13.3 Bonds Payable

When the amount to be borrowed is significant, bonds can provide a source of cash that is compiled from many investors. The process to issue bonds is initiated by a bond indenture that contains details such as the denomination or face value of the bonds, the annual interest rate and payment dates (usually twice per year), and the face amount payable at maturity. Each bond is issued as a certificate with a specific denomination or face value, and bonds are usually issued in multiples of $100 or $1,000.

Many bond issuances are sold to an underwriter or broker who acts as the seller in the marketplace. Brokers can buy the entire issue and resell, thereby assuming all the risks in the marketplace, or they can sell on behalf of the issuing company on a commission basis. Each bond issuance has a credit rating assigned to it by independent rating agencies such as Standard & Poor’s Corporation. The ratings indicate the degree of riskiness assigned to the issue. Essentially, the higher the rating (AAA or investment-grade bonds), the more access the company has to investors’ capital at a reasonable interest rate. Conversely, the lower the rating (CCC/C or junk bonds), the higher the risk and interest rate to be paid. Since the rating assigned is a function of company performance, this rating can change over the lifespan of the bond issue. Companies will take great care to preserve their high ratings.

Types of Bonds

There are many types of bonds with different features for sale in the marketplace. Some of the more common ones are listed below:

- Registered bonds: Each bond is registered in the investor’s name. If the bond is sold, the certificate is cancelled and a new one is issued.

- Coupon or bearer bonds: The bond is not registered in the investor’s name, so whoever holds the bond will receive the interest and face value at maturity.

- Term or serial bonds: Bonds that mature on a single date are term bonds, while those that mature in instalments are serial bonds.

- Secured and unsecured bonds: Secured bonds have security or collateral that was assigned to the issue. For example, mortgage bonds are secured by claims against real estate. If the issuer defaults on payments, the security can be seized through a court order and used to satisfy the amounts owed to the bondholders. Debentures are bonds that are not secured and are often issued by school boards and municipalities.

- Callable or convertible bonds: Callable bonds give the issuer the right to call and retire the bonds before maturity. Convertible bonds allow the holder to convert the bonds into capital such as the common shares in the company. Convertible debt gives rise to some interesting accounting challenges in terms of the embedded debt and equity characteristics for these types of securities. Convertible debt will be discussed in detail in Chapter 14.

13.3.1. Initial and Subsequent Measurement, at Par, at a Discount, and at a Premium

As with notes payable, bonds are initially recognized at their fair value at the time of issuance, which is measured at the present value of their future cash flows. They are subsequently measured at amortized cost. Transaction fees for bonds measured at amortized cost are to be capitalized, meaning that the costs will reduce the bond payable amount and be amortized over the life of the bond.

Classification

Bonds are issued as a long-term debt security, which matures in several years, and are classified as long-term payables on the SFP/BS. When a bond issue’s maturity date occurs within the next 12 months of the reporting date, or within the business’s operating cycle if greater than 12 months, it is classified as a short-term bond payable.

You are encouraged to review the section on time value of money, presented earlier in this chapter, which discussed the present value learning concept.

Bonds Issued at Par

This bond issue is the simplest to account for. If bonds are issued at their face value on their interest payable date with no transaction fees, the cash proceeds received from the investors will be the initial measurement amount recorded for the bond issue. The interest expense is recorded in the same amount as the cash interest paid, at the face or stated rate, and there is no accrued interest. This means that the effective interest rate (market rate) and the stated rate (face rate) are the same. At maturity, the amount paid to the bondholders is the face value (or par value) amount, which is also the fair value on that date.

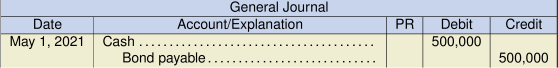

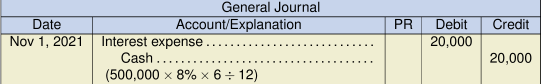

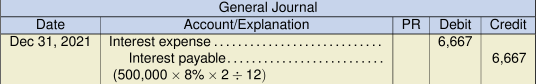

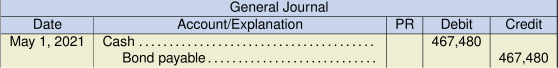

To illustrate, on May 1, 2021, Engels Ltd. issued 10-year, 8%, $500,000 par value bonds with interest payable each year on May 1 and November 1. The market rate at the time of issuance is 8% and the company year-end is December 31.

To record the bond issuance on May 1:

To record the interest payment on November 1:

To record the accrued interest on December 31 year-end:

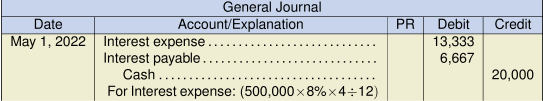

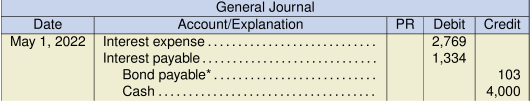

To record the interest payment on May 1, 2022:

Note how the interest payable for the accrued interest recorded at year-end is reversed at the first interest payment the following year, on May 1, 2022.

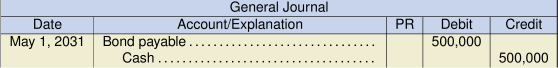

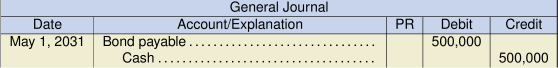

At maturity, the May 1, 2031, entry would be:

Bonds Issued at a Discount

As explained earlier in this chapter regarding notes payable, the market rate (effective rate or yield) is not always the same as the stated or face rate. When these two interest rates are different, each one is used to determine certain cash flows required to calculate the present value. The stated or face rate determines the interest payment amount (PMT), while the market or effective rate is used to determine the present value of the bond issuance (I/Y).

To illustrate, on May 1, 2021, Engels Ltd. issued a 10-year, 8%, $500,000 face value bond with interest payable each year on May 1 and November 1. The market rate at the time of issuance is 9% and the company year-end is December 31. In this case the stated rate of 8% is less than the market rate of 9%. This means that the bond issuance is trading at a discount and the fair value, or its present value of the future cash flows, will be less than the face value upon issuance. The present value is calculated as:

| 20,000 | PMT | (where semi-annual interest using the stated or face rate is |

| 4.5 | I/Y | (where 9% market or effective interest is paid twice per year) |

| 20 | N | (where interest is paid twice per year for 10 years) |

| 500,000 | FV | (where a single payment of the face value is due in a future year 2031); |

Expressed in the following variables string, and using a financial calculator, the present value is calculated:

Present value (PV) = (20,000 PMT, 4.5 I/Y, 20 N, 500,000 FV) = $467,480

The stated rate of 8% is less than the market rate of 9%, resulting in a present value less than the face amount of $500,000. This bond issuance is trading at a discount. Since the market rate is greater, the investor would not be willing to purchase bonds paying less interest at the face value. The bond issuer must, therefore, sell these at a discount to entice investors to purchase them. The investor pays the reduced price of $467,480. For the seller, the discount amount of $32,520 (![]() ) is subsequently amortized over the life of the bond issuance using one of two possible methods, the same as was explained for long-term notes payable earlier in this chapter. IFRS companies are to amortize discounts and premiums using the effective interest rate method, and ASPE companies can choose between the simpler straight-line method and the effective interest rate method. The total interest expense for either method will be the same.

) is subsequently amortized over the life of the bond issuance using one of two possible methods, the same as was explained for long-term notes payable earlier in this chapter. IFRS companies are to amortize discounts and premiums using the effective interest rate method, and ASPE companies can choose between the simpler straight-line method and the effective interest rate method. The total interest expense for either method will be the same.

Assuming the effective interest rate method is used for the example, the interest schedule for the bond issuance is shown below:

| Payment | Interest @4.5% | Amortization | Balance | |

|---|---|---|---|---|

| May 1, 2021 | 467,480 | |||

| Nov 1, 2021 | 20,000 | 21,037 | 1,037 | 468,517 |

| May 1, 2022 | 20,000 | 21,083 | 1,083 | 468,517 Year-end accrued interest is May 1 interest for 2 months: 21,083 × 2 ÷ 6 = 7,028 1,083 × 2 ÷ 6 = 361 |

