20.7 Comprehensive Example: Both Methods

The example below will incorporate some different transactions that were discussed earlier in this course, or the prerequisite courses. These include more complex transactions such as long-term investments such as Available for Sale investments, long-term liabilities such as accrued pension liabilities, deferred income taxes payable or bonds issued at a discount and equity items such as convertible securities, stock options and re-acquisition and retirement of shares.

Below are three financial statements for Ace Ltd., as on December 31, 2020.

| Ace Ltd. Statement of Income For the Year Ended December 31, 2020 |

||||

|---|---|---|---|---|

| Sales | $1,400,000 | |||

| Cost of golds sold | 630,000 | |||

| Gross profit | 770,000 | |||

| Operating expenses | ||||

| Depreciation expense | $43,000 | |||

| Salaries and benefits expense | 120,000 | |||

| Utilities expenses | 50,000 | |||

| Travel expenses | 26,000 | |||

| Operating expenses, including rent expense | 80,000 | 319,000 | ||

| Income from operations | 451,000 | |||

| Other (non-operating) revenue and expenses: | ||||

| Investment income | 3,000 | |||

| Interest expense | (30,000) | |||

| Gain on sale of AFS investment | 3,000 | |||

| Loss on sale of machinery | (15,000) | (39,000) | ||

| Income before taxes | 412,000 | |||

| Income tax expense | 79,000 | |||

| Deferred tax recovery | (12,000) | 67,000 | ||

| Net income | $345,000 | |||

| Ace Ltd. Statement of Comprehensive Income For the Year Ended December 31, 2020 |

||

|---|---|---|

| Net income | $345,000 | |

| Other comprehensive income | ||

| Items that may be reclassified subsequently to net income or loss: | ||

| Increase in fair value, AFS investments (OCI)* | 44,000 | |

| Removal of unrealized gain on sale of AFS investment* | (3,000) | |

| Actuarial loss on defined benefit pension plan* | (20,000) | |

| Comprehensive income | 366,000 | |

* In the interest of simplicity, income taxes have been ignored.

| Ace Ltd. Balance Sheet As at December 31, 2020 |

|||

|---|---|---|---|

| 2020 | 2019 | ||

| Assets | |||

| Current assets | |||

| Cash | $50,000 | $30,000 | |

| Accounts receivable (net) | 110,000 | 145,000 | |

| Inventory | 175,000 | 200,000 | |

| Prepaid insurance expenses | 6,000 | – | |

| Total current assets | 341,000 | 375,000 | |

| Investments – available for sale (OCI) | 150,000 | 80,000 | |

| Property, plant, and equipment | |||

| Land | 380,000 | 200,000 | |

| Machinery | 1,700,000 | 1,500,000 | |

| Accumulated depreciation | (363,000) | (400,000) | |

| Total property, plant, and equipment | 1,717,000 | 1,300,000 | |

| Goodwill | 300,000 | 300,000 | |

| Total assets | $2,508,000 | $2,055,000 | |

| Liabilities and Shareholders’ Equity | |||

| Current liabilities | |||

| Accounts payable | $200,000 | $300,000 | |

| Salaries payable | 128,000 | 125,000 | |

| Income taxes payable | 115,000 | 120,000 | |

| Total current liabilities | 443,000 | 545,000 | |

| Long-term liabilities | |||

| 6%, convertible bonds payable, net | – | 750,000 | |

| 7.2% bonds payable, net | 453,000 | – | |

| Deferred income tax payable | 38,000 | 50,000 | |

| Accrued pension benefit liability | 85,000 | 75,000 | |

| Total long-term liabilities | 576,000 | 875,000 | |

| Total liabilities | 1,019,000 | 1,420,000 | |

| Shareholders’ Equity | |||

| Paid-in capital | |||

| Common shares | 1,210,000 | 500,000 | |

| Contributed capital, bond conversion rights | – | 35,000 | |

| Contributed capital, stock options | 62,000 | 50,000 | |

| Total paid-in capital | 1,272,000 | 585,000 | |

| Retained earnings | 192,000 | 46,000 | |

| Accumulated Other Comprehensive Income, pension |

(40,000) | (20,000) | |

| Accumulated Other Comprehensive Income, investments |

65,000 | 24,000 | |

| Total shareholders’ equity | 1,489,000 | 635,000 | |

| Total liabilities and shareholders’ equity | $2,508,000 | $2,055,000 | |

Additional information:

- Issued additional 7.2%, $500,000, 10-year bonds payable for cash of $452,000.

- Cash dividends were declared and paid.

- An AFS investment (OCI) was sold for $50,000 cash on January 2, 2020. Its original cost was $47,000 and had a carrying value of $50,000 (fair value) at the time of the sale. All unrealized gains previously recorded to OCI/AOCI for the sold investment were reclassified to net income. AFS investments of $76,000 were purchased for cash.

- There is a stock option plan for senior executives. In 2020, stock options with a book value of $15,000 were exchanged for common shares, along with $40,000 in cash. The remaining increase in the stock options account is due to the compensation expense included in the income statement as salaries and benefits.

- The six percent convertible bond payable was converted into common shares at the beginning of 2020.

- Land was acquired for cash.

- Machinery, with an original cost of $100,000 and a net book value of $20,000, was sold at a loss of $15,000. Additional machinery for other activities was acquired in exchange for common shares.

- Common shares with an average original issue price of $430,000 were retired for $485,000.

- The accrued pension benefit liability was increased by $20,000, due to an actuarial revaluation, and $10,000, because of the difference between funding and the pension expense.

- The company’s policy is to report dividends received, interest received, and interest paid as operating activities, and dividends paid as financing activities.

20.7.1. Preparing the Statement of Cash Flows: Indirect Method

Indirect Method Steps:

- Headings

- Record net income/(loss)

- Adjust out non-cash items from the income statement

- Current assets and current liabilities changes

- Non-current asset accounts changes

- Non-current liabilities and equity accounts changes

- Subtotal and reconcile

- Disclosures

Following the steps listed above, prepare a statement of cash flows using the indirect method. Details are provided below for each step, followed by the completed statement of cash flows.

Notes to the Solutions and Details About Calculations:

Step 1. Headings:

Insert headings and subheadings, leaving spaces within each section to record the relevant line items resulting from the subsequent steps.

Step 2. Record net income/(loss):

Net income (and not comprehensive income) is the starting point for a statement of cash flows with the indirect method. Comprehensive income will become relevant if any of the AFS investments are actually sold. Recall that upon sale, any unrealized gains or losses previously recorded to OCI will be realized and moved to retained earnings from AOCI.

Step 3. Adjustments:

When reviewing the income statement, non-cash items for depreciation, loss on sale of machinery, and realized gain on sale of AFS investments are reported. However, since this is a more complex example, there could be other hidden non-cash items that will become apparent when analyzing the non-current asset, liability, and equity accounts. Leave some space in this section in case other non-cash items are discovered in the accounts analysis.

Step 4. Current assets and liabilities:

Continue to use the accounting equation, A = L + E, to determine if the change amount for each non-cash working capital account is a positive number or a negative number (requiring a bracket).

Step 5. Non-current asset changes:

Analyze all the non-current asset accounts to determine the reasons for the changes in the accounts. Additional information taken from the various accounting records has been provided. Items 3, 6, and 7 pertain to non-current assets so this information will be incorporated into the step 5 analysis.

a. AFS investment (OCI):

| Long-term AFS investments | ||||

| 80,000 | ||||

| 50,000 | sale of investment | |||

| 76,000 | purchase of AFS investment | |||

| X = 44,000 | increase in fair value (OCI) | |||

| 150,000 | ||||

| AOCI, investments | ||||

| 24,000 | ||||

| 44,000 | increase in fair value (OCI) | |||

| 3,000 | remove realized gain on sale | |||

| 65,000 | ||||

Additional information:

In note # 3 states that $50,000 of AFS investments (fair value = carrying value) was sold for $50,000 cash, so there’s no gain or loss on the actual sale. However, the original cost was $47,000, so there is an accumulated unrealized gain of $3,000 ($50,000 fair value – $47,000 original cost) for the sold investment that was reclassified from OCI/AOCI to net income. This is confirmed by reviewing the income statement. This non-cash entry has already been adjusted in operating activities in Step 3, so no further action is required.

