Chapter 20

Solutions

Exercise 20.1

| Description | Section | Cash Flow In (Out) |

|---|---|---|

| Issue of bonds payable of $500 cash | Financing | 500 |

| Sale of land and building of $60,000 cash | Investing | 60,000 |

| Retirement of bonds payable of $20,000 cash | Financing | (20,000) |

| Redemption of preferred shares classified as debt of $10,000 | Financing | (10,000) |

| Current portion of long-term debt changed from $56,000 to $50,000 | Financing | * |

| Repurchase of company’s own shares of $120,000 cash | Financing | (120,000) |

| Amortization of a bond discount of $500 | Operating | Add $500 to net income |

| Issuance of common shares of $80,000 cash | Financing | 80,000 |

| Payment of cash dividend of $25,000 recorded to retained earnings | Financing | (25,000) |

| Purchase of land of $60,000 cash and a $100,000 note (the note would be a non-cash transaction that is not directly reported within the body of the SCF but requires disclosure in the notes to the SCF) | Investing | (60,000) |

| Cash dividends received from a trading investment of $5,000 | Operating | 5,000 |

| Increase in an available for sale investment due to appreciation in the market price of $10,000 | None – non-cash gain through OCI | – |

| Interest income received in cash from an investment of $2,000 | Operating | 2,000 |

| Leased new equipment under an operating lease for $12,000 per year | Operating | Already in net income |

| Interest and finance charges paid of $15,000 | Operating | (15,000) |

| Purchase of equipment of $32,000 | Investing | (32,000) |

| Increase in accounts receivable of $75,000 | Operating | (75,000) |

| Leased new equipment under a finance lease with a present value of $40,000 | None – non-cash | – |

| Purchase of 5% of the common shares of a supplier company for $30,000 cash | Investing | (30,000) |

| Decrease in a sales related short term note payable of $10,000 | Operating | (10,000) |

| Made the annual contribution to the employee’s pension benefit plan for $220,000 | Operating | (220,000) |

| Increase in income taxes payable of $3,000 | Operating | 3,000 |

| Purchase of equipment in exchange for a $14,000 long-term note | None – non-cash | – |

* The current portion of long-term debt for both years would be added to their respective long-term debt payable accounts and reported as a single line item in the financing section.

Exercise 20.2

a.

| Rorrow Ltd Balance Sheet as at December 31, 2020 |

|||||

| 2020 | 2019 | Total W/C accounts except Cash* | |||

|---|---|---|---|---|---|

| Net Change | |||||

| Current assets | |||||

| Cash | $152,975 | $86,000 | |||

| Accounts receivable (net) | 321,640 | 239,080 | 1,160,890 (1) | 1,124,880 | (36,010) |

| Inventory | 801,410 | 855,700 | |||

| Prepaid insurance expenses | 37,840 | 30,100 | |||

| Equipment | 2,564,950 | 2,156,450 | |||

| Accumulated depreciation, equipment | (625,220) | (524,600) | |||

| Total assets | $3,253,595 | $2,842,730 | |||

| Current liabilities | |||||

| Accounts payable | $478,900 | $484,500 | 897,410(1) | 901,280 | (3,870) |

| Salaries and wages payable | 312,300 | 309,600 | |||

| Accrued interest payable | 106,210 | 97,180 | |||

| Bonds payable, due July 31, 2028 | 322,500 | 430,000 | |||

| Common shares | 1,509,300 | 1,204,000 | |||

| Retained earnings | 524,385 | 307,450 | |||

| Total liabilities and shareholders’ equity | $3,253,595 | 2,842,730 | Net Change | (39,880) | |

| *exclude current portion of long-term debt as this account is not a working capital account

(1) A/R + Inventory + Prepaid = $1,160,890. A/P + Salaries Payable + Interest Payable = $897,410 |

|||||

| Rorrow Ltd Income Statement For the year ended December 31, 2020 |

|

|---|---|

| Sales | $5,258,246 |

| Expenses | |

| Cost of goods sold | 3,150,180 |

| Salaries and benefits expense | 754,186 |

| Depreciation expense | 100,620 |

| Interest expense | 258,129 |

| Insurance expense | 95,976 |

| Income tax expense | 4,612,189 |

| Net income | $646,057 |

| Rorrow Ltd SCF – Direct Method Worksheet |

|||

|---|---|---|---|

| I/S Accounts | Changes to Working Capital Accounts | Net Cash Flow In (Out) | |

