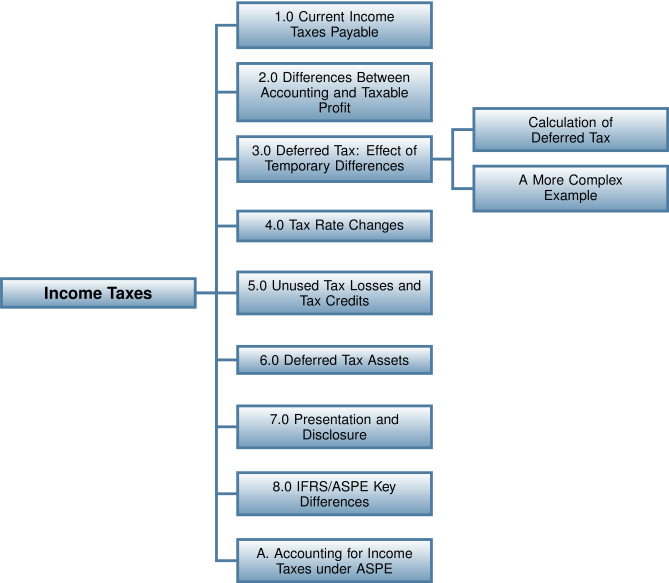

15.0 Income Tax

Learning Objectives

After completing this chapter, you should be able to:

- Explain the relationship between taxable profit and accounting profit and calculate current taxes payable.

- Explain what permanent and temporary differences are and describe the deferred tax effects of those differences.

- Calculate the deferred tax effects of temporary differences and record the journal entries for current and deferred taxes.

- Determine the effect of changes in tax rates and calculate current and deferred tax amounts under conditions of changing rates.

- Analyze the effect of tax losses and determine the appropriate accounting of those losses.

- Explain the rationale for the annual review of deferred tax assets and describe the effects of this review.

- Prepare the presentation of income tax amounts on the balance sheet and income statement and explain the disclosure requirements.

- Explain the key differences between the treatment of income taxes under IFRS and ASPE.

Introduction

The levy of taxes is a well-established method for governments to raise the funds necessary to carry out its various programs and initiatives. There are, of course, always vigorous debates about the appropriate level of taxation and the uses to which the taxation proceeds are put, but it is an inescapable truth that governments require some form of taxation revenue to function. One form of taxation that is commonly used is an income tax. Most of us are familiar with the application of personal income tax, as this type of tax is levied on employment and other forms of personal income. Governments also raise funds through assessing income taxes on corporate profits. This practice raises some interesting and complex accounting questions, and it is these questions that will be addressed in this chapter. We will not, however, be examining the processes involved in preparing corporate tax returns or the development of sophisticated tax structures like the one described in the opening vignette, as our focus is on the financial accounting and reporting issues. As well, we will not be looking at other forms of taxation, such as value-added taxes or payroll taxes, as these topics have been discussed in previous chapters.