12.6 Commitments and Guarantees

We have seen in our previous discussions that IFRS requires recognition of assets and liabilities when certain criteria have been met. In many business transactions, companies will enter into contracts that commit them to future actions. If neither party has executed any part of these contracts at the reporting date, then we would normally not recognize any asset or liability. However, because the contract will require future actions by both parties, there is a justification for disclosure, as financial statement readers are interested in the future profits and cash flows of the business. As such, there are disclosure requirements for certain types of commitments, and, in some cases, there are even recognition criteria.

An unexecuted contract to purchase property, plant, and equipment is a common commitment that requires disclosures. Even if the contract has not yet been fully executed, IAS 16.74 requires disclosure of the commitment. As PPE expenditures are often irregular and material, this disclosure helps the financial statement reader understand the potentially significant effect of the contract on future cash flows.

We previously discussed the concept of an onerous contract. This is a contract for which the unavoidable future costs of the contract exceed the economic benefits that are expected. This result is clearly not what the entity originally intended when it entered into the contract, but circumstances can change and can result in contracts turning into unprofitable ventures. In determining the unavoidable future costs, the entity should use the least net cost of exiting the contract, which may be either the cost of fulfilling the contract or the payment of penalties under the contract for non-performance. When an onerous contract exists, IAS 37.66 requires the entity to recognize a liability for the amount of the obligation.

Consider the following example. Rapid Rice Inc., a wholesale distributor of bulk rice to food manufacturers, has entered into a contract to purchase 1,000,000 kg of rice at $0.40 per kilogram. The company intends to resell the rice to its customers at $0.50 per kilogram. If Rapid Rice Inc. cancels the purchase contract before it is fulfilled, it must pay a penalty of 30% of the total contract value. One month after the contract is signed, but before any rice is delivered, the vendor reduces the price of rice to $0.30 per kilogram, due to weak market conditions. Also as a result of these weak market conditions, Rapid Rice Inc. is forced to reduce the price it charges its customers to $0.37 per kilogram. Rapid Rice Inc. has the choice of fulfilling the contract and selling at the adjusted price to its customers, or cancelling the contract and purchasing at the current price to fill its orders. The following analysis is required to determine if this is an onerous contract:

| Fulfill Contract | Cancel Contract | |

|---|---|---|

| Expected benefit ( |

$370,000 | $370,000 |

| Unavoidable costs ( |

$400,000 | |

| or ( |

$300,000 | |

| Penalty |

$120,000 | |

| Net Cost | $(30,000) | $(50,000) |

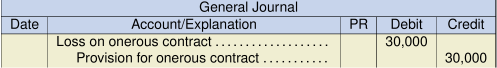

A third option would be to simply cancel the contract and not purchase any rice, but this would result in a net cost of $120,000 (i.e., the penalty). Since all options result in a loss, this is an onerous contract. The least costly option is to fulfill the contract. The company will then need to record a provision as follows: