Chapter 16

Solutions

Exercise 16.1

| DC or DB | |

|---|---|

| The employer has no obligation to the fund beyond the required payment | DC |

| Accounting for this type of plan is more complicated | DB |

| The employer bears the investment risk with this type of plan | DB |

| A liability is only recorded when the required payment is not made by year-end | DC |

| Accounting for this type of plan will likely require the use of actuarial specialists | DB |

Exercise 16.2

a. ![]() monthly salary

monthly salary

Employee contribution = ![]()

Employer contribution = ![]()

Note: Pension expense = ![]()

Pension liability = ![]()

Cash paid to the pension plan = ![]()

Cash paid to the employees = ![]()

b. The company will report a pension expense of $630,000 in the appropriate section of the income statement.

c. The company will report a pension liability of $87,500 on December 31, 2022. This will be reported as a current liability, as the funds are remitted to the plan in January 2023.

Exercise 16.3

- Pension expense =

- Pension expense =

Exercise 16.4

| Current Service Cost | $1,600,000 | |

| Interest on DBO | 936,000 | |

| Interest on Assets | (900,000) | |

| Pension Expense | $1,636,000 |

Exercise 16.5

a.

| Pension Plan | Company Accounting Records | |||||

| DBO | Plan Assets | Net Defined Benefit Balance | Cash | Annual Pension Expense | OCI | |

|---|---|---|---|---|---|---|

| Opening balance | 6,300,000 CR | 5,950,000 DR | 350,000 CR | |||

| Service cost | 575,000 CR | 575,000 DR | ||||

| Interest: DBO | 441,000 CR | 441,000 DR | ||||

| Interest: assets | 416,500 DR | 416,500 CR | ||||

| Contribution | 682,000 DR | 682,000 CR | ||||

| Benefits paid | 186,000 DR | 186,000 CR | ||||

| Remeasurement | 20,500 DR | 20,500 CR | ||||

| gain: assets | ||||||

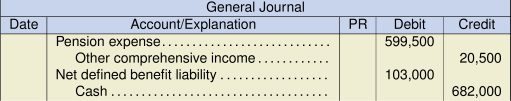

| Journal entry | 103,000 DR | 682,000 CR | 599,500 DR | 20,500 CR | ||

| Closing balance | 7,130,000 CR | 6,883,000 DR | 247,000 CR | |||

b.

c. The company will report a non-current liability of $247,000 on December 31, 2021.

Exercise 16.6

a.

| Pension Plan | Company Accounting Records | |||||

| DBO | Plan Assets | Net Defined Benefit Balance | Cash | Annual Pension Expense | OCI | |

|---|---|---|---|---|---|---|

| Opening balance | 4,400,000 CR | 4,550,000 DR | 150,000 DR | |||

| Service cost | 565,000 CR | 565,000 DR | ||||

| Interest: DBO | 352,000 CR | 352,000 DR | ||||

| Interest: assets | 364,000 DR | 364,000 CR | ||||

| Contribution | 422,000 DR | 422,000 CR | ||||

| Benefits paid | 166,000 DR | 166,000 CR | ||||

| Remeasurement | 52,000 CR | 52,000 DR | ||||

| loss: assets | ||||||

| Remeasurement | 176,000 CR | 176,000 DR | ||||

| loss: DBO | ||||||

| Journal entry | 359,000 CR | 422,000 CR | 553,000 DR | 228,000 DR | ||

| Closing balance | 5,327,000 CR | 5,118,000 DR | 209,000 CR | |||

| Non-Current Liabilities: | ||

|

Net defined benefit liability |

$209,000 | |

| Accumulated Other Comprehensive Income: | ||

|

Net remeasurement losses on defined benefit liability |

$(228,000) |

Exercise 16.7

a. 2020:

| Pension Plan | Company Accounting Records | |||||

| DBO | Plan Assets | Net Defined Benefit Balance | Cash | Annual Pension Expense | OCI | |

