11.4: Annuity Payment Amounts

Annuity Payment Amounts

You need to calculate an annuity payment in many situations:

- Figuring out loan or mortgage payments

- Determining membership or product payment plans

- Calculating lease payments

- Determining the periodic payment necessary to achieve a savings goal

- Determining the maximum payment that an investment annuity can sustain over a period of time

The Formula

Recall that the annuity payment amount, PMT, is one of the variables in Formula 11.2A, Formula 11.2B, Formula 11.3A, and Formula 11.3B. Calculating this amount then requires you to substitute the known variables and rearrange the formula for PMT. The most difficult part of this process is figuring out which of the four formulas to use. Your selection depends on the two questions stated below.

-

Are the annuity payments to be made at the beginning or at the end of the payment interval? In other words, do you have an annuity due or an ordinary annuity?

-

Do you know the amount that the annuity starts or ends with? In other words, do you know the present value or future value of the annuity?

How It Works

Follow these steps to solve for any annuity payment amount:

Step 1: Identify the annuity type. Draw a timeline to visualize the question.

Step 2: Identify the variables that you know, including I/Y, C/Y, P/Y, and Years. You must also identify a value for one of PVORD, PVDUE, FVORD, or FVDUE.

Step 3: Depending on the type of an annuity, calculate the periodic interest rate.

For simple annuities you need to calculate the periodic interest rate (i) using the formula

[latex]i=\frac{I/Y}{C/Y}[/latex]

For general annuities you need to calculate the equivalent periodic rate, ieq, that matches the payment interval using the formula

[latex]i_{eq}=(1+i)^{\frac{C/Y}{P/Y}}-1[/latex]

Step 4: You may or may not have a value for FV or PV. If a single payment PV or FV is known, move it to the other end of the time segment using appropriate formula. When you move the amount to the same focal date as the present or future value of the annuity, either add this number to the annuity value or subtract it as the situation demands. Example 11.4.3 later in this section will illustrate this practice.

Step 5: Apply the correct annuity payment formula that matches your annuity type and known present or future value. Select from Formula 11.2A, Formula 11.2B, Formula 11.3A, or Formula 11.3B then rearrange for the annuity payment amount, PMT. If you performed step 4 above, be sure to use the adjusted future or present value of your annuity in the formula.

Concept Check

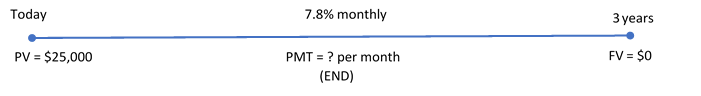

Example 11.4.1: Payments on a Loan

Morgan wants to consolidate a lot of smaller debts into a single three-year loan for $25,000. If the loan is charged interest at 7.8% compounded monthly, what is her payment amount at the end of every month?

Solution:

Step 1: The payments are made at the end of the payment intervals, and the compounding period and payment intervals are the same. Therefore, this is an ordinary simple annuity. Calculate the monthly amount of her loan payment, or PMT.

The timeline for the loan appears below.

Step 2: Given information:

PV = $25,000; I/Y = 7.8%; C/Y = 12; P/Y = 12; Years = 3; FV = $0

Step 3: Calculate the periodic interest rate, i.

[latex]i=\frac{I/Y}{C/Y}=\frac{7.8\%}{12}=0.65\%[/latex]

Step 4: Since FV=$0, skip this step.

Step 5: Use the formula for PVORD and solve for PMT.

[latex]n=P/Y \times \text{(Number of Years)}=12 \times 3=36[/latex]

[latex]\begin{align} PV_{ORD}&=PMT \left[\frac{1-(1+i)^{-n}}{i}\right]\\ \$25,\!000&=PMT\left[\frac{1-(1+0.0065)^{-36}}{0.0065}\right]\\ PMT&=\frac{\$25,\!000}{32.005957}=\$781.10 \end{align}[/latex]

Calculator instructions:

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| 36 | 7.8 | 25,000 | Answer: -781.104587 | 0 | 12 | 12 |

The figure shows how much principal and interest make up the payments. To pay off her consolidated loan, Morgan’s month-end payments for the next three years will be $781.10.

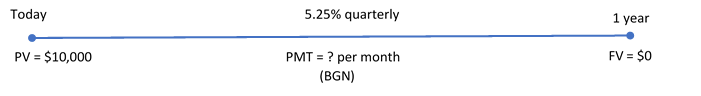

Example 11.4.2: Funding a Backpack Trip Across Europe

Franco has placed $10,000 into an investment fund with the goal of receiving equal amounts at the beginning of every month for the next year while he backpacks across Europe. If the investment fund can earn 5.25% compounded quarterly, how much money can Franco expect to receive each month?

Solution:

Step 1: The payments are at the beginning of the payment intervals, and the compounding period and payment intervals are different. Therefore, this is a general annuity due. Calculate the monthly amount he can receive, or PMT.

The timeline for the vacation money appears below.

Step 2: PVDUE = $10,000; I/Y = 5.25%; C/Y = 4; P/Y = 12; Years = 1; FV = $0

Step 3: Since P/Y [latex]\ne[/latex] C/Y, calculate the equivalent interest rate (ieq) that matches the payment interval.

[latex]i=\frac{I/Y}{C/Y}=\frac{5.25\%}{4}=1.3125\%[/latex]

[latex]i_{eq}=(1+i)^{\frac{C/Y}{P/Y}}-1=(1+0.013125)^{\frac{4}{12}}-1=0.004355998\; \text{per month}[/latex]

Step 4: Since FV=$0, skip this step.

Step 5: Calculate the payment amount, PMT, using the formula for PVDUE.

[latex]n=P/Y \times \text{(Number of Years)}=12 \times 1=12[/latex]

[latex]\begin{align} PV_{DUE}&=PMT \left[\frac{1-(1+i_{eq})^{-n}}{i_{eq}}\right] \times(1+i_{eq})\\ \$10,\!000&=PMT \left[\frac{1-(1+0.004355998)^{-12}}{0.004355998}\right] \times(1+0.004355998)\\ PMT&=\frac{\$10,\!000}{11.717849}=\$853.40 \end{align}[/latex]

Calculator instructions:

| Mode | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|

| BGN | 12 | 5.25 | -10,000 | Answer: 853.398928 | 0 | 12 | 4 |

The figure shows how much principal and interest make up the payments. While backpacking across Europe, Franco will have his annuity pay him $853.40 at the beginning of every month.

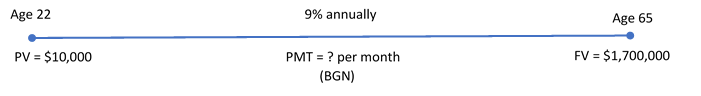

Example 11.4.3: Planning RRSP Contributions

Kingsley’s financial adviser has determined that when he reaches age 65, he will need $1.7 million in his RRSP to fund his retirement. Kingsley is currently 22 years old and has saved up $10,000 already. His adviser thinks that his RRSP will average 9% compounded annually throughout the years. To meet his RRSP goal, how much does Kingsley need to invest every month starting today?

Solution:

Step 1: The payments are made at the beginning of the payment intervals, and the compounding period and payment intervals are different. Therefore, this is a general annuity due. Calculate the monthly amount Kingsley needs to contribute, or PMT.

The timeline for Kingsley’s RRSP contributions appears below.

Step 2: PV = $10,000; FVDUE = $1,700,000; I/Y = 9%; C/Y = 1; P/Y = 12; Years = 43

Step 3: Calculate the equivalent interest rate (ieq) that matches the payment interval.

[latex]i=\frac{I/Y}{C/Y}=\frac{9\%}{1}=9\%[/latex]

[latex]i_{eq}=(1+i)^{\frac{C/Y}{P/Y}}-1=(1+0.09)^{\frac{1}{12}}-1=0.007207323\; \text{per month}[/latex]

Step 4: You need to move the present value to Kingsley’s age 65, the same date as FVDUE. Calculate the future value, FV. The FV is money the annuity does not have to save, so you subtract it from FVDUE.

[latex]n=P/Y \times \text{(Number of Years)}=12 \times 43=516[/latex]

[latex]FV=PV \times (1+i_{eq})^n=\$10,\!000\times(1+0.007207323)^{516}=\$406,\!761.0984[/latex]

[latex]\text{New}\;FV_{DUE}=\$1,\!700,\!000-\$406,\!761.0984=\$1,\!293,\!238.902[/latex]

Step 5: Calculate the payment amount, PMT, using the formula for FVDUE.

[latex]\begin{align} FV_{DUE}&=PMT \left[ \frac{(1+i_{eq})^n-1}{i_{eq}}\right]\times(1+i_{eq})\\ \$1,\!293,\!238.902&=PMT \left[ \frac{(1+0.007207323)^{516}-1}{0.007207323}\right]\times(1+0.007207323)\\ PMT&=\frac{\$1,\!293,\!238.902}{5,\!544.647665}=\$233.24 \end{align}[/latex]

Calculator instructions:

| Mode | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|

| BGN | 516 | 9 | -10,000 | Answer: -233.240952 | 1700000 | 12 | 1 |

The figure shows how much principal and interest make up the final balance. To meet his retirement goals, Kingsley needs to invest $233.24 at the beginning of every month for the next 43 years. In doing so, he will achieve a $1.7 million balance in his account at age 65. (Note: Similar to loan payments, the last payment in actuality is required to be a slightly higher amount since the annuity payment was rounded downwards. However, the last payment is treated equally at this time for purposes of all calculations.)

