15.3 Deferred Tax: Effect of Temporary Differences

Temporary (or reversible) differences that affect taxable profit each year result in an effect on the amount of income taxes payable in the future as the temporary difference reverses. The accumulated tax effects of the temporary differences are recognized on the statement of financial position as deferred tax assets and/or deferred tax liabilities. Adjustments to the two statement of financial position accounts flow through deferred tax expense which is reported on the income statement. Deferred tax expense (resulting from a temporary difference) and current tax expense are both reported on the income statement.

An important point in understanding the effect of temporary differences on the company’s tax expense is the fact that temporary differences reverse themselves. That is, whatever effect the temporary difference has on the current tax expense, it will have an opposite effect in some future period. To determine the amount that will reverse in the future, we first need to consider how the temporary difference is calculated. IAS 12 defines a temporary difference as the “differences between the carrying amount of an asset or liability in the statement of financial position and its tax base” (CPA Canada, 2016, Accounting, IAS 12.5). Note that this definition uses a balance sheet perspective in that it focuses on the balances in the statement of financial position rather than on revenue and expense items recorded in the period. This is consistent with the conceptual framework, which defines revenues and expenses in terms of changes in the net assets of the business. To further understand this definition, we need to consider the item’s tax base, which is “the amount attributed to [the] asset or liability for tax purposes” (CPA Canada, 2016, Accounting, IAS 12.5). The tax base of an asset is the amount that will be deductible in future periods against taxable economic benefits when the asset’s carrying amount is recovered. If there is no future taxable benefit to be derived from the asset, then the tax base is equal to the carrying amount. The tax base of a liability is its carrying amount, less any amount that will be deductible in future periods with respect to the item. For unearned revenue, the amount that is deductible in the future can be thought of as the amount of revenue that is not taxable.

These definitions can be best understood by looking at a few examples:

- Goods are sold on credit to customers for $6,000, creating an account receivable on the company’s records. This asset has a carrying value of $6,000 and tax law requires that the amount to be reported as revenue in the period of the sale. Thus, the amount is fully taxable in the current period and will not be taxable in the future period. Because there is no future taxable benefit derived from this asset, its tax base is $6,000 (i.e., equal to its carrying value) and there is no temporary difference.

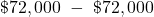

- A company reports an accrued liability for warranty costs of $72,000, which is its carrying value. This amount will not be deductible for tax purposes until the costs are actually incurred. The tax base is the carrying value less the amount deductible in future periods (

), or $0. Thus, there is a deductible temporary difference of $72,000.

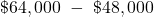

), or $0. Thus, there is a deductible temporary difference of $72,000. - A company purchased a piece of equipment for $100,000 several years ago. The current balance of accumulated depreciation is $36,000, thus the carrying value is $64,000. For tax purposes, accelerated capital allowances of $52,000 have been claimed and, therefore, the remaining balance that can be claimed for tax purposes in the future is $48,000. The tax base is $48,000 and there is a taxable temporary difference of $16,000 (

).

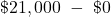

). - Current liabilities include $21,000 of unearned subscription revenue that was paid in advance and the revenue was taxed in the current period when it was received. The tax base is the carrying value ($21,000) less the amount that is deductible in the future ($21,000, representing the revenue that will not be taxable), or $0. Thus, there is a deductible temporary difference of $21,000 (

).

). - Included in current liabilities are accrued fines and penalties for late payment of taxes in the amount of $8,000. These are not deductible for tax purposes. The tax base is, therefore, $8,000 (

). There is no difference between the carrying value and the tax base. This is a permanent difference that only affects current taxes, not future taxes.

). There is no difference between the carrying value and the tax base. This is a permanent difference that only affects current taxes, not future taxes.

There are many other examples of temporary and permanent differences. The definitions above should always be applied to determine if a temporary difference exists or not, as this will determine the need to record a deferred tax amount. In some cases, deferred tax balances may result from a situation where there is no asset or liability recorded on the balance sheet. For example, a company may incur a research expense that cannot be capitalized under IFRS. However, the amount may be deductible in a future period against taxable income. In this case, there is no carrying value, as there is no asset, but there is a future deductible amount. This would create a deductible temporary difference.

15.3.1. Calculation of Deferred Tax

Once the temporary and permanent differences have been analyzed, the deferred tax amounts can be calculated and recorded. Let’s consider an example where the accounting depreciation and capital allowance for tax purposes are different.

A company purchases an asset on January 1, 2021, for $90,000. For accounting purposes, it will be depreciated straight-line over a three-year useful life with no residual value. For tax purposes, assume that capital allowances can be claimed in the first year equal to 50% of the asset’s cost, and in the second and third years equal to 25% of the asset’s cost. The carrying values and tax values will, therefore, be calculated as follows:

| Accounting Records | Tax Records | |||||

|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2021 | 2022 | 2023 | |

| Cost | 90,000 | 90,000 | 90,000 | 90,000 | 90,000 | 90,000 |

| Accumulated depreciation/ | 30,000 | 60,000 | 90,000 | 45,000 | 67,500 | 90,000 |

| Cumulative capital | ||||||

| allowance | ||||||

| Carrying amount/tax base | 60,000 | 30,000 | 0 | 45,000 | 22,500 | 0 |

The temporary differences are calculated as follows:

| 2021: |

= | taxable temporary difference | |

| 2022: |

= | taxable temporary difference | |

| 2023: |

= | nil temporary difference | |

The company reports net income of $100,000 in 2021, $120,000 in 2022, and $150,000 in 2023 and pays tax at a rate of 20% on its taxable income. Assume that there are no other differences between accounting and taxable income except the depreciation and capital allowances.

Tax payable in each year would be calculated as follows:

| 2021 | 2022 | 2023 | |

|---|---|---|---|

| Accounting income | 100,000 | 120,000 | 150,000 |

| Add non-deductible depreciation | 30,000 | 30,000 | 30,000 |

| Subtract deductible capital allowance | (45,000) | (22,500) | (22,500) |

| Taxable income | 85,000 | 127,500 | 157,500 |

| Tax rate | 20% | 20% | 20% |

| Tax payable | 17,000 | 25,500 | 31,500 |

Note that the tax payable above is the amount of expense that would be recorded if the taxes payable method were used, which is only allowed under ASPE.

The deferred tax each year is calculated as follows:

| 2021 | 2022 | 2023 | |

|---|---|---|---|

| Temporary difference | 15,000 | 7,500 | 0 |

| Tax rate | 20% | 20% | 20% |

| Deferred tax liability at end of year | 3,000 | 1,500 | 0 |

| Less previous balance | – | (3,000) | (1,500) |

| Adjustment required in year | 3,000 | (1,500) | (1,500) |

Note that in 2021, the temporary difference creates a deferred tax liability. This is because the capital allowance claimed is greater than the accounting depreciation, meaning less tax is paid in the current year but more will be paid in future years. In 2022 and 2023, the temporary difference reverses itself.

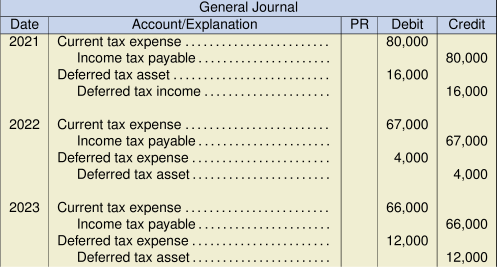

The company would record the following journal entries each year for the tax amounts:

The deferred tax income amounts in 2022 and 2023 represent a negative expense, or a recovery of the expense that was previously charged in 2021. This represents the tax effect of the reversal of the temporary difference. This type of negative expense may sometimes be referred to as a deferred tax benefit.

Excerpts from the company’s income statements over the three years will look like this:

| 2021 | 2022 | 2023 | |

|---|---|---|---|

| Income before tax | 100,000 | 120,000 | 150,000 |

| Income taxes: | |||

|

Current |

(17,000) | (25,500) | (31,500) |

|

Deferred |

(3,000) | 1,500 | 1,500 |

| Net income | 80,000 | 96,000 | 120,000 |

Note that each year the net income can be calculated as the income before tax multiplied by ![]() (i.e.,

(i.e., ![]() ). The reporting of the deferred tax amount has achieved proper matching by allocating the correct total tax expense to each period, which was the objective of the example examined in section 15.1.

). The reporting of the deferred tax amount has achieved proper matching by allocating the correct total tax expense to each period, which was the objective of the example examined in section 15.1.

Also note that even though the temporary difference reverses over a period of two years, we have not attempted to account for the time value of money. IAS 12 explicitly prohibits the discounting of future tax amounts, as it views the prediction of temporary difference reversals too complex and impractical. The prohibition of discounting is a way to maintain comparability between companies and acknowledges the trade-off between the costs and benefits of this type of information production.

15.3.2. A More Complex Example

Let’s now look at a more complex example involving a deferred tax asset and a permanent difference.

A company that sells computer printers offers a two-year warranty on each model sold. The fair value of the warranty cannot be independently determined, so the company uses the expense approach to determine the provision for the warranty liability. (See the current liabilities chapter for further details of the application of this approach.) In 2021, the total provision determined for future warranty costs was $80,000. The company expects that the actual repair costs will be incurred as follows: $20,000 in 2022 and $60,000 in 2023. No warranty repairs were incurred in 2021 when the sales were made. In the jurisdiction where the company operates, warranty costs are only deductible for tax purposes when they are actually incurred. As well, in 2022 the company received notice of a $5,000 penalty assessed for violation of certain consumer protection laws, and this penalty is not deductible for tax purposes. The company reported accounting income of $320,000 in 2021, $350,000 in 2022, and $390,000 in 2023.

The warranty liability reported in 2021 represents a deductible temporary difference because it results in amounts that will be deductible against future taxable income (i.e., when the warranty repairs are actually incurred). This will result in deferred tax asset originating in 2021 and then reversing in 2022 and 2023. We can analyze this temporary difference as follows:

| Accounting Records | Tax Records | |||||

|---|---|---|---|---|---|---|

| 2021 | 2022 | 2023 | 2021 | 2022 | 2023 | |

| Carrying amount, opening | 80,000 | 80,000 | 60,000 | 0 | 0 | 0 |

| Warranty costs incurred in year | 0 | 20,000 | 60,000 | 0 | 20,000 | 60,000 |

| Carrying amount, closing | 80,000 | 60,000 | 0 | 0 | 0 | 0 |

Note that the calculation of the carrying value for tax purposes, or tax base, follows the general rule described previously for liabilities (i.e., the tax base is the carrying value for accounting purposes less the amount deductible against future taxable income). Thus, the tax base is always nil because the carrying value for accounting purposes always represents the amount deductible against future taxable income.

The temporary differences are calculated as follows:

| 2021: |

= | deductible temporary difference | |

| 2022: |

= | deductible temporary difference | |

| 2023: |

= | nil temporary difference | |

The penalty incurred in 2022 represents a permanent difference, as this amount will never be deductible for tax purposes. Thus, this will only affect the current taxes in 2022 and will have no effect on deferred taxes.

If we assume a 20% tax rate, the calculation of tax payable will be as follows:

| 2021 | 2022 | 2023 | |

|---|---|---|---|

| Accounting income | 320,000 | 350,000 | 390,000 |

| Add non-deductible penalty | 0 | 5,000 | 0 |

| Add non-deductible warranty provision | 80,000 | 0 | 0 |

| Subtract deductible warranty costs | (0) | (20,000) | (60,000) |

| Taxable income | 400,000 | 335,000 | 330,000 |

| Tax rate | 20% | 20% | 20% |

| Tax payable | 80,000 | 67,000 | 66,000 |

The deferred tax each year would be calculated as follows:

| 2021 | 2022 | 2023 | |

|---|---|---|---|

| Temporary difference | 80,000 | 60,000 | 0 |

| Tax rate | 20% | 20% | 20% |

| Deferred tax asset at end of year | 16,000 | 12,000 | 0 |

| Less previous balance | – | (16,000) | (12,000) |

| Adjustment required in year | 16,000 | (4,000) | (12,000) |

The originating temporary difference in 2021 creates a deferred tax asset, which means that more tax is being paid in the current year, but less tax will be paid in future years when the temporary difference reverses itself.

The company will record the following journal entries each year for the tax amounts:

Excerpts from the company’s income statements over the three years will look like this:

| 2021 | 2022 | 2023 | ||

|---|---|---|---|---|

| Income before tax | 320,000 | 350,000 | 390,000 | |

| Income taxes: | ||||

|

Current |

(80,000) | (67,000) | (66,000) | |

|

Deferred |

16,000 | (4,000) | (12,000) | |

| Net income | 256,000 | 279,000 | 312,000 |

In 2021 and 2023, the total tax expense can be calculated as the income before tax multiplied by the tax rate. Therefore, as previously discussed, proper matching has been achieved. In 2022, the calculation does not reflect this result because of the effect of the permanent difference. The permanent difference creates a difference between tax and accounting income that will not reverse in future periods. Thus, there will be a permanent difference between the nominal and effective tax rate in that year only. We can see this in 2022, where the accounting income multiplied by the nominal tax rate is $70,000 (![]() ), but the total tax expense is $71,000 (

), but the total tax expense is $71,000 (![]() ). The $1,000 difference is due to the effect of the permanent difference, which results in an effective tax rate of 20.29% (

). The $1,000 difference is due to the effect of the permanent difference, which results in an effective tax rate of 20.29% (![]() ). Proper matching has still been achieved in this year with respect to the temporary difference, but the permanent difference cannot be matched to a different period.

). Proper matching has still been achieved in this year with respect to the temporary difference, but the permanent difference cannot be matched to a different period.