|---|---|---|---|---|---|---|

| Opening balance | 0 CR | 0 DR | 0 CR | |||

| Service cost | 389,000 CR | 389,000 DR | ||||

| Interest: DBO | 0 CR | 0 DR | ||||

| Interest: assets | 0 DR | 0 CR | ||||

| Contribution | 348,000 DR | 348,000 CR | ||||

| Benefits paid | 0 DR | 0 CR | ||||

| Remeasurement | 2,000 DR | 2,000 CR | ||||

| gain: assets | ||||||

| Remeasurement | 27,000 DR | 27,000 CR | ||||

| gain: DBO | ||||||

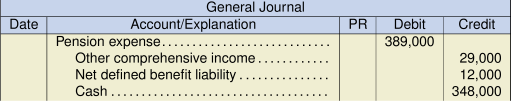

| Journal entry | 12,000 CR | 348,000 CR | 389,000 DR | 29,000 CR | ||

| Closing balance | 362,000 CR | 350,000 DR | 12,000 CR | |||

Remeasurement gains are derived by working backwards from the ending balances of the DBO and plan assets. No interest is calculated as the opening balances were zero and it is assumed that transactions occur at the end of the period.

2021:

| Pension Plan | Company Accounting Records | |||||

| DBO | Plan Assets | Net Defined Benefit Balance | Cash | Annual Pension Expense | OCI | |

|---|---|---|---|---|---|---|

| Opening balance | 362,000 CR | 350,000 DR | 12,000 CR | |||

| Service cost | 395,000 CR | 395,000 DR | ||||

| Interest: DBO* | 25,340 CR | 25,340 DR | ||||

| Interest: assets** | 24,500 DR | 24,500 CR | ||||

| Contribution | 301,000 DR | 301,000 CR | ||||

| Benefits paid | 50,000 DR | 50,000 CR | ||||

| Remeasurement | 15,500 CR | 15,500 DR | ||||

| loss: assets*** | ||||||

| Remeasurement | 0 CR | 0 DR | ||||

| loss: DBO | ||||||

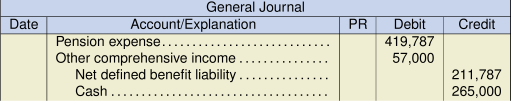

| Journal entry | 110,340 CR | 301,000 CR | 395,840 DR | 15,500 DR | ||

| Closing balance | 732,340 CR | 610,000 DR | 122,340 CR | |||

* ![]()

** ![]()

*** ![]()

(Work backwards from the ending balance to determine the balancing figure.)

2022:

| Pension Plan | Company Accounting Records | |||||

| DBO | Plan Assets | Net Defined Benefit Balance | Cash | Annual Pension Expense | OCI | |

|---|---|---|---|---|---|---|

| Opening balance | 732,340 CR | 610,000 DR | 122,340 CR | |||

| Service cost | 410,000 CR | 410,000 DR | ||||

| Interest: DBO* | 58,587 CR | 58,587 DR | ||||

| Interest: assets** | 48,800 DR | 48,800 CR | ||||

| Contribution | 265,000 DR | 265,000 CR | ||||

| Benefits paid | 54,000 DR | 54,000 CR | ||||

| Remeasurement | 15,000 CR | 15,000 DR | ||||

| loss: assets | ||||||

| Remeasurement | 42,000 CR | 42,000 DR | ||||

| loss: DBO | ||||||

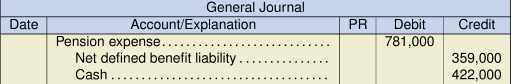

| Journal entry | 211,787 CR | 265,000 CR | 419,787 DR | 57,000 DR | ||

| Closing balance | 1,188,927 CR | 854,800 DR | 334,127 CR | |||

* ![]()

** ![]()

c. 2020:

| Non-Current Liabilities: | ||

|

Net defined benefit liability (underfunded) |

$12,000 | |

| Accumulated Other Comprehensive Income: | ||

| Net remeasurement gains on defined benefit liability | $29,000 |

2021:

| Non-Current Liabilities: | ||

|

Net defined benefit liability (underfunded) |

$122,340 | |

| Accumulated Other Comprehensive Income: | ||

| Net remeasurement gains on defined benefit liability | $13,500* |

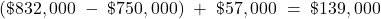

* Note: Balance = ![]()

