20.2 Statement of Cash Flows: Indirect Method Review

The statement of cash flows using the indirect method has been discussed in most introductory accounting courses. Since the statement of cash flows can be challenging, a review of the basic concepts is presented below.

The purpose of the statement of cash flows is to provide a means “to assess the enterprise’s capacity to generate cash and cash equivalents, and to enable users to compare cash flows of different entities” (CPA Canada, 2016, Accounting, Part II, Section 1540.01 and IAS 7.4). This statement is an integral part of the financial statements for three reasons. First, this statement helps readers to understand where these cash flows in (out) originated from during the current year. This helps management, shareholders, and creditors to assess a company’s liquidity, solvency, and financial flexibility. Second, these historic cash flows in (out) can be used to predict future company performance. Third, the statement of cash flows can shed light on a company’s quality of earnings and if there may be a disconnect between reported earnings and net cash flows from operating activities, as explained earlier.

Two methods are used to prepare a statement of cash flows, namely the indirect method and the direct method. The indirect method was discussed in previous accounting courses and will be reviewed again in this chapter. The direct method introduced in this chapter may be new for many students. Both methods organize the reported cash flows into three activities: operating, investing, and financing. As discussed next, the difference between the two methods occurs only in the first section for operating activities.

The indirect method reports cash flows from operating activities into categories such as:

- Net income/loss is reported.

- A series of adjustments to net income/loss for non-cash items are reported in the income statement.

- Changes in each non-cash working capital account. The current portion of long-term debt, including lease obligations and dividends payable, are not considered to be working capital accounts. They are included with their respective account to which they relate. For example, the current portion of long-term debt or lease is included with its related long-term liability account. Dividends payable is included with its related retained earnings account.

The direct method reports cash flows from operating activities into categories based on the nature of the cash flows, such as:

- cash received for sales

- cash paid for goods and services

- cash paid to or on behalf of employees

- cash received and paid for interest

- cash received and paid for dividends

- cash paid for income taxes

The statement of cash flows above for Wellbourn Services Ltd. is an example of a statement using the direct method. Note that the operating section line items using the direct method are based on the nature of the cash flows, whereas the indirect method line items are based on their connections with the income statement and working capital accounts.

There are some similarities between the two methods. For instance, the net cash flows from operating activities is the same for both methods, and the investing and financing activities are identical for both methods as well.

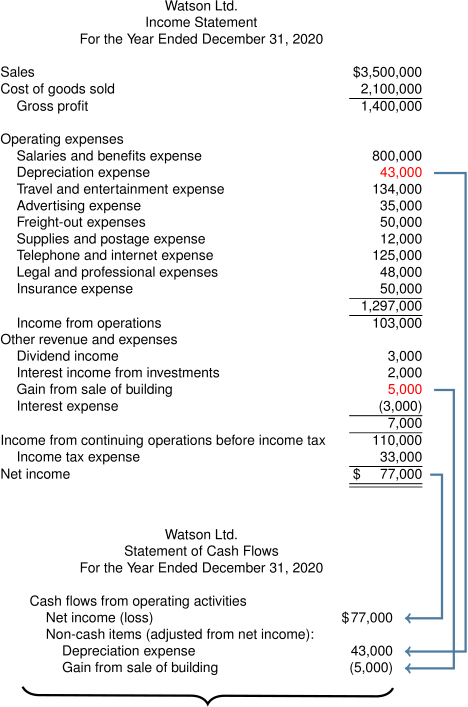

Below is an example of the format using the indirect method. Note the connections to the other financial statements.

20.2.1. Differences Between IFRS and ASPE

There are differences in some of the reporting items between IFRS and ASPE. For example, ASPE has mandatory disclosures as follows:

- cash dividends received and interest received or paid if reported in net income – operating section

- interest or cash dividends debited to retained earnings – financing section

- Cash paid income taxes are often reported separately but it is not a reporting requirement.