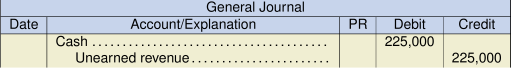

Entry for the sale:

Entry to reclassify:

Note # 3 also states that there was also a cash paid investment of $76,000.

The T-account requires another debit for $44,000 to balance properly. This must be for fair value changes and that is confirmed by reviewing the comprehensive income statement. This non-cash entry is not included in the income statement so no further action is necessary.

Analysis result: enter the cash amounts for the sale ($50,000) and the purchase of AFS investments ($76,000) highlighted in red in the investing activities section of the statement of cash flows.

b. Land:

| Land | ||||

| 200,000 | ||||

| X = 180,000 | purchase of land | |||

| 380,000 | ||||

Additional information in note # 6 states that land was purchased for cash.

There is no other information about the land account so the balancing amount of $180,000 must be the purchase price of the land.

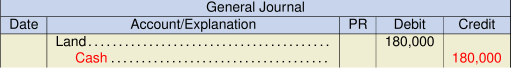

Entry for the purchase:

Analysis result: enter the cash amount for the purchase of land ($180,000) highlighted in red in the investing activities section of the statement of cash flows.

c. Machinery:

| Machinery | ||||

| 1,500,000 | ||||

| 100,000 | sale of machinery | |||

| X = 300,000 | purchase of machinery for shares | |||

| 1,700,000 | ||||

| Accumulated depreciation | ||||

| 400,000 | ||||

| 80,000 | sale of machinery | |||

| 43,000 | X = current year depreciation | |||

| 363,000 | ||||

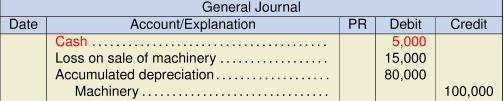

Additional information note # 7 states that there was a loss from the sale of machinery of $15,000 that originally cost $100,000. The carrying value at the time of the sale was $20,000. The cash amount for the sale would therefore be $5,000 ($20,000 carrying value – $15,000 loss). The accumulated depreciation for the sold machinery would be $80,000 ($100,000 original cost – $20,000 carrying loss).

Entry for the sale:

Accumulated depreciation requires another $43,000 credit to balance properly. This must be for the current year depreciation expense and that is confirmed by reviewing the income statement. This non-cash entry has already been adjusted in operating activities in Step 3, so no further action is required.

Note # 7 also stated that additional machinery was purchased in exchange for common shares. The balancing amount of $300,000 would account for this non-cash transaction which is not included in the SCF except as a supplemental disclosure required for non-cash items.

Analysis result: enter the cash amount for the sale of machinery ($5,000) highlighted in red in the investing activities section of the statement of cash flows.

Step 6. Non-current liabilities and equity changes:

Analyze all the non-current liability and equity accounts to determine the reasons for the changes in the accounts. Additional information taken from the various accounting records has been provided. Items 1, 2, 4, 5, 8, and 9 pertain to non-current liabilities and equity so this information will be incorporated into the step 6 analysis.

d. 6% bonds payable:

| 6% Convertible bonds payable | ||||

| 750,000 | ||||

| X = 750,000 | conversion of bonds to shares | |||

| – | ||||

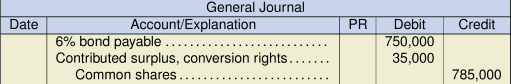

Additional information note # 5 states that these bonds were converted into common shares in 2020. The equity portion for the conversion rights of $35,000 will also be removed from the contributed surplus account.