2022:

| Non-Current Liabilities: | ||

|

Net defined benefit liability (underfunded) |

$334,127 | |

| Accumulated Other Comprehensive Income: | ||

| Net remeasurement losses on defined benefit liability | $(43,500)* |

* Note: Balance = ![]()

Exercise 16.8

a.

| Pension Plan | Company Accounting Records | ||||

| DBO | Plan Assets | Net Defined Benefit Balance | Cash | Annual Pension Expense | |

|---|---|---|---|---|---|

| Opening balance | 6,246,000 CR | 6,871,000 DR | 625,000 DR | ||

| Past service cost | 215,000 CR | 215,000 DR | |||

| Service cost | 510,000 CR | 510,000 DR | |||

| Interest: | 581,490 CR | 581,490 DR | |||

| Health Benefit Obligation* | |||||

| Interest: assets** | 618,390 DR | 618,390 CR | |||

| Contribution | 430,000 DR | 430,000 CR | |||

| Benefits paid | 850,000 DR | 850,000 CR | |||

| Journal entry | 258,100 CR | 430,000 CR | 688,100 DR | ||

| Closing balance | 6,702,490 CR | 7,069,390 DR | 366,900 DR | ||

* ![]()

** ![]()

The post-employment health benefit expense will be $688,100 for the year. Note that the interest on the health benefit obligation is calculated after taking the past service adjustment into account. This is necessary as the past service adjustment was made on January 1.

b. The company will report a non-current asset of $366,900, subject to any adjustment required as a result of the asset ceiling test.

Exercise 16.9

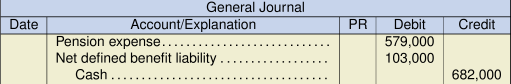

-

Pension Plan Company Accounting Records DBO Plan Assets Net Defined Benefit Balance Cash Annual Pension Expense Opening balance 6,300,000 CR 5,950,000 DR 350,000 CR Service cost 575,000 CR 575,000 DR Interest: DBO 441,000 CR 441,000 DR Interest: assets 416,500 DR 416,500 CR Contribution 682,000 DR 682,000 CR Benefits paid 186,000 DR 186,000 CR Remeasurement 20,500 DR 20,500 CR gain: assets Journal entry 103,000 DR 682,000 CR 579,000 DR Closing balance 7,130,000 CR 6,883,000 DR 247,000 CR

- The company will report a non-current liability of $247,000 on December 31, 2021.

Exercise 16.10

a.

| Pension Plan | Company Accounting Records | ||||

| DBO | Plan Assets | Net Defined Benefit Balance | Cash | Annual Pension Expense | |

|---|---|---|---|---|---|

| Opening balance | 4,400,000 CR | 4,550,000 DR | 150,000 DR | ||

| Service cost | 565,000 CR | 565,000 DR | |||

| Interest: DBO | 352,000 CR | 352,000 DR | |||

| Interest: assets | 364,000 DR | 364,000 CR | |||

| Contribution | 422,000 DR | 422,000 CR | |||

| Benefits paid | 166,000 DR | 166,000 CR | |||

| Remeasurement | 52,000 CR | 52,000 DR | |||

| loss: assets | |||||

| Remeasurement | 176,000 CR | 176,000 DR | |||

| loss: DBO | |||||

| Journal entry | 359,000 CR | 422,000 CR | 781,000 DR | ||

| Closing balance | 5,327,000 CR | 5,118,000 DR | 209,000 CR | ||

| Non-Current Liabilities: | ||

|

Net defined benefit liability |

$209,000 |

No accumulated other comprehensive income is reported. The remeasurement losses would simply be included in retained earnings through the closing of the pension expense account at the end of the year.