For IFRS, there are policy choices that, once made, should be applied consistently:

- interest received – choice of operating or investing section

- interest paid – choice of operating or financing section

- dividends received – choice of operating or investing section

- dividends paid – choice of operating or financing section

- cash paid income taxes – separately reported

For simplicity, this chapter will use the following norms for both IFRS and ASPE:

- interest received – operating section

- interest paid – operating section

- dividends received – operating section

- dividends paid – financing section

- income taxes paid – separately reported

As illustrated above, when using the indirect method, the sum of the non-cash adjustments to net income and changes to non-cash working capital accounts result in the total cash flows in (out) from operating activities. The other two activities for investing and financing follow. Any non-cash transactions occurring in the investing or financing sections are not reported in a statement of cash flows. Instead, they are disclosed separately in the notes to the financial statements. Examples of non-cash transactions would be an exchange of property, plant, or equipment for common shares, or the conversion of convertible bonds payable to common shares and stock dividends. If the transaction is a mix of cash and non-cash, the cash-related portion of the transaction is reported in the statement of cash flows with a note in financial statements detailing the non-cash and cash elements. The final section of the statement reconciles the net change in cash flows of the three activities, with the opening and closing cash and cash equivalents balances taken from the balance sheet.

20.2.2. Preparing a Statement of Cash Flows: Indirect Method

Presented below is the balance sheet and income statement for Watson Ltd.

| Watson Ltd. Balance Sheet As at December 31, 2020 |

||

|---|---|---|

| 2020 | 2019 | |

| Assets | ||

| Current assets | ||

| Cash | $307,500 | $250,000 |

| Investments (Held for trading at fair value) | 12,000 | 10,000 |

| Accounts receivable (net) | 249,510 | 165,000 |

| Notes receivable | 18,450 | 22,000 |

| Inventory (at lower of FIFO cost and NRV) | 708,970 | 650,000 |

| Prepaid insurance expenses | 18,450 | 15,000 |

| Total current assets | 1,314,880 | 1,112,000 |

| Long term investments (Held to maturity at cost) | 30,750 | 0 |

| Property, plant, and equipment | ||

| Land | 92,250 | 92,250 |

| Building (net) | 232,000 | 325,000 |

| 324,250 | 417,250 | |

| Intangible assets (net) | 110,700 | 125,000 |

| Total assets | 1,780,580 | 1,654,250 |

| Liabilities and Shareholders’ Equity | ||

| Current liabilities | ||

| Accounts payable | 221,000 | 78,000 |

| Accrued interest payable | 24,600 | 33,000 |

| Income taxes payable | 54,120 | 60,000 |

| Unearned revenue | 25,000 | 225,000 |

| Current portion of long-term notes payable | 60,000 | 45,000 |

| Total current liabilities | 384,720 | 441,000 |

| Long-term notes payable (due June 30, 2025) | 246,000 | 280,000 |

| Total liabilities | 630,720 | 721,000 |

| Shareholders’ equity | ||

| Paid in capital | ||

| Preferred, ($2, cumulative, participating – authorized issued and outstanding, 15,000 shares) | 184,500 | 184,500 |

|

Common (authorized, 400,000 shares; issued and outstanding (O/S) 250,000 shares for 2020);(2019: 200,000 shares issued and O/S)

|

862,500 | 680,300 |

| Contributed surplus | 18,450 | 18,450 |

| 1,065,450 | 883,250 | |

| Retained earnings | 84,410 | 50,000 |

| 1,149,860 | 933,250 | |

| Total liabilities and shareholders’ equity | 1,780,580 | 1,654,250 |

| Watson Ltd. Income Statement As at December 31, 2020 |

||

|---|---|---|

| Sales | $3,500,000 | |

| Cost of goods sold | 2,100,000 | |

| Gross profit | 1,400,000 | |

| Operating expenses | ||

| Salaries and benefits expense | 800,000 | |

| Depreciation expense | 43,000 | |

| Travel and entertainment expense | 134,000 | |

| Advertising expense | 35,000 | |

| Freight-out expenses | 50,000 | |

| Supplies and postage expense | 12,000 | |

| Telephone and internet expense | 125,000 | |

| Legal and professional expenses | 48,000 | |

| Insurance expense | 50,000 | |

| 1,297,000 | ||

| Income from operations | 103,000 | |

| Other revenue and expenses | ||

| Dividend income | 3,000 | |

| Interest income from investments | 2,000 | |

| Gain from sale of building | 5,000 | |

| Interest expense | (3,000) | |

| 7,000 | ||

| Income from continuing operations before income tax | 110,000 | |

| Income tax expense | 33,000 | |

| Net income | 77,000 | |

Additional information:

- The trading investment does not meet the criteria to be classified as a cash equivalent (see section 20.8 Specific Items for a discussion on cash equivalents) and no purchases or sales took place in the current year.

- An examination of the intangible assets sub-ledger revealed that a patent had been sold in the current year. The intangible assets have an indefinite life.

- No long-term investments were sold during the year.

- No buildings or patents were purchased during the year.

- There were no other additions to the long-term note payable during the year.

- Common shares were sold for cash. No other share transactions occurred during the year.

- Cash dividends were declared and paid.

- The note receivable maturity date is January 31, 2021, and was for a sale.

The statement of cash flows is the most complex statement to prepare. This is because preparation of the entries requires analysis of multiple accounts. Moreover, the transactions resulting in cash inflows are to be differentiated from the transactions resulting in cash outflows for each account. Preparing a statement of cash flows is made much easier if specific sequential steps are followed. Below is a summary of those steps.

- Complete the statement headings.

- Operating activities section – record the net income/(loss).

- Adjust out any non-cash line items reported in the income statement to remove them from the statement of cash flows. Examples of these are depreciation, amortization, and most gains or losses such as gains/losses from the sale of assets, gain/loss from redemption of debt, impairment losses, and fair value changes reported in net income.

- Record the description and change amount for each non-cash working capital account (current assets and current liabilities) except for the current portion of long-term debt line item since it is not a working capital account. Subtotal the operating activities section.

- Investment activities section – using T-accounts or other techniques, determine the change for each non-current (long-term) asset account. Analyze and determine the reason for the change(s). Record the reason and change amount(s) as cash inflows or outflows.

- Financing activities section – add back to long-term debt any current portion identified in the SFP/BS for both years, if any. Using T-accounts, or other techniques, determine the change for each non-current (long-term) liability and equity account. Analyze and determine the reason for the change(s). Record the reason and change amount(s) as cash inflows or outflows. One anomaly occurs with pension benefit liability. This liability is non-current, but it is not a financing activity as its nature is to benefit employees. For this reason, any change in funding for the pension liability, even though classified as non-current, is to be reported in operating activities.

- Subtotal the three sections. Record the opening and closing cash, including cash equivalents, if any. Reconcile the opening balance plus the subtotal from the three sections to the closing balance to ensure that the accounts balance correctly.

- Complete any required disclosures.

Here is a summary of the steps above, labelled with a key word or phrase for you to remember:

- Headings

- Record net income/(loss)

- Adjust out non-cash items

- Current assets and current liabilities changes

- Non-current asset accounts changes

- Non-current liabilities and equity accounts changes

- Subtotal and reconcile

- Disclosures

Applying the Steps:

Step 1. Headings:

| Watson Ltd. Balance Sheet As at December 31, 2020 |

||||||

|---|---|---|---|---|---|---|

| Cash flows from operating activities | ||||||

| Net income (loss) | ||||||

| Non-cash items (adjusted from net income): | ||||||

| Net cash from operating activities | ||||||

| Cash flows from investing activities | ||||||

| Net cash from investing activities | ||||||

| Cash flows from financing activities | ||||||

| Net cash from financing activities | ||||||

| Net increase (decrease) in cash | ||||||

| Cash, January 1 | ||||||

| Cash, December 31 | ||||||

Step 2. Record net income/(loss):

As illustrated in step 3 below.

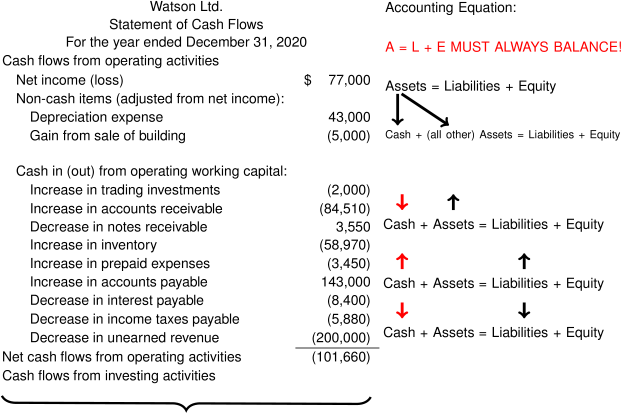

Step 3. Adjustments:

Enter the amount of the net income/(loss) as the first amount in the operating activities section. Next, review the income statement and select all the non-cash items. Look for items such as depreciation, depletion, amortization, and gains or losses (such as with the sale or disposal of assets). In this case, there are two non-cash items to adjust from net income. Record them as adjustments to net income in the statement of cash flows.

