18.3 Reacquiring Shares

Companies will sometimes buy back their own shares, often done to try to stabilize their share price or improve certain financial ratios, such as earnings per share. A share may also be repurchased as a way to return excess cash to shareholders without having to pay a dividend. Additionally, there may also be certain strategic benefits in repurchasing shares. Whatever the reason, the result is the same: the shares are no longer outstanding. After repurchase, the shares may continue to be held by the company as issued shares, which are referred to as treasury shares, or they may be cancelled. If they are held as treasury shares, they may be resold at a later date to new shareholders. However, if the shares are cancelled, then they must be completely removed from the accounting records. Note that some jurisdictions do not allow treasury shares, meaning that any repurchased shares must be immediately cancelled. We will examine the re-acquisition of shares for both cancellation and non-cancellation situations below.

Shares Repurchased and Cancelled

The IFRS does not provide any specific guidance on how to account for the repurchase of shares. However, ASPE does provide a set of steps to apply when shares are either repurchased or cancelled. These procedures contemplate two possible situations:

- The shares’ acquisition cost is greater than, or equal to, the assigned value.In this situation, the acquisition cost is allocated in the following sequence:

- First to share capital in an amount equal to the par, stated, or assigned value

- Any excess to contributed surplus, to the extent that the balance of contributed surplus was created by a previous cancellation of the same class of shares

- Any further excess to contributed surplus in an amount equal to the pro-rata share of the contributed surplus that arose from transactions, other than those above, in the same class of shares (for example, a share premium from a previous issue of par value shares)

- Any remaining excess to retained earnings.

- The shares acquisition cost is less than, or equal to, the assigned value.In this situation, the acquisition cost is allocated in the following sequence:

- First to share capital in an amount equal to the par, stated, or assigned value

- Any excess to contributed surplus (CPA Canada, 2016, Accounting, ASPE 3240.11 and 3240.13).

In part (b), the balance is included as an increase to contributed surplus because it wouldn’t be appropriate to report income from a share capital transaction. Also, note that where the shares are not par value shares, the assigned value indicated above is calculated as the weighted average cost of the shares at the transaction date.

It’s important to note – no gain or loss is recorded with the repurchase of a companies own shares. An equity account is usually impacted – retained earnings or contributed surplus.

The following illustration demonstrates the above rules:

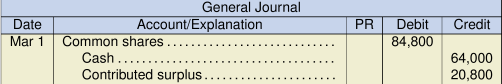

On January 1, 2021, a company had 100,000, no-par value common shares outstanding that were issued for total proceeds of $1,060,000. There was no contributed surplus associated with these shares on that date. On March 1, 2021, the company repurchased and cancelled 8,000 of these shares at a cost of $8 per share. The journal entry would be:

| Note: The common shares are eliminated at their average cost. |

| The contributed surplus is calculated as

|

On October 1, 2021, the company repurchased and cancelled a further 11,000 shares at a cost of $14 per share. The journal entry would be:

The common shares are again eliminated at their new average cost: ![]() . The previous contributed surplus is fully utilized, with an additional excess amount being charged to retained earnings.

. The previous contributed surplus is fully utilized, with an additional excess amount being charged to retained earnings.

In some jurisdictions, such as the United Kingdom, there may be additional legal restrictions that influence the accounting for share repurchases and cancellations. For example, on a share repurchase a company may be required to reallocate part of the retained earnings balance to a capital redemption reserve. This is done to provide a level of protection to the company’s creditors, as the capital redemption reserve is generally not available for use in subsequent dividend payments.

Shares Repurchased and Not Cancelled

When a company repurchases its own shares, but doesn’t cancel them, the returned shares are referred to as treasury shares. These shares are essentially held by the company to be issued at a later date. ASPE indicates a preference for what is known as the single-transaction method, which considers the repurchase, and subsequent re-issuance of the shares, as a single transaction. In this case, treasury shares held at the balance sheet date that have not yet been re-issued or cancelled are reported as a deduction from the total shareholders’ equity. They cannot be considered an asset as the company is merely holding shares of itself. When the treasury shares are first acquired, the journal entry would simply require a debit to the treasury shares account and a credit to cash. If the shares are subsequently re-issued, then the treasury shares account will be credited and cash will be debited. Any difference will be allocated to contributed surplus or retained earnings in a process that is essentially the inverse of the cancellation journal entries shown previously. If the shares are subsequently cancelled, rather than being reissued, then cancellation procedures outlined previously are followed.