9.3: Determining the Present Value

Determining the Present Value

PV is the Present Value or Principal. This is the new unknown variable. If this is in fact the amount at the start of the financial transaction, it is also called the principal. Or it can simply be the amount at some earlier point in time than when the future value is known. In any case, the amount excludes the future interest. To calculate this variable, substitute the values for the other three variables into the formula and then algebraically rearrange to isolate PV.

The Formula

Solving for present value requires you to use the future value formula we introduced in section 9.2 (Formula 9.2B). We rearrange the future value formula to solve for P.

[latex]\colorbox{LightGray}{Formula 9.3A}\; \color{BlueViolet}{\text{Present Value (Principal):}\; PV=\frac{FV}{(1+i)^n}}[/latex]

How It Works

Follow these steps to calculate the present value of a single payment:

Step 1: Calculate the periodic interest rate (i) using the formula

[latex]i=\frac{\text{Nominal Rate (I/Y)}}{\text{Compounds per Year (C/Y)}}[/latex]

Step 2: Calculate the total number of compound periods (n) using the formula

[latex]n=C/Y \times (\text{Number of years})[/latex]

Step 3: Calculate the present value using the present value formula

[latex]\begin{align}PV=\frac{FV}{(1+i)^n}\end{align}[/latex]

Your BAII Plus Calculator

You use the financial calculator in the exact same manner as described in Section 9.2. The only difference is that the unknown variable is PV instead of FV. You must still load the other six variables into the calculator and apply the cash flow sign convention carefully.

Example 9.3.1: Achieving a Savings Goal

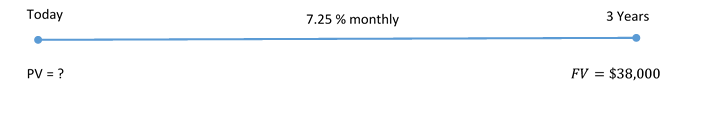

Castillo’s Warehouse will need to purchase a new forklift for its warehouse operations three years from now, when its new warehouse facility becomes operational. If the price of the new forklift is $38,000 and Castillo’s can invest its money at 7.25% compounded monthly, how much money should it put aside today to achieve its goal?

Solution:

Step 1: Given variables:

FV = 38,000; I/Y = 7.25%; C/Y = 12; Years = 3

Step 2: Calculate the periodic interest rate, i.

[latex]i=\frac{I/Y}{C/Y}=\frac{7.25\%}{12}=0.6041\overline{6}\%=0.006041\overline{6}[/latex]

Step 3: Calculate the number of compound periods, n.

[latex]n=C/Y \times (\text{Number of Years})=3 \times 12=36[/latex]

Step 4: Solve for the present value, PV.

[latex]\begin{align} PV&=\frac{FV}{(1+i)^n}\\ &=\frac{38,\!000}{(1+0.006041\overline{6})^{36}}\\ &=30,\!592.06 \end{align}[/latex]

| N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|

| 36 | 7.25 | ? | 0 | 38,000 | 12 | 12 |

If Castillo’s Warehouse places $30,592.06 into the investment, it will earn enough interest to grow to $38,000 three years from now to purchase the forklift.

Present Value Calculations with Variable Changes

Addressing variable changes in present value calculations follows the same techniques as future value calculations. You must break the timeline into separate time segments, each of which involves its own calculations.

Solving for the unknown PV at the left of the timeline means you must start at the right of the timeline. You must work from right to left, one time segment at a time using the formula for PV each time. Note that the present value for one time segment becomes the future value for the next time segment to the left.

How It Works

Follow these steps to calculate a present value involving variable changes in single payment compound interest:

Step 1: Read and understand the problem. Identify the future value. Draw a timeline broken into separate time segments at the point of any change. For each time segment, identify any principal changes, the nominal interest rate, the compounding frequency, and the segment’s length in years.

Step 2: For each time segment, calculate the periodic interest rate, i.

Step 3: For each time segment, calculate the total number of compounding periods, n.

Step 4: Starting with the future value in the first time segment on the right, solve for the present value.

Step 5: Let the present value calculated in the previous step become the future value for the next time segment to the left. If the principal changes, adjust the new future value accordingly.

Step 6: Using the present value formula, calculate the present value of the next time segment.

Step 7: Repeat steps 5 and 6 until you obtain the present value from the leftmost time segment.

Your BAII Plus Calculator

To use your calculator efficiently in working through multiple time segments, follow a procedure similar to that for future value:

- Load the calculator with all the known compound interest variables for the first time segment on the right.

- Compute the present value at the beginning of the segment.

- With the answer still on your display, adjust the principal if needed, change the cash flow sign by pressing the [latex]\pm[/latex] key, then store the unrounded number back into the future value button by pressing FV. Change the N, I/Y, and C/Y as required for the next segment.

Return to Step 2 for each time segment until you have completed all time segments.

Example 9.3.2: A Variable Rate Investment

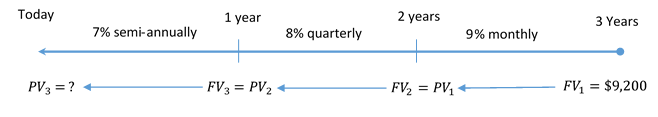

Sebastien needs to have $9,200 saved up three years from now. The investment he is considering pays 7% compounded semi-annually, 8% compounded quarterly, and 9% compounded monthly in successive years. To achieve his goal, how much money does he need to place into the investment today?

Starting from the right end of the timeline and working backwards:

Step 1: First time segment:

FV1 = $9,200; I/Y = 9%; C/Y = 12; Years = 1

[latex]i=\frac{I/Y}{C/Y}=\frac{9\%}{12}=0.75\%[/latex]

[latex]n =C/Y \times (\text{Number of Years})=1 \times 12=12[/latex]

Find PV1

[latex]\begin{align} PV_1&=\frac{FV_1}{(1+i)^n}\\ &=\frac{9,\!200}{(1+0.0075)^{12}}\\ &=8,\!410.991026 \end{align}[/latex]

This becomes FV2 in Step 2.

Step 2: Second line segment:

FV2 = PV1 = 8,410.991026; I/Y = 8%; C/Y = 4; Years = 1

[latex]i=\frac{I/Y}{C/Y}=\frac{8\%}{4}=2\%[/latex]

[latex]n =C/Y \times (\text{Number of Years})= 1 \times 4=4[/latex]

Find PV2

[latex]\begin{align} PV_2&=\frac{FV_2}{(1+i)^n}\\ &=\frac{8,\!410.991026}{(1+0.02)^{4}}\\ &=7,\!770.455587 \end{align}[/latex]

This becomes FV3 in Step 3.

Step 3: Third line segment:

FV3 = PV2= 7,770.455587; I/Y = 7%; C/Y = 2; Years = 1

[latex]i=\frac{I/Y}{C/Y}=\frac{7.5\%}{12}=0.625\%[/latex]

[latex]n =C/Y \times (\text{Number of Years})= 1 \times 2=2[/latex]

Find PV3

[latex]\begin{align} PV_3&=\frac{FV_3}{(1+i)^n}\\ &=\frac{7,\!770.455587}{(1+0.035)^{2}}\\ &=7,\!253.80 \end{align}[/latex]

The present value is $7,253.80

| Step | N | I/Y | PV | PMT | FV | P/Y | C/Y |

|---|---|---|---|---|---|---|---|

| 1 | 12 | 9 | ? | 0 | 9,200 | 12 | 12 |

| 2 | 4 | 8 | ? | 0 | ±(PV from Step 1) | 4 | 4 |

| 3 | 2 | 7 | ? | 0 | ±(PV from Step 1) | 2 | 2 |

Sebastien needs to place $7,253.80 into the investment today to have $9,200 three years from now.

When you calculate the present value of a single payment for which only the interest rate fluctuates, it is possible to find the principal amount in a single division:

[latex]PV=\frac{FV}{(1+i_1){n_1}\times (1+i_2)^{n_2}\times (1+i_3)^{n_3}\times \ldots(1+i_n)^{n_n}}[/latex]

where [latex]n[/latex] represents the time segment number.

In the previous example you can calculate the same principal as follows:

[latex]PV=\frac{\$9,200}{(1+0.0075)^{12}\times (1+0.02)^{4}\times (1+0.035)^{2}}=\$7,\!253.80[/latex]

Exercises

In each of the exercises that follow, try them on your own. Full solutions are available should you get stuck.

- A debt of $37,000 is owed 21 months from today. If prevailing interest rates are 6.55% compounded quarterly, what amount should the creditor be willing to accept today?

(Answer: $33,023.56)

- For the first 4½ years, a loan was charged interest at 4.5% compounded semi-annually. For the next 4 years, the rate was 3.25% compounded annually. If the maturity value was $45,839.05 at the end of the 8½ years, what was the principal of the loan? (Answer: $33,014.56)

Timeline for exercise 2 is included in Solution to Exercises.

Image Descriptions

Figure 9.3.1: Timeline showing PV = ? at Today (on the Left) with an arrow pointing to the end (on the Right) (3 years) where FV = $38,000 and 7.25% monthly throughout. [Back to Figure 9.3.1]

Figure 9.3.2: Timeline: FV1 = $9,200 at 3 years moving back to 2 years at 9% monthly to become PV1. At 22 years, PV1 becomes FV2 which moves to 1 year at 8% quarterly to become PV2. At 1 years, PV2 becomes FV3 which moves to Today at 7 % semi-annually to become PV3 = ?. [Back to Figure 9.3.2]