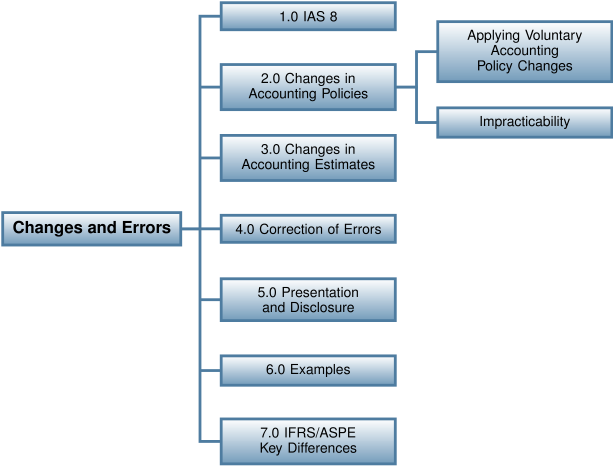

21.0 Changes and Errors

Learning Objectives

After completing this chapter, you should be able to:

- Describe the different types of accounting changes.

- Apply the appropriate method of accounting for an accounting policy change.

- Apply the appropriate method of accounting for an accounting estimate change.

- Apply the appropriate method of accounting for an error correction.

- Identify the disclosure requirements for different types of accounting changes.

- Describe the key differences between IFRS and ASPE with respect to the treatment of accounting changes and error corrections.

Introduction

As we have discovered in our previous discussions, accounting and financial reporting are time-sensitive activities. While the balance sheet represents the financial position of a company at a single point in time, the income statement and cash flow statements represent results for a defined period of time, usually one year. In attempting to present the economic truth of a company within the limitations of time, accountants are required to make choices, judgments, and estimations. It can be as simple as the choice of which depreciation method to use or determining the appropriate useful life for a piece of equipment. It is possible, however, that when accountants apply their judgment to make choices or estimates their judgment may later prove to be incorrect. Despite the extensive professional training that accountants receive, they can still make mistakes. Additionally, the need to produce timely information to fulfill the requirements of financial statement readers may sometimes result in less reliable information. In this chapter, we will examine different types of situations that can lead to both the revision of previously published financial information and to changes in the presentation of financial statements in the current and future periods.