| Cash received from sales | $5,258,246 | $(82,560) | $5,175,686 |

| Cash paid for goods and services | (3,150,180) | 54,290 | |

| (95,976) | (7,740) | ||

| (15,600) | (3,215,206) | ||

| Cash paid to or on behalf of employees | (754,186) | 2,700 | (751,486) |

| Cash paid for interest | (258,129) | 9,030 | (249,099) |

| Cash paid for income taxes | (253,098) | (253,098) | |

| Memo items: | |||

| Depreciation expense | (100,620) | ||

| Net cash flows from operating activities | $646,057 | $(39,880) | $706,797 |

| This amount balances to net change in W/C accounts shown above | |||

b.

| Rorrow Ltd. Statement of Cash Flows – Operating Activities |

||

|---|---|---|

| For the Year Ended December 31, 2020 | ||

| Cash flows from operating activities | ||

| Cash received from sales | $5,175,686 | |

| Cash paid for goods and services | 3,215,206 | |

| Cash paid to or on behalf of employees | 751,486 | |

| Cash paid for interest | 249,099 | |

| Cash paid for income taxes | 253,098 | |

| Net cash flows from operating activities | $706,797 | |

Exercise 20.3

a.

| Carmel Corp. Statement of Cash Flows |

||||

|---|---|---|---|---|

| For the Year Ended December 31, 2021 | ||||

| Cash flows from operating activities: | ||||

|

Net income |

$105,000 | |||

|

Adjustments for non-cash revenue and expense |

||||

|

items in the income statement: |

||||

|

Depreciation expense |

$48,000 | |||

|

Gain on sale of investments |

(2,200) | |||

|

Loss on sale of building |

5,000 | |||

|

Decrease in investments – trading |

136,600 | |||

|

Increase in accounts receivable |

||||

|

( |

(20,000) | |||

|

Decrease in accounts payable |

||||

|

( |

(90,800) | 76,600 | ||

|

Net cash from operating activities |

181,600 | |||

| Cash flows from investing activities | ||||

|

Proceeds from sale of building |

||||

|

( |

220,000 | |||

|

Purchase of land |

(220,000) | |||

|

Net cash from investing activities |

0 | |||

| Cash flows from financing activities | ||||

|

Reduction in long-term mortgage principal |

(30,000) | |||

|

Issuance of common shares |

20,000 | |||

|

Payment of cash dividends |

(8,000) | |||

|

Net cash from financing activities |

(18,000) | |||

| Net increase in cash | 163,600 | |||

| Cash at beginning of year | 84,000 | |||

| Cash at end of year | $247,600 | |||

Supplemental Disclosures:

- The purchase of equipment through the issuance of $50,000 of common shares is a significant non-cash financing transaction that would be disclosed in the notes to the financial statements.

Cash paid interest $35,000 - Note: Had there been cash paid income taxes, this would also be disclosed.

b. Free cash flow:

| Net cash from operating activities | $181,600 | |

| Capital expenditures – land | (220,000) | |

| Cash paid dividends | (8,000) | |

| Free cash flow | $(46,400) |

In the analysis of Carmel’s free cash flow above, we see that it is negative. While including dividends paid is optional, it would not have made a difference in this case. What does make a difference, however, is that the capital expenditures are those needed to sustain the current level of operations. In the case of Carmel Corp., the land was purchased for investment purposes, and not to meet operational requirements. With this in mind, the free cash flow would more accurately be:

| Net cash from operating activities | $181,600 | |

| Capital purchases | 0 | |

| Cash paid dividends | (8,000) | |

| Free cash flow | $173,600 |

This makes intuitive sense and it is supported by the results from one of the coverage ratios.

The current cash debt coverage provides information about how well Carmel Corp. can cover its current liabilities from its net cash flows from operations:

![]()

Carmel Corp.’s current cash debt coverage is 1.38 ($181,600 ÷ (87,200 + 176,000) × 50%). The company has adequate cash flows to cover its current liabilities as they come due and so, overall, its financial flexibility looks positive.

In terms of cash flow patterns, we see a positive trend, as Carmel Corp. has managed to more than triple its cash balance in the year, mainly from cash generated from operating activities. They were able to pay $8,000 in dividends, or a 1.7% return. And if dividends are paid several times throughout the year, then the return is more than adequate for investors. Carmel Corp. also sold off its traded investments for a profit, and some idle buildings at a small loss, to obtain sufficient internal funding for some land that they want to purchase as an investment. They also managed to lower their accounts payable levels by close to 60%. All of this supports the assessment that Carmel Corp.’s financial flexibility looks reasonable.

c. The information reported in the statement of cash flows is useful for assessing the amount, timing, and uncertainty of future cash flows. The statement identifies the specific cash inflows and outflows from operating activities, investing activities, and financing activities. This gives stakeholders a better understanding of the liquidity and financial flexibility of the enterprise. Some stakeholders have concerns about the quality of the earnings because of the variety and subjectivity of the bases that can be used to record accruals and estimates. As a result, the higher the ratio of cash provided by operating activities to net income, the more stakeholders can rely on the earnings reported.

Exercise 20.4

| Lambrinetta Industries Ltd. Statement of Cash Flows |

||||

|---|---|---|---|---|

| Year Ended December 31, 2021 | ||||

| Cash flows from operating activities: | ||||

| Net income | $161,500 | |||

| Changes and Adjustments | ||||

| Depreciation expense* | $25,500 | |||

| Change in A/R | 27,200 | |||

| Change in A/P | 11,900 | |||

| Change in investments, trading | (6,800) | |||

| 57,800 | ||||

| Net cash from operating activities | 219,300 | |||

| Cash flows from investing activities | ||||

| Sold plant assets | 37,400 | |||

| Purchase plant assets** | (130,900) | |||

| Net cash from investing activities | (93,500) | |||

| Cash flows from financing activities | ||||

| Note issued*** | 42,500 | |||

| Shares issued for cash | ||||

| (81,600 + 37,400 in exch for land – 130,900 ending balance) | ||||

| 11,900 | ||||

| Cash dividends paid**** | (188,700) | |||

| Net cash from financing activities | (134,300) | |||

| Net decrease in cash | (8,500) | |||

| Cash at beginning of year | 40,800 | |||

| Cash at end of year | $32,300 | |||

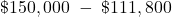

* ![]()

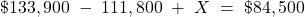

** ![]()

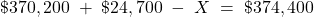

*** ![]()

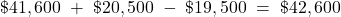

**** ![]()

Disclosures:

Additional land for $37,400 was acquired in exchange for issuing additional common shares.

Exercise 20.5

-

Egglestone Vibe Inc.

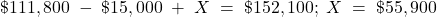

Statement of Cash FlowsFor the Year Ended December 31, 2021 Cash flows from operating activities: Net income

$24,700 Adjustments to reconcile net income to

net cash provided by operating activities

Depreciation expense (note 1)

$55,900 Loss on sale of equipment (note 2)

10,100 Gain on sale of land (note 3)

(38,200) Impairment loss – goodwill

63,700 Increase in accounts receivable

(36,400) Increase in inventory

(67,600) Decrease in accounts payable

(28,200) (40,700) Net cash used by operating activities

(16,000) Cash flows from investing activities Purchase of investments – available for sale

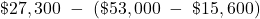

(20,000) Proceeds from sale of equipment

27,300 Purchase of land (note 4)

(62,400) Proceeds from sale of land

150,000 Net cash provided by investing activities

94,900 Cash flows used by financing activities Payment of cash dividends (note 5)

(42,600) Issuance of notes payable

10,500 Net cash used by financing activities

(32,100) Net increase in cash 46,800 Cash at beginning of year 37,700 Cash at end of year $84,500 General note: During the year, Egglestone Vibe retired $160,000 in notes payable by issuing common shares.

Notes to statements:

- Retained earnings account:

; Dividend declared but not paid = $20,500Dividends payable account:

; Dividend declared but not paid = $20,500Dividends payable account:  cash paid dividends

cash paid dividends

- Negative cash flows from operating activities may signal trouble ahead with regard to Egglestone’s daily operations, including profitability of operations and management of its current assets, such as accounts receivable, inventory and accounts payable. All three of these increased the cash outflows over the year. In fact, net cash provided by investing activities funded the net cash used by both operating and financing activities. Specifically, proceeds from sale of equipment and land were used to fund operating and financing activities, which may be cause for concern if the assets sold were used to generate significant revenue. Shareholders did receive cash dividends, but investors may wonder if these payments will be sustainable over the long term. Consider that dividends declared were $20,500, which was quite high compared to the net income of $24,700. In addition, the dividends payable account still had a balance payable of $41,600 from prior dividend declarations not yet paid. This creates increased pressure on the company to find sufficient funds to catch-up with the cash payments owed to investors. Egglestone may not be able to sustain payment of cash dividends of this size in the long-term if improvement of its profitability and management of its receivables, payables, and inventory are not implemented quickly.