| Nov 1, 2022 | 20,000 | 21,132 | 1,132 | 470,732 |

| May 1, 2023 | 20,000 | 21,183 | 1,183 | 471,732 |

| Nov 1, 2023 | 20,000 | 21,236 | 1,236 | 473,151 |

| May 1, 2024 | 20,000 | 21,929 | 1,292 | 474,443 |

| Nov 1, 2024 | 20,000 | 21,350 | 1,350 | 474,793 |

| May 1, 2025 | 20,000 | 21,411 | 1,411 | 477,203 |

| Nov 1, 2025 | 20,000 | 21,474 | 1,474 | 478,667 |

| May 1, 2026 | 20,000 | 21,540 | 1,540 | 480,218 |

| Nov 1, 2026 | 20,000 | 21,610 | 1,610 | 481,828 |

| May 1, 2027 | 20,000 | 21,682 | 1,682 | 483,510 |

| Nov 1, 2027 | 20,000 | 21,758 | 1,758 | 485,268 |

| May 1, 2028 | 20,000 | 21,837 | 1,837 | 487,105 |

| Nov 1, 2028 | 20,000 | 21,920 | 1,920 | 489,025 |

| May 1, 2029 | 20,000 | 22,006 | 2,006 | 491,031 |

| Nov 1, 2029 | 20,000 | 22,096 | 2,096 | 493,127 |

| May 1, 2030 | 20,000 | 22,191 | 2,191 | 495,318 |

| Nov 1, 2030 | 20,000 | 22,289 | 2,289 | 497,607 |

| May 1, 2031 | 20,000 | 22,392 | 2,392 | 500,000 |

The effective interest rate method ensures that a consistent interest rate is applied throughout the life of the bonds. Straight-line amortization results in varying interest rates throughout the life of the bonds because of the equal amount of the discount applied at each interest payment date.

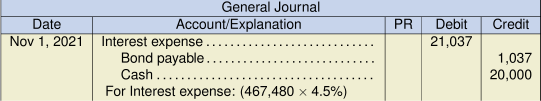

Using the information from the schedule, the entries are completed below.

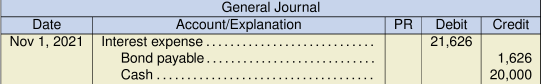

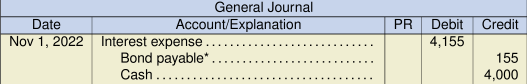

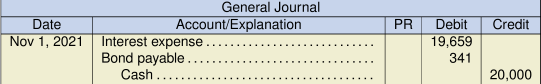

To record the interest payment on November 1:

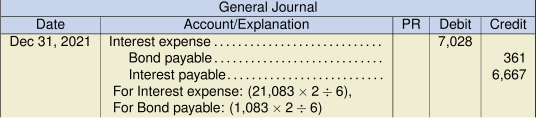

Recording the accrued interest at the December 31 year-end can be tricky, so preparing the relevant portion of an effective interest schedule will be useful:

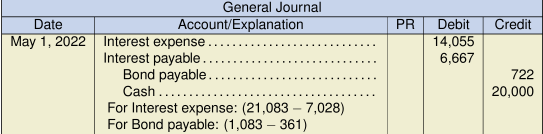

To record the interest payment on May 1, 2022:

Again, note how the interest payable for accrued interest recorded at year-end is reversed at the first interest payment the following year, on May 1, 2022.

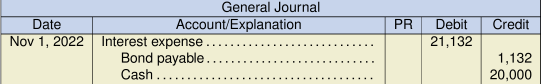

To record the interest payment on November 1, 2022:

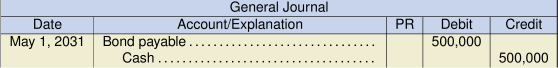

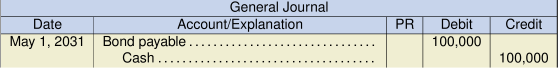

At maturity, the May 1, 2031, entry would be:

Bonds – Straight-Line Method

Companies that follow ASPE can choose to use the simpler straight-line interest method. The discount of $32,520 (![]() ) would be amortized on a straight-line basis over the 10 years. The interest was paid on a semi-annual basis in the illustration above, so the amortization of the discount would be $1,626 (

) would be amortized on a straight-line basis over the 10 years. The interest was paid on a semi-annual basis in the illustration above, so the amortization of the discount would be $1,626 (![]() ) on each interest payment date over the 10-year life of the bonds.

