Chapter 18

Solutions

Exercise 18.1

| Transaction | Effect |

|---|---|

| Issuance of common shares | NE |

| Share split | NE |

| A revaluation of surplus resulting from a remeasurement of an available-for-sale asset | NE |

| Declaration of a cash dividend | D |

| Net income earned during the year | I |

| Declaration of a share dividend | D |

| Payment of a cash dividend | NE |

| Issuance of preferred shares | NE |

| Re-acquisition of common shares | D or NE |

| Appropriation of retained earnings for a reserve | D |

| A cumulative, preferred dividend that is unpaid at the end of the year | NE |

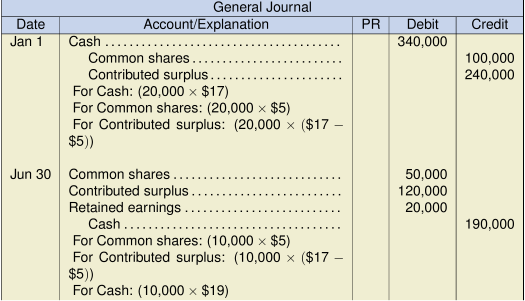

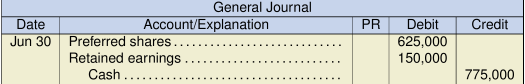

Exercise 18.5

Note: The contributed surplus is reduced on a pro-rata basis, as this surplus resulted from a share premium on issue, and not from a previous re-acquisition.

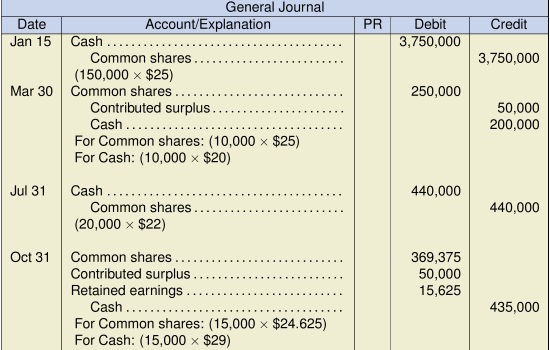

Exercise 18.6

| Note: Average issue cost of shares | = |

| = |

Also, note that the contributed surplus is fully utilized because it resulted from a previous re-acquisition of the same class of shares. As such, we do not need to allocate it on a pro-rata basis.

Exercise 18.8

-

Calculation Preferred Common Total Current year: (50,000 share × $3) $150,000 $150,000 Balance of dividends – $1,050,000 1,050,000 $150,000 $1,050,000 $1,200,000 -

Calculation Preferred Common Total Arrears: (50,000 shares × $3 × 2 years) $300,000 $300,000 Current year: ([50,000 shares × $3) 150,000 150,000 Balance of dividends – $750,000 750,000 $450,000 $750,000 $1,200,000 -

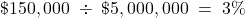

Calculation Preferred Common Total Arrears, as before $300,000 $300,000 Current year year basic dividend 150,000 $240,000 390,000 Current year participating dividend 196,146 313,854 510,000 $646,146 $553,854 $1,200,000 Note: The basic preferred dividend is calculated as before. Then, a like amount is allocated to the common shares. The preferred dividend can be expressed as a percentage:

(or

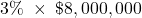

(or  ). Therefore, the common shares are also allocated a basic dividend of (

). Therefore, the common shares are also allocated a basic dividend of ( ) = $240,000. This leaves a remaining dividend of $510,000, which is available for participation. The participation is allocated on a pro-rata basis as follows:

) = $240,000. This leaves a remaining dividend of $510,000, which is available for participation. The participation is allocated on a pro-rata basis as follows:Carrying amounts of each class:

Preferred $5,000,000 38.46% Common 8,000,000 61.54% Total $13,000,000 100% The participating dividend is therefore:

Preferred: $510,000 × 38.46% = $196,146 Common: $510,000 × 61.54% = $313,854

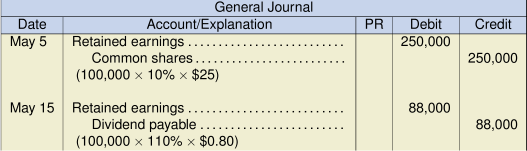

Exercise 18.9

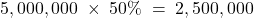

- Implied value of the company before the dividend:

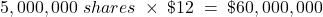

50% share dividend would issue an additional

50% share dividend would issue an additional  shares. The ex-dividend price should be

shares. The ex-dividend price should be  per share. A 3-for-2 share split results in the same number of shares being issued as above, making the share price $8.

