14.5 Stock Compensation Plans

An employee stock option is commonly viewed as a complex call option on the common stock of a company, granted by the company to an employee as remuneration or reward. The belief is that employees holding common shares will be motivated to align themselves with the company’s best interests. This is beneficial to the company as it allows them to retain valuable employees long-term in exchange for non-cash forms of compensation or benefits.

The most common stock option plans are employee stock option plans (ESOPs) and compensatory stock option plans (CSOPs), but stock appreciation rights plans (SARs) and other performance criteria based plans are also used in business.

14.5.1. Employee Stock Options Plans

These plans are relatively straightforward. In these plans, the employee is granted the option to purchase shares of the company. This is, therefore, not considered to be a compensation expense as the employee is simply given the opportunity to invest in the company’s equity by purchasing shares. By holding company shares, they share in the dividends and capital appreciation of the share in the marketplace the same as any other shareholders.

For example, Besco Ltd. implements an ESOP in which employees can purchase options to buy company shares for $15 per share. The cost of the option is $2 and 20,000 shares are available within this plan. No entry is required at this time because no transactions have occurred yet.

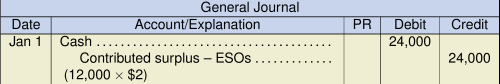

On January 1, employees purchase 12,000 options:

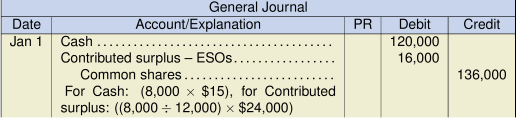

If the market price of the shares later increased to $20 per share, the options will be “in the money,” and employees holding these options will be motivated to purchase shares at a share price that is lower than the current share market price. If 8,000 of the 12,000 options were exercised to purchase shares at $15 each, the entry would be:

If the remaining options were not used by the end of the exercise period, the entry would be:

14.5.2. Compensatory Stock Options Plans

These plans are compensation based and are usually offered to key executives as part of their remuneration package. The executive is granted the option to purchase shares of the company in lieu of compensation, commencing on the exercise date and throughout the fiscal periods, until the expiry date. By holding company shares, the executives can share in the benefits of ownership, the same as with ESOPs. The difference is that the options are part of their compensation package and are not purchased for cash. Meaning that, as the employment service period is completed, compensation expense is to be allocated and recorded as an expense accrual.

It’s important to be aware of important terms relating to option plans:

Grant Date – this is the date that options are granted to employees (no entry on the grant date).

Vesting Date – this is the date when the employees earn their options. Compensation expense entries are made during the vesting period.

Exercise Date – this is the date when the employees can exercise (purchase) options. A journal entry has to be made when an employee exercises their options.

Expiration Date – this is the date when options are no longer available to the employees.

If options are allowed to expire because the service requirement is not met, such as when an employee leaves the company, IFRS requires that this be treated prospectively as a change in estimate. In contrast, ASPE gives companies a choice to either treat prospectively as a change in estimate, or to record forfeitures as they occur.

On August 1, 2020, Silverlights Ltd. granted stock options to its chief executive officer. Details are as follows:

| Option to purchase | 10,000 common shares | |

| Option price per share | $20 | |

| Fair value per common share on grant date | $18 | |

| Fair value of options on grant date | $17 | |

| Date when options can be exercised | August 1, 2022 | |

| Date when options expire | July 31, 2027 |

On August 1, 2022, 4,000 options were exercised when the fair value of the common shares was $25. Note that the fair value of the options on the grant date has to be determined using an option pricing model, or some other valuation technique, as there is no active market for employee stock options. The remaining stock options were allowed to expire. The company year-end is July 31, follows ASPE, and management chose to account for the expired options as they occurred.

On the August 1, 2020, grant date, no entry is recorded because the service period has only just begun and, as such, no economic event has yet taken place.

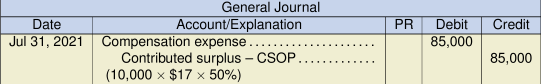

On July 31, 2021, year-end date, an adjusting entry to accrue compensation expense for one year of completed service or 50%:

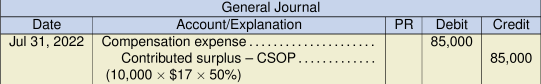

On July 31, 2022, year-end date, the remaining accrual is completed:

The total contributed surplus for this plan is now $170,000

(![]() ).

).

On August 1, 2022, exercise date for 4,000 options at the strike price:

On July 31, 2027, expiry date:

14.5.3. Stock Appreciation Rights and Performance-Based Plans

Stock Appreciation Rights Plans (SARs)

In this plan, employees’ entitlement to receive cash-paid compensation is based on an increase in the fair value of a stated number of shares from the pre-existing share price over the exercise period. Note that no shares are actually issued. The share price is tracked, and the cash-paid compensation is based on the results of these tracked changes. This plan eliminates the need for employees to actually exercise the options, buy the common shares, and later sell the common shares, to realize the monetary gain. However, the issue is how to best measure the fair value of the shares between the grant date and exercise date. ASPE and IFRS differ in their approach to this valuation, where IFRS requires the use of an options pricing model, while ASPE uses a less complex formula that calculates the difference between the pre-established share price with the market or fair value price on the exercise date for each share granted to the employee. For both standards, the total amount is allocated over the service period and recorded as compensation expense and a corresponding liability.

Performance-Based Plans

Some companies opt to also use other performance criteria, rather than simply the change in share prices. Other ratios, such as growth in sales, earnings per share, and return on assets, may be used as the basis for the compensation payment (which is allocated the same way as SARs, as explained above). Sometimes a performance-based plan will be offered to employees in combination with an options-based plan, and the employee can choose.

14.5.4. Disclosures of Compensation Plans

Some of the main disclosures include:

- Description of the compensation plan, including the numbers and dollar values of the options issued, exercised, forfeited, and expired.

- Description of the assumptions incorporated, and methods used, to determine the fair values.

- Total compensation expense included in net income and its related contributed surplus.

The reporting disclosures listed above are a simplified version of the more extensive disclosures required by the accounting standards. For example, BCE Inc.’s financial statements dedicated a significant number of pages to compensation information contained in Notes 2, 21, and 26.[1] The company also prepared a 61-page compensation discussion and analysis report to supplement the note disclosures. From this example, disclosures regarding compensation clearly go far beyond what is normally expected.

- For information on the extent of disclosures required regarding compensation, refer to BCE (2013) and BCE (2015), notes 2, 21, and 26, starting at page 125. ↵