) on each interest payment date over the 10-year life of the bonds.

The November 1, interest entry would be:

As stated previously, the interest expense will no longer be a constant rate over the life of the note but the ASPE standard recognizes that privately-held companies will want to apply a simpler method since ownership is usually limited to a small group of shareholders and the shares are not publicly traded.

Bonds Issued in Between Interest Payments

If investors purchase bonds on dates falling in between the interest payment dates, the investor pays an additional interest amount. This is because the bond issuer always pays the full six months interest to the bondholder on the interest payment date because it is the easiest way to administer multiple interest payments to potentially thousands of investors. For example, if an investor purchases bonds four months after the last interest payment, the issuer will add these additional four months of interest to the purchase price. When the next interest payment date occurs, the issuer pays the full six months interest to the purchaser. The interest amount paid and received by the bond-holder will net to two months. This makes intuitive sense given that the bonds have only been held for two months making interest for two months the correct amount.

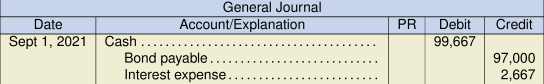

For example, on September 1, 2021, an investor purchases $100,000, 10-year, 8% bonds, at par, with interest payable each May 1 and November 1. The market price at the time of issuance was 97. The company year-end is December 31 and it follows ASPE. The amount paid by the investor on September 1, 2021, would be:

| Bond face value at market price ( |

$97,000 | |

|---|---|---|

| Accrued interest ( |

2,667 | |

| Total cash paid | $99,667 |

When the bond issuer pays the full month’s interest of $4,000 (![]() ), the net interest received by the bondholder will be $1,333 for two months (

), the net interest received by the bondholder will be $1,333 for two months (![]() ). For the entries below, assume the straight-line (SL) interest rate method (ASPE) is being used.

). For the entries below, assume the straight-line (SL) interest rate method (ASPE) is being used.

To record the bond issuance on September 1:

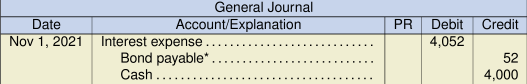

To record the interest payment on November 1:

* ![]() (round to $52, for simplicity), for Sep 1 to Nov 1 or two months

(round to $52, for simplicity), for Sep 1 to Nov 1 or two months

Note: the length of time of the 10 years that the company will hold the bonds will be 116 months: Sep 1/2021 to May 1, 2031,

(![]() from May 1, 2021 to Sep 1, 2021)

from May 1, 2021 to Sep 1, 2021)

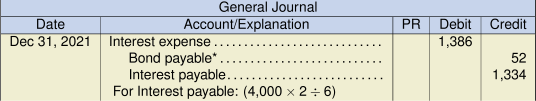

The December 31 year-end accrued interest entry:

* ![]() rounded, for Nov 1 to Dec 31, or two months

rounded, for Nov 1 to Dec 31, or two months

To record the interest payment on May 1, 2022:

* ![]() rounded for Jan 1 to May 1, or four months.

rounded for Jan 1 to May 1, or four months.

To record the interest payment on November 1, 2022:

* ![]() rounded for May 1 to Nov 1, or six months.

rounded for May 1 to Nov 1, or six months.

At maturity, the May 1, 2031, entry would be:

Bonds Issued at a Premium

If the stated rate is more than the market rate, the bond trades at a premium. This is because investors are seeking the best interest rate for their investment. If the stated rate is higher, the bond issuance is more desirable, and the investors would be willing to pay more for this investment than for another with a lower stated rate. The accounting for bonds purchased at a premium follows the same method as was illustrated for bonds at a discount. The illustration will be changed slightly to introduce the use of the market spot rate.

To illustrate, on May 1, 2021, Impala Ltd. issued a 10-year, 8%, $500,000 face value bond at a spot rate of 102 (2% above par). Interest is payable each year on May 1 and November 1. The company year-end is December 31 and follows IFRS.