Exercise 20.6

- For operating activities, use the steps from earlier in the chapter for the direct method: Step 3 – enter all the line items from the income statement to the most appropriate direct method category so that the total matches the income statement. Step 4 – enter all the changes to the non-cash working capital accounts (except current portion of LT debt) to the most appropriate direct method category, and use the accounting equation technique to determine if the cash flow change for each account is positive or negative. Complete the investing and financing sections as usual.

Bognar Ltd.

Statement of Cash Flows Worksheet – Direct MethodFor the Year Ended December 31, 2020 Step 3 Step 4 Step 5 I/S Accounts Changes to W/C +/- add’l adjustments Net cash flow Cash flows from operating activities: Cash received from sales – Sales

$1,852,400 – Accounts receivable

$(108,000) $1,744,400 Cash paid for goods and services – COGS

(1,213,300) – Other operating expenses

(342,100) – Inventory

(146,000) – Accounts payable

(37,300) (1,738,700) Cash paid to employees

N/A Cash received for interest income

0 Cash paid for interest for Bonds payable, net of discount ($1,034,250 – 1,089,000) = $54,750 non-cash interest expense (126,500) 54,750* (71,750) Cash received for income taxes ($69,300 – 26,400) 59,400 (42,900)** 16,500 Cash received for dividends

0 Memo Items:

Depreciation

(121,000) Depreciation

(82,500) Goodwill impairment

(66,000) Loss on Held for Trading investments

(32,500) 32,500*** Gain on sale of land

24,200 Loss on sale of machine

(10,800) Net cash flows from operating activities (58,700) (49,550) Cash flows from investing activities: Proceeds from sale of land ($430,500 – 363,000 + 24,200 gain)

91,700 Proceeds from sale of building ($1,176,000 – 1,144,000 = 32,000) less accum. depr.

($399,000 + 121,000 – 517,000) = $3,000 accum. depr. for the sold building

29,000 Sale of machinery

50,000 Purchase of machinery ($918,750 – 125,000 – 1,188,000) = $394,250 less

$166,000 = $228,250. $166,000 is a non-cash entry in exchange for shares

($199,500 – 60,000 – 305,500) = $166,000

(228,250) Net cash flows from investing activities (57,550) Cash flows from financing activities: Issuance of preferred shares

($885,150 – $1,152,800)

267,650 Repurchase of common shares

(65,000) Dividends paid ($326,550 – 5,000 common shares retirement – $58,700 net loss –

$151,800) = $111,050 dividends for both preferred and common shares.

Preferred shares dividend is $40,000. Common shares dividend is $71,050.

(111,050) Net cash flows from financing activities 91,600 Net increase in cash (15,500) Cash, opening 21,000 Cash, closing $5,500 Supplemental Disclosures:

Cash paid interest and income taxes are already reported as categories in operating activities when using the direct method. Only the non-cash items require supplementary disclosure (below).

Non-cash:

Machinery for $394,250 ($918,750 – $125,000 – $1,188,000) was purchased in exchange for $166,000 in common shares and $228,250 in cash.

Solution Notes:

* Bond amortization is a non-cash adjusting entry that affects interest expense in the income statement, therefore net income must be adjusted by $54,750 ($1,089,000 – $1,034,250) bond amounts, net of discount.** Deferred tax is a non-cash transaction affecting income tax expense in the income statement, therefore net income must be adjusted by $42,900 ($69,300 – $26,400).

*** The change in investments held for trading is due to the unrealized loss included in the income statement. This has already been adjusted in step 3, so no further action is required. Memo item only.

-

Bognar Ltd.

Statement of Cash FlowsFor the Year Ended December 31, 2020 Cash flows from operating activities: Cash received from sales

$1,744,400 Cash paid for goods and services

(1,738,700) Cash paid for interest

(71,750) Cash received for income taxes

16,500 Net cash flows from operating activities $(49,550) - Indirect Method

Bognar Ltd.

