Chapter 12

Solutions

Exercise 12.1

- CL

- CL

- CL

- CL

- Both

- Not recorded

- CL and possibly NCL if goods/services provided more than one year in the future

- NCL, unless decommissioning will happen within one year, then CL

- Not recorded unless lawsuit is settled/resolved

- CL

- CL

- Both

- CL or NCL, depending on term of note

- CL

- Both, depending on expiry date of points

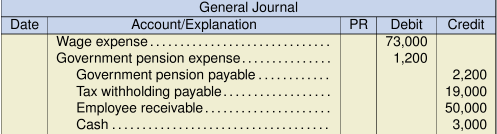

Exercise 12.4

a.

Note: The cash represents the total of the individual payroll cheques that would be written to each employee, less the amount of the advances paid.

b.

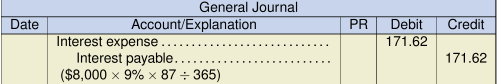

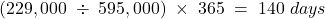

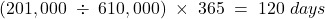

Note: Wage expense = ![]() (based on 5 working days per week)Government pension expense =

(based on 5 working days per week)Government pension expense = ![]()

In practice, the calculation of the government pension expense would be more complicated than this. However, the company would likely omit this part of the calculation, as it is not material to the accrual.

Exercise 12.5

-

January 2021 Factor Revenue One-year subscription

12/12 $2,040 Two-year subscription

12/24 $2,400 Three-year subscription

12/36 $2,800 July 2021 Factor Revenue One-year subscription

6/12 $1,080 Two-year subscription

6/24 $1,000 Three-year subscription

6/36 $1,027 December 2021 Factor Revenue One-year subscription

1/12 $120 Two-year subscription

1/24 $250 Three-year subscription

1/36 $280 Total of all revenue amounts recognized = $10,997

Note: This calculation assumes that services are provided in equal proportions throughout the contract term. If a different assumption is more accurate, then the calculations would be adjusted to reflect the expected pattern of service.

- Total contract payments received:

[(17+18+12) × $120) + [(24+20+30) × $200] + [(30+22+36) × $280] = $45,080 Less revenue recognized in 2021 $10,997 Total deferred revenue at December 31, 2021 $34,083 This will be reported as:

Current liability $18,013 Non-current liability $16,070 Calculation:

January 2021 Factor Current Liability One-year subscription

0/12 $0 Two-year subscription

12/24 $2,400 Three-year subscription

12/36 $2,800 July 2021 Factor Current Liability One-year subscription

6/12 $1,080 Two-year subscription

12/24 $2,000 Three-year subscription

12/36 $2,053 December 2021 Factor Current Liability One-year subscription

11/12 $1,320 Two-year subscription

12/24 $3,000 Three-year subscription

12/36 $3,360 Total current liability = $18,013

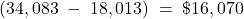

Total non-current liability =

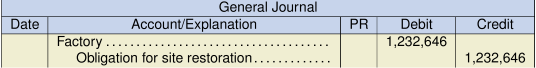

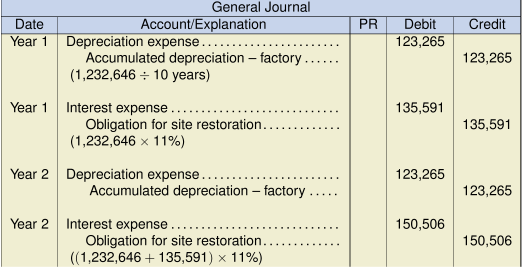

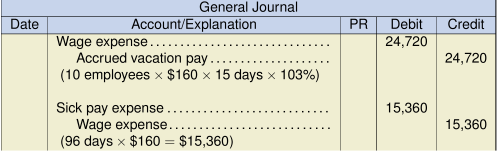

Exercise 12.7

a.

Note: This is simply a reclassification, as the employee would have been paid his or her regular pay on a sick day.

Note: This is simply a reclassification, as the employee would have been paid his or her regular pay on a sick day.

b. Vacation pay liability at December 31 = $24,720, per part (a)Sick pay liability at December 31 = $0 (these benefits do not accumulate)

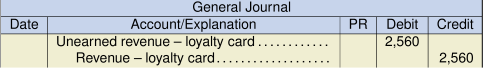

Exercise 12.8

a.

Fair value per cup = ![]()

(Denominator is total cups sold plus expected redemptions.)

Unearned revenue = ![]()

This records the redemption of the first 1,000 free cups.

b. Liability at the end of 2020 will be the unearned revenue balance:

= ![]() = $2,560

= $2,560

This will be reported as a current liability, as all loyalty cards expire within one year.

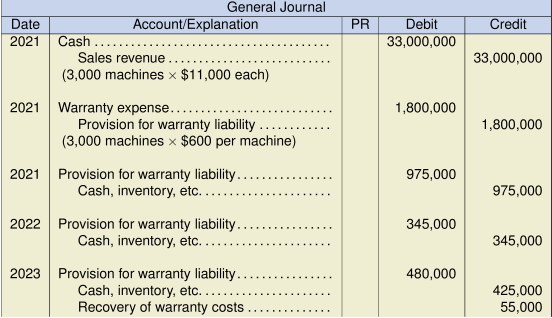

Exercise 12.10

a.

Note: This journal entry assumes that the three-year warranty period for all machines sold in 2021 has now expired. The balance of the provision must be reduced to zero once the warranty period ends. If there were still machines with remaining warranty rights, the balance of the provision would be carried forward to 2024 until the warranty period expired.

