Chapter 13

Solutions

Exercise 13.1

- Financing is generally obtained through three sources: borrowing the funds, issuing shares, and using internally generated funds. Using borrowed money to leverage, where the interest rate from the borrowing is less than the return from generating the profit, can maximize the returns paid to shareholders, and the related interest paid is tax deductible. However, borrowed funds must be repaid, which affects the company’s liquidity and solvency risk. Issuing shares, on the other hand, does not impact liquidity and solvency risk, but it may result in the dilution of ownership and associated lower market value and less dividends per share. Using internally generated funds may be appropriate if the company has excess cash profits and has determined that this project is the best use for these funds.

- Based on the information provided, borrowing is the most suitable source of financing for Evergreen Ltd. With a debt to total assets ratio of 56%, Evergreen Ltd. is underleveraged as compared with competitors operating in the same industry, averaging 60%. As a result, Evergreen Ltd. will likely be able to finance the expansion by borrowing and still maintain an acceptable level of liquidity and solvency risk lower than, or equal to, the 60% industry standard benchmark. If Evergreen Ltd. has significant amounts of property, plant, and equipment, it may be able to obtain the loan and secure it with its existing tangible assets. However, more information would be required before making a concrete recommendation.

Exercise 13.2

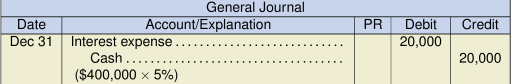

- The market interest rate at the time of signing the note would have been 5% because the note was issued at face value, meaning that the 5% stated rate was the same as the market rate at that time.

- The yield is the same as the market or effective rate, which is 5% in this case. Had the market rate been greater or lower than the face rate, the yield would be equal to the market rate.

- The current portion of the long-term debt is the principal portion of the debt that will be paid within one year of the reporting (balance sheet) date. In this case, as no principal portions are due until the note’s maturity on January 1, 2024, no amount will be reported as a current portion of long-term debt as at the December 31, 2021, reporting date. However, when the balance sheet at December 31, 2023, is prepared, the long-term note payable of $400,000 will be classified as a current liability because it will be due within one year of the December 31, 2023, reporting date.

Exercise 13.4

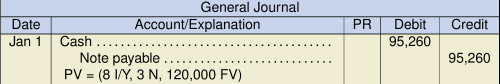

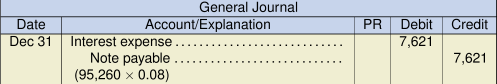

- If the note face value is $120,000, the duration is three years, and the PV is equal to $95,260, the interest rate would be:Interest rate = (+/- 95,260 PV, 3 N, 120,000 FV) = 7.999 (or 8%)

-

Date Interest @ 8% Balance Jan 1, 2021 95,260 Dec 31, 2021 7,621 102,881 Dec 31, 2022 8,230 111,111 Dec 31, 2023 8,889

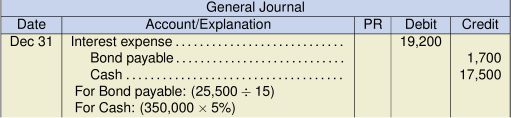

Exercise 13.7

PMT = (+/- 25,000 PV, 3 N, 8 I/Y) = 9,700.84 (or 9,701)

Payments each December 31 would be $9,701.

Exercise 13.9

-

To calculate the market rate (yield) at the time of the issuance to two decimal places:

-

Hobart Services Ltd.

Statement of Financial Position

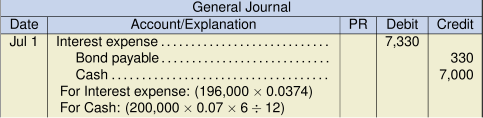

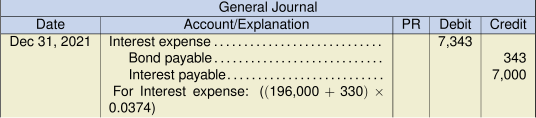

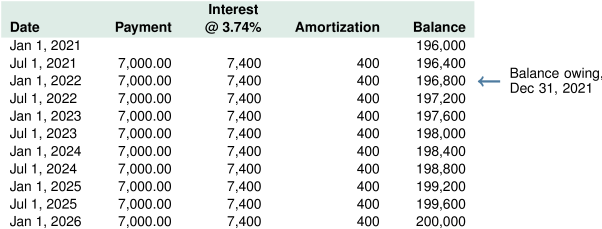

As at December 31, 2021Current liabilities: Interest payable $7,000 Long-term liabilities: Long-term bonds payable, 7%, due January 1, 2026 $196,673 Note: There is no current portion of long-term debt in this case because there is no pay-down of the principal. Looking at the payment schedule, the balance owing is increasing due to the amortization of the discount.

-

Hobart Services Ltd.

Statement of Financial Position

As at December 31, 2021Current liabilities: Interest payable $7,000 Long-term liabilities: Long-term bonds payable, 7%, due January 1, 2026 $196,800 Check Figures:

- The total cost of borrowing will be the same for both methods, though the pattern of recognition as illustrated in the two interest schedules above is different throughout the life of the bonds.

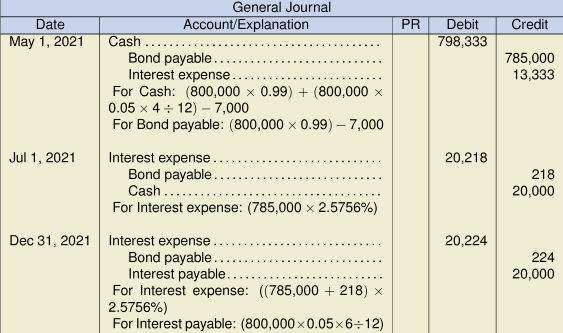

Exercise 13.10

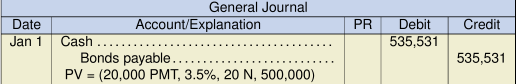

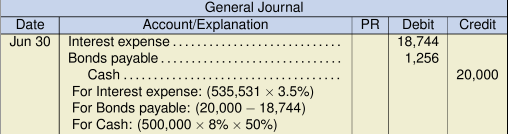

a. Effective interest rate:

I/Y = (+/- 785,000 PV, 20,000 PMT, 40 N, 800,000 FV) = 2.5756% every 6 months

* Fee is capitalized and will be amortized over the life of the bond. See full amortization schedule above.

c.

| Hobart Services Ltd. Statement of Financial Position As at December 31, 2021 |

||

|---|---|---|

| Current liabilities: | ||

| Interest payable | $20,000 | |

| Long-term liabilities: | ||

| Long-term bonds payable, 5%, due January 1, 2041 | $785,442 | |

When a note or bond is issued, the brokerage fees and any other directly attributable costs should be included in the fair value and amortized over the life of the debt. As a result, these types of additional costs will affect both the amount of the bond discount (or premium) amortized and the interest expense over the term of the bond. Exceptions to this are where the debt will subsequently be measured at fair value under the fair value option. In this case, the transaction costs would be expensed at the time of issuance and not included in the initial fair value measurement. [CPA Handbook, Accounting, Part II, Section 3856.07 and Part I, IFRS 9].

Exercise 13.11

When a note or bond is issued, the brokerage fees and any other directly attributable costs should be included in the fair value and amortized over the life of the debt. As a result, these types of additional costs will affect both the amount of the bond discount or premium amortized and the interest expense over the term of the bond. Exceptions to this are where the debt will subsequently be measured at fair value under the fair value option. In this case, the transaction costs would be expensed at the time of issuance and not included in the initial fair value measurement. (CPA Handbook, Accounting, Part II, Section 3856.07 and Part I, IFRS 9)

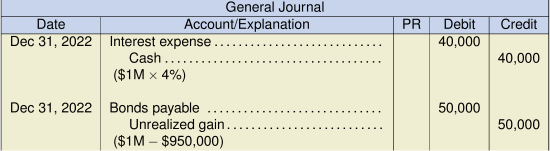

- ASPE

- IFRS (IFRS 9)

- The risk for Tribecca increased in this case, so the fair value of its debt owing decreased. The offsetting entry to the decrease (debit) to bonds payable is an unrealized gain. An entry booking a gain seems like an illogical outcome, given that the company is now worse off than before due to higher risk.

