17.2 Classification Criteria for Capitalization

For all businesses to comply with the accounting standards, lease agreements must be classified as either an operating lease or as a capital (ASPE)/finance (IFRS) lease. Each accounting standard has set its own criteria to determine the classification and is based on who substantively bears the risks and rewards of ownership or the right-of-use of the asset.

In the next section, we will review, in detail accounting for leases using ASPE and then using IFRS.

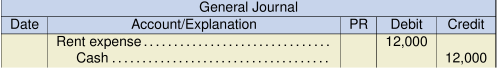

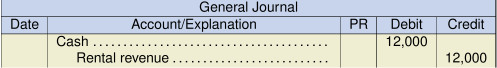

Before getting into the details regarding the accounting treatment under IFRS, be aware that there is a new IFRS standard, IFRS 16 that commenced January 1, 2019. The impact of this new standard resulted in all asset-based leases being capitalized with only two exceptions; low $-value, and short-term leases of 12 months or less. These can continue to be treated as operating leases. This means that many of the leases that previously met the criteria as operating leases will now be capitalized and recorded as a right-of-use asset and a leased obligation (liability). The classification approach has changed to a contract-based one that views asset-based leases as “right-of-use” assets where the lessor gives the lessee the right to use the leased asset in exchange for periodic payments over the lease term. These payments represent a contractual obligation to the lessee. For the lessee, this means recognition of a right-of-use asset and a lease obligation, which will reduce the instances of “off-balance sheet financing” as an operating lease. For lessors, the accounting treatment has not changed from the previous IFRS standard. If the lease is classified as an operating lease under either ASPE or IFRS, the entries are straightforward. For example, if the lessee pays $12,000 per year, and the lease is classified as an operating lease under either ASPE or IFRS, the entries are as follows:

For lessee:

If the lease payment is made in advance, a prepaid expense account may be used and costs expensed over the fiscal period consumed. No entries are made by the lessee to classify and record a leased asset or to recognize a lease obligation (liability). No obligation means that the lessee can use the leased asset without any impact on its liquidity, coverage, or debt ratios. Classification as an operating lease is an example of off-balance sheet financing. The avoidance of reporting a liability can motivate manufacturers and lessee businesses to play with the numbers to stay under the ASPE capitalization criteria, enabling management to classify the lease as an operating lease and avoid reporting an additional liability for the lease obligation. This allows a business to report operations in the best light, even though from an economic standpoint the results reported to shareholders and creditors do not reflect the economic reality. Since IFRS 16 allows a lease to be classified as an operating lease only if it is a low $-value or for short-term leases of 12 months or less, it has effectively eliminated the opportunity under IFRS for management to manipulate the numbers.