Note: This journal entry assumes that the three-year warranty period for all machines sold in 2021 has now expired. The balance of the provision must be reduced to zero once the warranty period ends. If there were still machines with remaining warranty rights, the balance of the provision would be carried forward to 2024 until the warranty period expired.

b. 2021 warranty liability = ![]()

2022 warranty liability = ![]()

2023 warranty liability = ![]()

(assuming all warranty periods have expired by the end of 2023)

Note: In 2021, the liability would be separated into current and non-current portions, based on management’s best estimate of the pattern of future warranty repairs. In 2022, the liability would be reported only as current.

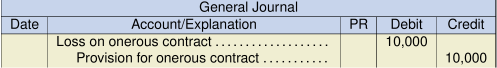

Exercise 12.11

- If contract is completed:

Sales revenue =

= $450,000 Cost of product =

= 500,000 Loss on contract $(50,000) If contract is cancelled and sales still made:

Sales revenue (as above) $450,000 Cost of product = 10,000 grams × $31 per gram = 310,000 Cancellation penalty 75,000 Profit on contract $65,000 If contract is cancelled and no sales made, the $75,000 penalty still applies.

Because the option of cancelling the contract and continuing to make sales results in a profit, this is not an onerous contract. No journal entry is required.

-

If contract is completed, loss is as calculated in part (a) $(50,000) If contract is cancelled and sales made: Sales revenue (as above) $450,000 Cost of product = 10,000 grams × $31 per gram = 310,000 Cancellation penalty 150,000 Loss on contract $(10,000) If contract is cancelled and no sales, penalty applies $(150,000) In this case, all options result in a loss, so this is an onerous contract. A journal entry is required to recognize the least costly option available:

Exercise 12.12

-

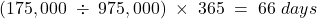

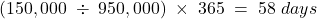

Ratio 2021 2020 Current 1.14 1.13 Quick 0.74 0.79 Days’ sales uncollected 66 days 58 days Days’ payable outstanding 140 days 120 days Current: 2021

2020

Quick: 2021

2020

Days’ sales uncollected: 2021

2020

Days’ payable outstanding: 2021

2020

- The company’s cash decreased from the previous year, but this does not reveal much. The ratio analysis, however, does reveal some worrying trends in liquidity. The current ratio has been maintained at almost exactly the same level as the previous year, but it is only slightly above 1. This may indicate that the company will have difficulty meeting its short-term obligations when they come due. The quick ratio further emphasizes this point. The quick ratio declined from the previous year and is now less than 1. This means the company would not be able to fully pay its current obligations if they were to become immediately due. This could cause problems with trade creditors and the company’s bank, which could lead to further actions taken by those parties that could negatively affect the business. The collection period for receivables has also slowed by 8 days from the previous year, which indicates that it is taking longer to collect from customers. This trend will further exacerbate any cash flow problems the company has in meeting its current payment obligations. The actual collection period of 66 days may be reasonable, but the company’s credit terms and general industry conditions would need to be examined to see if this is in line with what is expected for this type of business. The payment period for the company’s suppliers shows the most alarming trend. The company is now taking 140 days to pay its payable, an increase of 20 days over the previous year. This could indicate serious cash flow problems, and may cause loss of credit with suppliers which could, ultimately, result in an inability to obtain a supply of inventory. The standard credit terms offered by suppliers will need to be examined to put this calculation into context. As well, the supplier list should be examined to see if there are any related parties involved that are granting more favourable credit terms than would be normally expected.Overall, the company appears to have some problems in managing its working capital, which could lead to more serious liquidity problems in the future. The company seems to be using trade creditors as its main source of short term financing, which may cause a degrading of the company’s credit and reputation with those suppliers. However, more information is required to fully understand these trends.

Exercise 12.13

1. Assurance-type (expense based)

| Y6 | Accounts Receivable | 2,565,000 | ||

| Sales Revenue | 2,565,000 | |||

| (450 units x $5,700 each) | ||||

| to record sales on account | ||||

| Y6 | Warranty Expense | 24,650 | ||

| Cash | 24,650 | |||

| to record payment of warranty expenses | ||||

| Y6 | Warranty Expense | 73,950 | ||

| Warranty Liability | 73,950 | |||

| to record estimated future warranty liability | ||||

| ($98,600 - $24,650) | ||||

2. Service-type (revenue based)

| Y6 | Accounts Receivable | 2,565,000 | ||

| Sales Revenue | 2,427,100 | |||

| Unearned Warranty Revenue | 137,900 | |||

| (450 units × $5,700 each) = accounts receivable | ||||

| to record sales on account | ||||

| Y6 | Warranty Expense | 24,650 | ||

| Cash | 24,650 | |||

| to record payment of warranty expenses | ||||

| Y6 | Unearned Warranty Revenue | 34,475 | ||

| Warranty Revenue | 34,475 | |||

| $137,900 × ($24,650 ÷ $98,600) | ||||

| to remeasure unearned revenue - based on proportion of costs incurred (indicated in question) | ||||

Exercise 12.14

1. Assurance-type warranty

| Y8 | Cash | 18,670,000 | ||

| Sales Revenue | 18,670,000 | |||

| to record cash sales | ||||

| Y8 | Warranty Expense | 54,100 | ||

| Cash | 54,100 | |||

| to record warranty expense incurred | ||||

| Y8 | Warranty Expense | 325,000 | ||

| Warranty Liability | 325,000 | |||

| to accrue for estimated additional future warranty expenses | ||||

2. Service-type warranty

| Y8 | Cash | 18,670,000 | ||

| Sales Revenue | 17,800,000 | |||

| Unearned Warranty Revenue | 870,000 | |||

| to record cash sales | ||||

| Y8 | Warranty Expense | 54,100 | ||

| Cash | 54,100 | |||

| to record warranty expense incurred | ||||

| Y8 | Unearned Warranty Revenue | 348,000 | ||

| Warranty Revenue | 348,000 | |||

| $870,000 × 40% earned | ||||