Exercise 13.13

- Under IFRS, this debt is to be reported as a current liability on the December 31, 2021, financial statements because it was not refinanced by the reporting date. The only exception is if the refinancing was done under an agreement that existed at December 31, 2021, and the decision about the refinancing was solely up to management’s discretion.

- Under ASPE, this debt can be reported as a long-term liability because it has been refinanced on a long-term basis before the financial statements are completed. In this case, the entity’s financial statements are not yet finalized, so ASPE would permit the debt to be included with long-term liabilities.

Exercise 13.14

Settlement or modification:

Old debt: $25,000 (amount due):

New annual interest payment: ![]()

New debt (PV using the old rate): PV (1,080 PMT, 8 I/Y, 3 N, 18,000 FV) = 17,072

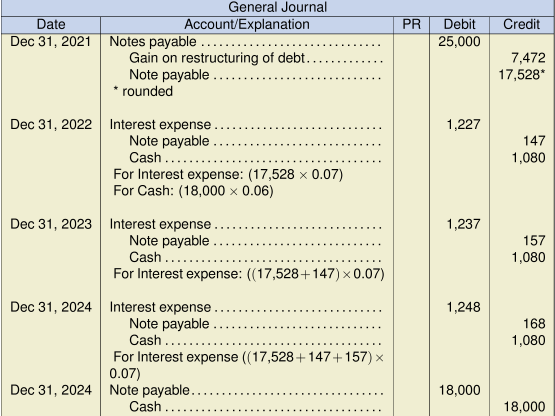

The new debt is more than 10% difference of the old debt’s value, so the renegotiation would be considered a settlement and not a modification in terms. A settlement requires the old debt to be removed from the records and the present value amount of the note payable with the new terms be recorded.

The PV of the new note payable at the current market rate would be:

PV (1080 PMT, 7 I/Y, 3 N, 18,000 FV) = 17,527.62

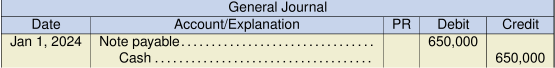

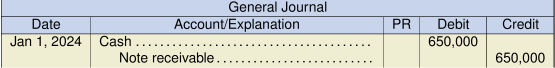

The entries would be:

Exercise 13.15

- Initial fair value amount of the house on January 1, 2021:

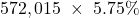

PV = (5.75%, 6 N, 800,000 FV) = $572,015 Dec 31, 2021 Interest: (  )

)= 32,891 Carrying value of the note, Dec 31, 2021 = $604,906 - The assessed value for the house of $590,000 is only a tax assessment notice for purposes of tax levies and payments. Though it is intended to reflect some sort of value of the house, it may not necessarily be an accurate measure. The more accurate measure in this case would be the present value of the future cash flows of the note, using a known, agreed-upon bank rate. The tax assessment amount of $590,000 can be compared to the present value of $572,015 for consistency and reasonableness. In this case, the amounts are close.

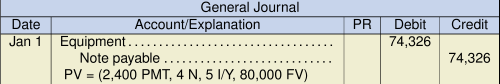

Exercise 13.16

- The purchase price of the equipment should be recorded at the present value of the future cash flows of the instalment note at the imputed interest rate of 7%. This is the best measure of the fair value of the asset because it represents the present value of an agreed series of future cash flows at a known market rate. The listing price represents a tentative amount asked for the equipment and could be above or below the price that is agreed to between both parties.

