing this chapter, you should be able to:

- Describe leases and their role in accounting and business.

- Describe the criteria used for ASPE and IFRS to classify a lease as a capital/finance lease.

- Prepare the accounting entries of a capitalized lease for both the lessee and lessor.

- Prepare the accounting entries of a capitalized sale and leaseback transaction.

- Explain how leases are disclosed in the financial statements.

- Explain the similarities and differences between ASPE and IFRS regarding capitalization criteria, interest rates, and disclosures.

Introduction

This chapter will focus on the basics of leasing agreements. Leases can be classified as either an operating lease, like a simple rental agreement, or a capital lease, where the leased item is classified as an asset with a corresponding liability (whether or not the legal title transfers to the lessee). The accounting standards focus on the economic substance rather than on the legal form. Leases will be discussed in terms of their use in business, their recognition, measurement, reporting and analysis. Leases will also be discussed and illustrated from both the viewpoint of the company leasing from another party (lessee), and the company leasing to another party (lessor).