Exercise 16.11

1. IFRS

|

Item |

DBO |

Plan Assets |

Net Defined Pension Balance |

Cash |

Expense |

OCI |

||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Balance, 1/1/Y8 | 317,500 | CR | 317,500 | DR | - | |||||||

| Current service cost | 74,300 | CR | 74,300 | DR | ||||||||

| Interest: DBO (1) | 15,875 | CR | 15,875 | DR | ||||||||

| Interest: Assets (2) | 15,875 | DR | 15,875 | CR | ||||||||

| Remeasurement Loss: Assets (3) | 3,075 | CR | 3,075 | DR | ||||||||

| Contributions | 64,900 | DR | 64,900 | CR | ||||||||

| Benefits Paid | 48,000 | DR | 48,000 | CR | ||||||||

| Past service adjustment | 55,800 | CR | - | - | - | 55,800 | DR | - | ||||

| Entry | 68,275 | CR | 64,900 | CR | 130,100 | DR | 3,075 | DR | ||||

| Balance, 12/31/Y8 | 415,475 | CR | 347,200 | DR | 68,275 | CR | ||||||

| (1) $317,500 × 5% | ||||||||||||

| (2) $317,500 × 5% | ||||||||||||

| (3) $15,875 - 12,800 actual return | ||||||||||||

| Entry | |||

| Pension Expense | 130,100 | ||

| Pension Adjustment - OCI | 3,075 | ||

| Cash | 64,900 | ||

| Net Defined Pension Liability | 68,275 | ||

2. ASPE

|

Item |

DBO |

Plan Assets |

Net Defined Pension Balance |

Cash |

Expense |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Balance, 1/1/Y8 | 317,500 | CR | 317,500 | DR | - | |||||

| Current service cost | 74,300 | CR | 74,300 | DR | ||||||

| Interest: DBO (1) | 15,875 | CR | 15,875 | DR | ||||||

| Interest: Assets (2) | 15,875 | DR | 15,875 | CR | ||||||

| Remeasurement Loss: Assets (3) | 3,075 | CR | 3,075 | DR | ||||||

| Contributions | 64,900 | DR | 64,900 | CR | ||||||

| Benefits Paid | 48,000 | DR | 48,000 | CR | ||||||

| Past service adjustment | 55,800 | CR | - | - | - | 55,800 | DR | |||

| Entry | 68,275 | CR | 64,900 | CR | 133,175 | DR | ||||

| Balance, 12/31/Y8 | 415,475 | CR | 347,200 | DR | 68,275 | CR |

| Entry | |||

| Pension Expense | 133,175 | ||

| Cash | 64,900 | ||

| Net Defined Pension Liability | 68,275 | ||

Exercise 16.12

1. IFRS

|

Item |

DBO |

Plan Assets |

Net Defined Pension Balance |

Cash |

Expense |

OCI |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Opening balances | 268,600 | CR | 300,100 | DR | 31,500 | DR | |||||||

| Current service cost | 45,600 | CR | 45,600 | DR | |||||||||

| Interest - debt | 10% | 26,860 | CR | 26,860 | DR | ||||||||

| Interest - assets | 10% | 30,010 | DR | 30,010 | CR | ||||||||

| Remeasurement | 3,001 | CR | 3,001 | DR | |||||||||

| Contributions | 99,700 | DR | 99,700 | CR | |||||||||

| Benefits Paid | 54,700 | DR | 54,700 | CR | |||||||||

| Journal Entries | 54,249 | DR | 99,700 | CR | 42,450 | DR | 3,001 | DR | |||||

| Closing Balance | 286,360 | CR | 372,109 | DR | 85,749 | DR |

|

Journal Entry |

|||||||

| Plan Assets | Pension Expense | 42,450 | |||||

| Actual | 27,009 | OCI | 3,001 | ||||

| Expected | 30,010 | Net Defined Benefit | 54,249 | ||||

| - 3,001 | Cash | 99,700 | |||||

| Note - the plan is OVER funded | |||||||

2. ASPE

|

DBO |

Plan Assets |

Net Defined Pension Balance |

Cash |

Expense |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Opening balances | 268,600 | CR | 300,100 | DR | 31,500 | DR | |||||

