36 Roche Strategies to Tackle Biosimilar Issue

by Neethu Shaji Saji

It was a nice day in spring 2019, Roche CEO, Severin Schwann was reading monthly reports about the recent developments of the company preparing for a meeting with investors later that afternoon. The investor’s meeting was scheduled immediately after FDA approved the fourth biosimilar of Herceptin produced by Pfizer in the U.S. This meeting is very important for Roche to give confidence to the investors and educate them about the strategies Roche has taken over the years to prepare for the biosimilar competition. “I am confident that I can convince investors about the strong strategies taken by Roche to tackle the biosimilar competition’’ says Severin Schwann [1].

Three of Roche biologic cancer drugs: Avastin, Herceptin, and Tarceva are coming off patent in the U.S during the 2019-20 time period [2]. Biotech drugs or biologics are drugs that are either partially or completely made from living cells. Due to this reason, biosimilars to biologics are complex to develop compared to generics of chemically synthesized small molecule drugs [3]. FDA describes biosimilar as a biological drug that is almost identical to its reference drug in all clinically relevant structure and function. A little bit of variation is acceptable in clinically non-relevant structures [3]. Biosimilars are made by companies other than the innovator companies once the reference drug comes off patent protection.

Bevacizumab sold by Roche under the brand name Avastin is an anti-angiogenic drug, that prevents the formation of new blood vessels that bring nutrients to cancer cells. This drug is all set to come off patent in the U.S. in July 2019 and the EU in 2022. [4]. Trastuzumab sold under the brand name Herceptin is a monoclonal antibody that is used in the treatment for breast cancer. The patent for Herceptin has already expired in 2014 in the EU and will expire in 2019 in the U.S. [5]. This drug brought revenue of 7 billion USD to Roche in 2018 [6]. Erlotinib hydrochloride with the brand name Tarceva is an epidermal growth factor receptor inhibitor that is used to treat patients suffering from several types of cancer. [7]. This drug will come off patent in the U.S. in November 2020 and in the EU in March 2020 [8].

These three drugs together generated $100 billion in their lifetime from the U.S. [2] and a total of 19 billion USD to the company’s revenue in 2017 [9]. These figures represent a significant portion of Roche’s revenue. In 2018, they added $ 7 billion to Roche’s revenue just from the U.S. [2] So, the patent expiries of these three biologic drugs will pave the way for the entry of biosimilars to the market and this will significantly impact the revenue these drugs bring to the company.

In addition to patent expiries, Roche will also lose the royalty money it collects from many companies from this year. Royalty money is from ‘Cabilly patents’- that was originally granted to Genentech in 1983 for inventing a reaction step involved in the cell-based drug production [6]. Roche acquired Genentech in 2009 [10]. This patent allowed Roche to collect royalty fees from companies that used this step in their drug manufacturing process. In 2017, Roche collected about $840.4 million from its ‘Cabilly royalties’ [6]

The series of patent expiries of blockbuster biologic drugs and the expiration of Cabilly patents will significantly decrease the revenue generated by Roche from these sources. But Schwann is confident that the company can overcome the current situation. He says “We can overcome the biosimilar erosion curve’’ [11].

Roche history

Fritz Hoffmann-La Roche, who believed in the potential influence of pharmaceuticals in treating diseases foundedRoche on October 1st, 1896, in Switzerland [12]. During the time period from 1897 to 1914, the company grew significantly and started several offices in Germany, London, and New York. The company experienced losses during the first world war due to the boycott of Roche products in Germany [12]. During the 1920s, 30s and early 40s, the company flourished by its sales of vitamins. Roche diversified its pipeline and started focusing on antimicrobials, antidepressants, and anti-cancer drugs during the 1950s and early 60s [12]. The company extended its interest to biotech industry during the early 2000s. Today, Roche is a leader in diagnostics and pharmaceuticals [12]. Roche’s drug sales dominate in the fields of cancer, neuroscience, immunology, and microbiology [13].

Biosimilars in Market

In 1984, Drug Price Competition and Patent Term Restoration Act also known as Hatch-Waxman Act was passed which allowed the sales of generic versions of chemically derived drugs in the U.S. once the traditional small molecule drugs came off patent [14]. Unlike biologics, these small molecules drugs are synthetically made by a series of chemical reactions. The biologic drugs did not come under this law, so the biotech companies enjoyed a monopoly in the market and gained a high–profit margin. Due to the high price of biologic drugs and the increasing cost of treatment, things started to change in the late 2000s. In March 2010, U. S president Barrack Obama signed Affordable Care Act, that opened the market for the biosimilars of biologic drugs in the U.S. This act granted biosimilar drug maker’s easier access to the market once the reference biologic drug comes out of patent [15, 16].