Step 4. Current assets and liabilities:

Calculate and record the change between the opening and closing balances for each non-cash working capital account as shown below (with the exception of the current portion of long-term notes payable, which is netted with its respective long-term notes payable account) as shown below:

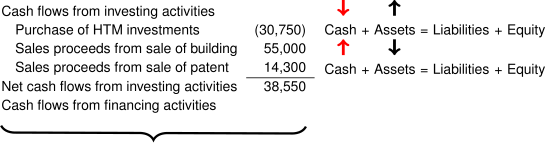

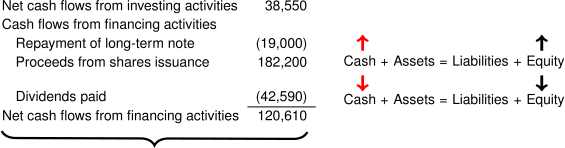

Cash inflows to the company are reported as positive numbers while cash outflows are reported as negative numbers using brackets. How does one determine if the amount is a positive or a negative number? A simple tool is to use the accounting equation to determine whether cash is increasing as a positive number or decreasing as a negative number. Recall the accounting equation:

Assets = Liabilities + Equity

This must always remain in balance. This equation can be applied when analyzing the various accounts to record the changes. For example, accounts receivable has increased from $165,000 to $249,510 for a total increase of $84,510. Using the accounting equation, this can be expressed as:

A = L + E

Expanding the equation a bit:

Cash + accounts receivable + all other assets = Liabilities + Equity

If accounts receivable INCREASES by $84,510, then this can be expressed as a black up-arrow above the account in the equation:

Holding everything in the equation constant, except for cash, if accounts receivable INCREASES, then the effect on the cash account must have a corresponding DECREASE in order to keep the equation balanced:

If cash DECREASES, then it is a cash outflow and the number must be negative with brackets as shown in the statement above.

Conversely, when analyzing liability or equity accounts, the same technique can be used. For example, an increase in account payable (liability) of $143,000 will affect the equation as follows:

Again, holding everything else constant except for cash, if accounts payable INCREASES as shown by the black up-arrow above, then cash must also INCREASE by a corresponding amount in order to keep the equation in balance.

If cash INCREASES, then it is a cash inflow and the number will be positive with no brackets as shown in the statement above.

Step 5. Non-current asset changes:

The next section to complete is the investing activities section. The analysis of all of the non-current assets accounts must also take into account whether there have been any current year purchases, disposals, or adjustments as part of the analysis. The use of T-accounts for this type of analysis provides a useful visual tool to help understand whether the changes that occurred in the account are cash inflows or outflows, as shown below.

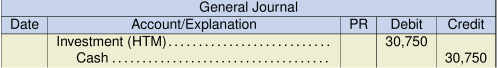

There are four non-current asset accounts: long-term investments, land, buildings, and intangible assets. The land account had no change, as there were no purchases or sales of land. Analyzing the investment account results in the following cash flows:

| Long-term investment | ||||

| – | ||||

| ?? | = purchase of investment | |||

| 30,750 | ||||

Additional information in note #3 above stated that there were no sales of long-term investments during the year, the entry would have been for a purchase:

Cash paid for the investment was therefore $30,750.

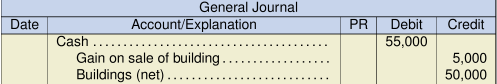

Analysis of the buildings account is a bit more complex because of the effects of the contra account for accumulated depreciation. In this case, the buildings account, and its contra account, must be merged together since the SFP/BS reports only the net carrying amount. Analyzing the buildings account results in the following cash flows:

| Building (net of accum. depr.) | ||||

| 325,000 | ||||

| 43,000 | current year accum. Depr. | |||

| 50,000 | = X sale of building | |||

| 232,000 | ||||

Additional information note # 4 states that no buildings were purchased so the

balancing amount of $50,000 must be for a sale of a building.

Since there was a gain from the sale of buildings, the entry would have been:

The sale of the patent is straightforward since there were no other sales, purchases, or amortization in the current year (as stated in steps 2 and 4).

Step 6. Non-current liabilities and equity changes:

There are five long-term liability and equity accounts: long-term notes payable, preferred shares, common shares, contributed surplus, and retained earnings. The preferred shares and contributed surplus accounts had no changes to report. Note that just because an account balance has no change during the year, this does not necessarily mean that there were no transactions. For example, old shares could be retired and new shares issued for the same face value. These transactions would need to be reported in the cash flow statement, even though the net change in the account is zero.

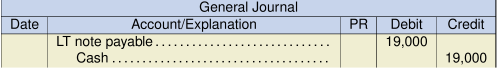

Analyzing the long-term notes payable account results in the following cash flows:

| Long-term note payable | ||||

| 325,000 | the sum of both the current and long-term amounts | |||

| 19,000 | X = repayment | |||

| 306,000 | the sum of both the current and long-term amounts | |||

Since there were no other transactions stated in the additional information note # 5 above,

the entry would have been:

Cash paid was therefore $19,000.

