47 Helix: Stocking the Shelves in their Genetic Testing App Store

By: Tyler Boulanger

April 9th, 2019

Mankind’s knowledge of the human genome and its effects on health, behaviour, physical attributes and much more is constantly expanding. Each year there is a hot new product on the market that provides consumers with more information about their genetic makeup. From 23andMe to Ancestry DNA, several of these services have entered the mainstream and built public knowledge on genetic testing. These direct-to-consumer (DTC) genetic tests are putting an infinite amount of information into the hands of consumers and, naturally, many of these consumers want to try them all. Each product advertises its own unique approach to genotype analysis and it would seem like the information from one would supplement or overlap with the information from another. However, the lack of coordination between organizations is making it difficult for consumers to fully jump on board. Varying testing and analysis method have led to varying results between companies. The requirement to order a new genetic test for each company creates a price tag that is unaffordable to most. This also makes it difficult for startup companies to compete with the more popular entities, as consumers are put in a situation where they need to choose just one genetic test provider.

This was likely the situation that James Lu, a student of chemical engineering and medicine, found himself in when he co-founded Helix in 2015. Helix provides a solution to the issue of needing to pay for a new genetic test with each test provider, acting as an “app store” platform where customers can pay for only one genetic test and have the results applied to a wide range of genetic tests. James was very interested in the vast landscape of information available from genetics, stating “DNA plays a role in every part of our lives, and we’re just starting to use this information to make better decisions in our life and discover new things about ourselves” (Lu, 2016). In creating Helix, Lu hoped to make this information more accessible to everyone, believing that learning about how to make lifestyle changes to better their health and wellness is every patient’s right. He stated, “We’re really trying to focus on the 99 percent of people that have never had access to this kind of testing, but of course we want it to be responsible access” (Molteni, 2018).

As Helix grew to include a combination of well-known and startup partners from across the United States, the company’s business model seemed to be working well in their home country. Lu and his team faced many questions about the future direction of Helix and if they could truly compete with the market’s giants like 23andMe or Ancestry DNA. As an organization that only served the United States, international expansion seemed to be the only way to keep up. That process is costly though and required partnerships with genomics apps from around the world. And so, Lu and his team were left to consider what international growth would entail and how to create the right strategy to advance. Would they ever be able to take on 23andMe’s research and resources, or should they just stick to being the solution in niche markets? Are there alternative revenue sources that could be used to fund this next step? Or would there need to be an exit strategy in place in case they can’t compete? These decisions were looming as Helix’s leadership tried to enjoy the success and growth of their company.

THE BIRTH AND GROWTH OF HELIX

Helix was created in August 2015 by co-founders James Lu, Justin Kao, Scott Burke (Ramsey, 2016). The company is based in San Francisco, where technology businesses are made to thrive in Silicon Valley. It also runs its sequencing lab in San Diego; it is one of the largest CLIA- (Clinical Laboratory Improvement Amendments) and CAP- (College of American Pathologists) accredited Next Generation Sequencing laboratories in the world (Helix, 2016a). Only the United States are currently served by Helix, though some of the apps they are partnered with operate internationally independent of Helix. Robin Thurston, who created MapMyFitness and acted as CEO until the service was acquired by Under Armour, was brought in as CEO of Helix in 2016. Thurston joined the team because he was interested in going back to a startup after years at an established company. He wanted to make genomic data both fun and accessible to the average consumer (Ramsey, 2016). Helix’s leadership was confident that Thurston can help Helix advance as DTC genetic testing enters the mainstream.

Helix claimed they had a simple but powerful mission: “to empower every person to improve their life through DNA” (Helix, 2016b). They did this by creating a standardized platform for performing a wide range of genomic analyses using only one genetic test. In essence, Helix is an app store that connects customers to both established and startup apps that they are partnered with. This way, Helix can provide their customers with a broad collection of services and partners no longer need to perform the genetic testing themselves. Helix’s motivation for creating the platform was centred around some of the issues they saw with the DTC genomic testing services available. Mainly, the inconvenience of needing to get sequenced for each testing service was of concern (Lu et al., 2019). They wanted to relieve this financial and administrative burden and administrative concern from consumers. The lack of incentives for companies to share data is theorized as the main cause of this burden; sharing large amounts of individual genomic data could create a myriad of issues relating to data privacy (Lu et al., 2019). By creating a centralized platform for DTC genetic testing, this concern can be mitigated by Helix.

Helix is responsible for shipping their own DNA collection kits to and from customers, sequencing the DNA, securely storing the sequencing data, and distributing relevant data to partners when customers want to use their service. They collaborate with high-quality partners who create on-demand products that use customer’s DNA in interesting ways. The analysis from these products is involved in a variety of personal areas including health, fitness, nutrition, lifestyle, genealogy, and inherited traits. At launch in 2017, Helix had 20 products available to their customers (Ross, 2019). By 2019, Helix expanded to offer 35 products from 20 partner companies and continues to add more (Business Wire, 2018). These partners included established health care institutions and innovative app developers, providing both profound insights and discoveries that are just for fun. Helix evaluates each partner and product, making sure they meet the requirements of the company’s Scientific Evidence Evaluation process. This ensures the underlying scientific concepts and claims of each partner product are logical and substantiated. On Helix’s store, products are divided into four categories: entertainment, wellness, health, and ancestry (Exhibit 1).

HELIX’S TECHNOLOGIES

In January 2019, Helix published patents on their platform technology in the US and worldwide; the patent applications themselves are still pending. The title of the patent is “Genomic services platform supporting multiple application providers,” outlining the concept of a network of genomic services as well as the pipeline from testing, to bioinformatics processing, to third-party apps, to consumers (Lu et al., 2019). The patent includes a series of diagrams that illustrate the possible variations of how Helix’s platform will be executed, including Exhibit 2. Helix’s pipeline essentially involves sending a DNA sampling kit to users, collecting those samples, sequencing them, and storing that data. Consumers then buy a product from an app partnered with the Helix store, Helix provisions only the data required to perform the genomic analysis of that specific product, and the partner analyzes the data and distributes the final results to the customer (Ross, 2019). Any companies with a good idea for a genomic analysis service but not the capacity to develop an end-to-end system that includes sequencing can be assisted by Helix’s model.

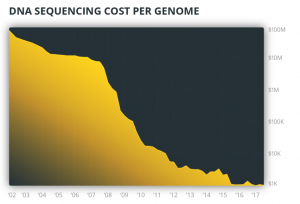

Software aside, sequencing technologies play a large role in Helix’s future success. While it cost US $10,000 to sequence a megabase (one million bases) of DNA in 2001, it now only costs about a cent (National Human Genome Research Institute, 2018). This emergence in technology has made the process much more affordable to genetic testing companies and, therefore, their customers. It was facilitated by the development of Next Generation Sequencing, which provides more efficient, automated, and high-throughput DNA sequencing and allows for lower labor and reagent costs (Mordor Intelligence, 2018). As DNA sequencing technologies continue to improve, the costs of DTC genetic tests will only get lower. In most DTC genetic testing, polymerase chain reaction is used on consumer DNA samples, usually isolated from a salivary sample, to amplify the DNA of genes being analyzed for the test (Biotech Primer, 2018). A Next Generation sequencing microarray is then performed on this amplified DNA to determine which version of the gene the individual has for each of the hundreds or thousands of genes being tested. If you’ve used a DTC genetic test in the past, it is likely it was done using a microarray (Dunaway, 2018). While microarrays focus on specific areas of the genome that are theorized to be of importance, whole genome sequencing (WGS) and whole exome sequencing (WES) are far more comprehensive techniques that sequence the entire genome and protein-coding regions, respectively. However, these techniques are still far too costly to be used for a DTC genetic test and give large amounts of information that is difficult to sort through (Dunaway, 2018).

Where Helix gained a clear advantage over its competitors’ techniques was in the creation of their own proprietary assay called Exome+. With Exome+, each of a customer’s 20,000 protein-coding genes can be sequenced. It also sequences other information-rich regions of the genome identified by the Helix team, including mitochondrial DNA, making the test more robust than common microarrays or WESs (Dunaway, 2018). Helix claims that its exome sequencing is done at a clinical grade, allowing for the accuracy and quality of results that would be expected of a clinical test (Dunaway, 2018). Illumina, who assisted in the creation of Exome+, also states that the test yields 100 times more data than any test commonly used by other consumer-focused companies (Ross, 2019). With such a broad collection of data, Helix is able to apply this information across the products of any of their customers. This is the main reason that Helix customers only need to have their DNA sample once when using many apps, as the information produced by other consumer genetic tests is likely specifically applicable to their own analysis techniques. There is little information available on what makes Exome+ able to complete more comprehensive genetic testing at a competitive price, but the technique gives Helix a clear competitive advantage by producing superior data without breaking the bank.

WORKING WITH ILLUMINA

As a company heavily focused on sequencing, it is certainly advantageous to be strongly backed by Illumina, their largest shareholder (Robbins, 2016). Illumina is a global leader in sequencing and array-based technologies, serving customers in a broad range of markets (Helix, 2016a). They mainly focus on research and clinical settings, but hoped to conquer the consumer market when they joined forces with Helix in 2015. At launch Illumina was a significant investor, contributing much of their Series A funding. As of November 2018, Illumina owned 50% of the outstanding shares, and therefore voting equity, in Helix (Ross, 2019). They also held a consolidated variable interest entity (VIE), giving them controlling interest that is not based on the majority of voting rights. As more investors have joined Helix, Illumina’s shares have become more diluted, resulting in decreased income from Helix since 2016 (Exhibit 3). Much of the funding from Illumina contributes to Helix’s research and development (R&D); and selling, general and administrative expenses (SG&A) (Exhibit 4). Illumina wanted originally wanted to partner with Helix to pursue the development and commercialization of a consumer genomics “marketplace” (Ross, 2019). They, like Helix, thought this was an effective way to affordably provide customers with unprecedented amounts of genetic information through third-party partners. Their end goal is that, through Helix, an ecosystem is created where a wide range of genetic testing apps are able to coexist and succeed.

Having connections to Illumina paid dividends to Helix early on, as they had access to their world-class equipment and received assistance in developing Exome+ and their own lab. However, Illumina’s large presence in San Diego has allowed other genomics companies to make use of their services and equipment as well (Fikes, 2018). Human Longevity, Synthetic Genomics, and Edico Genomics are just some of the companies that have been able to flourish due in part to their proximity to Illumina. Perhaps the most impactful way Illumina helps genomics companies succeed is through the Illumina Accelerator, which is run in partnership with Helix. Both Illumina and Helix hope this will play a major role in creating the innovation ecosystem for the consumer genomics industry that they are striving for. As part of the accelerator, experts from Helix work with startups to innovate and develop their product with the ideal outcome of eventually being able to put that product in the Helix store. The available Helix experts have a wide range of specialties, from Next Generation Sequencing to software design to business development. This can help the startups overcome barriers including cost pressures, regulatory and data security requirements, and continually evolving sequencing technologies (Business Wire, 2017). With the accelerator, Helix is not only finding innovative partners to work with, but helping foster them themselves.

EXAMPLES OF HELIX’S DIVERSE PARTNERS

With Helix’s partnerships being formed through a variety sources, it is easy to recognize the broad range of potential for genomic applications when looking further into two very different products they offer: GeneGuide and Dot One. GeneGuide was created by Mayo Clinic, a well-known medical centre focused on education and research. Mayo Clinic is also an investor in Helix. Partnering with a well-known third-party organization can add reliability and higher reputation to genetic health tests, compared to the ambiguous standards of a consumer-based company such as 23andMe. The GeneGuide app provides users with insights into the implications that their genetics have on their health and educates users about genetics and how to interpret genomic data (Exhibit 5). Physicians affiliated with Mayo Clinic can even recommend the service to patients. Additionally, physicians are encouraged to share their genetic reports with their health care providers for informed decision-making (Gallagher, 2018).

Contrasting with this clinical-grade testing from an established company is the startup company Dot One, who create personalized designs based on your genetic code. Founded by Iona Inglesby during her time at University, Dot One uses this DNA information provided by helix to create a variety of items; including socks, tee shirts, scarfs and tote bags; that feature colourations and patterns unique to the user (Inglesby, 2018) (Exhibit 6). Inglesby had a passion for fusing science with art and loved that Scottish families often patterned material that could be passed down generations. This led her to the idea for Dot One, which was initially given a 3/10 grade from a course evaluator at her university. After starting to work with Helix, entirely new customer channels in the US opened up for Dot One through assistance in simplifying their business model. Whether a partner is an established organization or an entrepreneur with humble beginnings, Helix has been able to both cut costs and increase market access for them.

FUNDING & REVENUE

Before they were able to create their world-class sequencing lab, Helix needed funding to bring their idea to life. On August 15, 2015, Helix secured US $100 million in Series A financing from their founding investors, allowing them to launch the company. These investors included Illumina, Mayo Clinic, and LaunchCapital. After years of development, Helix then received US $200 million in Series B Financing in preparation for their initial release of the service to consumers later that year. Illumina contributed about half of that funding while other major contributors included: Temasek, Sutter Hill Ventures, DFJ Growth, Warburg Pincus, and Kleiner Perkins (Business Wire, 2018). The law firm Cooley advised on both financings (Fikes, 2018).

As of now, Helix has two main sources of revenue. The first is through the sale of their DNA testing kits. Customers can either purchase Helix’s DNA Discovery Kit (US $80), which involves no third-party organizations and gives broad, basic information about the user’s genetics, or purchase one of the partner products in Helix’s store, which will come with Helix’s DNA kit. Prices for the partner products are highly variable, but once the testing kit is completed once it does not need to be completed again. It is unclear how much of the price of a product goes to Helix and how much goes to the partner when the testing kit is included, but this is certainly Helix’s main way of getting revenue directly from consumers.

The other source of generating revenue is through selling users’ data to companies conducting research on genomics. Much like at other DTC genetic testing companies, these transactions tend to bring large amounts amount of revenue in at one time. However, Helix takes a much more secure, controlled approach to this process. Helix user data is only sold to companies partnering with them through products; these companies have been thoroughly evaluated by Helix to ensure their data is being properly used in research. Because data is sold to partners, data will only be shared for users who use that partner’s product and have consented to their data being studied. For example, genomic data is sold to National Geographic for research used in their app Geno 2.0. This contrasts with 23andMe, who recently sold all of their user data to GlaxoSmithKline for US $300 million (Brodwin, 2018). The amount of revenue gained by Helix from selling user data has not been publicly disclosed.

DTC GENETIC TESTING MARKET

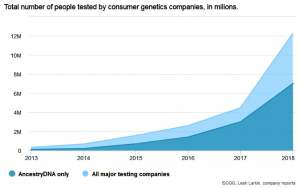

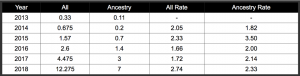

DTC genetic testing is a rapidly-growing industry; this growth sets the stage for a swift increase in partnerships with innovative genomic analysis products for Helix in the near future. Genetic testing in general is well established as being profitable, being valued at over $7.8 billion US in 2017 (Mordor Intelligence, 2018). DTC genetic tests, however, have just recently begun to appear as a rapidly growing and profitable market, largely due to the decrease in sequencing costs as technology advances (Exhibit 7). The DTC genetic testing market was valued at $117.1 million US in 2017 (Credence Research, 2018), and has been projected to reach $611.2 million US by 2026, with a compound annual growth rate (CAGR) estimated at 19.4% (Credence Research, 2018). North America leads the market with over 45% of the market share; much of the market’s value is owed to sharing genome bank data, a trend that is expected to continue throughout the foreseeable future (Credence Research, 2018). With the number of consumers interested in partaking in consumer genomics increasing every year (Exhibit 8) and genetic data being of great importance in solving many public health concerns, the DTC genetic testing market looks to surely continue growing.

CHALLENGES AHEAD

Going forward, there still exists the concern that consumers feel pressure to choose between Helix and other prominent competitors such as 23andMe or Ancestry DNA, as Exome+ is not applicable to those companies’ analyses. Competing with these companies, who currently hold a much larger portion of the market than Helix, is the main challenge ahead. One major contributing factor to Helix’s smaller customer segment is their confinement to the United States, as those other services are available globally. Although North America is the largest market for DTC genetic testing, expansion into the worldwide market is an opportunity that is yet to be taken advantage of. But what would international expansion for Helix require? Certainly, regulations on genetic testing are very different around the world. The costs of transporting biological samples internationally and the differences in technological norms are barriers as well. It is possible that Helix could take advantage of worldwide diversity by forming partnerships with genomics companies all over the world, but what kind of expenses would this create? Finding the right approach to international expansion will be key to competing with the larger DTC genetic testing companies.

Additionally, Helix needs to consider what their strategy would be if competition between the large companies results in a polarized market, where customers are split between different tests and the lack of consistency between them causes a rift in consumers’ images of DTC genetic testing. Although competition is healthy, would working together create a more accessible, consistent product for everyone? Although the market is clearly growing, should an exit or acquisition plan be made just in case customers dry up or the above effects of competition come to fruition? Whether it is a partnership with other large companies to pool their resources and lower costs for all; or being acquired fully by Illumina or another large genomics company, there are several possible approaches.

Overall, many questions remain about what approach Helix’s leadership should take as they look to scale up and compete with the industry’s giants.

Exhibits

EXHIBIT 1

CATEGORIES OF HELIX STORE PRODUCTS

Source: https://www.helix.com/pages/store

Source: https://www.helix.com/pages/store

EXHIBIT 2

PATENT DIAGRAM OF HELIX PLATFORM CONCEPT

“a high-level architectural view of a system including a genomic services platform in accordance with the disclosure”

Source: United States patent No. US20190026641A1: Genomic services platform supporting multiple application providers

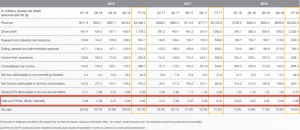

EXHIBIT 3

ILLUMINA’S NON-GAAP INCOME STATEMENT AFTER 2018 FISCAL YEAR

Shows the decrease in their revenue from Helix since 2016 because of the dilution of their shares, especially as more investors entered during Series B funding in 2018

Source: Illumina: Source Book January 2019

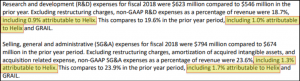

EXHIBIT 4

STATEMENT IN ILLUMINA’S FINANCIAL STATEMENT FOR THE 2018 FISCAL YEAR

Illumina describes the inclusion of Helix’s R&D and SG&A expenses in their own expenses

Source: Press Release: Illumina Reports Financial Results for Fourth Quarter and Fiscal Year 2018

EXHIBIT 5

IMAGE OF GENEGUIDE PRODUCT

Illustrates components of GeneGuide’s products, including the DNA sampling kit from Helix (left) and genetic education tools on desktop (middle) and mobile (right) apps

Source: https://newsnetwork.mayoclinic.org

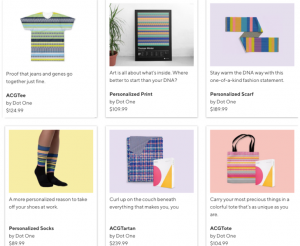

EXHIBIT 6

DOT ONE PRODUCT SELECTION

Image of the options available from Dot One on Helix’s store

Source: https://www.helix.com/collections/entertainment

EXHIBIT 7

DNA SEQUENCING COST FROM 2002 TO 2017

Graph illustrating the decrease in sequencing cost per genome over time

Source: https://cointelegraph.com/news/lifes-code-blockchain-and-the-future-of-genomics

EXHIBIT 8

CONSUMERS OF DTC GENETIC TESTING FROM 2013 TO 2018.

Graph illustrating the increase in genetic testing amongst worldwide consumers since 2013 (a) and chart showing their growth rates by year. Values in chart are in millions (“All” and “Ancestry” columns) and growth rate per year (“All Rate” and “Ancestry Rate” columns. The year 2017 has been referred to by many as “the year consumer genetics blew up”, but this graph makes it clear there was also a large increase in 2015.

a)

b)

Source: http://www.the-burgenland-bunch.org/Newsletter/Newsletter285.htm

REFERENCES

Biotech Primer [Web log post]. (2018, December 4). A Chip Off the Old Block, Personal Genomics Turns Heads in Biotech. Retrieved from http://biotechprimer.com

Brodwin, E. (2018, August 3). DNA-testing companies like 23andMe sell your genetic data to drugmakers and other Silicon Valley startups. Retrieved from www.businessinsider.com

Business Wire [Press release]. (2017, August 17). Helix Teams Up with Illumina Accelerator to Drive Innovation and DNA-Powered Products for Consumers. Retrieved from www.businesswire.com

Business Wire [Press release]. (2018, June 28). Helix Announces Final Close of Its $200 Million Series B Financing With Temasek to Continue Acceleration Into Consumer Genomics. Retrieved from www.businesswire.com

Credence Research. (2018, June 12). Direct-To-Consumer (DTC) Genetic Testing Market Size, Share, Growth, Opportunities, Analysis And Forecast 2018 To 2026. Retrieved from www.abnewswire.com

Dunaway, K. (2018, March 9). What is Exome+, and why did Helix create it? Retrieved from http://blog.helix.com

Fikes, B. J. (2018, July 9). Personal genomics company Helix raises $200 million. Retrieved from www.sandiegouniontribune.com

Gallagher, C. (2018, October 1). New Mayo Clinic GeneGuide DNA testing application provides genetic testing, insights backed by Mayo Clinic expertise. Retrieved from http://newsnetwork.mayoclinic.org

Helix [Press Release]. (2016a, January 11). Helix Expands Ecosystem for Consumer Genomics Through Two New Partnerships. Retrieved from http://cdn.helix.com

Helix [Press Release]. (2016b, July 12). Helix Appoints Former Under Armour Chief Digital Officer and Co-Founder and CEO of MapMyFitness Robin Thurston as Chief Executive Officer. Retrieved from http://cdn.helix.com

Illumina [Press Release]. (2019, January 29). Illumina Reports Financial Results for Fourth Quarter and Fiscal Year 2018. Retrieved from www.illumina.com

Inglesby, I. (2018, April 18). My DNA story: Iona Inglesby, founder of Dot One. Retrieved from http://blog.helix.com

Lu, J. (2016, October 5). An Insider’s Look At Personal Genomics: Today’s Cutting Edge, Tomorrow’s Everyday Experience. Retrieved from www.huffpost.com

Lu, J., Chou, J., Lee, W., Williams, C., Warren, J., and Jiang, R. (2019). United States Patent No. US20190026641A1. Retrieved from https://patents.google.com/patent/US20190026641A1

Molteni, M. (2018, April 10). Helix Takes Clinical Genetic Testing Straight to Consumers. Retrieved from www.wired.com

Mordor Intelligence [Web report]. (2018, March). Genetic Testing Market – Segmented by Treatment Type, Diseases, Technology, and Geography – Growth, Trends and Forecasts (2018 – 2023). Retrieved from www.mordorintelligence.com

National Human Genome Research Institute [Web log post]. (2018, December 4). DNA Sequencing Costs: Data. Retrieved from www.genome.gov

Ramsey, L. (2016, July 13). Why a former Under Armour executive just joined a company that wants to become the app store of genetics. Retrieved from www.businessinsider.com

Robbins, R. (2016, October 27). One Start-Up Claims to Tailor Wine to Your DNA. Retrieved from www.scientificamerican.com

Ross, J. (2019, January). Illumina: Source Book January 2019. Retrieved from www.illumina.com