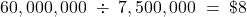

per share. A 3-for-2 share split results in the same number of shares being issued as above, making the share price $8. - For the 50% share dividend, the dividend amount will be calculated as

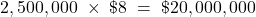

Therefore, after the dividend, the equity section will appear as follows:

Therefore, after the dividend, the equity section will appear as follows:

Common shares $32,500,000 Retained earnings 22,000,000 Total equity $54,500,000 A 3-for-2 share split has no effect on the accounts, as it simply increases the number of outstanding shares. Therefore, the equity section will appear as follows:

Common shares $12,500,000 Retained earnings 42,000,000 Total equity $54,500,000 - Either action will result in the share price dropping to $8 per share from $12. However, the total reported equity will not change as it’s just a question of how the deck will be shuffled, so to speak, in the equity section. The decision will depend on both the legal framework in the company’s jurisdiction and the corporate objectives of the distribution. There may be legal restrictions and tax implications, with respect to the share dividend, which would make the share split easier to implement. On the other hand, if the directors would like to capitalize some of the retained earnings to potentially reduce future shareholder demands for dividends, then the share dividend would be the better approach. The directors will also have to consider if the shareholder response will be different for each scenario. The directors should also consider if there are any other contracts or agreements, such as loan covenants, that would be affected by the decision.

Exercise 18.10

Average issue price = ![]()

Preferred dividend: ![]()

Common dividend: ![]()

b.

| Ocamp Inc. Statement of Changes in Shareholders’ Equity Year Ended 31 December 2022 |

||||||

| Total | Preferred Shares | Common Shares | Contributed Surplus | Retained Earnings | Accumulated Other Comp. Income | |

|---|---|---|---|---|---|---|

| Balance on January 1 | $1,217,000 | $225,000 | $280,000 | $7,000 | $590,000 | $115,000 |

| Comprehensive Income: | ||||||

| Net Income | 120,000 | 120,000 | ||||

| Revaluation | 23,000 | 23,000 | ||||

| Total comprehensive | ||||||

| Income | 143,000 | |||||

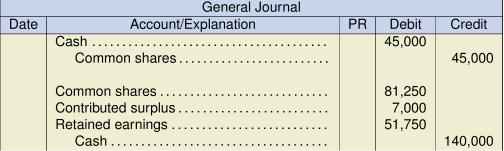

| Shares issued | 64,000 | 19,000 | 45,000 | |||

| Shares retired | (140,000) | (81,250) | (7,000) | (51,750) | ||

| Cash dividend – Common | (33,000) | (33,000) | ||||

| Cash dividend – Preferred | (11,000) | (11,000) | ||||

| Share dividend – Common | — | 48,000 | (48,000) | |||

| Balance by December 31 | $1,240,000 | $244,000 | $291,750 | — | $566,250 | $138,000 |

Note: Additional details of the transactions and the authorized and issued shares would be contained in the notes to the financial statements.

Exercise 18.11

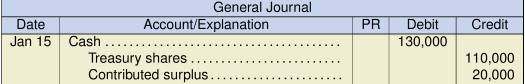

Note: Treasury shares were acquired at a price of ![]() per share. This is the price used to remove the treasury shares on resale.

per share. This is the price used to remove the treasury shares on resale.

Average issue price = ![]() per share

per share

Average issue price = ![]() per share

per share

![]()

There is no contributed surplus balance associated with preferred share re-acquisitions, so the full difference is charged to retained earnings.

Common dividend:

![]()

Note: The shares remaining in treasury are excluded from the dividend calculation, as the company cannot pay itself a dividend. The company’s issued share capital includes the treasury shares, although they are not outstanding.

Preferred dividend: ![]()

Note: This calculation assumes that the cumulative, unpaid dividend on the retired preferred shares was not paid. Depending on the articles of incorporation and local legislation, the cumulative, unpaid dividend may need to be paid prior to retirement of the shares. This would result in an additional dividend of $50,000 (![]() ) paid on the date of retirement.

) paid on the date of retirement.