Note how the current portion of long-term debt has been included in the analysis of the long-term note payable. The current portion line item is a reporting requirement relating to the principal amount owing one year after the reporting date. As it is not actually a working capital account, it is omitted from the operating section and included with its corresponding long-term liability account in the financing activities. For example, the opening balance of $325,000 above is the sum of the current portion ($45,000) plus the long-term portion ($280,000). Similarly, the ending balance of $306,000 is the sum of the current portion ($60,000) plus the long-term portion ($246,000).

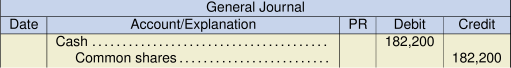

The common shares and retained earnings accounts are straightforward and the analysis of each is shown below.

| Common shares | ||||

| 680,300 | ||||

| 182,200 | X = share issuance | |||

| 862,500 | ||||

Since there were no other transactions stated in the additional information note #6 above, the entry would have been:

Cash received was therefore $182,200.

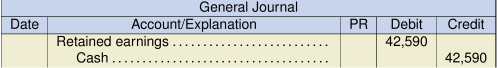

| Retained earnings | ||||

| 50,000 | ||||

| 77,000 | net income | |||

| X = 42,590 | dividends paid | |||

| 84,410 | ||||

The additional information note #7 stated that cash dividends were declared

and paid, so the entry would have been:

Cash paid was therefore $42,590.

Step 7. Subtotal and reconcile:

The three activities total a net increase in cash of $57,500. When added to the opening cash balance of $250,000, the resulting total of $307,500 is equal to the ending cash balance for the year ending December 31, 2020. This can be seen in the completed statement of cash flows following step 8.

Step 8. Required disclosures:

The statement of cash flows using the indirect method must separately disclose the cash flows for:

- Interest paid

- Interest received

- Dividends received (dividends paid are reported in the financing section)

- Cash paid income taxes

- Non-cash transactions that may have occurred in the current year.

If not too lengthy, these items can be disclosed in the notes or at the bottom of the statement. The cash received for dividend income and interest income was taken directly from the income statement since no accrual accounts exist on the balance sheet for these items. Cash paid for interest charges and income taxes are calculated on the basis of an analysis of their respective liability accounts from the balance sheet and expense accounts from the income statement.

Below is the completed statement of cash flows using the indirect method with required disclosures for Watson Ltd., for the year ending December 31, 2020:

| Watson Ltd. Statement of Cash Flows As at December 31, 2020 |

||

|---|---|---|

| Cash flows from operating activities | ||

| Net income (loss) | $77,000 | |

| Non-cash items (adjusted from net income): | ||

| Depreciation expense | 43,000 | |

| Gain from sale of building | (5,000) | |

| Cash in (out) from operating working capital: | ||

| Increase in trading investments | (2,000) | |

| Increase in accounts receivable | (84,510) | |

| Decrease in notes receivable | 3,550 | |

| Increase in inventory | (58,970) | |

| Increase in prepaid expenses | (3,450) | |

| Increase in accounts payable | 143,000 | |

| Decrease in interest payable | (8,400) | |

| Decrease in income taxes payable | (5,880) | |

| Decrease in unearned revenue | (200,000) | |

| Net cash flows from operating activities | (101,660) | |

| Cash flows from investing activities | ||

| Purchase of HTM investments | (30,750) | |

| Sales proceeds from sale of building | 55,000 | |

| Sales proceeds from sale of patent | 14,300 | |

| Net cash flows from investing activities | 38,550 | |

| Cash flows from financing activities | ||

| Repayment of long-term note | (19,000) | |

| Proceeds from shares issuance | 182,200 | |

| Dividends paid | (42,590) | |

| Net cash flows from financing activities | 120,610 | |

| Net increase (decrease) in cash | 57,500 | |

| Cash, January 1 | 250,000 | |

| Cash, December 31 | 307,500 | |

| Disclosures: | ||

| Cash paid for income taxes | $38,880 | |

| ( |

||

| Cash paid for interest charges | 11,400 | |

| ( |

||

| Cash received for dividend income | 3,000 |

Note that the interest income of $2,000 reported in the income statement is not included in the additional disclosures shown above. This is because the interest income was accrued as an adjusting entry regarding the trading investments, so it was not a cash-received item.