This was a huge shock for the pharmaceutical companies because the biosimilar companies now have access to the billion-dollar biologic market. The introduction of biosimilars can significantly affect the sales of brand name due to the low price of biosimilars. They also provide similar effects as the brand name itself. The low price of biosimilars can be attributed to less research needed as most of the work is done by the innovator companies including testing of 1000s of molecules to come out with one successful drug. Since the law passed in 2011, several pharma companies that owned the market of some blockbuster drugs had lost it to biosimilar competitors. All the biotechnology and pharmaceutical companies started coming up with different strategies to protect their patents and thus extend the market monopoly as long as possible. Keeping patent life longer was important for them due to the increased price of research and decrease in the launch of new drugs.

The first biologic drug patented by Roche did not expire in Europe until 2013 and in the U.S until 2018; Mabthera expired in 2013 in Europe and in 2018 in the U.S [17]. This gave Roche a couple of years to come up with strategies since the law changed in 2010.

The strategies they adopted to deal with the patent crisis are discussed below.

Evergreening- by thickening of patents

Evergreening is a strategy that pharma companies adopt to extend patent protection and prevent biosimilars from creating a market competition for the drug [18]. In the pharmaceutical world, inventors make slight modifications to the original drug or find a new use for it and patent the modified version [18]. The new patent extends the protection period thus preventing the launch of new biosimilars. The different ways by which Roche obtained new patents for their old drug include:

1. Patent new uses for old drugs: is a strategy that is often used by the innovator companies to drive up the sales of old drugs or drugs coming out of patents. This will prevent biosimilar entry by extending the protection by patenting new functions for older drugs [19]. For example, i) Avastin was previously approved for treating colorectal cancer, lung cancer, breast cancer, renal cancer, brain cancer, and some eye disease [20]. In 2018, it was granted the approval to be used for ovarian cancer [21] (ii) Actemra/RoActemra was approved for the treatment of a type of juvenile idiopathic arthritis in 2018 [21] (iii) MabThera/Rituxan, previously treated some autoimmune diseases and some cancers was recently approved to treat moderate to severe pemphigus vulgaris [21][22].

2. New formulations: Another strategy to drive up the dropping drug sales is combining an old drug with a relatively new drug developed by Roche in combination therapy [19]. The biosimilars may not act exactly the same way as the brand name when taken with the newer drugs in the combination therapy. Schwann says, “This strategy gives the company a chance to differentiate, to raise the standard of care, and to get in earlier lines of treatment’’ [23]. Tecentriq (new drug) in combination with Avastin(old drug), paclitaxel, and carboplatin (chemotherapy), is approved to be prescribed for cases with metastatic non-squamous lung cancer with no epithelial growth factor receptor (EGFR) or anaplastic lymphoma kinase (ALK) genomic tumor aberrations [21]. Herceptin biosimilars are all set to enter the market in the U.S by this year, but Roche filed several additional patents on combination therapy so that the protection could potentially be extended until 2033 if granted [24].

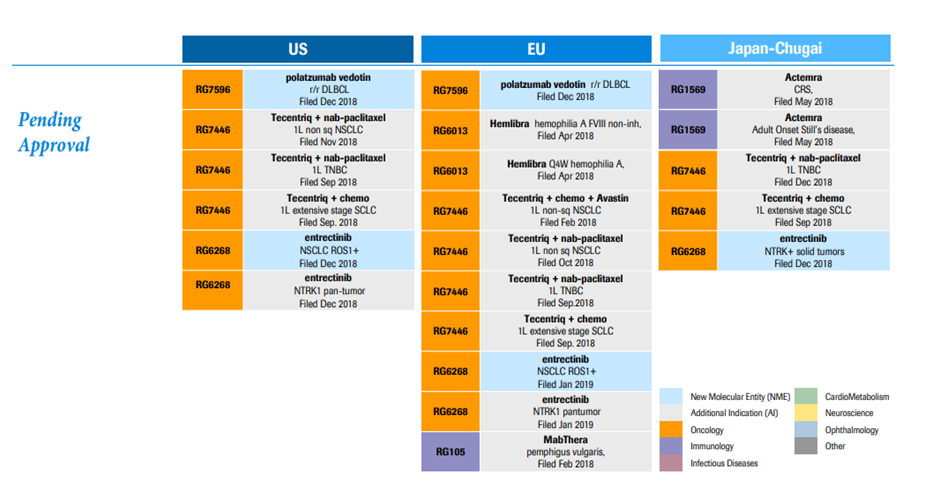

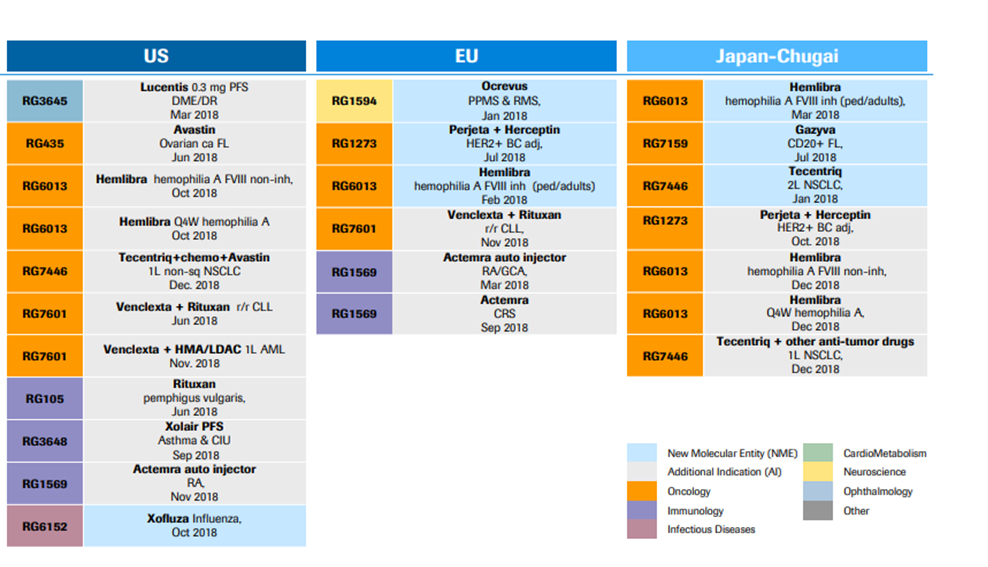

*Major patent grants in 2018 and pending approvals for patents are shown in Exhibit I and II.

Cutting Jobs and Operational Costs

Roche recently announced some job cuts in the U.S. and Europe. In Europe, they plan to stop some of the company’s operations [25]. These layoffs and operational shutdowns are part of the cost cut strategy in response to recent revenue loss from blockbuster drugs [25].

Acquisitions to strengthen the drug pipeline and access new technologies

Another strategy adopted by Roche is to form partnerships with companies that develop promising drugs and technologies by acquiring them. Roche acquired Foresight VISION4 (2017), Ignyta Inc (2017), Foundation Medicine, Inc. (2018), Tusk Therapeutics (2018), and Spark Therapeutics (2019 [26]. Out of these five recent acquisitions, Ignyta Inc and Tusk Therapeutics are developing drugs that fall into Roche’s traditional cancer business. On the other hand, Foresight VISIO4 is a company that developed a retinal drug delivery method known as port delivery system [27]. Roche fully acquired Foundation Medicine Inc for 2.4 billion USD in June 2018 where Roche already had a share of 57% from 2015. This acquisition gave Roche access to Foundation Therapeutics genomic profiling technology which can be utilized in the field of personalized medicine approach [28].

Earlier in 2018, Roche acquired Flatiron Health, that owns an oncology-based data platform. Roche’s acquisition of Flatiron, which is a relatively new company was driven by the need to improve the results of oncology drug clinical trials [29]. Traditionally, oncology was one of Roche hot spot, but in today’s situation where drugs are coming off patents and show signs of losing the market to biosimilars, Roche needs to maximize the efficiency of clinical trials by finding the right cohort of cancer patients for their future trials. This is where Flatiron technology becomes valuable for Roche. Flatiron collects unstructured oncology data from multiple labs and other repositories which will help to recruit people for clinical trials [29]. Using this data is not an easy path for Roche as there are strict regulations for a pharma company to use results acquired by a U. S provider [29].

