13.1: Calculating Principal and Interest Component

Calculating Principal and Interest Component

When you take out a mortgage for yourself or your business, where does your money go? You need a chart of your loan payments showing how much interest the bank charges and how much is applied against your principal.

This chapter takes you through calculating the principal and interest components of any single payment or series of payments for both loans and investment annuities.

What Is Amortization?

Amortization is a process by which the principal of a loan is extinguished over the course of an agreed-upon time period through a series of regular payments that go toward both the accruing interest and principal reduction. Two components make up the agreed-upon time component:

- Amortization Term. The amortization term is the length of time for which the interest rate and payment agreement between the borrower and the lender will remain unchanged. Thus, if the agreement is for monthly payments at a 5% fixed rate over five years, it is binding for the entire five years. Or if the agreement is for quarterly payments at a variable rate of prime plus 2% for three years, then interest is calculated on this basis throughout the three years.

- Amortization Period. The amortization period is the length of time it will take for the principal to be reduced to zero. For example, if you agree to pay back your car loan over six years, then after six years you reduce your principal to zero and your amortization period is six years.

Calculating Interest and Principal Components for a Single Payment

At any point during amortization you can precisely calculate how much any single payment contributes toward principal and interest. Businesses must separate the principal and interest components for two reasons:

- Interest Expense. Any interest paid on a debt is an accounting expense that must be reported in financial statements. In addition, interest expenses have tax deduction implications for a business.

- Interest Income. Any interest that a company receives is a source of income. This must be reported as revenue in its financial statements and is subject to taxation rules.

The Formula

To calculate the interest and principal components of any annuity payment, follow this sequence of two formulas.

[latex]\colorbox{LightGray}{Formula 13.1A}\; \color{BlueViolet}{\text{Interest Portion of an Ordinary Single Payment:}}\; INT=BAL \times i[/latex]

[latex]\colorbox{LightGray}{Formula 13.1B}\; \color{BlueViolet}{\text{Principal Portion of a Single Payment:}}\; PRN=PMT-INT[/latex]

where,

INT is the interest portion of the payment.

BAL is the principal balance after the previous payment.

P/Y is the number of payment intervals per year.

C/Y is the number of compoundings periods per year.

PRN is the principal portion of the annuity payment.

PMT is the annuity payment amount.

i is the periodic interest rate per payment interval.

Important Notes

Calculating the periodic interest rate (i)

For ordinary simple annuities where the compounding interval equals the payment interval (P/Y = C/Y) you calculate the periodic rate, [latex]i[/latex], using the formula

[latex]i=\frac{I/Y}{C/Y}[/latex]

For ordinary general annuities where the compounding interval does not equal the payment interval (P/Y [latex]\ne[/latex] C/Y) you need to calculate the equivalent periodic rate, [latex]i_{eq}[/latex], per payment interval using the formula

[latex]i_{eq}=(1+i)^{\frac{C/Y}{P/Y}}-1[/latex]

How It Works

Follow these steps to calculate the interest and principal components for a single annuity payment:

Step 1: Identify the known time value of money variables, including I/Y, C/Y, P/Y, Years, and one of PVORD or FVORD. The annuity payment amount may or may not be known.

Step 2: If the annuity payment amount is known, proceed to step 3. If it is unknown, solve for it using the appropriate formula and round the payment to two decimals.

Step 3: Calculate the future value of the original principal immediately prior to the payment being made. For example, when you calculate the interest and principal portions for the 22nd payment, you need to know the balance immediately after the 21st payment.

Step 4: Calculate the future value of all annuity payments already made. For example, if you need to calculate the interest and principal portions for the 22nd payment, you need to know the future value of the first 21 payments.

Step 5: Calculate the balance (BAL) prior to the payment by subtracting step 4 (the future value of the payments) from step 3 (the future value of the original principal). The fundamental concept of time value of money allows you to combine these two numbers on the same focal date.

Step 6: Calculate the interest portion of the current annuity payment using Formula 13.1A.

Step 7: Calculate the principal portion of the current annuity payment using Formula 13.1B.

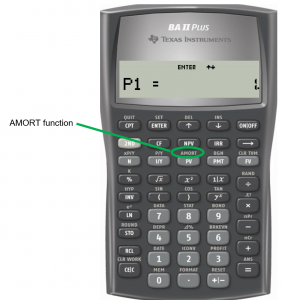

Your BAII Plus Calculator

The function that calculates the interest and principal components of any single payment on your BAII Plus calculator is called AMORT. It is located on the 2nd shelf above the PV button.

The Amortization window has five variables (use ↓ or ↑ to scroll through them). The first two, P1 and P2, are data entry variables. The last three, BAL, PRN, and INT, are output variables.

- P1 is the starting payment number. The calculator works with a single payment or a series of payments.

- P2 is the ending payment number. This number is the same as P1 when you work with a single payment. When you work with a series of payments later in this section, you set it to a number higher than P1.

- BAL is the principal balance remaining after the P2 payment number. The cash flow sign is correct as indicated on the calculator display.

- PRN is the principal portion of the payments from P1 to P2 inclusive. Ignore the cash flow sign.

- INT is the interest portion of the payments from P1 to P2 inclusive. Ignore the cash flow sign.

To use the Amortization function, the commands are as follows:

- You must enter all seven time value of money variables accurately (N, I/Y, PV, PMT, FV, P/Y and C/Y). If PMT was computed, you must re-enter it with only two decimals and the correct cash flow sign.

- Press 2nd AMORT.

- Enter a value for P1 and

- Using the ↓ and ↑, scroll through BAL, PRN, and INT to read the output.

- Press Enter followed by ↓.

- Enter a value for P2 and press Enter followed by ↓. Note that the higher the numbers entered in P1 or P2, the longer it takes the calculator to compute the outputs. It is possible that your calculator will go blank for a few moments before displaying the outputs.

Note: If you are interested in a single payment, you must set P1 and P2 to the exact same value. For example, if you want the 22nd payment then both P1 = 22 and P2 = 22.

Concept Check

Example 13.1.1: Interest and Principal of a Loan Payment

The accountant at the accounting firm of Nichols and Burnt needs to separate the interest and principal on the tenth loan payment. The company borrowed $10,000 at 8% compounded quarterly with month-end payments for two years.

Solution:

Note that this is an ordinary general annuity. Calculate the principal portion (PRN) and the interest portion (INT) of the tenth payment on the two-year loan.

Step 1: Given information:

PVORD = $10,000; I/Y = $8%; C/Y = 4; P/Y =12; Years = 2; FV = $0

Step 2: PMT is unknown. Calculate the payment amount using Formula 11.3A

Since P/Y [latex]\ne[/latex] C/Y, find the equivalent interest rate (ieq) that matches the payment interval.

[latex]i=\frac{I/Y}{C/Y}=\frac{8\%}{4}=2\%[/latex]

[latex]i_{eq}=(1+i)^{\frac{C/Y}{P/Y}}-1=(1+0.02)^{\frac{4}{12}}-1=0.00662271\; \text{per month}[/latex]

[latex]n=P/Y \times \text{(Number of Years)}=12 \times 2 =24[/latex]

[latex]\begin{align} PV_{ORD}&=PMT \left[\frac{1-(1+i_{eq})^{-n}}{i_{eq}}\right]\\ \$10,\!000&=PMT\left[\frac{1-(1+0.00662271)^{-24}}{0.00662271}\right]\\ \$10,\!000&=PMT\left[\frac{0.146509}{0.00662271}\right]\\ \$10,\!000&=PMT (22.122213)\\ PMT&=\frac{\$10,\!000}{22.122213}=\$452.03 \end{align}[/latex]

Step 3: Calculate the future value of the loan principal after the 9th monthly payment (9 months) using Formula 9.2B.

[latex]\begin{align} FV&=PV(1+i_{eq})^n\\ &=\$10,\!000(1+0.00662271)^9\\ &=\$10,\!612.08 \end{align}[/latex]

Step 4: Calculate the future value of the first nine payments using Formula 11.2A

[latex]\begin{align} FV_{ORD}&=PMT \left[\frac{(1+i_{eq})^n-1}{i_{eq}}\right]\\ &=\$452.03\left[\frac{(1+0.00662271)^9-1}{0.00662271}\right]\\ &=\$4,\!177.723942 \end{align}[/latex]

Step 5: Calculate the principal balance after nine payments.