Statement of Cash Flows (Indirect method)For the Year Ending December 31, 2020 Cash flows from operating activities: Net loss $(58,700) Non-cash items (adjusted from net income) Gain on sale of land

(24,200) Depreciation ($121,000 – $82,500)

203,500 Loss on impairment of goodwill

66,000 Loss on sale of machine

10,800 Loss on Held for Trading investment

32,500*** Interest expense for bond payable

54,750* Cash in (out) from operating working capital: Increase in accounts receivable

(108,000) Increase in inventory

(146,000) Decrease in accounts payable

(37,300) Decrease in deferred taxes payable

(42,900)** Net cash flows from operating activities $(49,550) * Bond amortization is a non-cash adjusting entry that affects interest expense in the income statement and is not included in the adjustments. Net income must, therefore, be adjusted by $54,750 ($1,089,000 – $1,034,250) bond amounts, net of discount.

** Deferred tax is a non-cash transaction affecting income tax expense in the income statement and is not included in the adjustments. Net income must, therefore, be adjusted by $42,900 ($69,300 – $26,400).

*** The change in investments held for trading asset account is due to the unrealized loss included in the income statement.

Supplemental Disclosures (Indirect Method):

Interest paid $71,750 ($126,500 interest expense – bonds payable, net of discount of $54,750 ($1,034,250 – $1,089,000))

Non-cash:

Machinery for $394,250 ($918,750 – $125,000 – $1,188,000) was purchased in exchange for $166,000 in common shares and $228,250 in cash.

Exercise 20.7

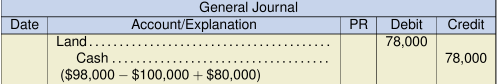

a. Land – Entry #1

Land – Entry #2

Land – Entry #2

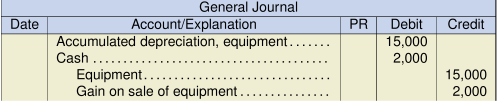

Equipment – Entry #1

Equipment – Entry #1

Equipment – Entry #2

Equipment – Entry #2

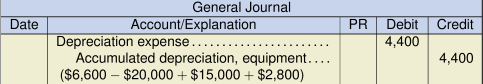

Equipment – Entry #3

Equipment – Entry #3

Equipment – Entry #4

Equipment – Entry #4

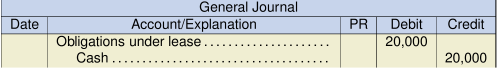

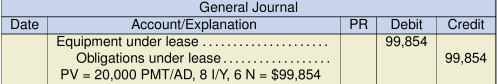

Lease – Entry #1

Lease – Entry #1

| Investing activities: | |||

| Payment on exchange of land | (5,000) | ||

| Purchase of land | (78,000) | ||

| Proceeds from sale of equipment | 2,000 | ||

| Purchase of equipment | (9,000) | ||

| Financing activities: | |||

| Payment on capital lease | (20,000) |

c.

| Partial statement of cash flows – indirect method | |||

| Cash flows from operating activities: | |||

| Net income | N/A | ||

| Non-cash items (adjusted from net income): | |||

|

Gain on disposal of land |

(15,000) | ||

|

Gain on sale of equipment |

2,000 | ||

|

Loss on disposal of equipment |

1,200 | ||

|

Depreciation expense on equipment |

4,400 | ||

|

Depreciation expense on leased equipment |

8,321 | ||

| Cash in (out) from operating working capital: | |||

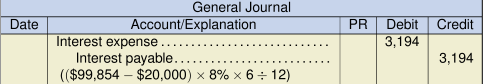

|

Increase in interest payable |

3,994 | ||

| Net cash flows from operating activities | N/A | ||

Disclosures:

| Interest paid ($3,994 interest expense – $3,994 increase in interest payable) | $ | 0 |

Non-cash items:

Land that originally cost $80,000 was exchanged for another tract of land with a fair value of $100,000 and a cash payment of $5,000.

Equipment worth $99,854 was acquired in exchange for a six year capital lease at an annual interest rate of 8%.