The Flatiron’s oncology data services, when combined with the genomic profiling technology developed by Foundation Medicine, will help Roche to increase the success of their clinical trials and bring more drugs into the market. Finding the right cohort of patients for the trial increases the speed at which the clinical trials are done and save millions of dollars for the company.

In February 2019, Roche acquired Spark Therapeutics for $ 4.8 billion. Spark Therapeutics mainly focuses on gene therapies for diseases like blindness, hemophilia, lysosomal disorders, and neurodegenerative diseases that have genetic origins [30]. “The fit of Spark and Roche is really excellent. It provides us with a broad portfolio and expertise across the value chain,” said Schwann [31]

Diversify the pharmaceutical division with strong drugs

Roche is now focusing on diversifying their current drug pipeline because the competition in the oncology field is increasing. Traditionally, most of Roche’s blockbuster drugs were cancer drugs. The strong launch of Ocrevus in Multiple Sclerosis and Hemlibra for hemophilia A are examples of this diversification process [32]. Even though only about 40,000 people in the world suffer from hemophilia A, Hemlibra is an expensive medicine that can cost up to $492,000 per year for a patient of 140 pounds [33]. Through Hemlibra, Roche plans to enter the $10 billion industry of hemophilia A drug market [33]. Ocrevus was approved by FDA in 2017 to treat patients with multiple sclerosis. This was a huge success and partially compensated the loss caused by biosimilars [34]. Severin Schwan describes Ocrevus as “the most successful launch in the history of Roche” [34]. It added a whopping 1.4 billion Swiss franc to Roche’s revenue in less than one and a half years since its launch [34]. Schwan is happy with the success of Ocrevus, Hemlibra, and new cancer drugs in the market which are Perjeta, Alecensa and Tecentriq [34]. “In the first half of the year, both our pharmaceutical and diagnostics divisions achieved very strong results. Given the very good, continuously growing uptake of our new medicines, we are well on track to rejuvenate our portfolio. The growth of our business will continue, also beyond the current year’’ says Schwann [34].

Roche has a number of drugs in the pipeline for neurodegenerative disorders like Alzheimer’s disease, Autism, Parkinson’s disease, and Huntington’s disease, where the focus of other companies is becoming comparatively decreasing [32] [35].

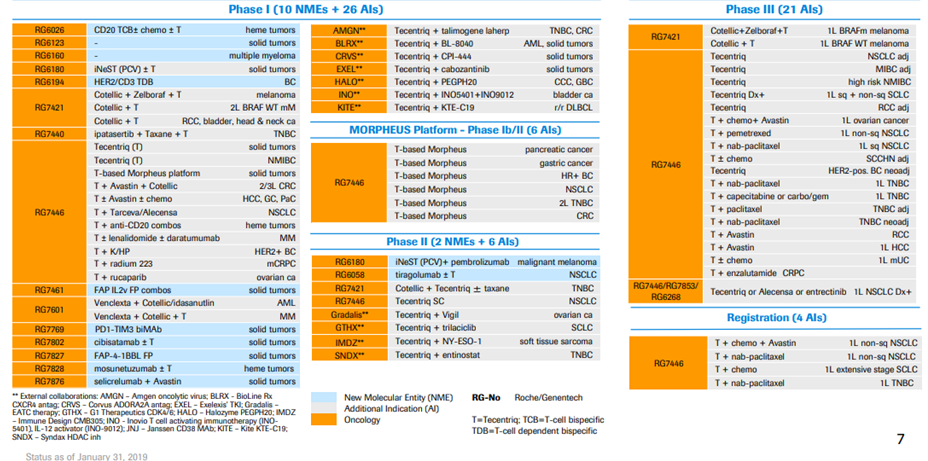

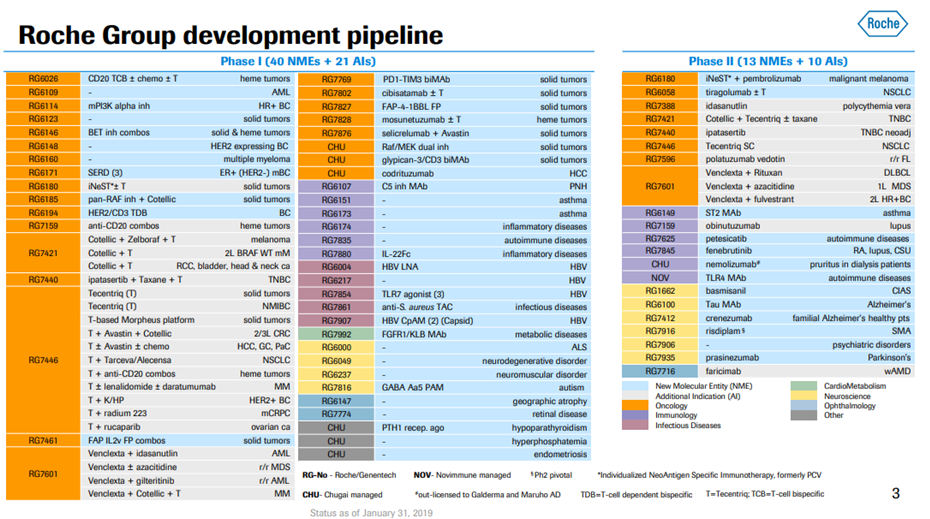

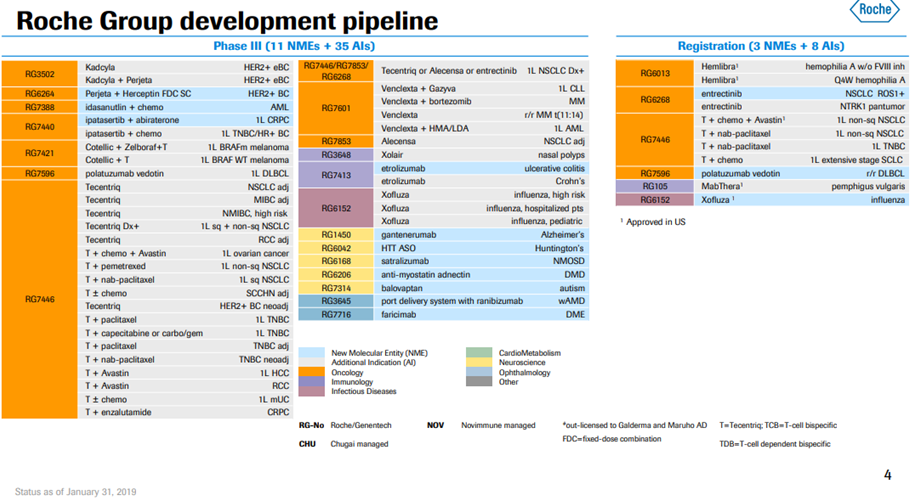

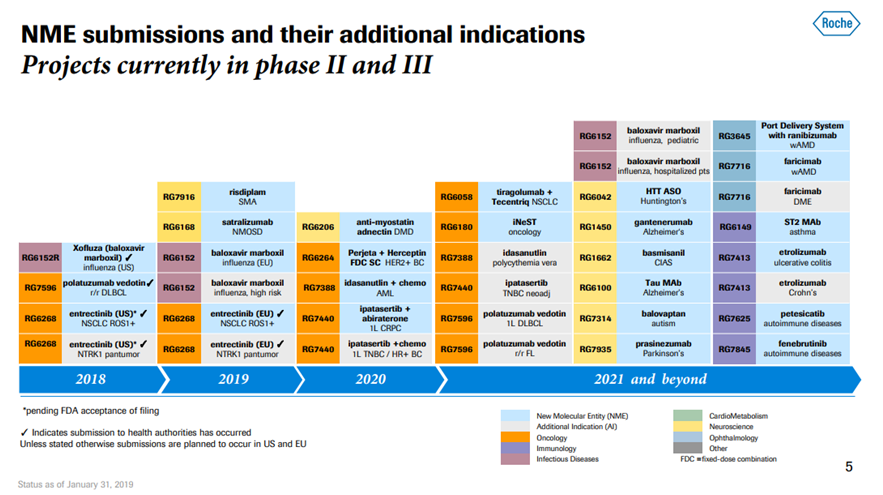

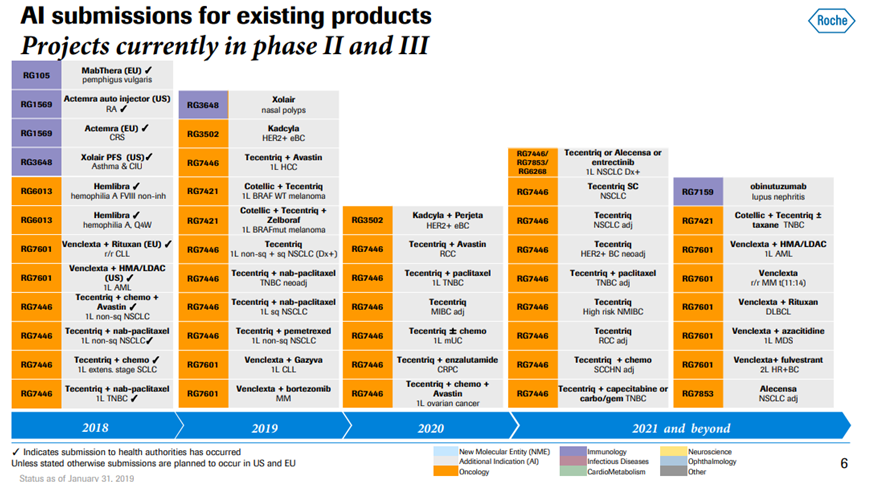

*Exhibit III and IV shows Roche’s current drug pipeline and clinical trials.

Roche Controversary in India

Sometimes the strategies Roche executed to keep the market monopoly did not always end with a happy note. An example of this is the case against Roche in India. Biocon and Mylan filed a lawsuit against Roche in the Delhi supreme court alleging that Roche abused its dominant position in India to prevent biosimilar competition for Herceptin in India. Roche sold Trastuzumab in India under the brand name Herceptin from 2002 to 2012 [36]. It withdrew Herceptin from the Indian market in 2012 and introduced two cheaper versions: BICELTIS and HERCLON. In 2014, two generic versions of Herceptin CANMAb and HERTRAZ was brought to the market by Biocon and Mylan, after which Roche’s market share declined [36].

In 2014, Roche sued Biocon and Mylan alleging that the new drugs did not meet the guidelines for biosimilars and thus cannot claim that their drugs are biosimilars to Roche’s Herceptin [37,38,39]. Roche successfully sued biosimilar companies in this lawsuit and halted their sales in India [37,38,39]. The regulatory agencies in India later lifted the ban for CANMAb and HERTRAZ and allowed their re-entry to the market. In 2016, Biocon and Mylan filed a lawsuit against Roche claiming that they used their dominant position as the largest market share holder for Herceptin in India to influence regulatory authorities and spread misinterpretations as a means to keep the biosimilar competitors out of market [37,38,39]. In 2017, the competition commission of India (CCI) ordered an investigation in response to the allegations made by Biocon and Mylan. [37,38,39]. If the allegations are proven, it will be a setback for Roche in India.

More Potential Strategies to Compensate Biosimilar Competition

Some other strategies Roche could implement are:

- Reduction in price

Reduced price of biosimilars is the main incentive that encourages people to opt for biosimilars over brand names. Reducing the price of the drugs when they come off patents can decrease the number of people switching to biosimilar version and also discourage the companies from bringing biosimilars to the market. This is because patients will be less likely to switch to a biosimilar if they get the brand name drug for a comparable price as that of a potential biosimilar.

- Enter the generic business

Roche possesses high-class infrastructure for developing drugs and state of art types of equipment for research & development of drugs. The generic industry is estimated to be about $380.60 Billion by 2021 [40]. Recent developments in the biosimilar market and legal battles show that how hard the innovator companies tried to stop biosimilar entries they eventually made it to the market. So, it would be a good idea for Roche to enter the generic or biosimilar business or even acquire companies making biosimilars.

- Some other strategies of evergreening like focusing on specific stereoisomers

Stereoisomers are mirror images of each other [19]. Patenting by stereoisomers is another strategy Roche can use to improve patent life. This means if both stereoisomers have similar effects, then they can patent one stereoisomer first and then later the other stereoisomer [19].

- Enter avenues with limited competitions

Orphan drugs- These are the drugs that are developed to treat diseases that are rare. The low numbers of patients are often combated with the higher price, and incentives provided by many countries to develop orphan drugs. The innovator company of orphan drugs often receives some tax exemptions, extended patent protections, and grants from the government [41]. Limited incentives and low prevalence of the diseases can discourage biosimilar development in this field thus allowing the innovator companies to enjoy a market monopoly for a longer time.

- Focusing on high success clinical trials

Clinical trials can often be very costly. If the company can improve the success of clinical trials, the cost of drug development can be reduced. This money can then be used to bring the drug cost down in the relevant market with high biosimilar competition. As discussed above, the technologies acquired by Roche like that of Flatiron’s oncology data services can help them select the right cohort of patients for oncology clinical trials and increase their success rate and avoid rejections from FDA. This strategy is applicable to any field where they plan to launch drugs.

“I am sure we will overcome the biosimilar incursion through our new drugs and other strategies” [42] saying this Mr. Schwann went back to prepare his talk for the investor’s meeting later that evening. He was confident that the strategies Roche implemented, the new strong sales of new drugs, the increase in 2018 sales despite the biosimilar entry will convince the investors that the company is in the right trajectory.

References:

4. http://www.gabionline.net/Biosimilars/News/FDA-approves-bevacizumab-biosimilar-Mvasi

5. https://en.wikipedia.org/wiki/Trastuzumab#History

6. https://endpts.com/on-top-of-expiring-herceptin-patents-roche-faces-huge-royalty-losses-in-2019

7. https://en.wikipedia.org/wiki/Erlotinib

10. https://www.gene.com/media/press-releases/4325/1990-09-07/genentech-and-roche-merger-transaction-c

12. https://www.roche.com/about/history.htm#focus_on_biotech_2000

13. Oliveira, R. A., & Fierro, I. M. (2018). New strategies for patenting biological medicines used in rheumatoid arthritis treatment. Expert Opinion on Therapeutic Patents, 28(8), 635-646. doi:10.1080/13543776.2018.1502748

14. https://en.wikipedia.org/wiki/Drug_Price_Competition_and_Patent_Term_Restoration_Act

16. https://en.wikipedia.org/wiki/Patient_Protection_and_Affordable_Care_Act

17. Greenwald, M., Tesser, J., & Sewell, K. L. (2018). Biosimilars Have Arrived: Rituximab. Arthritis, 2018, 1-6. doi:10.1155/2018/3762864

18. Collier, R. (2013). Drug patents: The evergreening problem. Canadian Medical Association Journal, 185(9). doi:10.1503/cmaj.109-4466.

19. Gupta, Himanshu & Kumar, Suresh & Kumar Roy, Saroj & S Gaud, R. (2010). Patent protection strategies. Journal of pharmacy & bioallied sciences. 2. 2-7.

20. https://en.wikipedia.org/wiki/Bevacizumab#Eye_disease

21. https://www.roche.com/dam/jcr:af865dfd-50fb-458b-9cac-34097db9d3ec/en/ar18e.pdf

22. https://en.wikipedia.org/wiki/Rituximab

23. https://blog.imagevita.org/roche-prepares-to-feel-chill-of-patent-expiries/

25. https://www.pharmaceutical-technology.com/comment/roches-rituxan-biosimilar-woes-just-beginning/

26. https://en.wikipedia.org/wiki/Hoffmann-La_Roche

28. https://www.roche.com/investors/updates/inv-update-2015-01-12.htm

34. https://pharmaphorum.com/news/roche-ms-ocrevus-blockbuster/

35.https://www.roche.com/research_and_development/who_we_are_how_we_work/pipeline.htm

37. https://spicyip.com/2017/04/cci-order-on-pharma-major-roche-i.html

38. https://spicyip.com/2017/05/cci-order-on-pharma-major-roche-ii.html

39. https://spicyip.com/2017/05/cci-order-on-pharma-major-roche-iii.html

41. https://en.wikipedia.org/wiki/Orphan_drug

Exhibit I. Major Pending Approvals 2019

Source: https://www.roche.com/dam/jcr:d6a6a8a5-d42b-4678-9bf3-aa69bf00d535/en/irp190131-annex.pdf (Retrieved on April 11th, 2019).

Exhibit II. Major Patent Approvals 2018

Source: https://www.roche.com/dam/jcr:d6a6a8a5-d42b-4678-9bf3-aa69bf00d535/en/irp190131-annex.pdf (Retrieved on April 11th, 2019).

Exhibit III. Cancer Immunotherapy Pipeline Overview

Source: https://www.roche.com/dam/jcr:d6a6a8a5-d42b-4678-9bf3-aa69bf00d535/en/irp190131-annex.pdf (Retrieved on April 11th, 2019).

Exhibit IV. Roche Developmental Pipeline & Clinical Trials

Source: https://www.roche.com/dam/jcr:d6a6a8a5-d42b-4678-9bf3-aa69bf00d535/en/irp190131-annex.pdf (Retrieved on April 11th, 2019).