18.2 Issuing Shares

When a company is first incorporated, it will be authorized to issue a certain number of shares. This authorization does not, in and of itself, create any accounting transaction that needs to be recorded. However, after the shares are authorized they can be issued, which creates an accounting transaction. We will look at several examples of different types of share issuances.

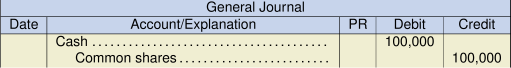

Shares Issued for Cash

This is the simplest scenario: shares will be issued to the holder in exchange for a cash payment. For example, if 10,000 common shares are issued at a price of $10 each, the journal entry would be:

Note: Each class of shares should be recorded in a different account, as the disclosure of the amounts of different classes of shares is required. Also, when brokerage houses, agents, lawyers, and other professionals are involved in issuing the shares, any fees or commissions charged by these parties should be directly deducted from the share capital amount.

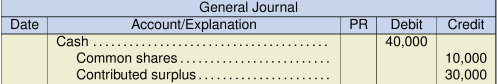

Par Value Shares Issued for Cash

In the example above, the net amount of cash received simply becomes the stated capital amount of the shares. In some jurisdictions, shares are authorized with a par value, which is a value that will be directly stated on the share certificate. However, as market conditions will dictate the actual issue price of the shares, it is possible that an amount greater than the par value will be received when the shares are issued. The excess amount over the par value still represents contributed capital, but it must be recorded separately. If, for example, 5,000 shares with a par value of $2 per share are issued for $8, the journal entry would be:

The contributed surplus amount will be reported as part of the contributed capital on the balance sheet. This account is sometimes described as share premium or additional paid-in capital.

Subscribed Shares

Sometimes a company may offer shares on a subscription basis, allowing the holder to pay for the shares in a series of payments. The accounting for these types of transactions will depend on local legislation, the terms of the subscription contract, and corporate policy. We will look at a few different examples of these types of transactions.

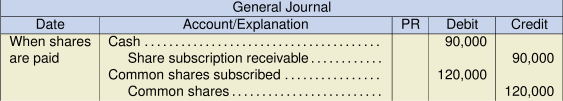

Scenario 1

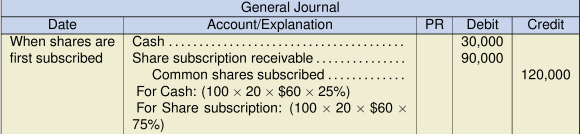

A company offers to issue its shares in blocks of 20 at a price $60 per share. The contract requires a 25% down payment with the remaining 75% payable in six months, and 100 individuals accept the offer. Local legislation does not allow shares to be issued until they are fully paid. The following journal entries are required:

The share subscription receivable conceptually does not represent a receivable in the conventional sense, as it represents a capital and not an income transaction. As such, the most appropriate treatment would be to show it as a contra-equity account. However, some argue that because it does represent a future benefit to the company, it should be reported as an asset. Both presentations can be found in practice. The common shares subscribed account should be shown as part of the contributed capital section, but it should be segregated from the issued share capital.

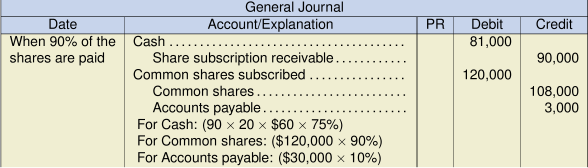

In six months’ time, the following journal entry is required:

Note: If a dividend is declared between the subscription date and the final payment date, the treatment of that dividend will depend on local legislation. Although it is likely that the shares will not be eligible for dividends, as they have not yet been issued, some jurisdictions allow the distribution of a pro-rata dividend based on the amount of cash received to date. In our example, the subscribers would be eligible for 25% of the regular dividend amount declared. Similarly, if a shareholders’ meeting is held during this interim period, the subscribers may be eligible for a pro-rata share of votes at the meeting.

Scenario 2

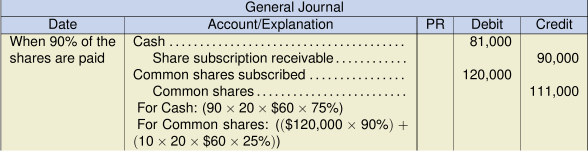

Let’s assume the same set of facts as Scenario 1, except that 10 of the subscribers default on their final payments. At the time of the initial subscription, the journal entry will be identical to the one used in Scenario 1. However, at the time of final payment, the journal entry will depend on local legislation, the subscription contract, and corporate policy. If we assume that legislation requires a refund of the initial deposit to the defaulting subscribers, then the journal entry would look like this:

Scenario 3

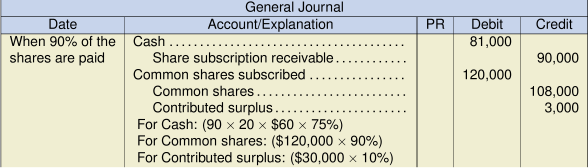

Let’s assume the same set of facts as Scenario 2, except that local legislation allows shares to be issued to defaulting subscribers pro-rata, based on the amounts of their deposits. The journal entry on issuance would look like this:

In some cases, the company may charge a fee to the defaulting subscribers, which would be allocated to contributed surplus, rather than to common share capital.

Scenario 4

Let’s assume the same set of facts as Scenario 2, except that local legislation allows the company to keep the defaulting subscribers’ deposits. In this case, the following journal entry is recorded at issuance:

Shares Issued for Goods or Services

Sometimes a company may issue shares in exchange for assets other than cash, or in exchange for services provided. These situations may occur when a company is in the start-up phase of its life cycle and wishes to preserve scarce cash resources. In these cases, the shares should be recorded at the fair value of the asset acquired or service received. Note that this treatment is different than the treatment of non-monetary exchanges of assets, where the fair value of the asset given up is normally used as the transaction amount. This difference results because fair values of assets or services are usually more reliable than fair values of shares. In the rare circumstance that the fair values of the assets or services cannot be determined, the fair value of the shares issued should then be used. This value is obviously easier to determine for a publicly traded company. In all cases, non-monetary exchanges for shares will involve the exercise of good judgment on the part of the accountant.

A company may also issue its shares in exchange for shares of another company. This type of business combination is an advanced financial accounting concept that is not covered in this text.