- PV = (40,541 PMT, 7 I/Y, 4 N) = 137,321

- From the perspective of a creditor, an instalment note payment includes both the interest and principal, whereas, for an interest-bearing note, the principal amount is not due until maturity. In other words, the instalment note provides a regular reduction of the principal balance as part of every payment received, reducing the creditor’s investment in the debt and freeing up cash to use elsewhere.

Exercise 13.17

For Hornblower Corp.:

- Determine if this is a modification of terms or settlement: Present value of old debt is $700,000.Present value of new debt using the historic rate: PV = (45,500 PMT, 8 I/Y, 2 N, 650,000 FV) = 638,409. This loan is deemed as a modification in terms because the present value of the future cash flows of the new debt using the old rate of $638,409 does not differ by an amount greater than 10% of the present value of the old debt of $700,000. There will be no entry for Hornblower Corp. due to the restructure of the loan. The old debt remains on the books of Hornblower Corp. at $700,000 and no gain or loss is recognized. A note disclosure regarding the modification of terms is required.

- The interest expense is based on the future cash flows specified by the new terms with the pre-restructuring carrying amount of the debt of $700,000. The effective interest rate is calculated as follows:I/Y = (+/- 700,000 PV, 45,500 PMT, 2 N, 650,000 FV) = 2.98% (rounded)

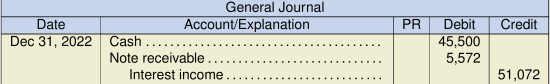

For Firstly Trust:

- Present value of old debt is $700,000.

Note: If Firstly Trust had previously recorded an allowance for doubtful accounts for this note, the debit entry would be to the AFDA account instead of the bad debt expense.

-

Date Payment 7% Interest @ 8% Reduction in Carrying Amount Balance Dec 31, 2021 638,409 Dec 31, 2022 45,500 51,072 5,572 643,981 Dec 31, 2023 45,500 51,519* 6,019 650,000 * Rounded

Exercise 13.18

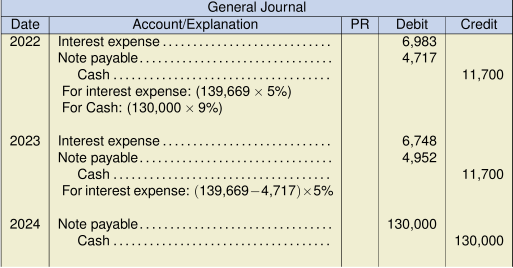

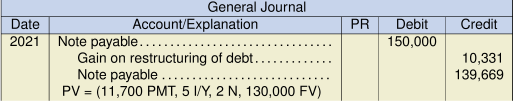

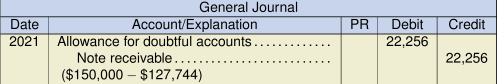

- Determine if the changes should be accounted for as a settlement or as a modification: Old debt: $150,000New terms using old rate of 10%: PV = (11,700 PMT, 10 I/Y, 2 N, 130,000 FV) = 127,744. The present value of the new terms using the old rate of 10% differs by an amount larger than 10% of the present value of the old debt of $150,000. As a result, the renegotiated debt is considered a settlement. The old debt is removed from the books of Ulting Ltd. with a gain/loss being recognized, and the new debt is recorded.

Interest schedule:

Exercise 13.19

1. Substantial Modification?

In order to determine if there is a gain or not, we have to determine if the modification of terms is greater or less than 10% of the original.

| Notes | ||

|---|---|---|

| PV | $2,280,631 | |

| Rate | 10% | must use the known rate or 10% (to be consistent and comparable) |

| Nper | 3 | (Y4, Y5, Y6) |

| Pmt | -192,000 | this is the interest based on the restructured amount of the loan ($2,400,000 × 8%) |

| FV | -2,400,000 | |

| Type | 0 |

Compare old debt to new (restructured) debt:

| Old Debt | $2,500,000 |

| New Debt | $2,280,631 |

| Difference | $219,369 |

| As a percent | 8.77% |

Therefore, since the present value of the future cash flows of the new (restructured) debt does not differ by more than 10%, it is not considered to be a substantial modification.

