Chapter 14

Solutions

Exercise 14.1

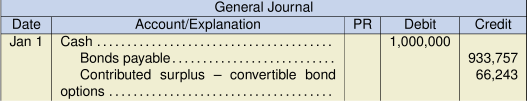

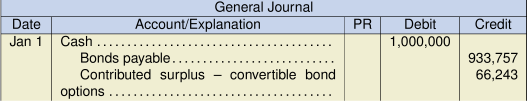

a. PV = (60,000 PMT, 8 I/Y, 4 N, 1,000,000 FV) = $933,757

b. For IFRS, the residual method is used. This allocates the proceeds first to the liability component and the residual to the equity component. The debt component is measured first as the par value compared to the present value of future cash flows without the convertible feature:

| Total proceeds at par | $1,000,000 |

| PV of the debt component by itself | (933,757) |

| Incremental value of option | $66,243 |

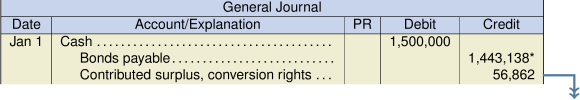

Entry:

c. Under ASPE, the zero-equity method can be used as a policy choice. The equity component would be measured at $0 and the rest to the debt component.

Entry:

Also, the residual method can also be used as explained above. Entry is the same as the entry for IFRS:Entry:

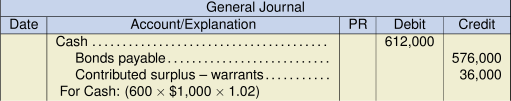

Exercise 14.2

a. Under IFRS, the residual method is applied whereby cash is allocated to the value of the debt instrument first, and the residual is allocated to equity. The debt value is calculated as $576,000 and the warrants are accounted for as equity instruments.

b. Under ASPE one option is to measure the component that is most easily measurable first (usually the debt component) and apply the residual to the other equity component. This is the option under IFRS, and the journal entry will, therefore, be the same:

Another option is to measure the equity component using the zero-equity method. This means that equity is measured at $0 and the journal entry would be:

Another option is to measure the equity component using the zero-equity method. This means that equity is measured at $0 and the journal entry would be:

c. Allocating the entire issuance to the debt component, and therefore zero to equity, results in a higher debt to total assets ratio as compared with the residual method. A lower debt to total assets ratio indicates better debt paying ability and long-run solvency.

Exercise 14.4

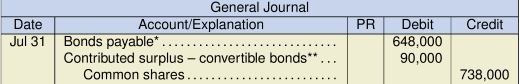

a.

b.

Note: The bonds payable carrying value would no longer include any unamortized premium, so the face value or par value would be the carrying value at maturity.

Note: The bonds payable carrying value would no longer include any unamortized premium, so the face value or par value would be the carrying value at maturity.

c. Due to common shares market price volatility, there is a risk in waiting to convert the bonds. If the bondholder does not convert when the common share market value is high, no gain will be realized. Conversely, if the common shares market price declines too far, the bondholder risks not being able to sell the bonds, rendering the conversion rights worthless.

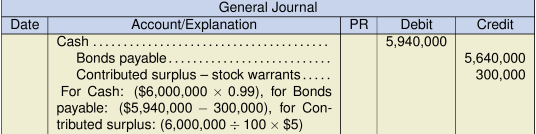

Exercise 14.5

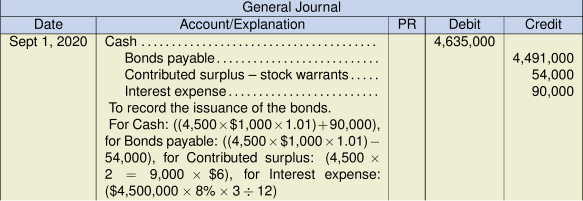

Residual method, using the fair value of the warrants first and the residual to the bonds:

Zero-equity method, which measures the equity component at $0:

Exercise 14.10

a.

* PV (10%, 5N, 135,000 PMT, 1,500,000 FV)

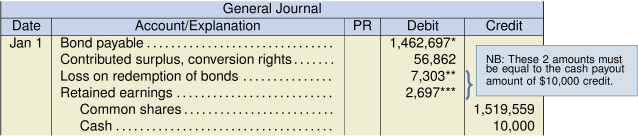

b. IFRS:

* 1,443,138 × 10% – 135,000 = 9,314

1,443,138 + 9,314 = 1,452,452 × 10% – 135,000 = 10,245

1,452,452 + 10,245 = 1,462,697

Or: Using present values and changing the number of periods from five years to three years: PV (10%, (5 – 2)N, 135,000 PMT, 1,500,000 FV) = $1,462,697

c. ASPE:

* Same calculation as in previous part

** 1,462,697 – 1,470,000 = 7,303

*** 10,000 – 7,303 = 2,697

Exercise 14.11

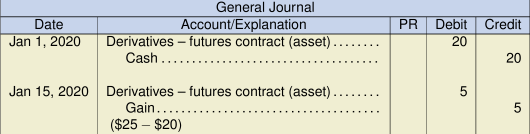

Exercise 14.12

- January 1, 2020: No journal entry necessary since the fair value of the forward contract would be $0.

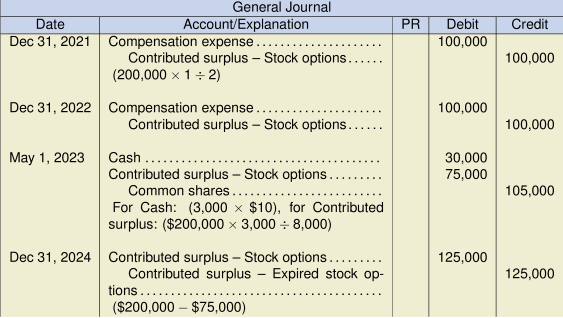

Exercise 14.14

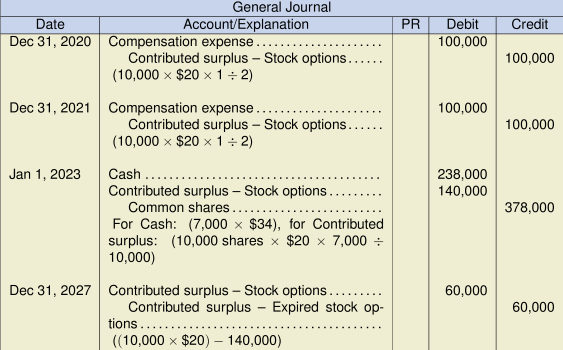

- January 1, 2021: No entry on the grant date.

- The market price of the shares of $15 on May 1, 2023, is not used in recording the exercise of the stock options. From an accounting perspective, the market price is not relevant. It is, nonetheless, relevant to the employees in making their decision to exercise their stock options. The market price is mentioned to indicate that the timing of the exercise is justified, or at least makes sense. Employees exercising a stock option would have paid $10 and could resell the shares immediately for $15, for a gain of $5 per share.

Exercise 14.15

| September 1, Y3 | NO ENTRY | |||

| this date just indicates that the company adopted a plan - no financial impact | ||||

| January 1, Y4 | NO ENTRY | |||

| this is the grant date. This is the start of the plan but no financial impact has occurred. | ||||

| December 31, Y4 | Compensation Expense | 174,050 | ||

| Contributed Surplus - CSOP | 174,050 | |||

| ($348,100 total compensation expense / 2 years - exercise period) | ||||

| December 31, Y5 | Compensation Expense | 174,050 | ||

| Contributed Surplus - CSOP | 174,050 | |||

| ($348,100 total compensation expense / 2 years - exercise period) | ||||

| May 1, Y6 | Cash (1) | 656,250 | ||

| Contributed Surplus - CSOP (2) | 261,075 | |||

| Common Shares | 917,325 | |||

| (1) Cash = 26,250 shares × $25.00 agreed upon option price | ||||

| (2) Contributed Surplus = $348,100 × (26,250 options exercised / 35,000 options available) | ||||

| December 31, Y9 | Contributed Surplus - CSOP (1) | 87,025 | ||

| Contributed Surplus - Expired Stock Options | 87,025 | |||

| (1) $174,050 + $174,050 - 261,075 | ||||

Exercise 14.16

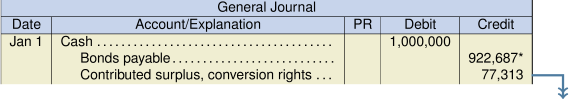

1. Entry at January 1, Y2

Before the entry is prepared, we must determine the present value of the bonds in order to determine the value of the contributed surplus – convertible bonds.

| PV | $1,555,756 |

| Rate | 3% |

| Nper | 4 |

| Pmt | -60,000 |

| FV | -1,500,000 |

| Type | 0 |

| Amount of cash received | $1,700,000 | (given) |

| Present value of bond | $1,555,756 | (without conversion feature) |

| Value of option | $144,244 |

| Jan 1, Y2 | Cash | 1,700,000 | ||

| Bonds Payable | 1,555,756 | |||

| Contributed Surplus - convertible bonds | 144,244 | |||

2. Amortization Schedule

|

Date |

Cash |

Interest Expense |

Amortization |

Carrying Value |

|---|---|---|---|---|

| Jan 1, Y2 | 1,555,756 | |||

| Dec 31, Y2 | 60,000 | 46,673 | 13,327 | 1,542,429 |

| Dec 31, Y3 | 60,000 | 46,273 | 13,727 | 1,528,702 |

| Dec 31, Y4 | 60,000 | 45,861 | 14,139 | 1,514,563 |

| Dec 31, Y5 | 60,000 | 45,437 | 14,563 | 1,500,000 |

3. Entry at December 31, Y2

| Interest Expense | 46,673 | ||

| Bonds Payable | 13,327 | ||

| Interest Payable (paid January 1, Y3) | 60, 000 | ||

4. Entry at December 31, Y3

| Interest Expense | 46,273 | ||

| Bonds Payable | 13,727 | ||

| Interest Payable (paid January 1, Y4) | 60,000 | ||

| interest is still owed to the bondholders for Y3 because the bonds were outstanding for the year. | |||

| Bonds Payable | 1,528,702 | ||

| Contributed Surplus - convertible bonds | 144,244 | ||

| Common Shares | 1,672,946 | ||

| contributed suplus must be cleared since bonds are converted | |||

Exercise 14.17

1. Purchase of options

| May 1, Y4 | Derivative - Finanacial Asset | 325 | ||

| Cash | 325 | |||

| to record the purchase of the option (derivative) | ||||

2. Change in fair value

| July 31, Y4 | Derivative - Finanacial Asset | 7,475 | ||

| Gain on value of derivative | 7,475 | |||

| to record the increase in value of derivative ($7,800 - 325) | ||||

3. Took delivery of share

| July 31, Y4 | FV-NI Investments (1) | 39,700 | ||

| Loss | 600 | |||

| Cash (2) | 32,500 | |||

| Derivative - Finanacial Asset | 7,800 | |||

| (1) must record at current fair value = 1,000 shares × $39.70 | ||||

| (2) cash is paid at agreed upon price = 1,000 shares × $32.50 | ||||

4. Settled the option

| July 31, Y4 | Cash (1) | 7,200 | ||

| Loss | 600 | |||

| Derivative - Financial Asset | 7,800 | |||

| (1) since settle, only receive the difference in share price = 1,000 shares × ($39.70 - $32.50) | ||||

| note - the loss is the same under both scenarios | ||||

Exercise 14.18

| Jan 7, Y3 | no entry - the fair value of the forward contract is $0. | |||

| Jan 20, Y3 | Derivative - Financial Asset | 675 | ||

| Gain | 675 | |||

| to record the increase in fair value ($675 - $0) | ||||

| Mar 15, Y3 | Loss | 279 | ||

| Derivative - Financial Asset | 279 | |||

| to record the decrease in fair value ($675 - $396) | ||||

| May 4, Y3 | Derivative - Financial Asset | 342 | ||

| Gain | 342 | |||

| to record the increase in fair value ($738 - $396) | ||||

| Aug 31, Y3 | Cash (1) | 57,000 | ||

| Gain | 56,262 | |||

| Derivative - Financial Asset | 738 | |||

| (1) cash is the difference between market price and contract price = 1,000 ounces × ($2,007 - $1,950) | ||||

If Midland took possession (delivery) of the gold

| Gold (1) | 2,007,000 | ||

| Gain | 56,262 | ||

| Derivative - Financial Asset | 738 | ||

| Cash (2) | 1,950,000 | ||

| (1) the gold (an asset) would be worth the market value = 1,000 ounces × $2,007 | |||

| (2) cash paid is the agreed upon amount per ounce = 1,000 ounces × $1,950 | |||

| note - the gain is the same whether taking delivery or not. | |||