Entry for the conversion:

This is a non-cash entry which is not included in the SCF except as a supplemental disclosure required for non-cash items.

Analysis result: no cash entries to record

e. 7.2% bonds payable:

| 7.2% Bonds payable | ||||

| – | ||||

| 452,000 | issuance of bonds | |||

| 1,000 | X = amortized discount | |||

| 453,000 | ||||

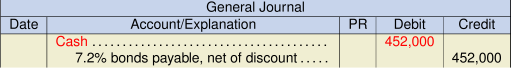

Additional information note # 1 states that bonds with a face value of $500,000 were issued for cash of $452,000. The discount amount would be $48,000 ($500,0000 – $452,000) which will be amortized.

Entry for the bond issuance:

The balancing amount of $1,000 must therefore be for amortization of the discount which will be included in net income as part of interest expense of $30,000. This $1,000 non-cash amount should be adjusted from net income in operating activities because it was not done in Step 3.

Analysis result: enter the cash amount for the bond issuance ($452,000) and adjust the $1,000 amortization expense highlighted in red in the financing activities section of the statement of cash flows.

f. Deferred income tax payable:

| Deferred Income Tax Payable | ||||

| 50,000 | ||||

| X = 12,000 | reduction of taxes | |||

| 38,000 | ||||

There is no additional information regarding this account. The balancing amount of $12,000 must be for a deferred income tax recovery which is confirmed by a review of the income statement. This non-cash entry was included in net income but not adjusted in Step 3, so it should be adjusted in the operating section now.

Analysis result: enter the non-cash amount for the deferred tax recovery ($12,000) highlighted in red in the operating activities section as an adjustment to net income.

g. Accrued pension benefit liability:

| Accrued Pension Benefit Liability | ||||

| 75,000 | ||||

| 20,000 | actuarial revaluation | |||

| X = 10,000 | funding amount greater than | |||

|

pension expense |

||||

| 85,000 | ||||

| AOCI, Pension Benefits | ||||

| 20,000 | ||||

| 20,000 | actuarial revaluation | |||

| 40,000 | ||||

Additional information note #9 states that this liability was increased by $20,000 due to an actuarial revaluation. This non-cash adjusting entry to OCI/AOCI was not included in net income so it will be omitted from the SCF.

Note #9 also states that the remaining difference was due to the difference between the funding (cash paid) and the pension expense.

Entries for pension benefit:

The pension expense amount is not known but the funding (cash) amount is known to be greater than the pension expense by $10,000. Even though this is a non-current liability, it’s purpose is to benefit employees and not as a source of financing cash flow. For this reason, it is more appropriate to record this non-current liability reduction as an operating activity instead of a financing activity.

Analysis result: enter the cash difference amount ($10,000) highlighted in red as an operating activity item for the reduction in the pension liability.

h. Common shares:

| Common shares | ||||

| 500,000 | ||||

| 300,000 | machinery in exchange for shares | |||

| 785,000 | 6% bonds converted | |||

| 430,000 | shares repurchase | |||

| 55,000 | options exercise for shares | |||

| 1,210,000 | ||||

| Contributed Surplus – Stock Options | ||||

| 50,000 | ||||

| 15,000 | options exercised for shares | |||

| 27,000 | X = compensation expense (non-cash) | |||

| 62,000 | ||||

Additional information note #8 states that shares with an original price of $430,000 were retired for $485,000 cash. The difference is to be debited to retained earnings.

Entry for shares repurchase:

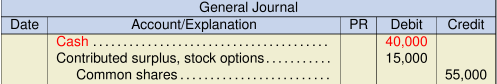

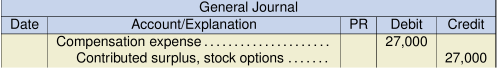

Additional information note #4 states that $15,000 of stock options were exercised along with an additional $40,000 in cash for common shares. The difference in the contributed surplus account was due to compensation expense.