2. Entry at December 31, Y3 (First-One)

| Dec 31, Y3 | Note Payable | 219,369 | ||

| Gain on Restructuring of Debt | 219,369 | |||

| (2,500,000 existing debt - $2,280,631 new debt) | ||||

3. Amortization Schedule

|

Date |

Cash (8%) |

Interest Expense (10%) |

Amortization |

Carrying Value |

|---|---|---|---|---|

| Dec 31, Y3 | 2,280,631 | |||

| Dec 31, Y4 | 192,000 | 228,063 | 36,063 | 2,316,694 |

| Dec 31, Y5 | 192,000 | 231,669 | 39,669 | 2,356,364 |

| Dec 31, Y6 | 192,000 | 235,636 | 43,636 | 2,400,000 |

4. Journal Entries

| Dec 31, Y4 | Interest Expense | 228,063 | ||

| Notes Payable | 36,063 | |||

| Cash | 192,000 | |||

| Dec 31, Y5 | Interest Expense | 231,669 | ||

| Notes Payable | 39,669 | |||

| Cash | 192,000 | |||

| Dec 31, Y6 | Interest Expense | 235,636 | ||

| Notes Payable | 43,636 | |||

| Cash | 192,000 | |||

| Jan 1, Y7 | Notes Payable | 2,400,000 | ||

| Cash | 2,400,000 | |||

5. First-One follows ASPE

| Dec 31, Y3 | no entry with ASPE – no gain/loss is recognized and there is no restatement of the note payable. |

If First-One follows ASPE, the amortization schedule will differ from IFRS. A new effective interest rate must be calculated.

|

Notes |

||

|---|---|---|

| Rate | 6.4288% | rounded to 4 decimal places |

| Nper | 3 | |

| Pmt | -192,000 | this is the interest based on the restructured amount of the loan ($2,400,000 × 8%) |

| PV | 2,500,000 | current value of debt |

| FV | -2,400,000 | future amount agreed to be paid |

| Type | 0 |

|

Date |

Cash (8%) |

Interest Expense (6.4288%) |

Amortization |

Carrying Value |

|---|---|---|---|---|

| Dec 31, Y3 | 2,500,000 | |||

| Dec 31, Y4 | 192,000 | 160,720 | 31,280 | 2,468,720 |

| Dec 31, Y5 | 192,000 | 158,710 | 33,290 | 2,435,430 |

| Dec 31, Y6 | 192,000 | 156,570 | 35,430 | 2,400,000 |

| Dec 31, Y4 | Interest Expense | 160,720 | ||

| Notes Payable | 31,280 | |||

| Cash | 192,000 | |||

| Dec 31, Y5 | Interest Expense | 158,710 | ||

| Notes Payable | 33,290 | |||

| Cash | 192,000 | |||

| Dec 31, Y6 | Interest Expense | 156,570 | ||

| Notes Payable | 35,430 | |||

| Cash | 192,000 | |||

| Jan 1, Y7 | Notes Payable | 2,400,000 | ||

| Cash | 2,400,000 | |||

Exercise 13.20

1. Substantial Modification?

In order to determine if there is a gain or not, we have to determine if the modification of terms is greater or less than 10% of the original.

|

Notes |

||

|---|---|---|

| PV | $2,280,631 | |

| Rate | 10% | must use the known rate or 10% (to be consistent and comparable) |

| Nper | 3 | (Y4, Y5, Y6) |

| Pmt | -192,000 | this is the interest based on the restructured amount of the loan ($2,400,000 × 8%) |

| FV | -2,400,000 | |

| Type | 0 |

Compare old debt to new (restructured) debt:

| Old Debt | $2,500,000 |

| New Debt | $2,280,631 |

| Difference | $219,631 |

| As a percent | 8.77% |

Therefore, since the present value of the future cash flows of the new (restructured) debt does not differ by more than 10%, it is not considered to be a substantial modification.