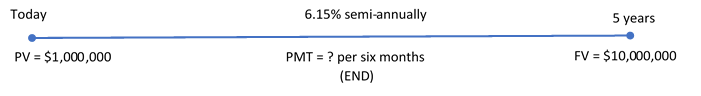

Example 11.4.4: Purchasing New Production Line Machinery

The production department just informed the finance department that in five years’ time the robotic systems on the production line will need to be replaced. The estimated cost of the replacement is $10 million. To prepare for this purchase, the finance department immediately deposits $1,000,000 into a savings annuity earning 6.15% compounded semi-annually, and it plans to make semi-annual contributions starting in six months. How large do those contributions need to be?

Solution:

Step 1:

The payments are made at the end of the payment intervals, and the compounding period and payment intervals are the same. Therefore, this is an ordinary simple annuity. Calculate the monthly amount the finance department needs to contribute, or PMT.

The timeline for the machinery fund appears below.

Step 2: Give information:

PV = $1,000,000; FVORD = $10,000,000; I/Y = 6.15%; C/Y = 2; P/Y = 2; Years = 5

Step 3: Calculate the periodic interest rate, i.

[latex]i=\frac{I/Y}{C/Y}=\frac{6.15\%}{2}=3.075\%[/latex]

Step 4: The present value must be moved to the five-year date, the same date as FVORD. Apply Formula 9.2A. This FV is money the annuity does not have to save, so it is subtracted from FVORD to arrive at the amount the annuity must generate.

[latex]n=P/Y \times \text{(Number of Years)}=2 \times 5=10[/latex]

[latex]FV=PV \times (1+i)^n=\$1,000,\!000\times(1+0.03075)^{10}=\$1,\!353,\!734.306[/latex]

[latex]\text{New}\;FV_{ORD}=\$10,\!000,\!000-\$1,\!353,\!734.306=\$8,\!646,\!265.694[/latex]

Step 5: Use the formula for FVORD and solve for PMT.

[latex]\begin{align} FV_{ORD}&=PMT \left[\frac{(1+i)^n-1}{i}\right]\\ \$8,\!646,\!265.694&=PMT\left[\frac{(1+0.03075)^{10}-1}{0.03075}\right]\\ PMT&=\frac{\$8,\!646,\!265.694}{11.503554}=\$751,\!616.87 \end{align}[/latex]

Calculator instructions:

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| 10 | 6.15 | -1,000,000 | Answer: -751,616.8656 | 10,000,000 | 2 | 2 |

The figure shows how much principal and interest make up the final balance. To have adequate funding for the production line machinery replacement five years from now, the finance department needs to deposit $751,616.87 into the fund every six months. (Note: Similar to loan payments, the last payment in actuality is required to be a slightly lower amount since the annuity payment was rounded upwards. However, the last payment is treated equally at this time for purposes of all calculations.)

Exercises

In each of the exercises that follow, try them on your own. Full solutions are available should you get stuck.

- To save approximately $30,000 for a down payment on a home four years from today, what amount needs to be invested at the end of every month at 4.5% compounded semi-annually? (Answer: $572.08)

- Sinclair does not believe in debt and will only pay cash for all purchases. He has already saved up $140,000 toward the purchase of a new home with an estimated cost of $300,000. Suppose his investments earn 7.5% compounded monthly. How much does he need to contribute at the beginning of each quarter if he wants to purchase his home in five years? (Answer: $3,943.82)

- The Kowalskis’ only child is eight years old. They want to start saving into an RESP such that their son will be able to receive $5,000 at the end of every quarter for four years once he turns 18 and starts attending postsecondary school. When the annuity is paying out, it is forecast to earn 4% compounded monthly. While they make contributions at the end of every month to the RESP, it will earn 8% compounded semi-annually. Additionally, at the end of every year of contributions the government places a $500 grant into the RESP. What is the monthly contribution payment by the Kowalskis? (Answer: $364.88 )

Note: Solution to exercises are demonstrated using the calculator only.

Timelines for exercises are included in Solutions to Exercises.

Image Descriptions

Figure 11.4.1: Timeline showing PV = $25,000 at Today and FV = $0 at 3 Years. 7.8% monthly. PMT = ? per month (END) [Back to Figure 11.4.1]

Figure 11.4.2: Timeline showing PV = $10,000 at Today and FV= $0 at 1 Year. 5.25% quarterly. PMT = ? per month (BGN) [Back to Figure 11.4.2]

Figure 11.4.3: Timeline showing PV = $10,000 at Age 22 and FV= $1,700,000 at Age 65. 9% annually. PMT = ? per month (BGN) [Back to Figure 11.4.3]

Figure 11.4.4.: Timeline showing PV = $1,000,000 at Today and FV= $10,000,000 at 5 Years. 6.15% semi-annually. PMT = ? per six months (END) [Back to Figure 11.4.4]

An annuity in which the payment interval equals the compounding interval (P/Y equals to C/Y).

An annuity in which the payment interval does not equal the compounding interval (P/Y does not equal C/Y).