12.4 Current Non-Financial Liabilities

As described in Section 12.2, non-financial liabilities are those liabilities that are settled through the delivery of something other than cash. Often, the liability will be settled by the delivery of goods or services in a future period. Examples include: unearned revenues, product warranties, and customer loyalty programs. For these types of liabilities, the determination of the amount to be settled, and the timing of the settlement, may not always be clear. However, because a present obligation exists, the liability must still be recorded. We will examine several examples of non-financial liabilities and consider the related measurement and accounting issues.

Unearned Revenues

One of the most common non-financial liabilities is unearned revenue. Unearned revenue results when a customer makes a payment in advance of receiving a good or a service. Examples include the following: prepayment for a magazine subscription, purchase of season tickets for a sports team, prepayment for airline flights that will be taken in the future, annual dues for a recreational club, prepaid maintenance contracts, and gift cards sold by retail stores. In these examples, the key feature is that the money is paid by the customer prior to receiving any goods or services from the vendor. Because the vendor has a performance obligation to provide these items in the future, the amount received must be recorded as a liability, usually described as unearned revenue. The unearned revenue should be reported at the fair value of the outstanding obligation and will be reclassified as revenue as the goods or services are provided. In most cases, the fair value will be equal to the cash received, as the transaction is normally presumed to be negotiated by arm’s length parties and is not expected to extend far into the future, that is, no discounting is required. For unearned revenues resulting from the sale of gift cards by retail stores, an estimate will need to be made of the number of gift cards that will not be redeemed, as some customers will never use the cards and, therefore, the store will never deliver the goods or services. This estimate affects the fair value of the total obligation and can usually be determined by examining historical redemption patterns.

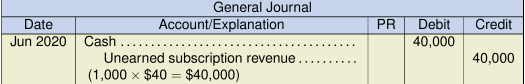

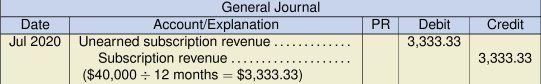

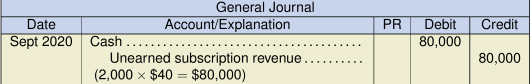

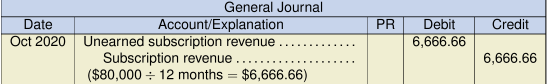

Consider the following example of a magazine subscription. Motoring Monthly sold 1,000 one-year subscriptions to its magazine in June 2020, and a further 2,000 one-year subscriptions in September 2020. The magazine is published monthly, and the price of a one-year subscription is $40. Delivery of the magazines commences in the month following payment. The following journal entries would be recorded in 2020:

The entry above records the initial payment of the first group of subscriptions.

The entry above recognizes one month of subscription revenue and would be repeated for the months starting August 2020 to June 2021, when the subscription expires.

The entry above records the initial payment of the second group of subscriptions.

The entry above records the initial payment of the second group of subscriptions.

The entry above recognizes one month of subscription revenue and would be repeated for the months starting November 2020 to September 2021, when the subscription expires.

The entry above recognizes one month of subscription revenue and would be repeated for the months starting November 2020 to September 2021, when the subscription expires.

To summarize, the company will report the following amount as a current liability on its balance sheet as at December 31, 2020:

| Unearned subscription revenue | $80,000 | |

| ($40,000 × 6 ÷ 12 + $80,000 × 9 ÷ 12) | ||

The company will also report the following amount as revenue on its income statement for the year ended December 31, 2020:

| Subscription revenue | $40,000 | |

| ($40,000 × 6 ÷ 12 + $80,000 × 3 ÷ 12) | ||

On the income statement, the company would also report the costs to produce and distribute the magazine to properly convey the gross margin earned on the sales.

Product Warranties

As a way to promote sales and develop customer loyalty, many businesses will offer a warranty on their products. A warranty will obligate the company to repair the product if it doesn’t function correctly, or replace it if it cannot be fixed. While there are many limitations to warranty arrangements, including time limits, the contract with the customer does obligate the company to deliver the goods or services in the future, assuming the requisite conditions have been met. If the warranty arrangement does not meet definition of a distinct service under IFRS 15, a separate performance obligation is not created. In this case, the warranty will be accounted for as a provision under IAS 37 and a result, the company will required to recognize this obligation as a liability on the balance sheet. As before, the obligation should be reported at its fair value. This approach, sometimes referred to as the expense approach, will be discussed further in Section 12.5. In some cases, the value of the warranty may be explicitly stated, as is the case with extended warranties that require separate payment from the product itself, such as those sold by automobile retailers. In other cases, however, the price of the warranty may be implicitly included with the total sale price of the product. This is essentially a bundled sale, which was discussed previously in the revenue chapter. If you recall the treatment of bundled sales, the value of each component should be determined using the relative stand-alone selling prices of those components, and then recorded as revenue or unearned revenue as appropriate. This approach is often referred to as the revenue approach.

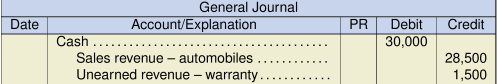

Consider the following example. Calvino Cars manufactures and sells new automobiles. Included with every sale is a two-year comprehensive warranty that will cover the cost of any repairs due to mechanical failure. The company recently sold a unit of its most popular model, the Cosimo, for $30,000. This price includes the two-year warranty. Based on analysis of similar arrangements at other car companies that sell separate warranties, Calvino Cars estimates that the stand-alone selling price of this warranty is $1,500. The company has also estimated that 25% of the cost of warranty repairs will be incurred in the first year of the warranty term and 75% in the second year. The journal entry at the time of sale would be: In the first year, repair costs of $304 are actually incurred for this vehicle. Two journal entries are required in this case:

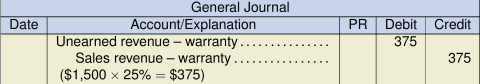

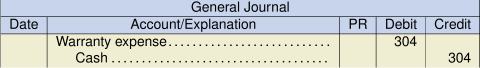

In the first year, repair costs of $304 are actually incurred for this vehicle. Two journal entries are required in this case:

The first journal entry recognizes the revenue from the warranty, based on the expected pattern of costs to service the warranty. The second journal entry records the actual costs of the repairs made. In the second year, the remaining revenue

The first journal entry recognizes the revenue from the warranty, based on the expected pattern of costs to service the warranty. The second journal entry records the actual costs of the repairs made. In the second year, the remaining revenue ![]() will be recognized and any repair costs incurred will be recorded in a similar fashion. If, after the first year, it is estimated that future repair costs would exceed the remaining unearned revenue, then an additional liability would need to be established. This is referred to as an onerous contract, a concept that will be discussed later in the chapter.

will be recognized and any repair costs incurred will be recorded in a similar fashion. If, after the first year, it is estimated that future repair costs would exceed the remaining unearned revenue, then an additional liability would need to be established. This is referred to as an onerous contract, a concept that will be discussed later in the chapter.

Customer Loyalty Programs

As a method of encouraging repeat business and customer loyalty, many companies offer loyalty rewards. Often denominated in points, they can be redeemed later for additional goods or services. For example, many grocery and other retail stores allow customers to collect points that can be applied against future purchases. Also, airlines quite often encourage their passengers to collect travel miles that can be applied to future flights. Because there is the potential for an obligation to deliver goods or services in the future, these loyalty rewards need to be accounted for as a contract liability.

The general principles of IFRS 15 are applied in these cases, which results in the loyalty reward being considered a separate performance obligation of the sales transaction. It is quite likely that an active market for the loyalty points does not exist, so some type of estimation technique is required to determine the stand-alone selling price of the rewards. IFRS 15 suggests that the estimate of the stand-alone selling price of the loyalty points should reflect the discount the customer is expected to obtain by using the points, adjusted for:

- the discounts that could otherwise be received by customers without using the loyalty points; and

- the likelihood that the loyalty points will used

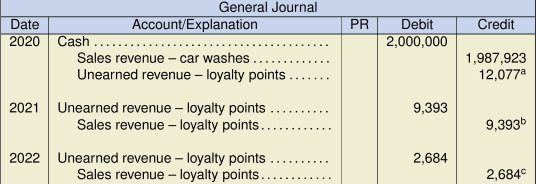

Obviously there is some judgment required in making these fair value determinations. Let’s look at an example involving a premium car wash. Sudz offers car wash and detailing services for all types of passenger vehicles. To encourage repeat business, the company awards points for each car wash, which can be redeemed in the future for additional car washes or for upgraded services, such as glass repair and scratch buffing. In 2020, the company earned $2,000,000 in revenue from car washes and awarded 10,000 points. The stand-alone selling price of the car washes is $2,000,000. Based on an examination of the awards chosen by customers in the past, the company has estimated the stand-alone selling price of the points awarded at $12,150. As well, the company expects that 10% of the award points will never be redeemed. In 2021, 7,000 points are redeemed and in 2022, 2,000 points are redeemed. The journal entries to record these transactions are as follows:

Notes:

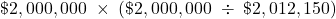

- Revenue on sale allocated based on relative, stand-alone selling prices:

Car washes = = $1,987,923

= $1,987,923

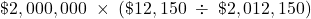

Loyalty points = = $12,077

= $12,077 - To determine the loyalty point revenue earned in 2021, we must first determine the value of a single loyalty point:

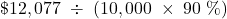

= $1.3419 per point

= $1.3419 per point

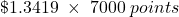

Thus, revenue earned in 2021 = = $9,393

= $9,393 - Revenue earned in 2022 =

= $2,684

= $2,684

Note that the value per point is based on the total unearned revenue divided by the number of points expected to be redeemed, rather than the total number of points awarded. If the estimates turn out to be incorrect, the revenue will simply be adjusted prospectively in the current year.