2. Entry at December 31, Y3 (First-One)

| Dec 31, Y3 | Modification Loss | 219,369 | ||

| Notes Receivable | 219,369 | |||

| (2,500,000 existing debt - $2,280,631 new debt) | ||||

| Note: | If Big Bank made any allowance, rather than loss, the debit could be to allowance for doubtful accounts | |||

3. Amortization Schedule

|

Date |

Cash (8%) |

Interest Expense (10%) |

Amortization |

Carrying Value |

|---|---|---|---|---|

| Dec 31, Y3 | 2,280,631 | |||

| Dec 31, Y4 | 192,000 | 228,063 | 36,063 | 2,316,694 |

| Dec 31, Y5 | 192,000 | 231,669 | 39,669 | 2,356,364 |

| Dec 31, Y6 | 192,000 | 235,636 | 43,636 | 2,400,000 |

4. Journal Entries

| Dec 31, Y4 | Cash | 192,000 | ||

| Notes Receivable | 36,063 | |||

| Interest Revenue | 228,063 | |||

| Dec 31, Y5 | Cash | 192,000 | ||

| Notes Receivable | 39,669 | |||

| Interest Revenue | 231,669 | |||

| Dec 31, Y6 | Cash | 192,000 | ||

| Notes Receivable | 43,636 | |||

| Interest Revenue | 235,636 | |||

| Jan 1, Y7 | Cash | 2,400,000 | ||

| Interest Revenue | 2,400,000 | |||

Exercise 13.21

1. Present value calculation

| PV | $2,683,449 |

| Rate | 13% |

| Nper | 5 |

| Pmt | -300,000 |

| FV | -3,000,000 |

| Type | 0 |

2. Amortization schedule

|

Date |

Cash |

Interest Expense |

Amortization |

Carrying Value |

|---|---|---|---|---|

| Jan 1, Y2 | 2,683,449 | |||

| Dec 31, Y2 | 300,000 | 348,848 | 48,848 | 2,732,298 |

| Dec 31, Y3 | 300,000 | 355,199 | 55,199 | 2,787,496 |

| Dec 31, Y4 | 300,000 | 362,375 | 62,375 | 2,849,871 |

| Dec 31, Y5 | 300,000 | 370,483 | 70,483 | 2,920,354 |

| Dec 31, Y6 | 300,000 | 379,646 | 79,646 | 3,000,000 |

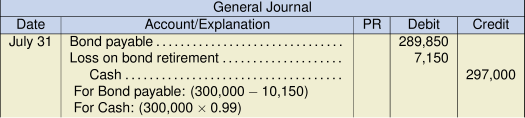

3. Entry for bonds called (redeemed)

| Dec 31, Y4 | Bonds Payable | 2,849,871 | ||

| Loss of redemption of bonds | 100,129 | |||

| Cash | 2,950,000 | |||

Exercise 13.22

| Jan 1, Y8 | Bonds Payable (1) | 986,000 | |||

| Loss on Redemption of Bonds | 44,000 | ||||

| Cash (2) | 1,030,000 | ||||

| (1) Carrying value of bonds at Jan 1, Y8: | |||||

| Par value | 1,000,000 | ||||

| issue price ($1,000,000 × .98) | 980,000 | ||||

| discount - to be amortized | 20,000 | ||||

| Time expired (6 years/ 20 years) | 6,000 | ||||

| Unamortized discount | 14,000 | ||||

| Carrying value of bonds = $980,000 + $6,000 = $986,000 | |||||

| OR: $1,000,000 - 14,000 = $986,000 | |||||

| (2) Cash - reacquisition price = $1,000,000 × 1.03 | 1,030,000 | ||||