21.4 Correction of Errors

Given the complex nature of some accounting transactions, it is inevitable that errors in reported amounts will sometimes occur. IAS 8 defines errors as both omissions and misstatements, and suggests that errors result from the failure to use or misuse of reliable information that was available and could have reasonably been expected to be obtained when the financial statements were issued. Thus, management cannot claim that a misstatement is simply a change in estimate if they did not take reasonable steps to verify the original amount recorded. IAS 8 also suggests that errors can include mathematical mistakes, mistakes in application of accounting policies, oversights, misinterpretations of facts, and fraud. We can see that there is quite a range of potential causes of financial misstatements. However, regardless of the cause, errors need to be corrected once they are discovered.

If the error is discovered before the financial statements are issued, then the solution is simple: correct the error. This is a normal part of the accounting and audit cycle of a business, and the procedure of correcting errors with year-end adjusting journal entries is quite common. However, if the error is not discovered until after the financial statements have been published, then the company faces a much larger problem. If the error is discovered soon after the financial statements are published, it may be possible to recall the documents and republish a corrected version. However, it is more likely that the error will not be discovered until financial statements are being prepared for a subsequent year. In this case, the error will appear in the amounts presented as comparative figures, and will likely also have an effect on the current year. In this case, the error should be corrected through a process of retrospective restatement, similar to the procedures used for accounting policy changes. Note that a subtle difference in terminology is used: accounting policy changes are retrospectively applied, while error corrections result in retrospective restatements. Despite the difference in terms, the basic principle is the same: a retrospective restatement results in financial statements that present the comparative and current amounts as if the error had never occurred.

Consider the following example. In preparing its 2022 financial statements, management of Manaugh Ltd. discovered that a delivery truck purchased early in 2020 had been incorrectly reported as a repair and maintenance expense in that year rather than being capitalized. The vehicle’s cost was $50,000 and was expected to have a useful life of five years with no residual value. Assume that depreciation for tax purposes is calculated in the same way as for accounting purposes, and that the company’s tax rate is 20%. Also assume that prior year tax returns will be refilled to reflect the correction of the error.

Prior to the discovery of the error, the company reported the following results on its 2022 draft financial statements:

| 2022 (Draft) |

2021 | |

|---|---|---|

| Revenue | $900,000 | $850,000 |

| Expenses | 690,000 | 625,000 |

| Income before tax | 210,000 | 225,000 |

| Income tax | 42,000 | 45,000 |

| Net income | 168,000 | 180,000 |

| Opening retained earnings | 1,230,000 | 1,050,000 |

| Closing retained earnings | $1,398,000 | $1,230,000 |

In order to correct the error, we need to understand the balances of the relevant accounts prior to the error correction, and what they should be after the error is corrected. This analysis will need to be applied to all years affected by the error. Although there is no prescribed format for evaluating the effects of errors, a tabular analysis, as shown below, is often useful:

| 2022 | 2021 | 2020 | |

|---|---|---|---|

| Repair expense incorrectly included | 50,000 | ||

| Depreciation expense, incorrectly excluded | (10,000) | (10,000) | (10,000) |

| Net effect on income before tax | (10,000) | (10,000) | 40,000 |

| Income tax expense over-(under) stated | 2,000 | 2,000 | (8,000) |

| Adjustment required to net income | (8,000) | (8,000) | 32,000 |

| Adjustment required to vehicle account | 50,000 | 50,000 | 50,000 |

| Adjustment required to accumulated depreciation | 30,000 | 20,000 | 10,000 |

| Adjustment required to income taxes payable | (2,000) | (2,000) | 8,000 |

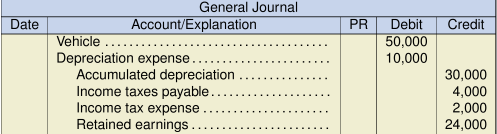

After analyzing the effects of the error, the following journal entry should be made in 2022 in order to correct the error:

Note that the adjustment corrects the balance sheet accounts, including retained earnings, to the amounts that would have been reported at December 31, 2022, had the error never occurred. The adjustment to retained earnings represents the net effect on income of the correction in 2020 and 2021, that is, ![]() . As well, because the books for 2022 have not yet been closed, we are able to adjust the two expense accounts, depreciation and income taxes, directly to the income statement. If, however, the books had already been closed for 2022, then these expense amounts would simply be added to the retained earnings adjustment.

. As well, because the books for 2022 have not yet been closed, we are able to adjust the two expense accounts, depreciation and income taxes, directly to the income statement. If, however, the books had already been closed for 2022, then these expense amounts would simply be added to the retained earnings adjustment.

After correcting the error, the financial statements will be presented as follows:

| 2022 | 2021 (Restated) |

|

|---|---|---|

| Revenue | $900,000 | $850,000 |

| Expenses | 700,000 | 635,000 |

| Income before tax | 200,000 | 215,000 |

| Income tax | 40,000 | 43,000 |

| Net income | $160,000 | $172,000 |

The retained earnings portion of the statement of shareholders’ equity will include the following information:

| 2022 | 2021 (Restated) |

|

|---|---|---|

| Opening balance, as previously stated | $1,050,000 | |

| Effect of error correction, net of taxes of $8,000 | 32,000 | |

| Opening balance, restated | $1,254,000 | 1,082,000 |

| Net income for the year | 160,000 | 172,000 |

| Closing balance | $1,414,000 | $1,254,000 |

The difference between the corrected closing retained earnings balance and the uncorrected balance (![]() ) can be derived directly from the journal entry by adding the prior period retained earnings adjustment to the current year expense adjustments (

) can be derived directly from the journal entry by adding the prior period retained earnings adjustment to the current year expense adjustments (![]() ). Also note that the balance sheet will present the corrected amounts for the vehicle, accumulated depreciation, income taxes payable, and retained earnings with the 2021 comparative column labelled as “restated.”

). Also note that the balance sheet will present the corrected amounts for the vehicle, accumulated depreciation, income taxes payable, and retained earnings with the 2021 comparative column labelled as “restated.”

Analyzing and correcting errors is one of the most important skills an accountant can possess. This skill requires not only judgment, but also a very solid understanding of the operation of the accounting cycle, as the sources and effects of the errors may not always be obvious. Additionally, the accountant needs to be aware of the causes of the errors, as some parties may prefer that the accountant not detect or correct the error. In such cases of fraud or inappropriate earnings management, managers may deliberately try to hide the error or prevent correction of it. In other cases, management may try to offer explanations that suggest the error is just a change in estimate, not requiring retrospective restatement. Sometimes these justifications may be motivated by factors that don’t reflect sound accounting principles. As such, the accountant must be prudent and exhibit good judgment when examining the causes of errors to ensure the final disclosures fairly present the economic reality of the situation.