15.5 Unused Tax Losses and Tax Credits

A company may, at times, suffer a taxable loss in a given year. Because income tax is based on a percentage of taxable income, this situation results in no tax being payable. However, it does not result in a negative tax (i.e., a refund). Instead, companies are often allowed to apply the taxable loss to other taxation years where taxable profits were earned. Although the tax laws vary by jurisdiction, it is common to allow the loss to be carried back for a certain number of years and carried forward for a certain number of years. In Canada, the current law allows the loss to be carried back 3 years and carried forward 20 years.

When a loss is carried back and applied to previous years’ taxable income, the result will be a refund of taxes paid in that year. This will be achieved by filing amended tax returns for the previous year(s) showing the application of the loss, and then requesting a refund of the taxes previously paid. It is important to note that the rate at which the taxes are refunded will be the rate in effect in the previous year, not the current tax rate.

Consider the following example. In 2021, a company suffers a taxable loss of $100,000. Taxable incomes reported in the three previous years were as follows:

| 2018 | $10,000 |

|---|---|

| 2019 | 86,000 |

| 2020 | 90,000 |

The tax rates in effect were 30% in 2018, 25% in 2019 and 2020, and 20% in 2021. The loss incurred in 2021 will be carried back and taxes will be recovered as follows:

| 2018 | = | $3,000 | |

|---|---|---|---|

| 2019 | = | 21,500 | |

| 2020 | = | 1,000 | |

| Total refund | $25,500 | ||

Note that the total amount carried back cannot exceed the amount of the current year loss ($100,000). It is common practice for companies to apply the loss to the oldest tax years first, and then apply remaining amounts to more recent years. However, other patterns of application are also possible, depending on the circumstances of the company and the tax rates in effect each year.

In the above example, the company will record the following journal entry in 2021:

The company’s income statement will be presented as follows:

| Loss before tax | (100,000) | ||

| Income taxes: | |||

|

Current tax income from loss carryback |

25,500 | ||

| Net loss | (74,500) |

The income tax receivable will be presented as a current asset on the balance sheet, as it should be recovered within one year. No other accounting entries are required in this case.

A more complicated situation occurs when the amount of the current year tax loss exceeds the taxable income of the previous three years. In this case, a portion of the current tax loss is unused and may be carried forward. When carrying forward a tax loss, the company is expecting to apply it to a future year when taxable income is once again earned. However, this now creates uncertainty, because the company’s ability to earn taxable income in the future is not guaranteed. IAS 12 states that a deferred tax asset can be set up to recognize the benefit of the loss carried forward only if it is probable that future taxable profit will be available to utilize the loss. Although the standard does not define probable, an accepted interpretation of this term is “more likely than not.” IAS 12 indicates that the presence of a loss itself casts some doubt on the company’s ability to generate future profits. In assessing the probability of future taxable income, the accountant should consider not only the presence of a current loss, but also other factors such as the existence of temporary differences that will reverse in the future, the persistence and nature of the current loss, and tax planning opportunities that may allow the loss to be used in the future. This is another area where judgment on the part of the accountant is required.

Let’s revisit our previous example, with one change. Assume now that the loss in the current year is $300,000 and that all other factors remain the same. In this situation, the company will first apply as much of the loss as possible to the previous three years. This will generate a tax refund calculated as follows:

| 2018 | = | $3,000 | |

|---|---|---|---|

| 2019 | = | 21,500 | |

| 2020 | = | 22,500 | |

| Total refund | $47,000 | ||

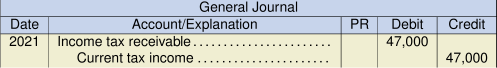

The company will make the following journal entry with respect to this loss:

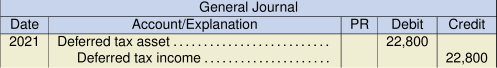

In addition, the company needs to consider the effect of the loss carried forward, which is calculated as $114,000 ($300,000 – $10,000 – $86,000 – $90,000). If, after assessing all the relevant facts and conditions, the company believes it is probable that sufficient future taxable profit will be generated to utilize the loss, a deferred tax asset can be recognized as follows:

The amount is calculated as follows: $114,000 × 20% = $22,800. Note, as with other deferred tax amounts, we are using the rate that we expect to be in effect when the amount is realized. In this case, the current rate of 20% is used, as there is no indication that the rate will change in the future.

The company would report the tax amounts on the 2021 income statement as follows:

| Loss before tax | (300,000) | ||

| Income taxes: | |||

| Current tax income from loss carryback | 47,000 | ||

| Deferred tax income from loss carryforward | 22,800 | ||

| Net loss | (230,200) |

Now, if in 2022 the company earns a profit of $250,000, the loss carryforward can be fully utilized. By doing so, the company could reduce its current tax payable as follows:

| Taxable profit reported | $250,000 |

|---|---|

| Loss carryforward utilized | (114,000) |

| Taxable profit, adjusted | 136,000 |

| Tax rate | 20% |

| Current tax payable | $27,200 |

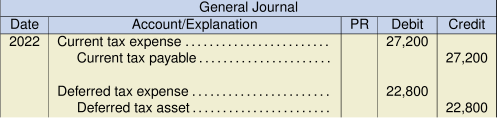

The following journal entries would be required in 2022:

The company’s 2022 income statement is presented as follows:

| Income before tax | 250,000 | ||

| Income taxes: | |||

| Current tax expense | (27,200) | ||

| Deferred tax expense | (22,800) | ||

| Net income | 200,000 |

The deferred tax expense represents the reversal of the benefit realized in 2021, when the loss was initially created. The deferred tax asset would carry a nil balance at the end of the 2022.

Returning to 2021, if the company had determined that it was not probable that it would be able to generate future taxable profits to utilize the loss, then no deferred tax asset would be recorded in that year. In a subsequent year, if profits were actually generated, then the current tax expense for that year would simply be reduced by the effect of the loss carryforward. In our example above, only the current tax entries would be recorded, and the deferred tax recognition and reversal entries would not be recorded. Although this treatment would mean presentation of a single, reduced current tax amount in the year that the loss is utilized, disclosure must be made of the components of this reduced tax, that is, the current tax otherwise calculated less the effect of the loss carryforward.