Entry for exercise of options:

Entry for compensation expense:

It is now evident that $27,000 of the compensation expense included in net income in salaries and benefits line item is a non-cash transaction that was not adjusted in Step 3. This amount should therefore be adjusted out of net income in operational activities now.

Analysis result: enter the cash amount for the shares repurchase ($485,000) and the cash amount for stock options ($40,000) highlighted in red in the investing activities section of the statement of cash flows. Also, enter the adjusting entry ($27,000) highlighted in red in the operating activities section of the statement of cash flows.

i. Retained earnings:

| Retained earnings | ||||

| 46,000 | ||||

| 345,000 | net income | |||

| 55,000 | stock options | |||

| X = 144,000 | dividends paid | |||

| 192,000 | ||||

Additional information note #2 states that dividends were declared and paid but no amount given. The balancing amount to retained earnings of $144,000 must therefore be the amount of the dividend.

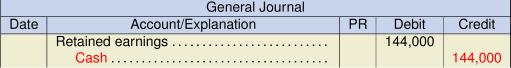

Entry for dividends paid:

Analysis result: enter the dividend amount ($144,000) highlighted in red in the financing activities section of the statement of cash flows.

Step 7. Subtotal and reconcile:

Calculate subtotals for each section and also for net cash flows. Reconcile the net amount to the opening and closing cash balances from the balance sheet.

Step 8. Required disclosures:

Prepare the additional disclosures for cash paid interest and income taxes.

Below is the prepared statement of cash flows based on the steps discussed above.

![]()

Disclosures:

Cash paid for income taxes ![]()

Cash paid for interest charges ![]()

Machinery ($300,000) was purchased in exchange for shares.

Six percent convertible bonds ($750,000), and contributed surplus rights ($35,000), were converted to common shares.

Stock options ($15,000) and cash ($40,000) were exercised for common shares.

20.7.2. Operating Activities Section: Direct Method

We will once again use the comprehensive illustration above for Ace Ltd. to demonstrate the completion of the operating activities section using the direct method. The first example explained below demonstrates how to prepare a direct method statement on its own. The second example demonstrates a quick technique to convert an already prepared indirect statement of cash flows into a direct method format.

Direct Method Steps:

- Headings and categories

- Three additional columns

- Record each income statement reporting line amount to its respective direct method category under the Income Statement Accounts column. Non-cash items are shown as memo items only.

- Record the net change amount for each non-cash working capital account. Also record any adjustment amounts resulting from the analysis of non-current accounts from the investing or financing sections (highlighted in blue below).

- Calculate the net cash flow amount for each category.

- Calculate the subtotal for the operating activities section.

In this example, steps 1 and 2 are self-explanatory. Steps 3, 4, and 5 are represented by entries in each of the columns in the schedule above. Note that this example is more complex as some non-cash costs were embedded with other income statement expenses initially treated as cash items and left unadjusted. There was also a reduction in the non-current pension liability which was more appropriately reported as an operating activity. These items were discovered when the analysis of the non-current assets (investing activities), liabilities and equity (financing activities) were completed. As a result, there are four additional adjusting entries (e, f, g and h) that must be adjusted in Step 4 of the operating section above (highlighted in blue).

In this example, steps 1 and 2 are self-explanatory. Steps 3, 4, and 5 are represented by entries in each of the columns in the schedule above. Note that this example is more complex as some non-cash costs were embedded with other income statement expenses initially treated as cash items and left unadjusted. There was also a reduction in the non-current pension liability which was more appropriately reported as an operating activity. These items were discovered when the analysis of the non-current assets (investing activities), liabilities and equity (financing activities) were completed. As a result, there are four additional adjusting entries (e, f, g and h) that must be adjusted in Step 4 of the operating section above (highlighted in blue).