13.6 Long-Term Debt Analysis

The chapter on cash and receivables emphasized the importance of maintaining an adequate cash flow and an efficient inventory-to-cash cycle. When debt is incurred, companies are always mindful that the debt, including interest, must be repaid, thereby drawing down on cash flows. For this reason, various liquidity and solvency ratios are constantly monitored by management and investors to ensure company performance is optimal and access to debt financing continue at reasonable interest rates.

Debt is part of a continuum. Too little debt could mean that companies are not taking advantage of leverage (also known as gearing). Too much debt can cause severe shortages in the cash needed to service the debt (pay the interest and principal amounts owing in a timely manner) if it is incurred at a greater rate than the inventory-to-cash cycle can generate cash. Companies in this position can only access additional financial markets at much higher interest rates and are subject to increasingly restrictive debt covenants imposed and monitored by the creditor. Important ratios used in the monitoring process and for restrictive covenants regarding long-term debt include:

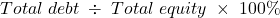

- Debt to equity: Measures the company’s share of debt compared to equity.

- Note: There are also variations of this ratio that only consider long-term debt amounts for the numerator. This occurs when the creditor is concerned with the long-term financial structure of the company.

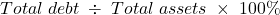

- Debt to total assets: Measures the company’s share of assets that are financed by debt.

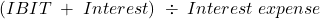

- Times interest earned: Measures the company’s ability to cover its interest payments as they come due.Income before income taxes and interest expense

Below is the unclassified balance sheet for Carmel Corp. as at December 31, 2021:

|

Carmel Corp. |

|||

|---|---|---|---|

| Cash | $84,000 | Accounts payable | $146,000 |

| Accounts receivable (net) | 89,040 | Mortgage payable | 172,200 |

| Investments - trading | 134,400 | Common shares | 400,000 |

| Buildings (net) | 340,200 | Retained earnings | 297,440 |

| Equipment (net) | 168,000 | $1,015,640 | |

| Land | 200,000 | ||

| $1,015,640 | |||

The net income for the year ended December 31, 2021 was broken down as follows:

| Revenue | $1,000,000 |

| Gain | 2,200 |

| Total revenue | 1,002,200 |

| Expenses | |

| Operating expenses | 784,200 |

| Interest expenses | 35,000 |

| Depreciation | 48,000 |

| Loss | 5,000 |

| Income tax | 25,000 |

| 897,200 | |

| Net income | $105,000 |

| Debt to equity | |

|---|---|

| Debt to total assets | |

| Times interest earned | |

As discussed previously, ratios are difficult to evaluate without something to compare them to, such as previous company trends or industry standards to use as comparative benchmarks. In general terms, if debt to total assets is less than 50%, this would be a reasonable result, meaning that equity has financed greater than 50% of the company’s total assets. As well, this shows that the company is profitable and is able to cover its interest expense reasonably.

Companies that are overextended find themselves under increasing pressure to use aggressive accounting policies to stay within the restrictive covenants set by creditors. This can lead to reporting bias. If discovered by the creditor, they can call the loan for immediate repayment, in which case the loan must subsequently be reclassified as a current liability, further worsening the current liability ratios such as the current ratio or acid test ratio. For this reason, it is wise for management to resist the temptation to use such accounting policies.