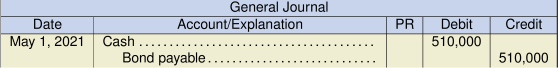

The spot rate is 102, so the amount to be paid is $510,000 (![]() ) and, therefore, represents the fair value or present value of the bond issuance on the purchase date.

) and, therefore, represents the fair value or present value of the bond issuance on the purchase date.

The entry for the bond issuance is:

However, what effective interest rate would be required to result in a present value of $510,000, a future value of $500,000 payable in 10 years, and a stated or face rate of 8% interest payable semi-annually? As was explained for the long-term notes payable earlier in this chapter, since all the other variables are known, and only the interest rate (I/Y) is unknown, it can be imputed as shown below:

| Effective interest rate (I/Y) | |

|---|---|

To prove that the 3.85% is the correct semi-annual effective interest rate, the present value is calculated as follows:

| 20,000 | PMT | (where semi-annual interest using the stated or face rate is |

| 3.8547 | I/Y | (where market or effective interest is paid twice per year) |

| 20 | N | (where interest is paid twice a year for 10 years) |

| 500,000 | FV | (where a single payment of the face value is due in a future year 2031); |

Expressed in the following variables string and using a financial calculator, the present value is calculated as follows:

Present value (PV) = (20,000 PMT, 3.8547 I/Y, 20 N, 500,000 FV) = $510,000 (rounded)

| Payment | Interest @ 3.8547% | Amortization | Balance | |

|---|---|---|---|---|

| May 1/21 | 510,000 | |||

| Nov 1/21 | 20,000 | 19,659 | 341 | 509,659 |

| May 1/22 | 20,000 | 19,646 | 354 | 509,305 Year-end accrued interest is May 1 interest for 2 months: 19,646 × 2 ÷ 6 = 6,549 354 × 2 ÷ 6 = 118 |

| Nov 1/22 | 20,000 | 19,632 | 368 | 508,937 |

Using the information from the schedule, the entries are completed below.

To record the interest payment on November 1:

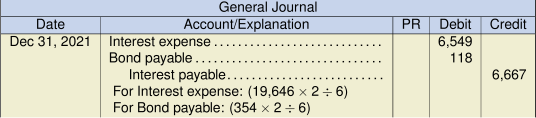

Recording the accrued interest at the December 31 year-end can be tricky, so preparing the relevant portion of an effective interest schedule will be useful:

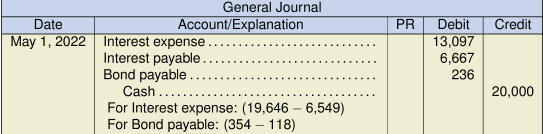

To record the interest payment on May 1, 2022:

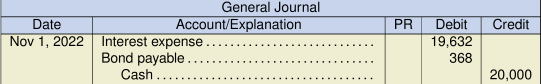

To record the interest payment on November 1, 2022:

At maturity, the May 1, 2031, entry would be:

13.3.2. Repayment Before Maturity Date

In some cases, a company may want to repay a bond issue before its maturity. Examples of such bonds are callable bonds, which give the issuer the right to call and retire the bonds before maturity. For example, if market interest rates drop, the issuer will want to take advantage of the lower interest rate. In this case, the re-acquisition price paid to extinguish and derecognize the bond issuance will likely be slightly higher than the bond carrying value on that date, and the difference will be recorded by the issuing corporation as a loss on redemption. The company can, subsequently, sell a new bond issuance at the new, lower interest rate.

For example, on January 1, 2021, Angen Ltd. issued bonds with a par value of $500,000 at 99, due in 2031. On January 1, 2025, the entire issue was called at 101 and cancelled. Interest is paid annually, and the discount amortized using the straight-line method. The carrying value of the bond on January 1, 2025, would be calculated as follows:

| Face value of bond | $500,000 | |

|---|---|---|

| Unamortized discount: | ||

| (3,000) | ||

| Carrying value on call date | $497,000 | |

| Re-acquisition price: $500,000 X 101 | 505,000 | |

| Loss on redemption | $8,000 |

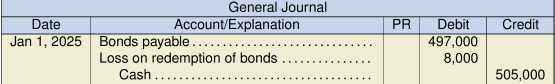

Angen Ltd. would make the following entry: