13.4 Special Applications: Mortgages

Special Applications: Mortgages

A mortgage is a special type of loan that is collaterally secured by real estate. In essence, the loan has a lien against the property, that is, the right to seize the property for the debt to be satisfied. An individual or business taking out a mortgage is obliged to pay back the amount of the loan with interest based on a predetermined contract. The financial institution, though, has a claim on the real estate property in the event that the mortgage goes into default, meaning that it is not paid as per the agreement. In these instances, financial institutions will pursue foreclosure of the property, which allows for the tenants to be evicted and the property to be sold. The proceeds of the sale are then used to pay off the mortgage. A mortgage always involves two parties. The individual or business that borrows the money is referred to as the mortgagor, and the financial institution that lends the money is referred to as the mortgagee.

This section explains mortgage fundamentals and shows you how to amortize and calculate payments on various mortgages.

How It Works

Follow these steps to calculate a mortgage payment:

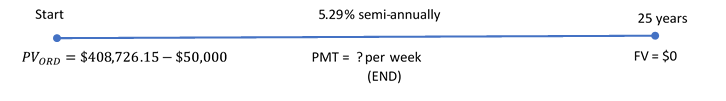

Step 1: Visualize the mortgage by drawing a timeline as illustrated below. Identify all other time value of money variables, including PVORD, I/Y, C/Y, P/Y, and Years. The future value, FV, is always zero (the mortgage is repaid).

Step 2: Calculate the periodic interest rate (i). See Important Notes developed in section 11.2.

Step 3: Calculate the number of annuity payments (n) using Formula 11.1. Remember to use the amortization period and not the term for the Years variable in this calculation.

Step 4: Calculate the ordinary annuity payment amount using Formula 11.3A and rearranging for PMT. You must round this calculated amount to two decimals since it represents a physical payment amount.

Concept Check

Example: 13.4.1: What Are the Payments

The Olivers are looking to purchase a new home from Pacesetter Homes in a northeastern Calgary suburb. An Appaloosa 3 model show home can be purchased for $408,726.15. They are planning on putting $50,000 as a down payment with a 25 year amortization and weekly payments. If current mortgage rates are fixed at 5.29% compounded semi-annually for a five year closed term, determine the mortgage payment required.

Solution:

Calculate the mortgage payment amount required (PMT).

Step 1: The mortgage timeline appears below.

PVORD = $408,726.15 - $50,000 = $358,726.15; I/Y = 5.29%; C/Y = 2; P/Y = 52; Years = 25; FV = $0

Step 2: Since [latex]P/Y \ne C/Y[/latex] find the equivalent rate (ieq) that matches the payment interval.

[latex]i=\frac{I/Y}{C/Y}=\frac{5.29\%}{2}=2.645\%[/latex]

[latex]i_{eq}=(1+i)^{\frac{C/Y}{P/Y}}-1=(1+0.02645)^{\frac{2}{52}}-1=0.001004591\; \text{per week}[/latex]

Step 3: Calculate the number of annuity payments (n) using Formula 11.1.

[latex]n=P/Y \times (\text{Number of Years})=52 \times 25 =1,\!300[/latex]

Step 4: Calculate the ordinary annuity payment amount using Formula 11.3A and rearranging for PMT.

[latex]\begin{align} PV_{ORD}&=PMT \left[\frac{1-(1+i_{eq})^{-n}}{i_{eq}}\right]\\ $358,\!726.16&=PMT\left[\frac{1-(1+0.001004591)^{-1300}}{0.001004591}\right]\\ $358,\!726.16&=PMT \frac{0.728912263}{0.001004591}\\ $358,\!726.16&=PMT(725.5811199)\\ PMT&=\$494.40 \end{align}[/latex]

Calculator instructions:

| Mode | N | I/Y | PV |

|---|---|---|---|

| END | 1,300 | 5.29 | 358,726.15 |

| PMT | FV | P/Y | C/Y |

|---|---|---|---|

| Answer: -494.398328 | 0 | 52 | 2 |

If the Olivers purchase this home as planned, they are mortgaging $358,726.15 for 25 years. During the first five-year term of their mortgage, they make weekly payments of $494.40. After the five years, they must renew their mortgage.

Renewing the Mortgage

When the term of a mortgage expires, the balance remaining becomes due in full. Typically the balance owing is still quite substantial, so the mortgage must be renewed. As discussed earlier, this means that the mortgagor assumes another mortgage, not necessarily with the same financial institution, and the amortization term is typically reduced by the length of the first term. The length of the second term of the mortgage then depends on the choice of the mortgagor. Other variables such as payment frequency and the interest rate may or may not change.

For example, assume a mortgage is initially taken out with a 25-year amortization and a five-year term. After five years, the mortgage becomes due in full. Unable to pay it, the mortgagor renews the mortgage for the remaining 20-year amortization, and also opts for a three-year term in assuming the new mortgage. When those three years are over, the mortgagor renews the mortgage for the remaining 17-year amortization and again makes another term decision. This process repeats until the debt is ultimately paid off.

How It Works

Follow these steps to renew a mortgage:

Steps 1 to 4: The steps for calculating the mortgage payment amount remain unchanged.

Step 5: Determine the balance remaining at the end of the mortgage term. This involves the following:

- Calculate the future value of the mortgage principal (FV) at the end of the term using Formulas 9.2.

- Calculate the future value of the mortgage payments (FVORD) made throughout the term using Formulas 11.1.

- Calculate the remaining balance by taking BAL = FV = FVORD.

Step 6: Depending on the information being sought, repeat the above steps as needed for each mortgage renewal using the new amortization remaining, the new interest rate, any changes in payment frequency, and the new term. For example, if you are looking for the mortgage payment in the second term, repeat just steps 2 through 4. If looking for the balance remaining at the end of the second term, repeat step 5 as well.

Note: With any renewal, the mortgagor may choose either to shorten or to lengthen the amortization period. If shortening the amortization period the mortgagor can pay off the mortgage faster. If the mortgagor wishes to lengthen the amortization period, the financial institution may look at the overall time to pay the debt and put an upper cap on how long the amortization period may be increased.

Your BAII Plus Calculator

When you use your BAII Plus calculator to calculate the remaining balance at the end of the term, you can arrive at this number in one of two ways. Once you have computed the mortgage payment amount and re-entered it into the calculator with only two decimals, you determine the last payment number for the mortgage term and then either

- Input this value into the N and solve for FV, or

- Open up the AMORT function and input the last payment number into both P1 and P2. Scroll down to BAL for the solution. For examples below we will use this approach.

Concept Check

Example 13.4.2: A Mortgage Renewal

The Chans purchased their home three years ago for $389,000 less a $38,900 down payment at a fixed semi-annually compounded rate of 4.9% with monthly payments. They amortized the mortgage over 20 years. The Chans will renew the mortgage on the same amortization schedule at a new rate of 5.85% compounded semi-annually. How much will their monthly payments increase in the second term?

Solution:

Calculate the original mortgage payment in the first term, or PMT1. Then renew the mortgage and recalculate the mortgage payment in the second term, or PMT2. The amount by which PMT2 is higher is their monthly payment increase.

Step 1: Given information:

First Term: PVORD = $389,000 - $38,900 = $350,100; I/Y = 4.9%; C/Y = 2; P/Y = 12; Years = 20; FV = $0

Second Term: PVORD = BAL after first term; I/Y = 5.85%; C/Y = 2; P/Y = 12; Years = 17; FV = $0

For the First Term (3 years):

Step 2: Since P/Y\ne C/Y find the equivalent rate (ieq) that matches the payment interval.

[latex]i=\frac{I/Y}{C/Y}=\frac{4.9\%}{2}=2.45\%[/latex]

[latex]i_{eq}=(1+i)^{\frac{C/Y}{P/Y}}-1=(1+0.0245)^{\frac{2}{12}}-1=0.004042263\; \text{per month}[/latex]

Step 3: Calculate the number of annuity payments (n) using Formula 11.1.

[latex]n=P/Y \times (\text{Number of Years})=12 \times 20 =240[/latex]

Step 4: Calculate the ordinary annuity payment amount using Formula 11.3A and rearranging for PMT.

[latex]\begin{align} PV_{ORD}&=PMT \left[\frac{1-(1+i_{eq})^{-n}}{i_{eq}}\right]\\ $350,\!100&=PMT\left[\frac{1-(1+0.004042263)^{-240}}{0.004042263}\right]\\ $350,\!100&=PMT \frac{0.620229289}{0.004042263}\\ $350,\!100&=PMT(153.4361543)\\ PMT&=\$2,\!281.73 \end{align}[/latex]

Step 5:

Principal: Calculate the future value of the mortgage principal (FV) at the end of 3 years (36 months).

[latex]n=12 \times 3 =36[/latex]

[latex]\begin{align} FV&=PV(1+i_{eq})^n\\ &=\$350,\!100(1+0.004042263)^{36}\\ &=\$404,\!821.7991 \end{align}[/latex]

Payments: Calculate the future value of the first 36 monthly payments using Formula 11.2A

[latex]\begin{align} FV_{ORD}&=PMT \left[\frac{(1+i_{eq})^n-1}{i_{eq}}\right]\\ &=\$2,\!281.73\left[\frac{(1+0.004042263)^{36}-1}{0.004042263}\right]\\ &=\$88,\!228.30644 \end{align}[/latex]

Balance: BAL = FV = FVORD = $404,821.7991 - $88,228.30644 = $316,593.49

Step 6: Calculate the ordinary annuity payment amount using Formula 11.3A and rearranging for PMT.

[latex]i=\frac{I/Y}{C/Y}=\frac{5.85\%}{2}=2.925\%[/latex]

[latex]i_{eq}=(1+i)^{\frac{C/Y}{P/Y}}-1=(1+0.02925)^{\frac{2}{12}}-1=0.004816626\; \text{per month}[/latex]

[latex]n=P/Y \times (\text{Number of Years})=12 \times 17 =204\;\text{payments}[/latex]

[latex]\begin{align} PV_{ORD}&=PMT \left[\frac{1-(1+i_{eq})^{-n}}{i_{eq}}\right]\\ $316,\!593.49&=PMT\left[\frac{1-(1+0.004816626)^{-204}}{0.004816626}\right]\\ $316,\!593.49&=PMT \frac{0.624776296}{0.004816626}\\ $316,\!593.49&=PMT(129.7124369)\\ PMT&=\$2,\!440.73 \end{align}[/latex]

Step 7: Calculate the increase from the first to the second payment.

$2,440.73 - $2,281.73 = $159.00

Calculator instructions:

| Action | Mode | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|---|

| First Term Payment | END | 240 | 4.9 | 350,100 | Answer: -2,281.730755 Re-keyed as -2,281.73 |

0 | 12 | 2 |

Use the AMORT function to find the BAL on the after the 3-year term (payments 1-36).

2nd AMORT

P1 = 1

P2 = 36

↓

BAL = $316,593.49

| Action | Mode | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|---|

| Second Term Payment | END | 204 | 5.85 | 316,593.49 | Answer: -2,440.73 | 0 | 12 | 2 |

The initial mortgage payment for the three-year term was $2,281.73. Upon renewal at the higher interest rate, the monthly payment increased by $159.00 to $2,440.73.

Exercises

In each of the exercises that follow, try them on your own. Full solutions are available should you get stuck.

- Three years ago, Phalatda took out a mortgage on her new home in Kelowna for $628,200 less a $100,000 down payment at 6.49% compounded semi-annually. She is making monthly payments over her three-year term based on a 30-year amortization. At renewal, she is able to obtain a new mortgage on a four-year term at 6.19% compounded semi-annually while continuing with monthly payments and the original amortization timeline.

Calculate the following:

a) Interest and principal portions in the first term. (Answer: $508,947.54)

b) New mortgage payment amount in the second term. (Answer: $99,737.98)

c) Balance remaining after the second term. (Answer: $475,372.69

- The Verhaeghes have signed a three-year closed fixed rate mortgage with a 20-year amortization and monthly payments. They negotiated an interest rate of 4.84% compounded semi-annually. The terms of the mortgage allow for the Verhaeghes to make a single top-up payment at any one point throughout the term. The mortgage principal was $323,000 and 18 months into the term they made one top-up payment of $20,000.

a) What is the balance remaining at the end of the term? (Answer: $270,417.34)

b) By what amount was the interest portion reduced by making the top-up payment? (Answer: $1,487.42)

- Fifteen years ago, Clarissa’s initial principal on her mortgage was $408,650. She set up a 30-year amortization, and in her first 10-year term of monthly payments her mortgage rate was 7.7% compounded semi-annually. Upon renewal, she took a further five-year term with monthly payments at a mortgage rate of 5.69% compounded semi-annually. Today, she renews the mortgage but shortens the amortization period by five years when she sets up a three-year closed fixed rate mortgage of 3.45% compounded semi-annually with monthly payments. What principal will she borrow in her third term and what is the remaining balance at the end of the term? What total interest portion and principal portion will she have paid across all 18 years? (Answer: $411,499.50)

Note: Solution to exercises are demonstrated using the calculator only.

Image Descriptions

Figure 13.4.1: Timeline showing PVord = $408,726.15 - $50,000 at Start and PV = $0 at 25 years. 5.29% semi-annually and PMT = ? per week (END). [Back to Figure 13.4.1]