Exercise 18.12

| Jun 1, Y6 | Share Subscription Receivable | 236,500 | ||

| Common Shares Subscribed | 236,500 | |||

| (10,000 shares × $23.65) | ||||

| Jun 1, Y6 | Cash | 82,775 | ||

| Share Subscription Receivable | 82,775 | |||

| down payment received of $236,500 × 35% | ||||

| 12/1/Y6 | Cash | 153,725 | ||

| Share Subscription Receivable | 153,725 | |||

| remainder of payment received on subscribed shares | ||||

| 12/1/Y6 | Common Shares Subscribed | 236,500 | ||

| Common Shares | 236,500 | |||

| subscribed shares fully paid, shares then issued | ||||

Exercise 18.13

1. Journal Entry

| Jul 1, Y7 | Common Shares (1) | 162,500 | ||

| Contributed Surplus | 42,670 | |||

| Retained Earnings | 28,830 | |||

| Cash (2) | 234,000 | |||

| (1) Common shares - remove at average price = 10,000 shares × $16.25. | ||||

| (2) Cash - based on market price = 10,000 shares × $23.40. | ||||

| clear and contributed surplus first, then use retained earnings. | ||||

2. Journal Entry

| Jul 1, Y7 | Common Shares (1) | 162,500 | ||

| Contributed Surplus | 71,500 | |||

| Cash (2) | 234,000 | |||

| (1) Common shares - remove at average price = 10,000 shares × $16.25. | ||||

| (2) Cash - based on market price = 10,000 shares × $23.40. | ||||

| no need to use retained earnings since contributed surplus has a large enough balance. | ||||

3. Journal Entry

| Jul 1, Y7 | Common Shares (1) | 162,500 | ||

| Retained earnings | 71,500 | |||

| Cash (2) | 234,000 | |||

| (1) Common shares - remove at average price = 10,000 shares × $16.25. | ||||

| (2) Cash - based on market price = 10,000 shares × $23.40. | ||||

| only use retained earnings since there is no balance in contributed surplus. | ||||

4. Difference between ASPE and IFRS

There is no real difference between IFRS and ASPE. IFRS does not provide guidance and therefore, the ASPE method is acceptable.

Exercise 18.14

1. The preferred shares are non-cumulative and non-participating

|

Preferred |

Common |

Total |

|

|---|---|---|---|

| Preferred (4,000 shares × $3.00) | 12,000 | 12,000 | |

| Common - get the remainder | - | 118,000 | 118,000 |

| $12,000 | $118,000 | $130,000 | |

| If there is $130,000 to be paid and the preferred receive a set amount of $12,000, then the remainder ($130,000 - $12,000 = $118,000) is paid to common shareholders. | |||

2. The preferred shares are cumulative and non-participating

| Preferred | Common | Total | |

|---|---|---|---|

| Preferred (4,000 shares × $3.00) | 12,000 | 12,000 | |

| Preferred (4,000 shares × $3.00) | 12,000 | 12,000 | |

| Preferred (4,000 shares × $3.00) | 12,000 | 12,000 | |

| Common - get the remainder | - | 94,000 | 94,000 |

| $36,000 | $94,000 | $130,000 | |

| If there is $130,000 to be paid and the preferred receive a set amount of $12,000. | |||

| There are three years that should be paid to the preferred shareholders: the current year and the preceeding two years, since preferred shares are cumulative. | |||

| The remainder ($130,000 - $36,000 = $94,000) is paid to common shareholders. | |||

3. The preferred shares are cumulative and participating

|

Preferred |

Common |

Total |

|

|---|---|---|---|

| Preferred (4,000 shares × $3.00) | 12,000 | 12,000 | |

| Preferred (4,000 shares × $3.00) | 12,000 | 12,000 | |

| Preferred (4,000 shares × $3.00) | 12,000 | 12,000 | |

| Common - treat the same as preferred | 9,000 | 9,000 | |

| Split the remainder | 48,571 | 36,429 | 85,000 |

| $84,571 | $45,429 | $130,000 | |

| There are three years that should be paid to the preferred shareholders: the current year and the preceeding two years, since preferred shares are cumulative. | |||

| Treat the common shareholders the same as preferred: | |||

| Preferred receive $3/$100 stated value = 3% dividend. Common shareholder $300,000 × 3%. | |||

| Pro rate split on remainder of dividend to be distributed: | |||

| Value of preferred | 57.14% | $400,000 | 4,000 shares × $100 stated value given |

| Value of common | 42.86% | $300,000 | |

| $700,000 | |||

| Remaining dividend to be split = $130,000 - $12,000 - $12,000 - $12,000 - $9,000 | |||

| 85,000 | |||

| To preferred | 57.14% | $48,571 | |

| To common | 42.86% | $36,429 | |

| $85,000 | |||