| Current service cost | 45,600 | CR | 45,600 | DR | |||||||

| Interest - debt | 10% | 26,860 | CR | 26,860 | DR | ||||||

| Interest - assets | 10% | 30,010 | DR | 30,010 | CR | ||||||

| Remeasurement | 3,001 | CR | 3,001 | DR | |||||||

| Contributions | 99,700 | DR | 99,700 | CR | |||||||

| Benefits Paid | 54,700 | DR | 54,700 | CR | |||||||

| Journal Entries | 54,249 | DR | 99,700 | CR | 45,451 | DR | |||||

| Closing Balance | 286,360 | CR | 372,109 | DR | 85,749 | DR |

|

Journal Entry |

|||||||

| Plan Assets | Pension Expense | 45,451 | |||||

| Actual | 27,009 | ||||||

| Expected | 30,010 | Net Defined Benefit | 54,249 | ||||

| - 3,001 | Cash | 99,700 | |||||

| Note - the plan is OVER funded | |||||||

Exercise 16.13

1. IFRS

|

Item |

DBO |

Plan Assets |

Net Defined Pension Balance |

Cash |

Expense |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Balance, 1/1/Y7 | 578,960 | CR | 500,640 | DR | 78,320 | CR | ||||

| Past Service Cost | 34,700 | CR | 34,700 | DR | ||||||

| Current service cost | 35,600 | CR | 35,600 | DR | ||||||

| Interest: DBO (1) | 36,820 | CR | 36,820 | DR | ||||||

| Interest: Assets (2) | 30,038 | DR | 30,038 | CR | ||||||

| Contributions | 114,200 | DR | 114,200 | CR | ||||||

| Benefits Paid | 77,800 | DR | 77,800 | CR | ||||||

| Entry | 37,119 | DR | 114,200 | CR | 77,081 | DR | ||||

| Balance, 12/31/Y7 | 608,280 | CR | 567,078 | DR | 41,201 | CR | ||||

| (1) ($578,960 + $34,700) × 6% since past service adjustment was effective Jan 1, interest should be included on the adjustment as well as the opening DBO balance | ||||||||||

| (2) $500,640 × 6% since return and discount rate are the same, no remeasurement | ||||||||||

| Entry | |||

| Pension Expense | 77,081 | ||

| Net Defined Pension Asset | 37,119 | ||

| Cash | 114,200 | ||

| Note - the plan is UNDER funded | |||

2. ASPE

|

Item |

DBO |

Plan Assets |

Net Defined Pension Balance |

Cash |

Expense |

|||||

|---|---|---|---|---|---|---|---|---|---|---|

| Balance, 1/1/Y7 | 578,960 | CR | 500,640 | DR | 78,320 | CR | ||||

| Past Service Cost | 34,700 | CR | 34,700 | DR | ||||||

| Current service cost | 35,600 | CR | 35,600 | DR | ||||||

| Interest: DBO (1) | 36,820 | CR | 36,820 | DR | ||||||

| Interest: Assets (2) | 30,038 | DR | 30,038 | CR | ||||||

| Contributions | 114,200 | DR | 114,200 | CR | ||||||

| Benefits Paid | 77,800 | DR | 77,800 | CR | ||||||

| Entry | 37,119 | DR | 114,200 | CR | 77,081 | DR | ||||

| Balance, 12/31/Y7 | 608,280 | CR | 567,078 | DR | 41,201 | CR | ||||

| (1) ($578,960 + $34,700) × 6% since past service adjustment was effective Jan 1, interest should be included on the adjustment as well as the opening DBO balance | ||||||||||

| (2) $500,640 × 6% since return and discount rate are the same, no remeasurement | ||||||||||

| Entry | |||

| Pension Expense | 77,081 | ||

| Net Defined Pension Asset | 37,119 | ||

| Cash | 114,200 | ||

| Note - the plan is UNDER funded | |||