BAL = FV − FVORD = $10,612.08 – $4,177.723942 = $6,434.356058

Step 6: Calculate the interest portion by using Formula 13.1A.

INT = BAL × ieq= $6,434.356058 × 0.00662271 = $42.612874

Step 7: Calculate the principal portion by using Formula 13.1B.

PRN = PMT – INT = $452.03 – $42.612874 = $409.42

Calculator instructions:

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| 24 | 8 | 10,000 |

Answer: -452.032375 Rekeyed as: -452.03 |

0 | 12 | 4 |

| P1 | P2 | BAL (output) | PRN (output) | INT (output) |

|---|---|---|---|---|

| 10 | 10 | 6,024.938937 | 409.417128 | 42.612871 |

The accountant for Nichols and Burnt records a principal reduction of $409.42 and an interest expense of $42.61 for the tenth payment.

Example 13.1.2: Interest and Principal of an Investment Annuity Payment

Baxter has $50,000 invested into a five-year annuity that earns 5% compounded quarterly and makes regular end-of-quarter payments to him. For his fifth payment, he needs to know how much of his payment came from his principal and how much interest was earned on the investment.

Solution:

Note that this is an ordinary simple annuity. Calculate the principal portion (PRN) and the interest portion (INT) of the fifth payment on the five-year investment annuity.

Step 1: Given information:

PVORD = $50,000; I/Y = 5%; C/Y = 4; P/Y = 4, Years = 5; FV = $0

Step 2: PMT is unknown. Calculate the payment amount using Formula 11.3A

[latex]i=\frac{I/Y}{C/Y}=\frac{5\%}{4}=1.25\%[/latex]

[latex]n=P/Y \times \text{(Number of Years)}=4 \times 5 =20[/latex]

[latex]\begin{align} PV_{ORD}&=PMT \left[\frac{1-(1+i)^{-n}}{i}\right]\\ \$50,\!000&=PMT\left[\frac{1-(1+0.0125)^{-20}}{0.0125}\right]\\ \$50,\!000&=PMT\left[\frac{0.219991452}{0.0125}\right]\\ \$50,\!000&=PMT (17.599316)\\ PMT&=\frac{\$50,\!000}{17.599316}=\$2,\!841.02 \end{align}[/latex]

Step 3: Calculate the future value of the loan principal after the 4th quarterly payment using Formula 9.2B.

[latex]\begin{align} FV&=PV(1+i)^n\\ &=\$50,\!000(1+0.0125)^4\\ &=\$52,\!547.26685 \end{align}[/latex]

Step 4: Calculate the future value of the first four quarterly payments using Formula 11.2A

[latex]\begin{align} FV_{ORD}&=PMT \left[\frac{(1+i)^n-1}{i_{eq}}\right]\\ &=\$2,\!841.02\left[\frac{(1+0.0125)^4-1}{0.0125}\right]\\ &=\$11,\!578.93769 \end{align}[/latex]

Step 5: Calculate the principal balance after four payments.

BAL = FV − FVORD = $52,547.26685 – $11,578.93769 = $40,968.32916

Step 6: Calculate the interest portion by using Formula 13.1A.

INT=BAL × ieq= $40,968.32916 × 0.0125=$512.104114

Step 7: Calculate the principal portion by using Formula 13.1B.

PRN = PMT – INT = $2,841.02 – $512.104114 = $2,328.92

Calculator instructions:

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| 20 | 5 | -50,000 |

Answer: 2,841.019482 Rekeyed as: 2,841.01 |

0 | 4 | 4 |

| P1 | P2 | BAL (output) | PRN (output) | INT (output) |

|---|---|---|---|---|

| 5 | 5 | -38,639.41327 | 2,328.915886 | 512.104114 |

On Baxter’s fifth payment of $2,841.02, he has $2,328.92 deducted from his principal and the remaining $512.10 comes from the interest earned on his investment.

Calculating Interest and Principal Components for a Series of Payments

In this section, you learn new formulas and a process for calculating the principal and interest portions involving a series of payments.

Formulas 13.1C and 13.1D are used to determine the interest and principal components for a series of annuity payments.

[latex]\colorbox{LightGray}{Formula 13.1C}\; \color{BlueViolet}{\text{Principal Portion for a Series of Payments:}}\; PRN=BAL_{P1}-BAL_{P2}[/latex]

[latex]\colorbox{LightGray}{Formula 13.1D}\; \color{BlueViolet}{\text{Interest Portion for a Series of Payments:}}\; INT=n \times PMT-PRN[/latex]

where,

PRN is the principal portion of the series of payments made.

BALP1 is the principal balance owing immediately prior the first payment in the series.

BALP2 is the principal balance owing after the last payment in the series.

INT is the interest portion of the series of payments.

PMT is the annuity payment amount.

n is the number of payments involved in the time segment inclusive.

How It Works

Follow these steps to calculate the interest and principal components for a series of annuity payments:

Step 1: Identify the known time value of money variables, including I/Y, C/Y, P/Y, Years, and one of PVORD or FVORD. The annuity payment amount may or may not be known.

Step 2: If the annuity payment amount is known, proceed to step 3. If it is unknown, solve for it and round the payment to two decimals.

Step 3: Calculate the future value of the original principal immediately prior to the series of payments being made. For example, when calculating the interest and principal portions for the 22nd through 25th payments, you need the balance immediately after the 21st payment.

Step 4: Calculate the future value of all annuity payments already made prior to the first payment in the series. For example, when calculating the interest and principal portions for the 22nd through 25th payments, you need the future value of the first 21 payments.

Step 5: Calculate the balance (BAL) prior to the series of payments by subtracting step 4 (the future value of the payments) from step 3 (the future value of the original principal). The fundamental concept of time value of money allows you to combine these two numbers on the same focal date. Do not round this number.

Steps 6 to 8: Repeat steps 3 to 5 to calculate the future value of the original principal immediately after the last payment in the series is made. For example, when calculating the interest and principal portions for the 22nd through 25th payments, you need the balance immediately after the 25th payment.

Step 9: Calculate the principal portion of the series of payments using Formula 13.1C.

Step 10: Calculate the interest portion of the series of payments using Formula 13.1D.

Your BAII Plus Calculator

Working with a series of payments on the BAII Plus calculator requires you to enter the first payment number into the P1 and the last payment number into the P2. Thus, if you are looking to calculate the interest and principal portions of payments four through seven, set P1 = 4 and P2 = 7. In the outputs, the BAL window displays the balance remaining after the last payment entered (P2 = 7), and the PRN and INT windows display the total principal interest portions for the series of payments.

Things To Watch Out For

A common mistake occurs in translating years into payment numbers. For example, assume payments are monthly and you want to know the total interest paid in the fourth year. In error, you might calculate that the fourth year begins with payment 36 and ends with payment 48, thus looking for payments 36 to 48. The mistake is to fail to realize that the 36th payment is actually the last payment of the third year. The starting payment in the fourth year is the 37th payment. Hence, if you are concerned only with the fourth year, then you must look for the 37th to 48th payments.

There are two methods to calculate the correct payment numbers:

- Calculate the payment at the end of the year in question, then subtract the payment frequency less one (P/Y – 1) to arrive at the first payment of the year. In the example, the last payment of the fourth year is 48. With monthly payments, or P/Y = 12, then 48 − (12 − 1) = 37, which is the first payment of the fourth year.

- You could determine the last payment of the year prior to the year of interest and add one payment to it. Thus, the end of the third year is payment #36, so the first payment of the fourth year is 36 + 1 = 37. The last payment of the fourth year remains at payment 48.

Example 13.1.3: Interest and Principal of a Series of Loan Payment

Revisit Example 13.1.1 The accountant at the accounting firm of Nichols and Burnt is completing the tax returns for the company and needs to know the total interest expense paid during the tax year that encompassed payments 7 through 18 inclusively. Remember, the company borrowed $10,000 at 8% compounded quarterly with month-end payments for two years.

Solution:

Note that this is an ordinary general annuity. Calculate the total principal portion (PRN) and the total interest portion (INT) of the 7th to the 18th payments on the two-year loan.

Step 1: Given information:

PVORD = $10,000; I/Y = 8%; C/Y = 4; PMT = $452.03; P/Y =12; Years = 2; FV = $0

Step 2: PMT is known. Skip this step.

Step 3: Calculate the future value of the loan principal prior to the first payment in the series (after the 6th monthly payment) using Formula 9.2B.

Recall from Example 13.1.1; ieq=0.00662271 per month

[latex]\begin{align} FV&=PV(1+i_{eq})^n\\ &=\$10,\!000(1+0.00662271)^6\\ &=\$10,\!404.00 \end{align}[/latex]

Step 4: Calculate the future value of the first six monthly payments using Formula 11.2A

[latex]\begin{align} FV_{ORD}&=PMT \left[\frac{(1+i_{eq})^n-1}{i_{eq}}\right]\\ &=\$452.03\left[\frac{(1+0.00662271)^6-1}{0.00662271}\right]\\ &=\$2,\!757.483452 \end{align}[/latex]

Step 5: Calculate the principal balance prior to the 7th payment.

BALP1 = FV − FVORD = $10,404.00 – $2,757.483452 = $7,646.516548

Step 6 to 8: Repeat steps 3 to 5 for the 18th monthly payment to calculate BALP2.

Step 6:

[latex]\begin{align} FV&=PV(1+i_{eq})^n\\ &=\$10,\!000(1+0.00662271)^{18}\\ &=\$11,\!261.62428 \end{align}[/latex]

Step 7: Calculate the future value of the 18 monthly payments using Formula 11.2A

[latex]\begin{align} FV_{ORD}&=PMT \left[\frac{(1+i_{eq})^n-1}{i_{eq}}\right]\\ &=\$452.03\left[\frac{(1+0.00662271)^{18}-1}{0.00662271}\right]\\ &=\$8,\!611.1580 \end{align}[/latex]

Step 8: Calculate BALP2.

BALP2 = FV − FVORD = $11,261.62428 – $8,611.1580 = $2,650.4662

Step 9: Calculate the principal portion by using Formula 13.1C.

PRN = BALP1 – BALP2 = $7,646.516548 – $2,650.4662 = $4,996.05

Step 10: Calculate the interest portion by using Formula 13.1D.

N = 7th through 18th payment inclusive = 12 payments;

INT = 12 × $452.03 − $4,996.05 = $428.31

Calculator Instructions

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| 24 | 8 | 10,000 | -452.03 | 0 | 12 | 4 |

| P1 | P2 | BAL (output) | PRN (output) | INT (output) |

|---|---|---|---|---|

| 7 | 18 | 2,650.466197 | 4,996.050354 | 428.309646 |

For the tax year covering payments 7 through 18, total payments of $5,424.36 are made, of which $4,996.05 was deducted from principal while $428.31 went to the interest charged.

Example 13.1.4: Interest and Principal of a Series of Investment Annuity Payments

Revisit Example 13.1.2, in which Baxter has $50,000 invested into a five-year annuity that earns 5% compounded quarterly and makes regular end-of-quarter payments to him. For his third year, he needs to know how much of his payments came from his principal and how much was interest earned on the investment.

Solution:

Note that this is an ordinary simple annuity. Calculate the principal portion (PRN) and the interest portion (INT) of the third-year payments for the five-year investment annuity. This is the 9th through the 12th payments inclusive.

Step 1: Given information:

PVORD = $50,000; I/Y = 5%; C/Y = 4; PMT = $2,841.02; P/Y = 4, Years = 5; FV = $0

Step 2: PMT is known. Skip this step.

Step 3: Calculate the future value of the loan principal prior to the first payment in the series (after the 8th quarterly payment) using Formula 9.2B.

[latex]\begin{align} FV&=PV(1+i)^n\\ &=\$50,\!000(1+0.0125)^8\\ &=\$55,\!224.30506 \end{align}[/latex]

Step 4: Calculate the future value of the first eight quarterly payments using Formula 11.2A

[latex]\begin{align} FV_{ORD}&=PMT \left[\frac{(1+i)^n-1}{i}\right]\\ &=\$2,\!841.02\left[\frac{(1+0.0125)^8-1}{0.0125}\right]\\ &=\$23,\!747.76825 \end{align}[/latex]

Step 5: Calculate the principal balance prior to the 7th payment.

BALP1 = FV − FVORD = $55,224.30506 – $23,747.76825 = $31,476.53681

Step 6 to 8: Repeat steps 3 to 5 for the 12th quarterly payment to calculate BALP2.

Step 6:

[latex]\begin{align} FV&=PV(1+i)^n\\ &=\$50,\!000(1+0.0125)^{12}\\ &=\$58,\!037.72589 \end{align}[/latex]

Step 7: Calculate the future value of the 12 monthly payments using Formula 11.2A

[latex]\begin{align} FV_{ORD}&=PMT \left[\frac{(1+i)^n-1}{i_{eq}}\right]\\ &=\$2,\!841.02\left[\frac{(1+0.0125)^{12}-1}{0.0125}\right]\\ &=\$36,\!536.544 \end{align}[/latex]

Step 8: Calculate BALP2.

BALP2 = FV − FVORD = $58,037.72589 – $36,536.544 = $21,501.18189

Step 9: Calculate the principal portion by using Formula 13.1C.

PRN = BALP1 – BALP2 = $31,476.53681 – $21,501.18189 = $9,975.35

Step 10: Calculate the interest portion by using Formula 13.1D.

N = 9th through 12th payment inclusive = 4 payments;

INT = 4 × $2,841.02 − $9,975.35 = $1,388.73

Calculator instructions:

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| 20 | 5 | -50,000 | 2,841.02 | 0 | 4 | 4 |

| P1 | P2 | BAL (output) | PRN (output) | INT (output) |

|---|---|---|---|---|

| 9 | 12 | -21,501.18189 | 9,975.354914 | 1,388.725086 |

In the third year, Baxter receives a total of $11,364.08 in payments, of which $9,975.35 is deducted from the principal and $1,388.73 represents the interest earned on the investment.

Exercises

In each of the exercises that follow, try them on your own. Full solutions are available should you get stuck.

- A lump sum of $100,000 is placed into an investment annuity to make end-of-month payments for 20 years at 4% compounded semi-annually.

a) What is the size of the monthly payment? (Answer: $604.25)

b) Calculate the principal portion of the 203rd payment. (Answer: $533.03)

c) Calculate the interest portion of the 76th payment. (Answer: $253.73)

d) Calculate the total interest received in the fifth year. (Answer: $3,332.61)

e) Calculate the principal portion of the payments made in the seventh year. (Answer: $4,241.39)

- At the age of 54, Hillary just finished all the arrangements on her parents’ estate. She is going to invest her $75,000 inheritance at 6.25% compounded annually until she retires at age 65, and then she wants to receive month-end payments for the following 20 years. The income annuity is expected to earn 3.85% compounded annually.

a) What are the principal and interest portions for the first payment of the income annuity? (Answer: $146,109.88)

b) What is the portion of interest earned on the payments made in the second year of the income annuity? (Answer: $5,250.65)

c) By what amount is the principal of the income annuity reduced in the fifth year? (Answer: $5,796.37)

- Art Industries just financed a $10,000 purchase at 5.9% compounded annually. It fixes the loan payment at $300 per month.

a) How long will it take to pay the loan off? (Answer: 3 years, 1 month)

b) What are the interest and principal components of the 16th payment? (Answer: $29.16)

c) For tax purposes, Art Industries needs to know the total interest paid for payments 7 through 18. Calculate the amount. (Answer: $403.33)

Image Description

Figure 13.C: BAII Plus Calculator indicating the button for the AMORT Function. [Back to Figure 13.C]

An annuity in which the payment interval equals the compounding interval, and payments are made at the term.

An annuity in which the payment interval does not equal the compounding interval, and payments are made at the end of the term.