Exercise 20.8

| Aegean Anchors Ltd. Statement of Cash Flows (Indirect method) |

||

|---|---|---|

| For the Year Ended December 31, 2020 | ||

| Cash flows from operating activities: | ||

| Net income | $288,000 | |

| Non-cash items (adjusted from net income) | ||

|

Depreciation |

217,000 | |

|

Equity in earnings of Vogeller |

(26,400) | |

|

Loss on sale of equipment |

3,000 | |

| Cash in (out) from operating working capital: | ||

| Increase in accounts receivable | (95,640) | |

| Decrease in inventory | (51,120) | |

| Decrease in accounts payable | (73,200) | |

| Decrease in income taxes payable | (10,800) | |

| Net cash flows from operating activities | 250,840 | |

| Cash flows from investing activities: | ||

| Loan to Vancorp Ltd. | (350,000) | |

| Cash payment received from Vancorp Ltd. | 48,200 | |

| Sale of equipment | 50,000 | |

| Net cash flows from investing activities | (251,800) | |

| Cash flows from financing activities: | ||

| Cash dividends paid | (102,000) | |

| Net cash flows from financing activities | (102,000) | |

| Net decrease in cash | (102,960) | |

| Cash and cash equivalent, opening | (34,200) | |

| Cash and cash equivalent, closing | $(137,160) | |

Disclosures:

| Interest paid | $18,000 | |

| Interest received | 11,300 | |

| Income taxes paid | 181,000 |

Non-cash:

Aegean Anchors acquired equipment in exchange for a financing lease of $324,000. (Interest rate is 8%.)

Cash and cash equivalents:

| 2020 | 2019 | |

|---|---|---|

| Cash | $33,960 | $53,280 |

| Bank overdraft | (171,120) | (87,480) |

| Total cash and cash equivalents | $(137,160) | $(34,200) |

Exercise 20.9

|

Alymer Inc |

|||

| Cash flow from operating activities | |||

| Cash received from customers (1) | $331,150 | ||

| Cash Paid to suppliers (2) | -139,000 | ||

| Cash paid for operating supplies (3) | -28,000 | ||

| Cash paid to employees (4) | -65,000 | ||

| Cash paid for interest | -11,400 | ||

| Cash paid for income tax (5) | -6,125 | ||

| Cash provided by operating activities | 81,625 | ||

| Cash flow from Investing Activities | |||

| Proceeds - from sale of equipment (6) | 8,000 | ||

| Purchased equipment | -44,000 | ||

| Cash used in investing activities | -36,000 | ||

| Cash flow from Financing Activities | |||

| Payment of short-term loan | -2,000 | ||

| Payment of long-term loan | -9,000 | ||

| Dividends paid | -6,000 | ||

| Cash used in financing activities | -17,000 | ||

| Increase in cash | 28,625 | ||

| Cash - beginning of year | 25,000 | ||

| Cash - end of year | $53,625 | ||

| Cash received from customers (1) | ||

| Sales | 338,150 | |

| change in a/r | -7,000 | |

| 331,150 | ||

| Cash Paid to suppliers (2) | ||

| CGS | -165,000 | |

| change in inventory | 20,000 | |

| change in a/p | 6,000 | |

| -139,000 | ||

| Cash paid for operating supplies (3) | ||

| Op expense | -120,000 | |

| Remove wages | 69,000 | |

| Remove depreciation | 24,000 | |

| Change in ppd rent | -1,000 | |

| -28,000 | ||

| Cash paid to employees (4) | ||

| Included in op exp | -69,000 | |

| Change in salary pay | 4,000 | |

| -65,000 | ||

| Cash paid for income tax (5) | ||

| Income tax expense | -4,125 | |

| change in tax payable | -2,000 | |

| -6,125 | ||

| Proceeds - from sale of equipment (6) | ||

| Cost | 20,000 | |

| A/D | 14,000 | |

| NBV | 6,000 | |

| Gain | 2,000 | |

| Proceeds | 8,000 | |

“T” Accounts

|

Equipment |

|||

| beg | 130,000 | ||

| 20,000 | sold (cost) | ||

| purchase | 44,000 | ||

| end | 154,000 | ||

|

Accumulated Depreciation |

|||

| 25,000 | beg | ||

| sold | 14,000 | ||

| 24,000 | depreciation exp | ||

| 35,000 | end | ||

Exercise 20.10

|

Lyons |

|||

| Cash flow from operating activities | |||

| Cash received from customers (1) | $1,326,600 | ||

| Cash paid to suppliers (2) | (795,700) | ||

| Cash paid for operating expenses (3) | (26,600) | ||

| Cash paid to employees (4) | (218,800) | ||

| Cash paid for interest (5) | (64,600) | ||

| Cash paid for income tax | (65,400) | ||

| Cash from operating activities | 155,500 | ||

| Cash flow from investing activities | |||

| Purchase plant assets (6) | (44,000) | ||

| Cash flow from financing activities | |||

| Paid mortgage | (25,000) | ||

| Paid dividends | (78,000) | ||

| Sold = issued common shares (7) | 4,750 | ||

| (98,250) | |||

| increase in cash | 13,250 | ||

| Cash - beginning of year | 20,000 | ||

| Cash - end of year | $33,250.0 | ||

| Note - $51,000 of common shares were issued to purchase plant assets | |||

| Cash received from customers (1) | ||

| Sales | 1,345,800 | |

| change in a/r | (19,200) | |

| 1,326,600 | ||

| Cash paid to suppliers (2) | ||

| CGS | (814,000) | |

| change in inventory | 10,300 | |

| change in a/pr | 8,000 | |

| (795,700) | ||

| Cash paid for operating expenses (3) | ||

| operating expense | (24,800) | |

| change in prepaid | (1,800) | |

| (26,600) | ||

| Cash paid for interest | ||

| salary expense | (207,800) | |

| change in salary pay | (11,000) | |

| (218,800) | ||

| Cash paid for interest (5) | ||

| Interest expense | (66,700) | |

| change in interest pay | 2,100 | |

| (64,600) | ||

| Purchase plant assets (6) | ||

| Change in plant assets | 95,000 | |

| Purchased by issuing shares | 51,000 | |

| Paid for in cash | 44,000 | |

| Sold = issued common shares (7) | ||

| Beginning balance | 280,000 | given |

| Purchased by issuing shares | 51,000 | given |

| Issued for cash | 4,750 | |

| Ending balance | 335,750 | given |

Exercise 20.11

|

Dorchester Inc |

||||

| Cash flow from operating activities | ||||

| Cash received from customers | $243,700 | |||

| Cash paid to suppliers | (114,290) | |||

| Cash paid for operating expenses | (21,400) | (op exp & accrued liab) | ||

| Cash paid for interest | (2,940) | |||

| Cash paid for income tax | (39,000) | (177,630) | ||

| Cash provided by operating activities | 66,070 | |||

| Cash flow from investing activities | ||||

| Proceeds from sale of land | 27,500 | |||

| Proceeds from sale of equipment | 10,550 | given | ||

| Cash paid for equipment | (91,000) | |||

| Cash used in investing activities | (52,950) | |||

| Cash flow from financing activities | ||||

| Proceeds from notes payable | 70,000 | |||

| Dividends Paid | (37,670) | |||

| Cash provided from financing activities | 32,330 | |||

| Increase in cash | 45,450 | |||

| Cash, beginning Jan 1, Y3 | 47,250 | |||

| Cash, ending Dec 31, Y3 | $92,700 | |||

Exercise 20.12

|

Kingsmill Corp |

||||||

| Cash flow from Operating Activities | ||||||

| Cash Received from Customers | $549,600 | (557,400 -3,000 -4,800) | ||||

| Cash Paid for Suppliers | (227,500) | (-253,000 + 16,000 + 9,500) | ||||

| Cash Paid for Operating Expenses | (271,500) | (-138,000 - 140,000 + 1,500 + 5,000) | ||||

| Cash Paid for Interest Expense | (15,100) | (-15,600 + 500) | ||||

| Cash Paid for Income Tax | (27,600) | (541,700) | (-20,200 - 8,100 + 700) | |||

| Cash provided by operating activities | 7,900 | |||||

| Cash flow from Investing Activities | ||||||

| Purchased equipment | (5,000) | |||||

| Cash flow from Financing Activities | ||||||

| Issued shares | 31,600 | |||||

| Paid dividends | (10,500) | |||||

| Cash provided by financing activities | 21,100 | |||||

| Increase in Cash | 24,000 | |||||

| Cash, beginning Jan 1, Y5 | 31,000 | |||||

| Cash, ending Dec 31, Y5 | $55,000 | |||||

| Sales Revenue | ||||||

| Expenses | 557,400 | |||||

| Cost of Goods Sold | 253,000 | |||||

| Selling Exp | 138,000 | |||||

| Admin Expense | 140,000 | |||||

| Interest Exp | 15,600 | |||||

| Income Tax Exp | 20,200 | |||||

| TOTAL EXPENSES | 566,800 | |||||

| Net Loss | -9,400 | |||||