20.4 Interpreting the Results

This section will focus on interpreting the results using the indirect method statement of cash flows, as it is the method most widely used in business today. For convenience, the entire statement of cash flows indirect method for Watson Ltd. is reproduced below.

| Watson Ltd. Statement of Cash Flows – Indirect Method For the Year Ended December 31, 2020 |

||

|---|---|---|

| Cash flows from operating activities | ||

| Net income (loss) | $77,000 | |

| Non-cash items (adjusted from net income): | ||

Depreciation expense |

43,000 | |

Gain from sale of building |

(5,000) | |

Cash in (out) from operating working capital: |

||

Increase in trading investments |

(2,000) | |

Increase in accounts receivable |

(84,510) | |

Decrease in notes receivable |

3,550 | |

Increase in inventory |

(58,970) | |

Increase in prepaid expenses |

(3,450) | |

Increase in accounts payable |

143,000 | |

Decrease in interest payable |

(8,400) | |

Decrease in income taxes payable |

(5,880) | |

Decrease in unearned revenue |

(200,000) | |

| Net cash flows from operating activities | (101,660) | |

| Cash flows from investing activities | ||

Purchase of HTM investments |

(30,750) | |

Sales proceeds from sale of building |

55,000 | |

Sales proceeds from sale of patent |

14,300 | |

| Net cash flows from investing activities | 38,550 | |

| Cash flows from financing activities | ||

| Repayment of long-term note | (19,000) | |

| Proceeds from shares issuance | 182,200 | |

| Dividends paid | (42,590) | |

| Net cash flows from financing activities | 120,610 | |

| Net increase (decrease) in cash | 57,500 | |

| Cash, January 1 | 250,000 | |

| Cash, December 31 | 307,500 | |

| Disclosures: | ||

| Cash paid for income taxes | $38,880 | |

| ( |

||

| Cash paid for interest charges | 11,400 | |

| ( |

||

| Cash received for dividend income | 3,000 |

The cash balance shows an increase of $57,500 for the current year. On the surface, a hasty conclusion could be drawn that all is well with Watson Ltd., as their bottom line is a positive cash flow. However, there is, in fact, trouble ahead for this company. We know this because the operating activities section, which represents the reason for being in business, is in a negative cash flow position. In other words, a company is expected to earn a profit, resulting in positive cash flows reflected in the operating activities section. However, in this case there is a negative cash flow of $101,660 from operating activities. Why?

For Watson Ltd., both the accounts receivable and inventory have increased, resulting in a net decrease in cash of $143,480. An increase in accounts receivable may mean that sales have occurred but the collections are not keeping pace with the sales on account. An increase in inventory may be because there have not been enough sales in the current year to cycle the inventory from current asset, to sales/profit, and, ultimately, to cash. However, the risk of holding large amounts of inventory is the increased possibility that the inventory will become obsolete, damaged, and unsellable.

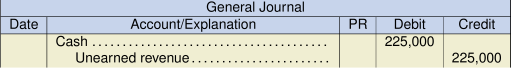

In this example, an additional reason for decreased net cash from operating activities is due to a decrease in unearned revenue. Recall that unearned revenue is cash received from customers in advance of the company providing the goods and services. In this case, the cash would have been reported as a positive cash flow in the operating activities section in the previous reporting period when the cash was actually received. At that time, the cash generated from operating activities would have increased by the amount of cash received for the unearned revenue. The entry upon receipt of the cash would have been:

When the company finally provides the goods and services to the customer, the net income reported at the top of the operating activities section will reflect the portion of the unearned revenue that has now been earned. However, the company did not obtain actual cash for this revenue in this reporting period since the cash was received in the prior reporting period. Keep in mind that unearned revenue is not normally an obligation that must be paid in cash to the customer, and getting customers to pay in advance is always a good cash management strategy. That said, once the goods and services are provided to the customer, the obligation ceases.

Listed in the investing activities section, there was a sale of a building and a purchase of a long-term investment in Held to Maturity (HTM) Investments. The sales proceeds from the building may have been partially invested in the HTM to make a return on the cash proceeds until it can be used in the future for its intended purpose. However, more analysis would be required to confirm whether this was the case. The sale of the patent also generated a positive cash flow. There was no gain on the sale of the patent reported in the income statement, so the sales proceeds did not exceed its carrying value at the time it was sold. Ideally, the patent would not have been sold in a panic, in an effort to raise immediate additional cash at the expense of future cash flows it could have generated.

Looking at the financing activities section, it is clear that the majority of cash inflows for this reporting period resulted from the issuance of additional common shares worth $182,200. This represents an increase in the share capital of more than 25%. Increased shares will have a negative impact on the earnings per share, and possibly the market price as well, which may give investors pause. The shareholders were also paid dividends of $42,590, but this amount only just covers the preferred shareholders dividend of $30,000 (![]() ) plus its share of the participating dividend. This leaves very little dividends for the common shareholders, a situation likely to cause concern among the common shareholder investors, made worse by the dilution of their holdings due to the large issuance of additional shares.

) plus its share of the participating dividend. This leaves very little dividends for the common shareholders, a situation likely to cause concern among the common shareholder investors, made worse by the dilution of their holdings due to the large issuance of additional shares.

When looking at the opening and closing cash balances for Watson Ltd., they seem like sizeable amounts. However, we must look at where the cash originated from. In this case, the $250,000 opening balance was due almost entirely to the $225,000 unearned revenue received in advance, which is not an ongoing source of capital. The ending cash balance of $307,500 was due to the issuance of additional share capital of $182,200 (a one-time transaction), plus an increase in accounts payable of $143,000 that will eventually have to be repaid. Consider also that during the year, the cash from the unearned revenues was being consumed and the issuance of the additional capital had not yet occurred. It would be no surprise, then, if cash at the mid-year point was insufficient to cover even the current liabilities, hence the increase in accounts payable and, ultimately, the issuance of additional capital shares.

In summary, Watson Ltd. is currently unable to generate positive cash flows from its operating activities. The unearned revenue of $225,000 at the start of the year added some needed cash early on, but this reserve was depleted by the end of the reporting year. In the meantime, without a significant change in how the company manages its inventory and receivables, Watson Ltd. may continue to experience a shortage of cash from its operating activities. To compensate, it may continue to sell off assets, issue more shares, or incur more long-term debt in order to obtain the needed cash. In any case, these sources will eventually dry up when investors are no longer willing to invest, creditors are no longer willing to extend loans, and no assets remain worth selling. Watson Ltd.’s current negative cash position from operating activities is unsustainable and must be turned around quickly for the company to remain a going concern.